Descending Broadening Wedge Pattern

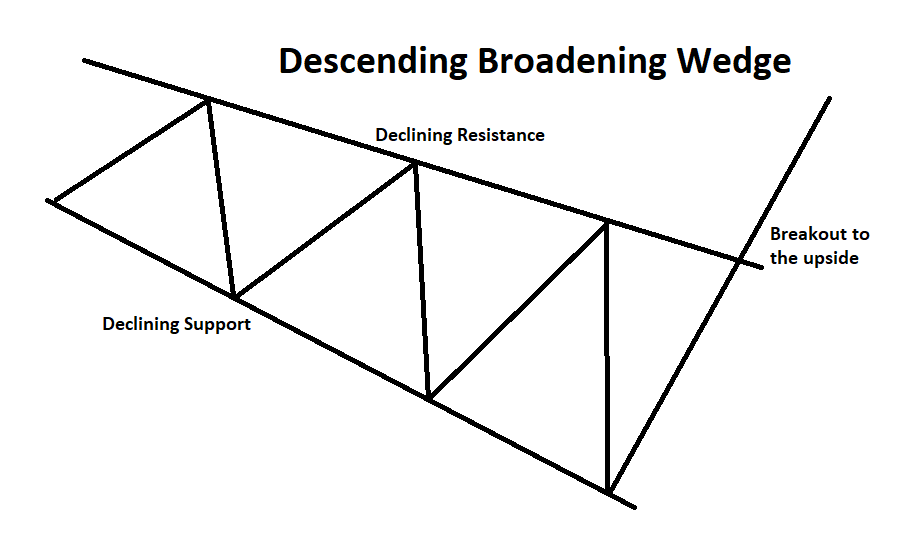

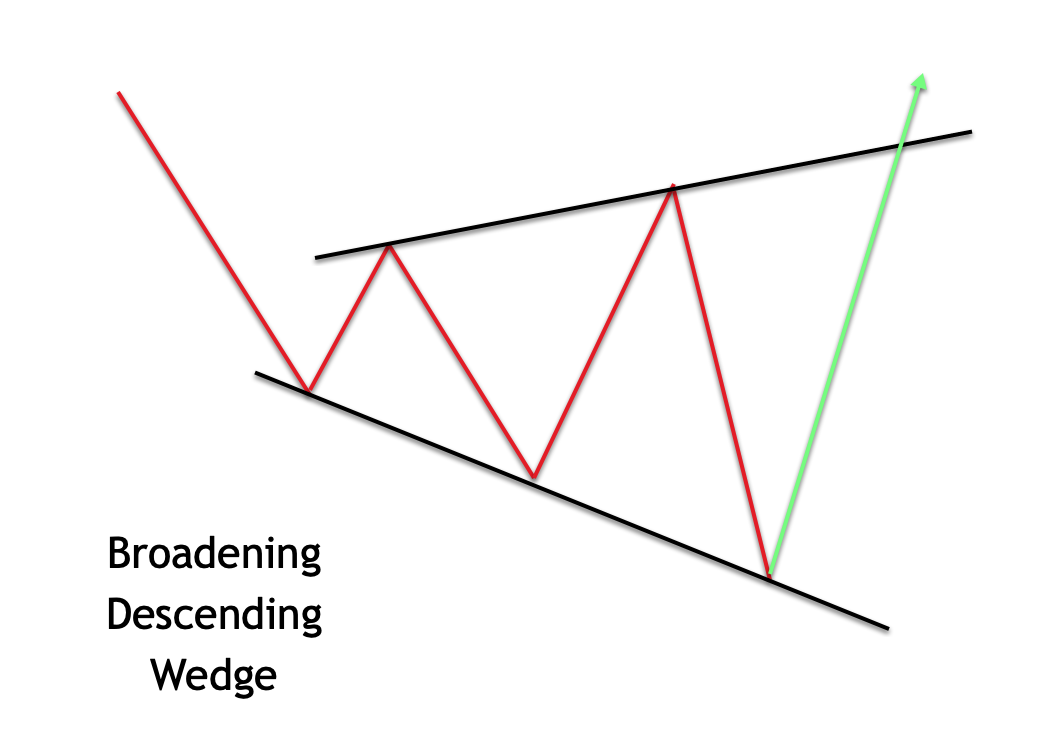

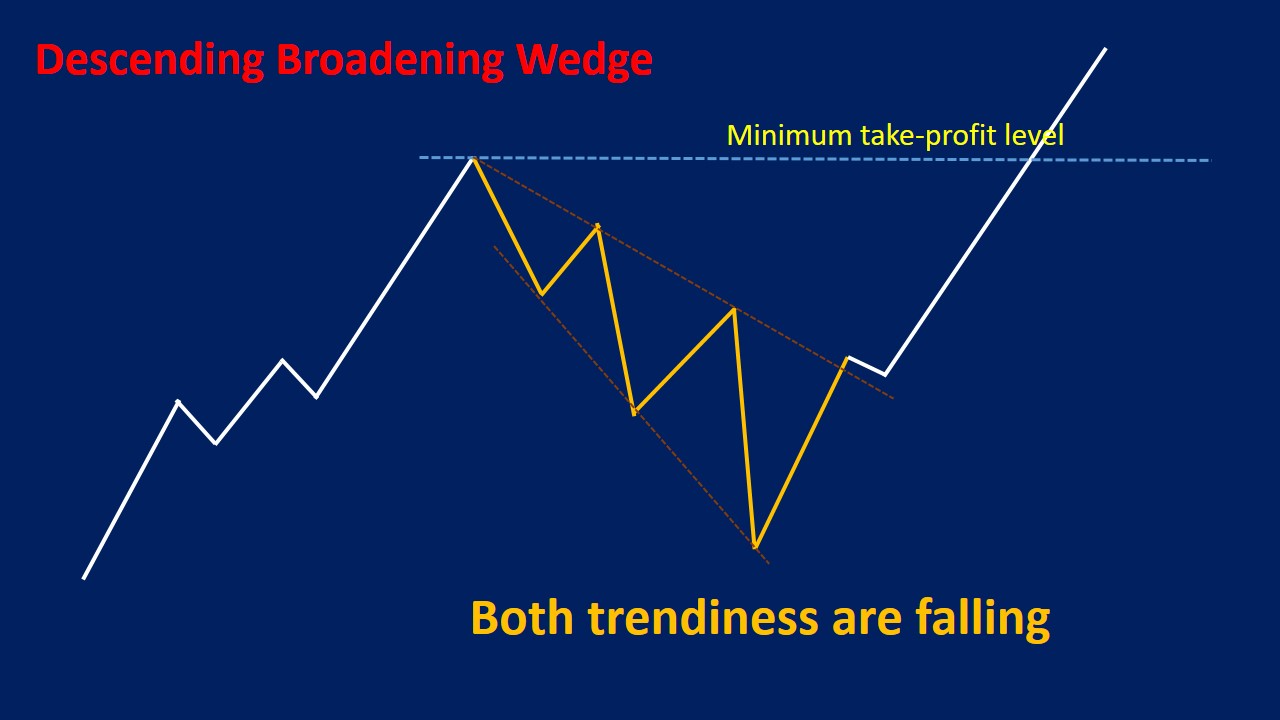

Descending Broadening Wedge Pattern - Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Web a descending broadening wedge forms as price moves between the upper resistance and lower support trend lines multiple times as the trading range expands during the downtrend in price. After the trendlines are formed, as soon. Web trading descending broadening wedges. It is represented by two lines, one ascending and one descending, that. The pattern is formed by two diverging lines, the resistance being a horizontal line and the support a bearish downward slant, so it is an inverted ascending triangle. Web the descending broadening wedge pattern is a crucial technical analysis tool, representing a potential bullish reversal in markets that have been trending downward. Web decending broadening wedges are megaphone shaped chart patterns with lower peaks and lower valleys. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. After the trendlines are formed, as soon. It is represented by two lines, one ascending and one descending, that. It is formed by two diverging bullish lines. A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. Swing traders can trade the pattern from top to bottom and from bottom to top. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web a descending broadening wedge forms as price moves between the upper resistance and lower support. It appears during a downtrend in price and is characterized by two diverging trend lines that look like a megaphone pointing down and to the right. The pattern is formed by two diverging lines, the resistance being a horizontal line and the support a bearish downward slant, so it is an inverted ascending triangle. It is represented by two lines,. In this pattern, the lower trendline connecting lower lows is steeper than the upper trendline connecting the lower highs. It appears during a downtrend in price and is characterized by two diverging trend lines that look like a megaphone pointing down and to the right. Web decending broadening wedges are megaphone shaped chart patterns with lower peaks and lower valleys.. After the trendlines are formed, as soon. The pattern is formed by two diverging lines, the resistance being a horizontal line and the support a bearish downward slant, so it is an inverted ascending triangle. A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. Web decending broadening wedges are megaphone shaped chart patterns. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. Web trading descending broadening wedges. The pattern is formed by two diverging lines, the resistance being a horizontal line and the support a bearish downward slant, so it is an inverted ascending triangle. Web a technical chart pattern. Web a descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is represented by two lines, one ascending and one descending, that. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Swing traders can trade the pattern from top to bottom and from bottom to top.. Web a descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It forms when price action oscillates between two diverging trendlines, with the upper trendline sloping downward and the lower trendline sloping upwards. After the trendlines are formed, as soon. Swing traders can trade the pattern from top to bottom and from bottom to top. Web. Web a descending broadening wedge is bullish chart pattern (said to be a reversal pattern). Web the descending broadening wedge pattern is a crucial technical analysis tool, representing a potential bullish reversal in markets that have been trending downward. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Web a descending. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. It is represented by two lines, one ascending and one descending, that. It is represented by two lines, one ascending and one descending, that diverge from each other. It is formed by two diverging bullish lines. Web a. Web trading descending broadening wedges. It is formed by two diverging bullish lines. After the trendlines are formed, as soon. It is represented by two lines, one ascending and one descending, that. In this pattern, the lower trendline connecting lower lows is steeper than the upper trendline connecting the lower highs. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Web a descending broadening wedge is bullish chart pattern (said to be a reversal pattern). Web contrary to the ascending broadening wedge, the descending broadening wedge pattern features a downward price movement where the price range expands over time. The pattern is formed by two diverging lines, the resistance being a horizontal line and the support a bearish downward slant, so it is an inverted ascending triangle. Descending broadening wedges tend to breakout upwards. Web a descending broadening wedge is a bullish chart pattern that is often considered a reversal pattern. Web decending broadening wedges are megaphone shaped chart patterns with lower peaks and lower valleys. Web the descending broadening wedge pattern is a crucial technical analysis tool, representing a potential bullish reversal in markets that have been trending downward. It is represented by two lines, one ascending and one descending, that diverge from each other. Swing traders can trade the pattern from top to bottom and from bottom to top. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation.

Descending Broadening Wedge Pattern Explained New Trader U

Descending Broadening Wedges Bullish (+) Green & Red Bullish

Eduational Example of a descending broadening wedge. para FXNZDUSD

Descending Broadening Wedge Pattern Explained New Trader U

Descending Broadening Wedge Chart Pattern Trading charts, Forex

How to Trade Rising and Falling Wedge Patterns in Forex Forex

Descending Wedge Chart Pattern

Broadening Wedge Pattern Types, Strategies & Examples

SANDUSDT Descending Broadening wedge pattern! for BINANCESANDUSDT by

Descending Broadening Wedge The Forex Geek

Web A Technical Chart Pattern Recognized By Analysts, Known As A Broadening Formation Or Megaphone Pattern, Is Characterized By Expanding Price Fluctuation.

It Appears During A Downtrend In Price And Is Characterized By Two Diverging Trend Lines That Look Like A Megaphone Pointing Down And To The Right.

A Descending Broadening Wedge Is Confirmed/Valid If It Has Good Oscillation Between The Two Upward Lines.

It Forms When Price Action Oscillates Between Two Diverging Trendlines, With The Upper Trendline Sloping Downward And The Lower Trendline Sloping Upwards.

Related Post: