Designation Of Homestead Request Form

Designation Of Homestead Request Form - Web attorney general ken paxton today warned consumers to beware of businesses that are sending misleading letters to texans offering a “designation of homestead” if they pay a fee. Web by practical law real estate. All homestead exemptions are filed with the appraisal district and there are no costs associated with filing these forms. Web recording a “designation of homestead” in the public records is optional. Counties make the standard homestead tax exemption available for free to property owners. Under the texas tax code if a homeowner files for and receives a tax exemption, they will receive a designation of. Web the letter asks homeowners to send $89 to get a homestead designation. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each county in which the property is located generally between jan. Web the letter is from homestead designation services. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. 1 and april 30 of the year for which the exemption is requested. Prices subject to change without notice. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. Under the texas tax code if a homeowner files for and receives a tax exemption, they will receive a designation of. Web homestead exemptions provide. Web homestead exemptions provide tax relief to residents who own and occupy their residential property as their primary residence. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. Web the letter asks homeowners to send $89 to get a homestead designation. The exemptions apply only to property that you own and occupy as. Counties make the standard homestead tax exemption available for free to property owners. Web recording a “designation of homestead” in the public records is optional. Web the letter asks homeowners to send $89 to get a homestead designation. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each county. Web by practical law real estate. When you couple that with recent headlines about tax relief, you can see why it piqued her interest. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. All homestead exemptions are filed with the appraisal district and there are no costs associated with filing these forms. Web. Web the letter is from homestead designation services. Web recording a “designation of homestead” in the public records is optional. Prices subject to change without notice. To file a designation of homestead, you are not required to use this form or this service. Counties make the standard homestead tax exemption available for free to property owners. When you couple that with recent headlines about tax relief, you can see why it piqued her interest. Web homestead exemptions provide tax relief to residents who own and occupy their residential property as their primary residence. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. The exemptions apply only to property that. Web by practical law real estate. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. To file a designation of homestead, you are not required to use this form or this service. This standard document can also be filed in response to a notice to a property owner to. Web the letter is from homestead designation services. To file a designation of homestead, you are not required to use this form or this service. This standard document can also be filed in response to a notice to a property owner to make a homestead designation. Web the designation of homestead under texas property code is distinct from the homestead. Prices subject to change without notice. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. To file a designation of homestead, you are not required to use this form or this service. All homestead exemptions are filed with the appraisal district and there are no costs associated with filing these forms. Web this. Web attorney general ken paxton today warned consumers to beware of businesses that are sending misleading letters to texans offering a “designation of homestead” if they pay a fee. Web the letter is from homestead designation services. Web homestead exemptions provide tax relief to residents who own and occupy their residential property as their primary residence. This standard document can. Prices subject to change without notice. Web the letter is from homestead designation services. Web homestead exemptions provide tax relief to residents who own and occupy their residential property as their primary residence. This standard document can also be filed in response to a notice to a property owner to make a homestead designation. A standard document that a property owner can record to make a voluntary designation of a homestead under texas law. Web recording a “designation of homestead” in the public records is optional. Under the texas tax code if a homeowner files for and receives a tax exemption, they will receive a designation of. Web by practical law real estate. Web the designation of homestead under texas property code is distinct from the homestead tax exemption. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Counties make the standard homestead tax exemption available for free to property owners. It’s titled “designation of homstead request form” and asks for a $49 check or money order. The exemptions apply only to property that you own and occupy as your principal place of residence. When you couple that with recent headlines about tax relief, you can see why it piqued her interest. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each county in which the property is located generally between jan. To file a designation of homestead, you are not required to use this form or this service.

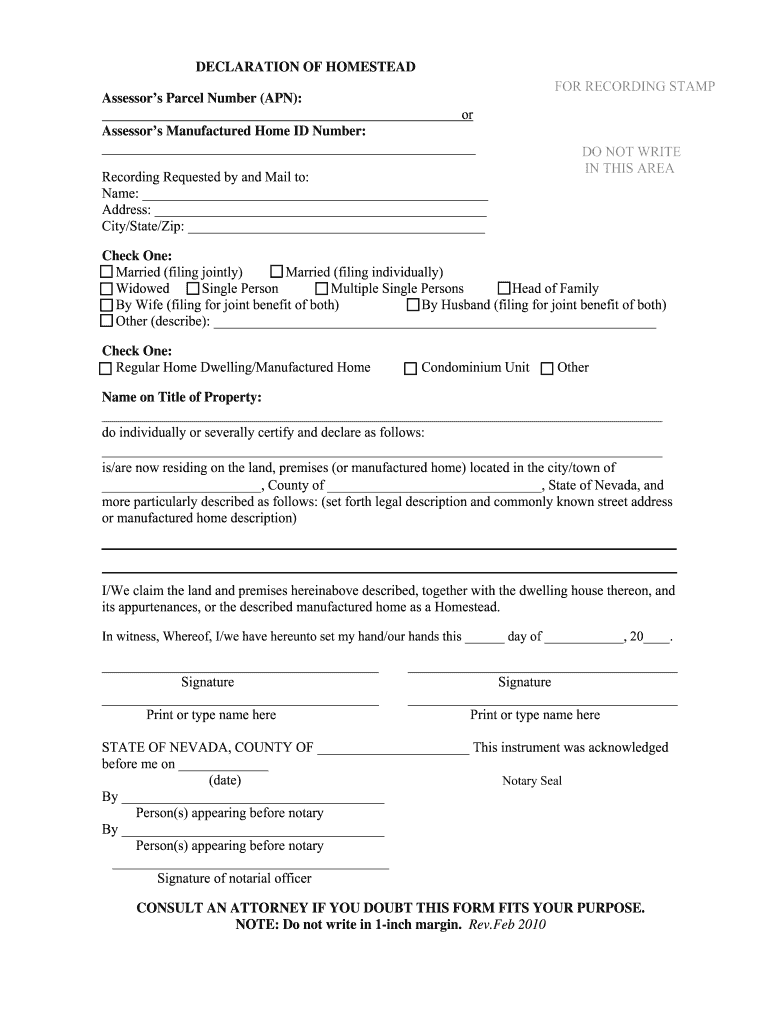

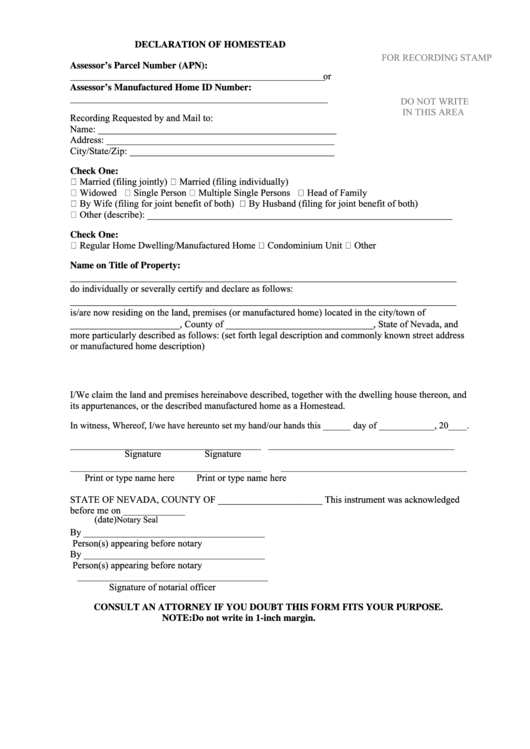

Nevada Homestead 20102024 Form Fill Out and Sign Printable PDF

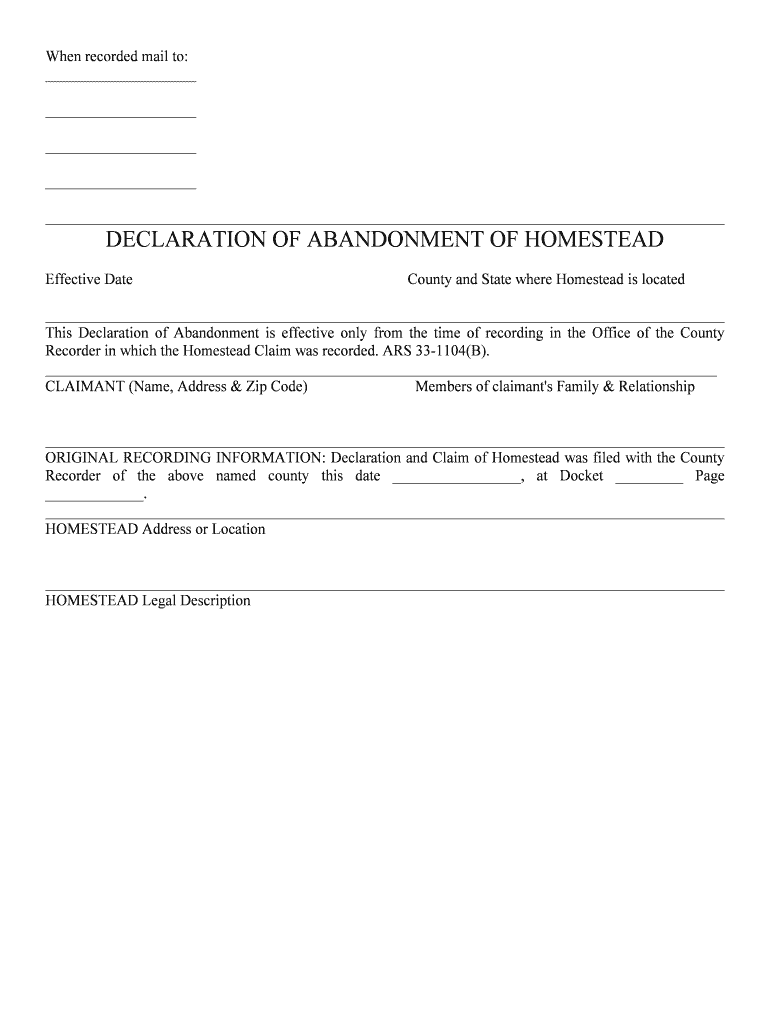

Designation Of Homestead Fillable Form Printable Forms Free Online

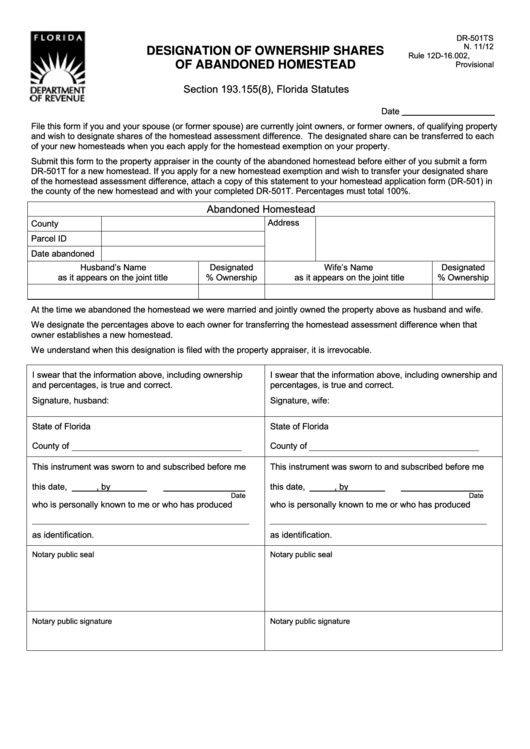

Form Dr501ts Designation Of Ownership Shares Of Abandoned Homestead

Designation Of Homestead Fillable Form Printable Forms Free Online

Declaration of Homestead FLORIDA HOMESTEAD SERVICES Form Fill Out and

Designation Of Homestead Fillable Form Printable Forms Free Online

Fillable Online APPLICATION FOR PRIMARY FAMILY HOMESTEAD DESIGNATION BY

Fillable Declaration Of Homestead Form printable pdf download

Texas Voluntary Designation of Homestead Designation Of Homestead

Texas Voluntary Designation of Homestead Voluntary Designation Of

1 And April 30 Of The Year For Which The Exemption Is Requested.

All Homestead Exemptions Are Filed With The Appraisal District And There Are No Costs Associated With Filing These Forms.

Web Attorney General Ken Paxton Today Warned Consumers To Beware Of Businesses That Are Sending Misleading Letters To Texans Offering A “Designation Of Homestead” If They Pay A Fee.

Web The Letter Asks Homeowners To Send $89 To Get A Homestead Designation.

Related Post: