Divergence Pattern

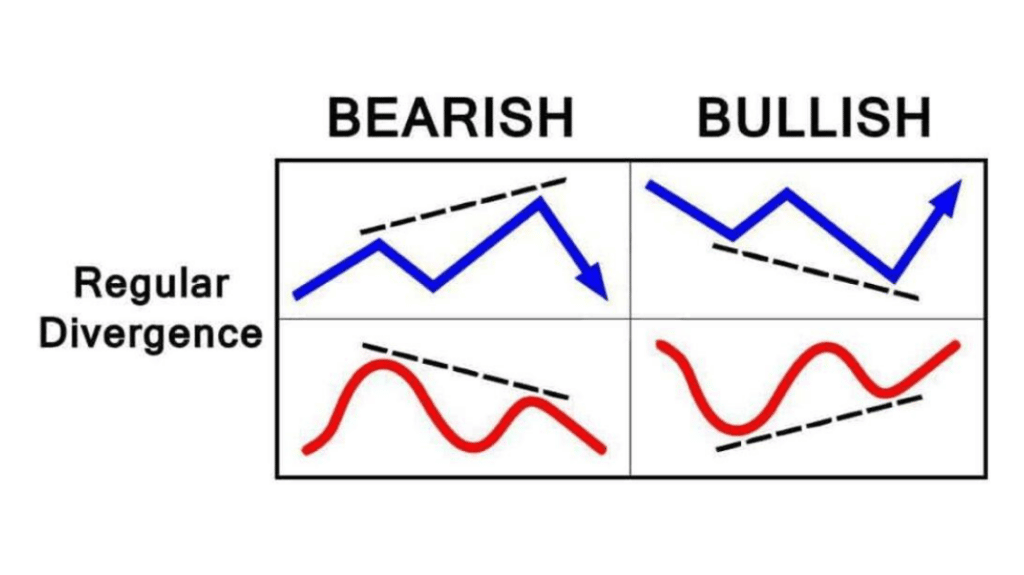

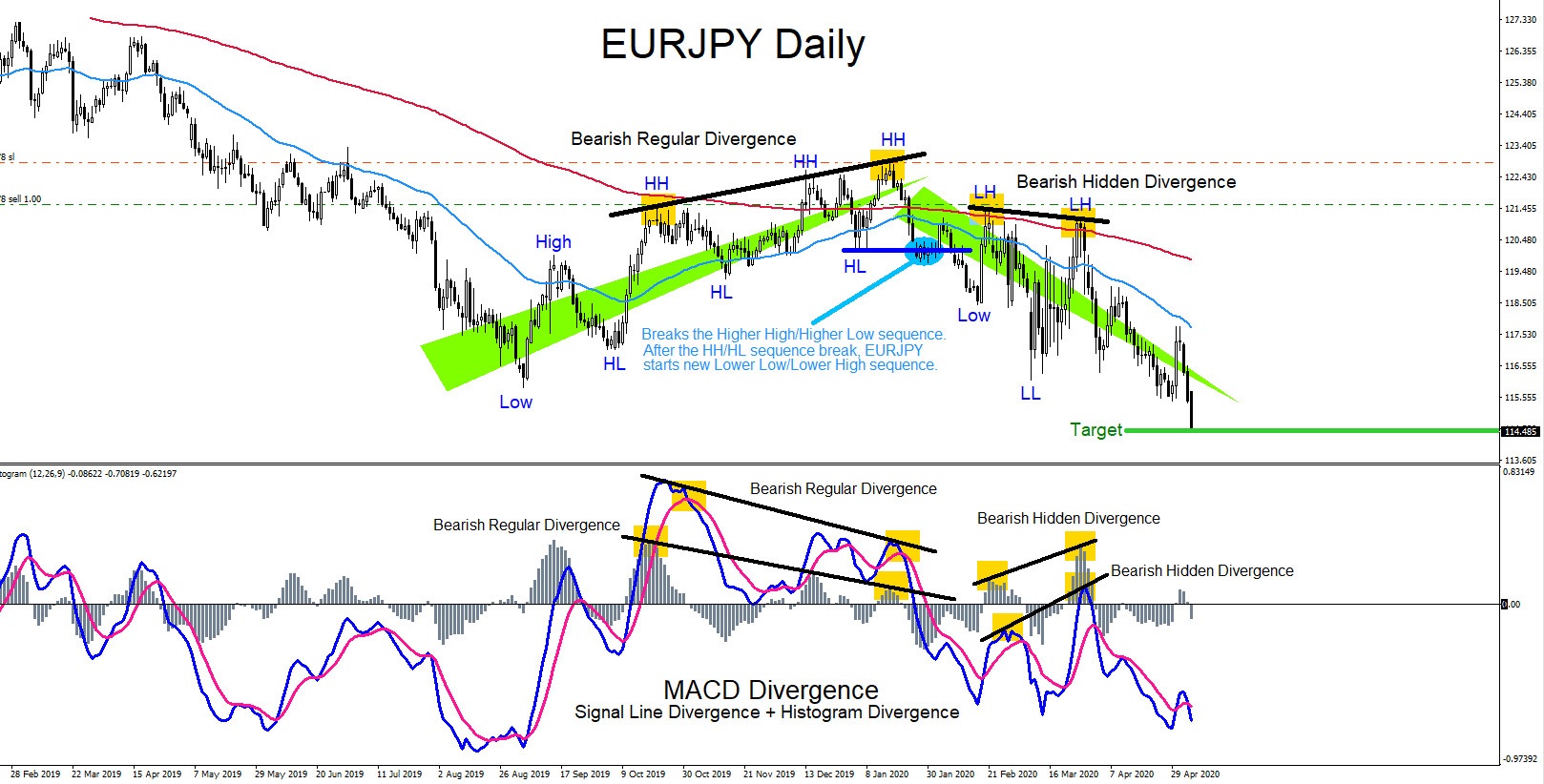

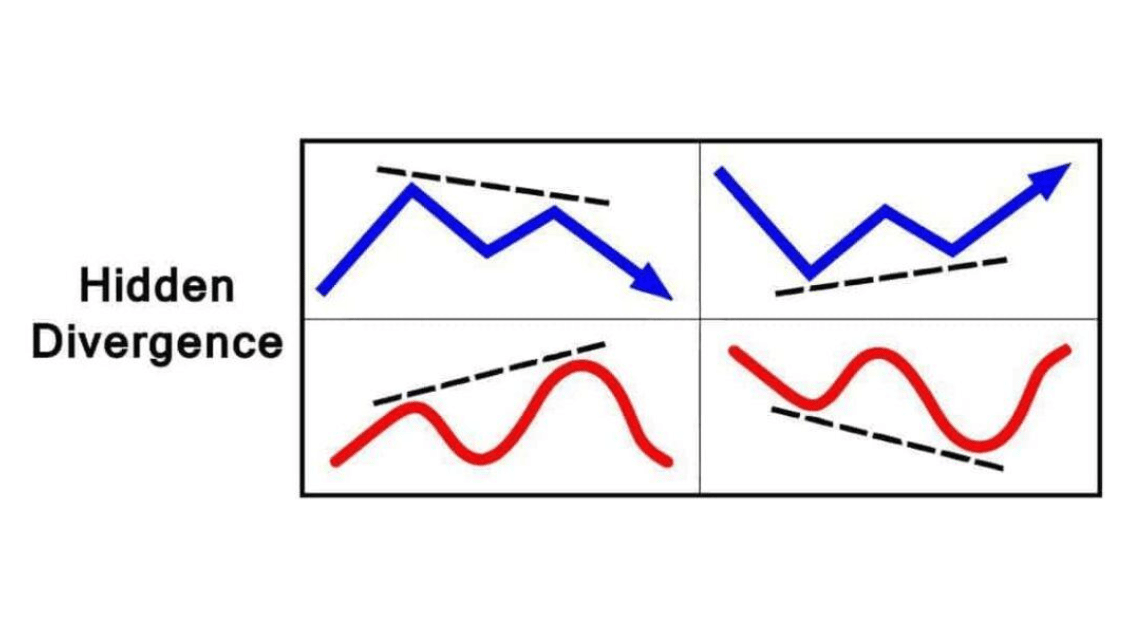

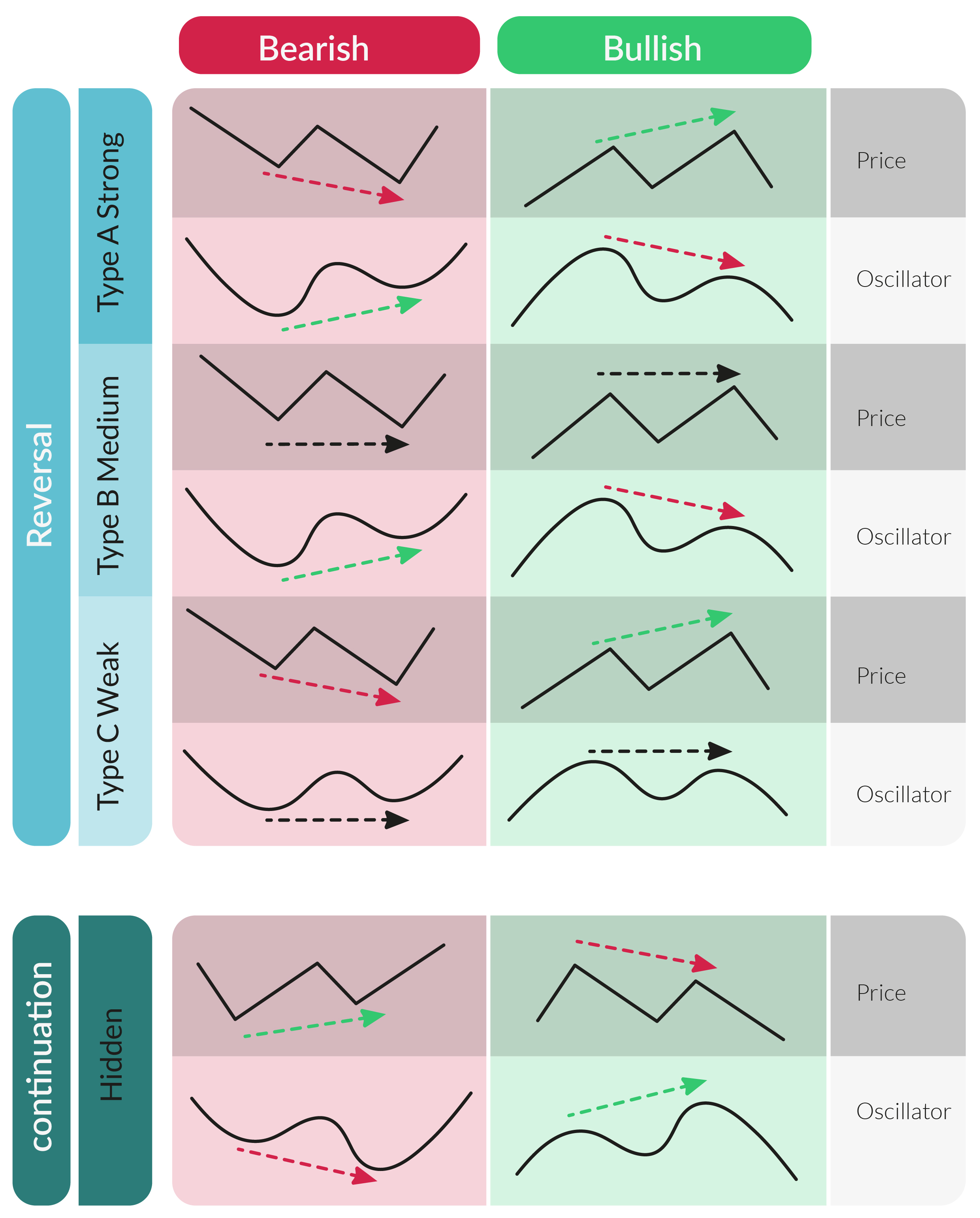

Divergence Pattern - Web divergence occurs when an asset’s price and an indicator, like the relative strength index (rsi), move in opposite directions. Web here’s what the divergence cheatsheet looks like: Being able to spot these types of patterns is a massive advantage as they will help you to identify new trading opportunities and give you an idea of. Familiarize yourself with the different types of divergence patterns and practice identifying them on price charts. These indicators are designed to provide estimates of an asset's price. This will help you develop a trained eye for spotting potential trading opportunities. Web in trading, divergence means that the price swings and the indicator (oscillator) movement are not in phase. This is more than a mere anomaly; Isolation by distance (ibd), isolation by resistance due to topography (ibrtopo), isolation by resistance due to habitat suitability (ibrsuit). A divergence signal is formed if the price is making a higher swing high when the oscillator is making a lower high, or if the price is making a lower swing low when the indicator is making a higher swing low. Web learn to spot divergence: The corresponding bullish divergence is an obvious buy signal. Web a divergence setup is a leading forex pattern, giving us an early entry into emerging price moves. Divergence is a warning sign that the price trend is weakening, and in some case may result in. There are four types of divergence patterns: Web divergence occurs when an asset’s price and an indicator, like the relative strength index (rsi), move in opposite directions. Web divergence is a pattern type that can be seen on cryptocurrency price charts that denotes a potential trend change. Web divergence indicates that something is changing but it doesn't mean that the trend will reverse. Make it your computer. Web divergence manifests as a discrepancy where the trajectory of an asset’s price contrasts with the movement of a related indicator. Through these examples, you’ll learn the highs and lows of each type, plus get the lowdown on the market psychology that brings them into play. Aha, that’s the tricky part! This is more than a mere anomaly; Divergence is. Traders can exploit these price discrepancies for profit. Divergence trading is an effective method, and allow traders to combine price action and indicator analysis into a trading strategy; Bullish and bearish trends can be spotted before they start affecting the price. The more divergence there is visible, the more likely a reversal does become. This is more than a mere. Make it your computer wallpaper! Isolation by distance (ibd), isolation by resistance due to topography (ibrtopo), isolation by resistance due to habitat suitability (ibrsuit). Web this mismatch between momentum and the actual price is referred to as a divergence. Web divergence in stock trading is a powerful reversal signal, as it can identify the start of a new trend. Web. Bullish and bearish trends can be spotted before they start affecting the price. This will help you develop a trained eye for spotting potential trading opportunities. In particular, divergence is used to read momentum and is generally considered a reliable signal that the current price trend is weakening and that a reversal may be approaching. Web here’s what the divergence. Isolation by distance (ibd), isolation by resistance due to topography (ibrtopo), isolation by resistance due to habitat suitability (ibrsuit). Web learn to spot divergence: Through these examples, you’ll learn the highs and lows of each type, plus get the lowdown on the market psychology that brings them into play. Web a divergence setup is a leading forex pattern, giving us. Aha, that’s the tricky part! It signals that the trader must consider strategy options: Web here’s what the divergence cheatsheet looks like: With this strategy, divergence traders are looking for price reversals or trend continuation signals to capture long price movements. Web divergence is a popular concept in technical analysis that describes when the price is moving in the opposite. Web this mismatch between momentum and the actual price is referred to as a divergence. The corresponding bullish divergence is an obvious buy signal. Web here’s what the divergence cheatsheet looks like: Web divergence is a very useful tool to help traders spot trend reversals or continuation patterns. While hidden divergence is observed at the end of a trend consolidation,. Familiarize yourself with the different types of divergence patterns and practice identifying them on price charts. Web here’s what the divergence cheatsheet looks like: Divergence is a warning sign that the price trend is weakening, and in some case may result in. The more divergence there is visible, the more likely a reversal does become. Web if prices hit a. While hidden divergence is observed at the end of a trend consolidation, classic or regular divergence is observed at the end of a trend. Make it your computer wallpaper! The entry can not be taken on the basis of divergence indicator alone. Being able to spot these types of patterns is a massive advantage as they will help you to identify new trading opportunities and give you an idea of. Each type of divergence will contain either a bullish bias or a bearish bias. In this analysis we will be using rsi as the oscillator indicator. Web a divergence setup is a leading forex pattern, giving us an early entry into emerging price moves. In the 1hr chart below, gbp/usd is building a bearish channel (black line). Generally, the bullish divergence signals an uptrend reversal or a price correction in the market. Through these examples, you’ll learn the highs and lows of each type, plus get the lowdown on the market psychology that brings them into play. Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences. Traders can exploit these price discrepancies for profit. Web a bullish divergence pattern refers to a situation when the price drops to new lows but the indicator does not follow and signals something different. There are two types of divergences: These indicators are designed to provide estimates of an asset's price. Divergence is a warning sign that the price trend is weakening, and in some case may result in.

What Is RSI Divergence? Learn How To Spot It

Get to Know the Divergence Pattern, Here's the Explanation!

How To Trade an RSI Divergence Complete Guide Living From Trading

Divergence Trading Patterns

Mengenal Divergence Pattern, Ini Penjelasannya!

Fisher Divergence Forex Trading Strategy The Ultimate Guide To Business

Trading strategy with Divergence chart patterns Trading charts, Forex

The New Divergence Indicator and Strategy 3rd Dimension

![RSI Divergence Cheat Sheet PDF [Free Download]](https://howtotrade.com/wp-content/uploads/2023/02/rsi-divergence-cheat-sheet-2048x1448.png)

RSI Divergence Cheat Sheet PDF [Free Download]

The Ultimate Divergence Cheat Sheet A Comprehensive Guide for Traders

Web Aimthe Factors That Influence The Diversity Of Yungas Andean Forest Remain Unexplored.

Web Divergence Manifests As A Discrepancy Where The Trajectory Of An Asset’s Price Contrasts With The Movement Of A Related Indicator.

Web Divergence Indicates That Something Is Changing But It Doesn't Mean That The Trend Will Reverse.

Web Divergence Is A Popular Concept In Technical Analysis That Describes When The Price Is Moving In The Opposite Direction Of A Technical Indicator.

Related Post: