Designated Funds Vs Restricted Funds

Designated Funds Vs Restricted Funds - Web guide to what are restricted funds. Web nonprofits must carefully manage their restricted funds in order to remain compliant with the irs and accountable to their donors. As a result, investors in bond funds. Designated funds are funds which come from unrestricted donations to the meeting and then are designated by the meeting for a particular purpose. Web restricted funds are donations received by a meeting which are restricted in their use by the donor. Please post your answer or comment by. When a charity has funds that are not intended for general use, it can be difficult to establish whether the funds should. Any use of the funds outside of the. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds and restricted funds. Learn how to distinguish between designated and restricted donations, and how they affect the tax deductibility and the church's control of the funds. Web restricted funds are donations received by a meeting which are restricted in their use by the donor. The project to which funds are restricted is most. Web restricted funds are based on the donor stipulations of the initial gift, and designated funds are created from an internal transfer initiated by leadership. Learn how to distinguish between designated and restricted. They are permanently restricted to that purpose and cannot be used. Learn more in this guide. There may be different kinds of unrestricted, we’ll show a couple. By rollie dimos | church budgeting & finances. Web restricted funds are donations received by a meeting which are restricted in their use by the donor. Web nonprofits must carefully manage their restricted funds in order to remain compliant with the irs and accountable to their donors. Learn how to distinguish between designated and restricted donations, and how they affect the tax deductibility and the church's control of the funds. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds. Web contributions with donor restrictions are designated by the donor for specific projects or purposes other than general use. There may be different kinds of unrestricted, we’ll show a couple. Web in particular, there is a need to be able distinguish between unrestricted (including designated) funds and restricted funds. Web the difference between restricted and designated funds. Any use of. Restricted funds can only be spent in. By rollie dimos | church budgeting & finances. Web restricted funds are donations received by a meeting which are restricted in their use by the donor. Web however, the difference between them is that designated funds are set aside for a specific end by the nonprofit itself, while restricted funds are restricted by. Restricted funds can only be spent in. How do nonprofits track restricted. We compare it with unrestricted & designated funds, explain its examples, types, & importance. Web guide to what are restricted funds. Web the difference between restricted and designated funds. The project to which funds are restricted is most. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control and impact for charitable giving. Web the principal remains untouched, while the interest or dividends provide a steady stream of income for the designated cause. Any use of the funds outside. Designated funds are funds which come from unrestricted donations to the meeting and then are designated by the meeting for a particular purpose. These funds can only be used for specific purposes,. Web nonprofits must carefully manage their restricted funds in order to remain compliant with the irs and accountable to their donors. When a charity has funds that are. First, restrictions are imposed by the donor when they make the gift or grant. Web restricted funds are monies set aside for a particular purpose as a result of designated giving. Learn how to distinguish between designated and restricted donations, and how they affect the tax deductibility and the church's control of the funds. They are permanently restricted to that. By rollie dimos | church budgeting & finances. Web guide to what are restricted funds. Learn more in this guide. Web the principal remains untouched, while the interest or dividends provide a steady stream of income for the designated cause. Web donor designated funds are restricted gifts that allow donors to specify how their contributions are used, providing greater control. We compare it with unrestricted & designated funds, explain its examples, types, & importance. What are restricted funds in a nonprofit organization? Web the principal remains untouched, while the interest or dividends provide a steady stream of income for the designated cause. Web two principles are at the core of the accounting requirements. Find out how to solicit, redirect and manage designated funds effectively and legally. Learn more in this guide. First, restrictions are imposed by the donor when they make the gift or grant. Please post your answer or comment by. Take the next step in managing restricted funds. Web restricted funds are donations received by a meeting which are restricted in their use by the donor. There may be different kinds of unrestricted, we’ll show a couple. Web restricted funds are monies set aside for a particular purpose as a result of designated giving. Web contributions with donor restrictions are designated by the donor for specific projects or purposes other than general use. When a charity has funds that are not intended for general use, it can be difficult to establish whether the funds should. Churches receive charitable contributions every week. Restricted funds can only be spent in.

Designated Giving versus Restricted Giving what's the difference

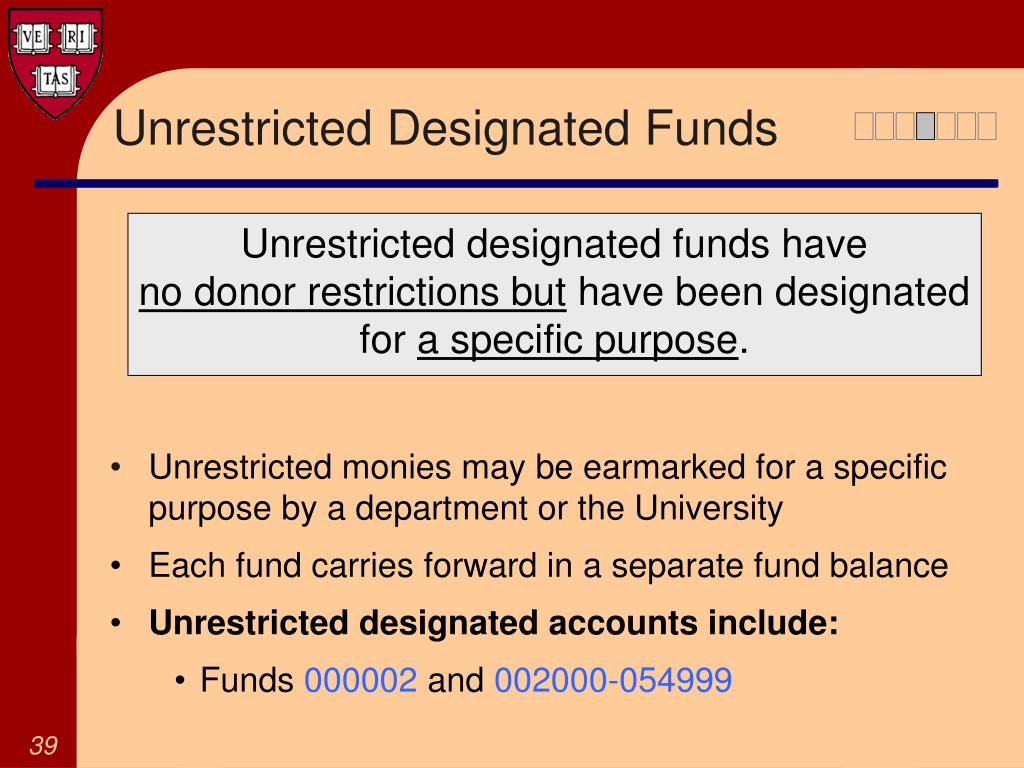

PPT Understanding the Harvard Chart of Accounts PowerPoint

Restricted vs. Unrestricted Funds How Your Donations Can Impact an

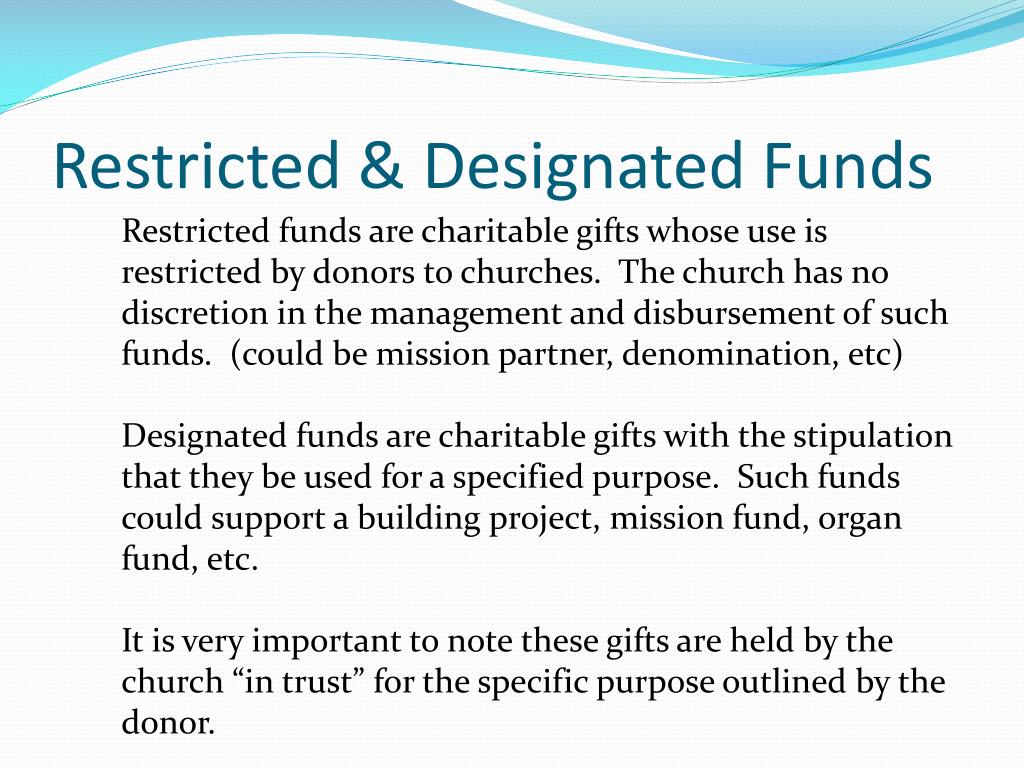

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

Implementing ASU 201614 on the Presentation of NotforProfit

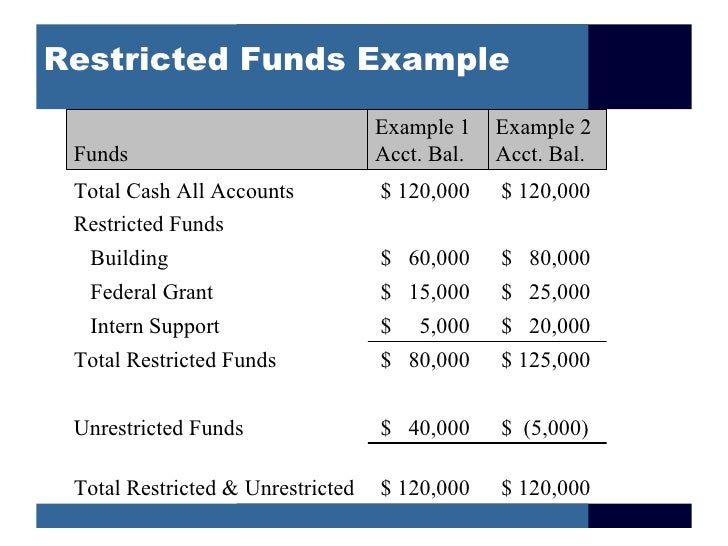

Financial Management Slides

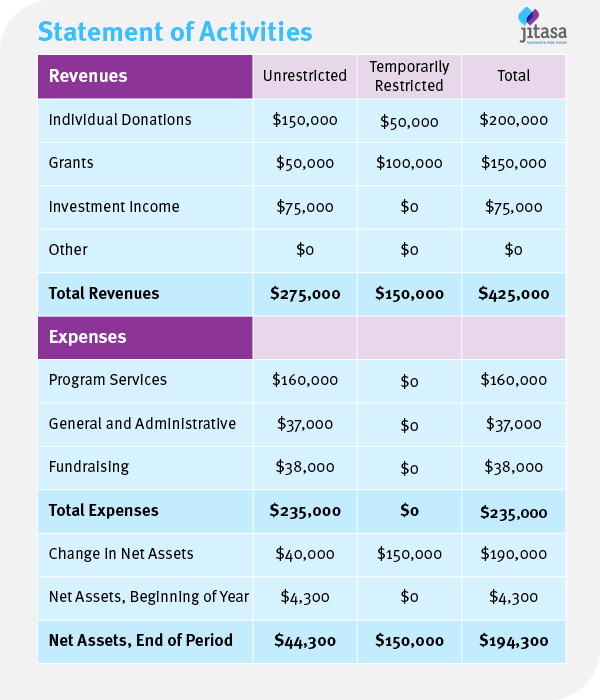

Restricted Funds What Are They? And Why Do They Matter? Jitasa Group

:max_bytes(150000):strip_icc()/Restricted-Fund-3-2-20c16aeec9274070bac757711f6b4ba0.jpg)

Restricted Fund Definition, Types, Legal Requirements

PPT Operations 103 Finances Class 2 PowerPoint Presentation, free

Web Nonprofits Must Carefully Manage Their Restricted Funds In Order To Remain Compliant With The Irs And Accountable To Their Donors.

By Rollie Dimos | Church Budgeting & Finances.

The Project To Which Funds Are Restricted Is Most.

Learn How To Distinguish Between Designated And Restricted Donations, And How They Affect The Tax Deductibility And The Church's Control Of The Funds.

Related Post: