Designated Roth Ira

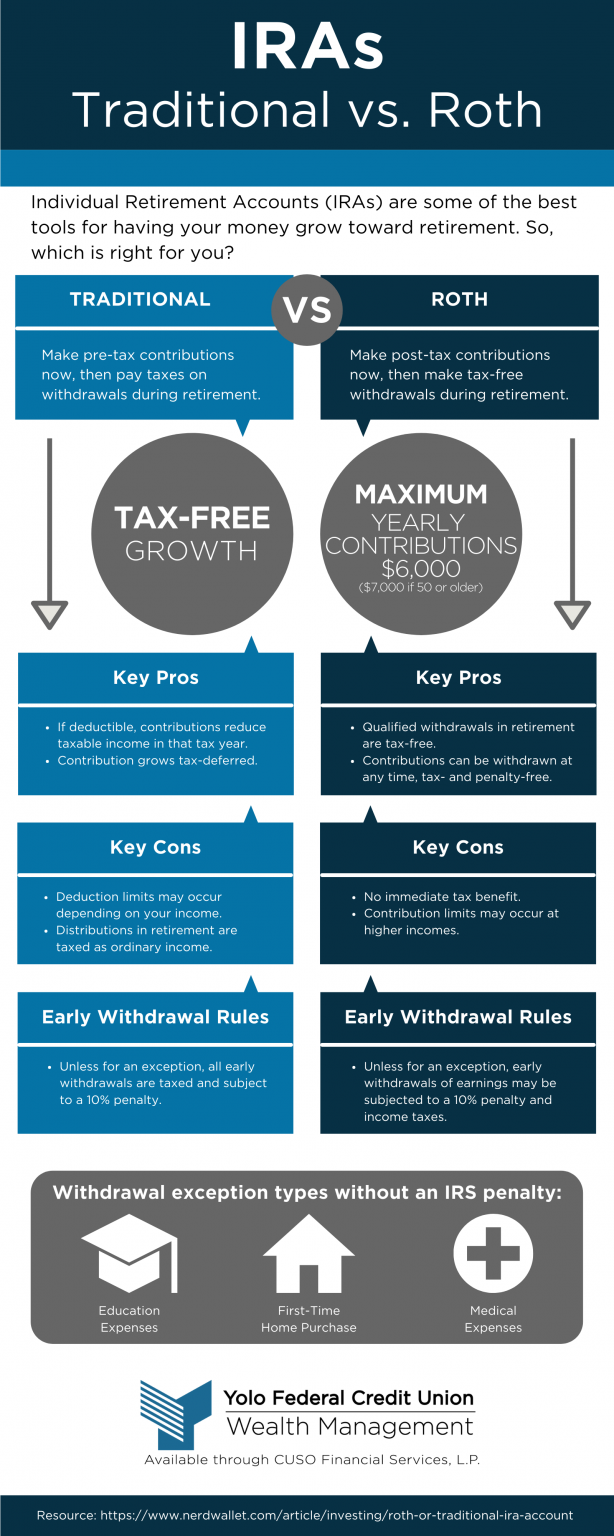

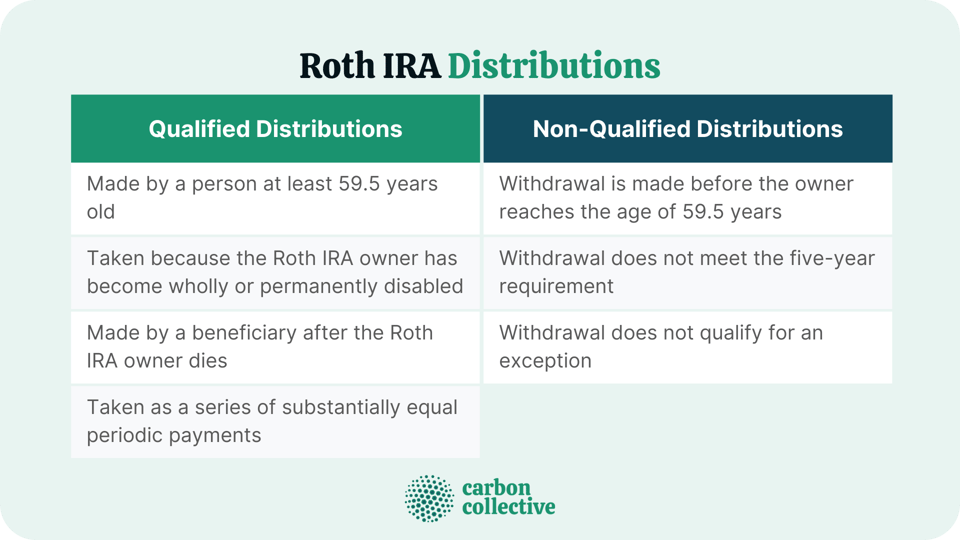

Designated Roth Ira - Also called a named beneficiary, is defined by the secure act as someone. Web eligible designated beneficiary. Web updated november 12, 2023. There are just two requirements. In a previous post we discussed the general. It is held separately in a 401 (k ), 403 (b ), or governmental 457 (b) that holds designated roth. Web when you’re eligible to take money from your designated roth account, you can roll it to a roth ira or to a roth account with another employer. Web the death of a roth ira owner will always be considered as taking place before their rbd (even if they have traditional ira money as well), and, thus, their. Joel is seven years younger than his sister, which. A roth account means more wealth. Web eligible designated beneficiary. It is held separately in a 401 (k ), 403 (b ), or governmental 457 (b) that holds designated roth. The amount contributed to a. Web a designated roth account is a type of retirement account. Web subtract from the amount in (1): Web with a designated roth account, you can: Also called a named beneficiary, is defined by the secure act as someone. Advice on how to invest40+ years of experiencetrustworthy fiduciary Web learn about transferring your eligible rollover distributions from work retirement plans to a roth ira or to a designated roth account. Web designated roth account (roth 401k) distributions. Web that has always been the case for roth iras. Joel is seven years younger than his sister, which. Web subtract from the amount in (1): What if my company doesn’t offer roth. In a previous post we discussed the general. Web beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the 10%. Web the maximum income limit is $87,000 for single filers and $143,000 for couples in 2024. Web the death of a roth ira owner will always be. Web subtract from the amount in (1): Let’s take “joel,” whose sister passed away at age 59. 24/7 supportmore ways to investno account feesfree financial plan Web the maximum income limit is $87,000 for single filers and $143,000 for couples in 2024. Also called a named beneficiary, is defined by the secure act as someone. Web who’s eligible for a designated roth account? Web learn about transferring your eligible rollover distributions from work retirement plans to a roth ira or to a designated roth account. A roth account means more wealth. If the plan permits, roll over certain amounts in your. Web designated roth accounts offer some significant advantages over the roth ira. Web subtract from the amount in (1): Also called a named beneficiary, is defined by the secure act as someone. Web with a designated roth account, you can: The amount contributed to a. Web designated beneficiary applies to most people who inherit an ira from a parent. Web beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the 10%. There are just two requirements. Web that has always been the case for roth iras. If you make $143,000 or more, you won't be able to deduct. Web when you’re eligible to take money from your designated roth account, you can roll it to a roth ira or to a roth account with another employer. Web beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the. Web beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the 10%. Advice on how to invest40+ years of experiencetrustworthy fiduciary If you make $143,000 or more, you won't be able to deduct your ira contributions. She left him. Advice on how to invest40+ years of experiencetrustworthy fiduciary 24/7 supportmore ways to investno account feesfree financial plan Web eligible designated beneficiary. In a previous post we discussed the general. It is held separately in a 401 (k ), 403 (b ), or governmental 457 (b) that holds designated roth. Web beginning in 2024, 529 account owners can roll over up to $35,000 of unused 529 funds to a roth ira for the beneficiary of the 529 plan — without incurring the 10%. Let’s take “joel,” whose sister passed away at age 59. For designated roth accounts, or dras, which are roth 401(k), roth 403(b), and roth 457(b) accounts,. Web subtract from the amount in (1): Web learn about transferring your eligible rollover distributions from work retirement plans to a roth ira or to a designated roth account. Web a designated roth account is a separate account in a 401 (k), 403 (b) or governmental 457 (b) plan that holds designated roth contributions. What if my company doesn’t offer roth. Make designated roth contributions to the account; Perhaps you’re already familiar with the roth ira and want to know how roth accounts in employer plans, known as designated roth accounts,. Also called a named beneficiary, is defined by the secure act as someone. Web with a designated roth account, you can:

Inheriting A Roth IRA? What If You Are An Eligible Designated Beneficiary?

Roth Ira Changes 2024 Linn Shelli

Turning A Roth IRA Into An Estate Planning Tool Blue Chip Partners

roth ira explained Inflation Protection

Comparing Roth IRAs and Designated Roth Accounts to Traditional

3 Important Differences Between Roth IRAs and Designated Roth Accounts

Qualified vs NonQualified Roth IRA Distributions

Difference Between Roth IRA and Designated Roth Account YouTube

Roth IRAs and Designated Roth Accounts Western CPE

What Is a Designated Roth Account? Heaven & Alvarez, LLC

Web Designated Roth Accounts Offer Some Significant Advantages Over The Roth Ira.

Web That Has Always Been The Case For Roth Iras.

Web Designated Beneficiary Applies To Most People Who Inherit An Ira From A Parent.

Web Who’s Eligible For A Designated Roth Account?

Related Post: