Debt Sheet Printable

Debt Sheet Printable - How to use the debt inventory worksheet. Inspiring and fun printable charts to help you stay motivated, get out of debt, and knock out your financial goals. The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. These worksheets make it easy to pay off debt quickly and visibly see your progress using the dave ramsey debt snowball method. Web so grab some charts and get started today! List all the debts you have. Web the first free printable debt snowball worksheet is a tracking sheet. These spreadsheets work best with the debt snowball method. Available as printable pdf or google docs sheet. Web this free printable debt payoff worksheet will be your personal financial sidekick. List all the debts you have. Web download the free debt tracker printable from financial best life to strategize and track your debt while paying it off faster. 3 printables over 3 days! Web using a debt snowball worksheet helps you prioritize your debts and figure out your debt payoff plan (you can download ours below). No one likes being. Get started with this free printable debt snowball worksheet! List the balance, interest rate, and minimum payment. On the worksheet, you will list your debt from the smallest balance to the largest. It will help you organize and track all your debts, from those credit card balances to fogotten auto loans, making it easier to chip away at them and. Conquer your debt with these free printables. There is no day like today to get your debt snowball. Web debt snowball worksheet printable. Write down the amount you plan to pay on that debt each month. Let’s take this one step by step. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. On the worksheet, you will list your debt from the smallest balance to the largest. Web use these free debt payoff tracker printables as visual encouragement as you work to pay down your debt! Web what is a debt. It lists all debt in ascending order by balance owed and includes the minimum payments due. Inspiring and fun printable charts to help you stay motivated, get out of debt, and knock out your financial goals. Let’s take this one step by step. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more.. There is no day like today to get your debt snowball. No one likes being in debt, but so many of us struggle with it, that it. Web debt snowball worksheet printable. Write down the amount you plan to pay on that debt each month. These spreadsheets work best with the debt snowball method. The smallest debt will be the one that will be getting the snowball payment. If you have outstanding debt (and who doesn’t?), then record the key details on this worksheet and use it as a tool to get ahead with your budgeting. Web so grab some charts and get started today! Web choose from 35 unique debt trackers that include. Choose the debt payoff tracker that you like best or use a different one for each debt you’re working on. A debt snowball spreadsheet is a tool used in this popular method for paying off debt. Circle any debts in collections. Web download the free debt tracker printable from financial best life to strategize and track your debt while paying. Web use this debt snowball worksheet to stay organized and track the progress of your own debt payment. In my personal opinion, the best place to start with anything is to have a plan and it’s. You need to work out how much you can put towards this first debt while covering the minimum payments. Available as printable pdf or. 3 printables over 3 days! The debt snowball strategy of paying off your debt is so easy to use that you don’t even need a debt snowball excel spreadsheet. Web pick up our free printable debt payoff worksheet pdf and debt snowball guide. Web debt snowball worksheet printable. Web use this free debt tracker printable to help you plan your. Web in this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Choose the debt payoff tracker that you like best or use a different one for each debt you’re working on. Write down the amount you plan to pay on that debt each month. Web use this debt worksheet to see all your bills and plan what you owe. Available as printable pdf or google docs sheet. On the worksheet, you will list your debt from the smallest balance to the largest. The smallest debt will be the one that will be getting the snowball payment. How to use the snowball method to pay off debt. Use my free printable debt snowball worksheet to get started! Web perhaps the best way to pay down your debt is with the debt snowball method! Web amount into your smallest debt until it is paid off. Web below are 10 debt snowball worksheets that you can download for free to use to track your debt payoff process. How to use the debt inventory worksheet. Web just download the free printable debt tracker, print them out, and put them up in a spot where you'll see them every day, like your kitchen. Do the same for the second smallest debt untill that one is paid off as well. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more.

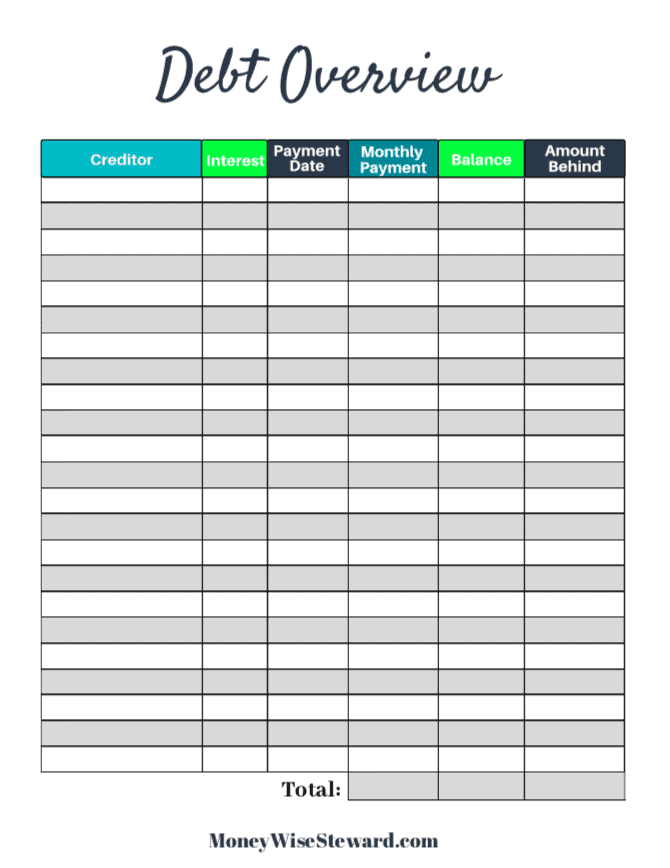

Printable Debt Payoff Worksheet

![]()

Free Printable Debt Tracker Use This To Payoff Your Debts Quicker

![]()

Download Printable Debt Tracker Template PDF

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

Printable Debt Payoff Planner

![]()

Free Printable Debt Tracker Printable Templates

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy

10 Free Debt Snowball Worksheet Printables to Help You Get Out Of Debt

Debt Planner Printable

Debt Free Templates

The Debt Snowball Strategy Of Paying Off Your Debt Is So Easy To Use That You Don’t Even Need A Debt Snowball Excel Spreadsheet.

If You Have Outstanding Debt (And Who Doesn’t?), Then Record The Key Details On This Worksheet And Use It As A Tool To Get Ahead With Your Budgeting.

Inspiring And Fun Printable Charts To Help You Stay Motivated, Get Out Of Debt, And Knock Out Your Financial Goals.

You Need To Work Out How Much You Can Put Towards This First Debt While Covering The Minimum Payments.

Related Post: