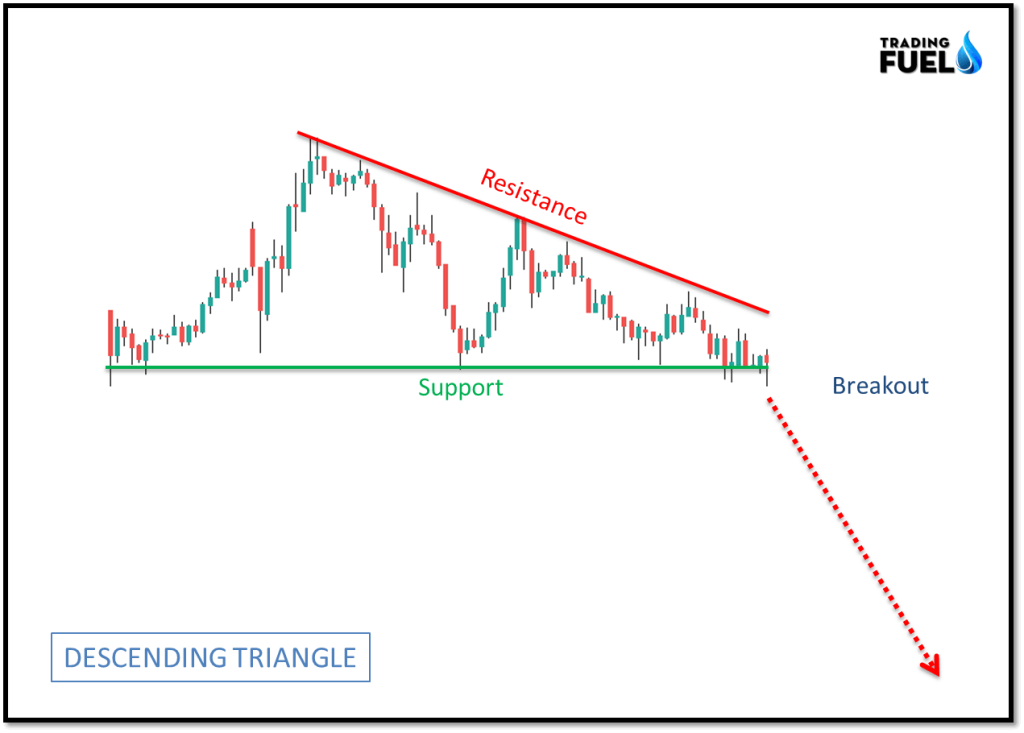

Descending Flag Pattern

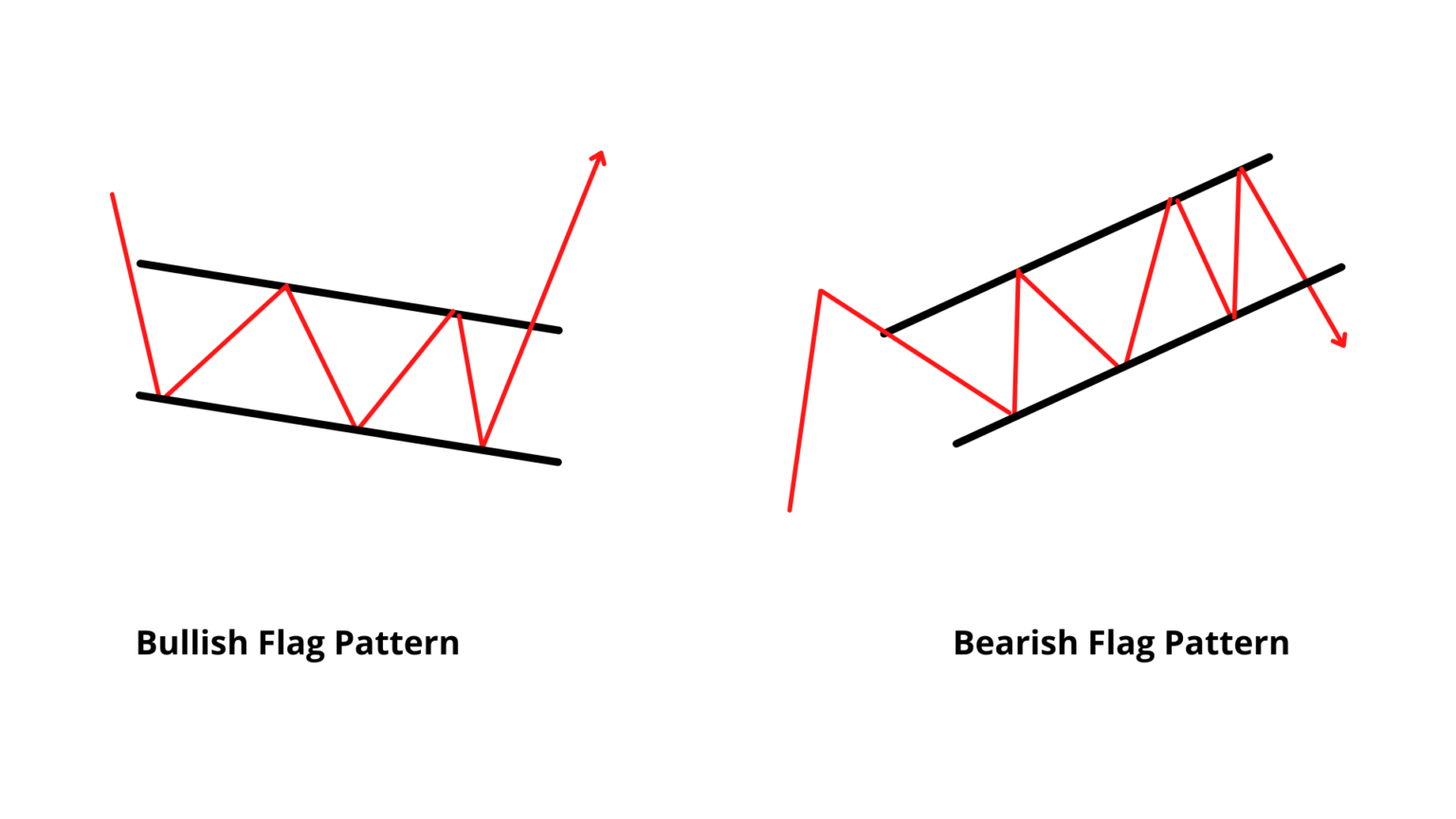

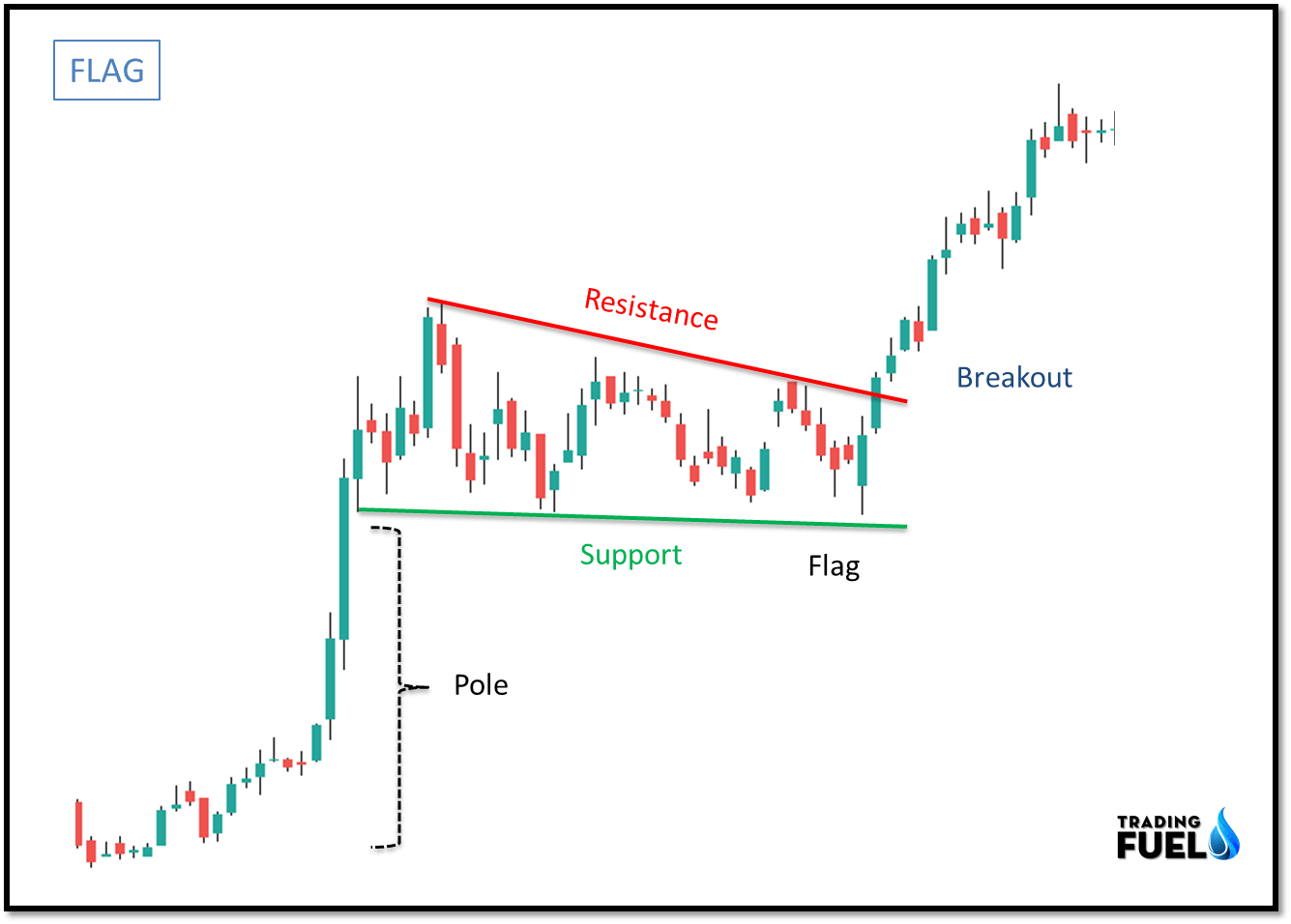

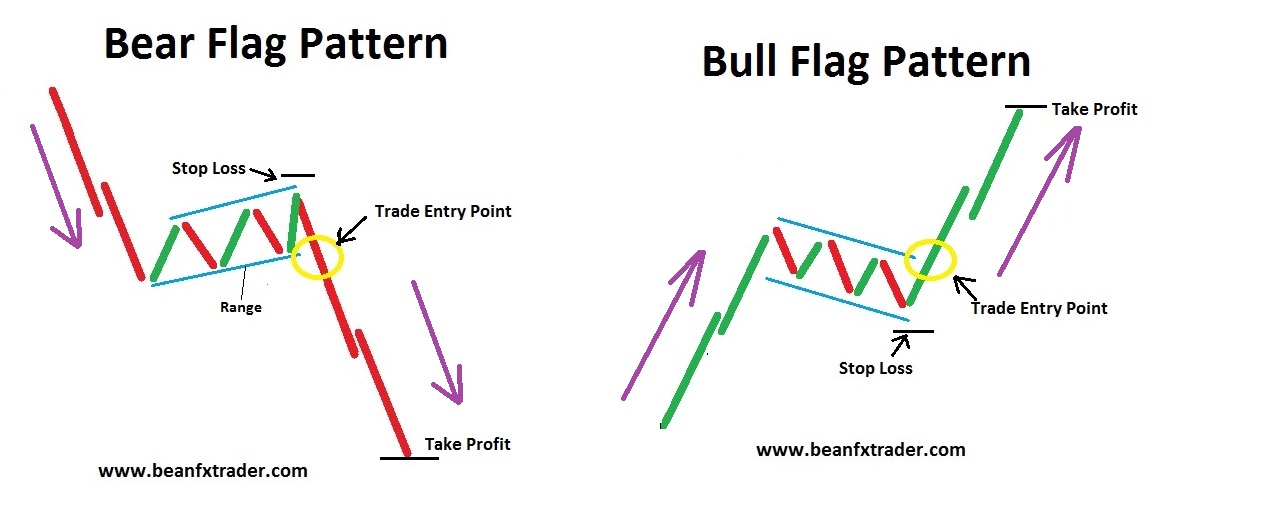

Descending Flag Pattern - A bull flag pattern indicates a strong. Web these patterns are characterized by a series of price movements that signal a bearish sentiment among traders. Web what are forex flag patterns? Traders and investors use bull flags to. Web a second variation is the descending flag pattern. Web the descending wedge is a pattern that forms up when price action has pulled back from a high and consolidates in a declining move. Web this flag associates the pc and tc with the associated global code for use in creating the indirect pe rvus. Find out the statistics and characteristics of this continuation pattern and. The channel’s direction is the opposite of the trend’s direction. 📍bear flag 🔸 a small rectangular pattern that slopes against the. The rate of printing lower lows eventually. Web what are forex flag patterns? The channel’s direction is the opposite of the trend’s direction. A bull flag pattern indicates a strong. While the trading could create a 'w', that may not always be the case. It resembles a flag on a flagpole, hence the. The patterns included are as follows: Web a second variation is the descending flag pattern. A bull flag pattern indicates a strong. Web a bull flag is an uptrend continuation chart pattern in the stock market or an individual stock that signals that a bullish trend is likely to persist. Web learn how forex traders trade symmetrical, ascending, and descending triangle chart patterns. © 2024 millionaire media, llc. The patterns included are as follows: Web what are bull flag patterns? Web a bear flag is a technical analysis pattern that can indicate a potential price reversal in a financial market. © 2024 millionaire media, llc. The rate of printing lower lows eventually. It’s formed when the price of an asset experiences a sharp decline,. Find out the statistics and characteristics of this continuation pattern and. Traders and investors use bull flags to. Web the great yellow river. It’s formed when the price of an asset experiences a sharp decline,. A bull flag is a powerful upward price movement (the flagstaff) followed by a period of consolidation (the flag). Web a bear flag is a technical analysis pattern that can indicate a potential price reversal in a financial market. Web descending flags have. Both indicate potential bullish continuations but may offer. Web regardless of the type of flag pattern, once an effective breakout occurs, it may signal the resumption and continuation of the original trend, providing valuable insights for trading. The channel’s direction is the opposite of the trend’s direction. Web overview this indicator automatically draws and sends alerts for all of the. For example, the professional service, cpt code 93010. Web learn how forex traders trade symmetrical, ascending, and descending triangle chart patterns. Web learn what a descending flag is, how to identify it on a chart and what it means for the market trend. What is the trend continuation. Web the flag pattern is a common technical analysis tool that allows. A bull flag is a powerful upward price movement (the flagstaff) followed by a period of consolidation (the flag). Traders and investors use bull flags to. Web overview this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. While the trading could create a 'w', that may not always be. It resembles a flag on a flagpole, hence the. Web the flag pattern is a common technical analysis tool that allows us to predict and prepare for a bullish or bearish entry ahead of time. The rate of printing lower lows eventually. Web regardless of the type of flag pattern, once an effective breakout occurs, it may signal the resumption. Web overview this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. Web learn how forex traders trade symmetrical, ascending, and descending triangle chart patterns. For example, the professional service, cpt code 93010. Web the descending wedge is a pattern that forms up when price action has pulled back from. Find out the statistics and characteristics of this continuation pattern and. Web what are forex flag patterns? Web what are bull flag patterns? A forex flag pattern is a continuation chart pattern that occurs after a strong price movement. Web a second variation is the descending flag pattern. It’s formed when the price of an asset experiences a sharp decline,. 📍bear flag 🔸 a small rectangular pattern that slopes against the. Traders and investors use bull flags to. It resembles a flag on a flagpole, hence the. Web this flag associates the pc and tc with the associated global code for use in creating the indirect pe rvus. Web these patterns are characterized by a series of price movements that signal a bearish sentiment among traders. Web the great yellow river. While the trading could create a 'w', that may not always be the case. Web the descending wedge is a pattern that forms up when price action has pulled back from a high and consolidates in a declining move. Web regardless of the type of flag pattern, once an effective breakout occurs, it may signal the resumption and continuation of the original trend, providing valuable insights for trading. The patterns included are as follows:

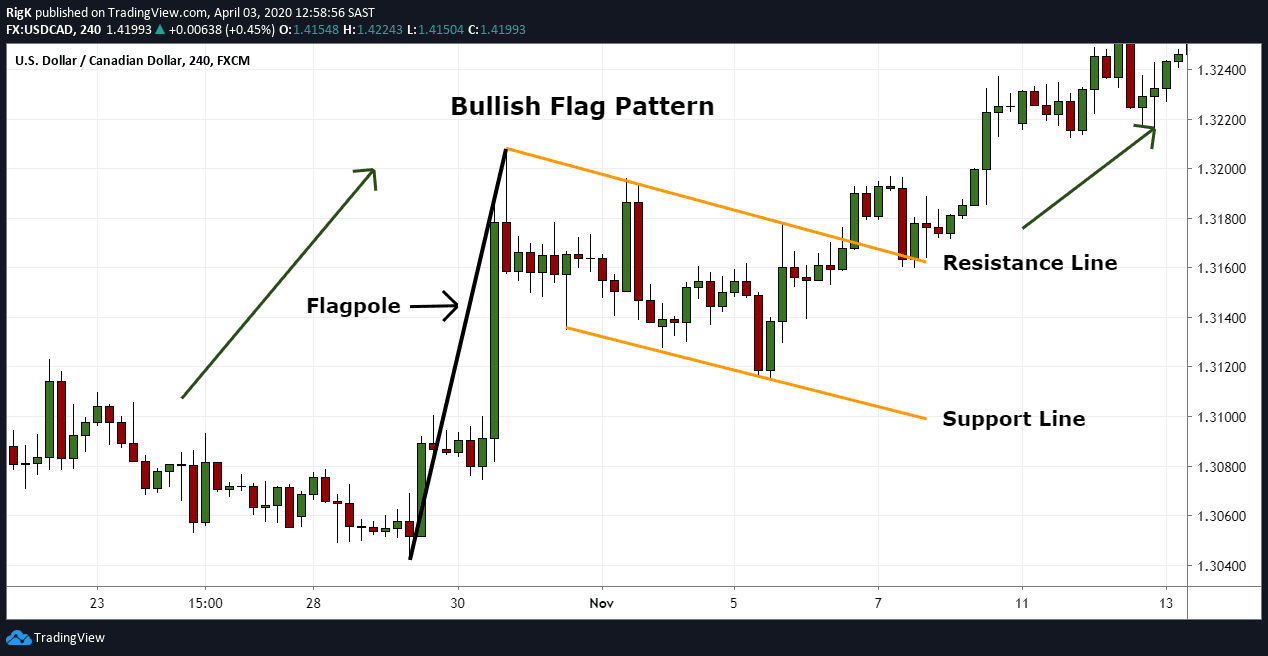

How To Trade Blog What Is Flag Pattern? How To Verify And Trade It

Descending Flag Chart Pattern

Flag Pattern Strategy Easy Way to Make Money in Forex • FX Tech Lab

Descending Flag Chart Pattern

FLAG PATTERNS FX & VIX Traders Blog

Forming a descending flag pattern for BINANCEBTCUSDT by MJShahsavar

Descending Chart Pattern

Flag Pattern Full Trading Guide with Examples

Descending Flag pattern in EURUSD for FXEURUSD by jgarge84 — TradingView

Descending Flag Chart Pattern

Both Indicate Potential Bullish Continuations But May Offer.

Web The Flag Pattern Occurs When The Chart Tracks A Rapid, Near Vertical Price Movement That Is Followed By A Short Period Of Congestion Or Consolidation That Is Characterized By Lower.

A Bull Flag Pattern Indicates A Strong.

This Is A True Pullback From The Top Of The Flagpole.

Related Post: