Cost Of Goods Template

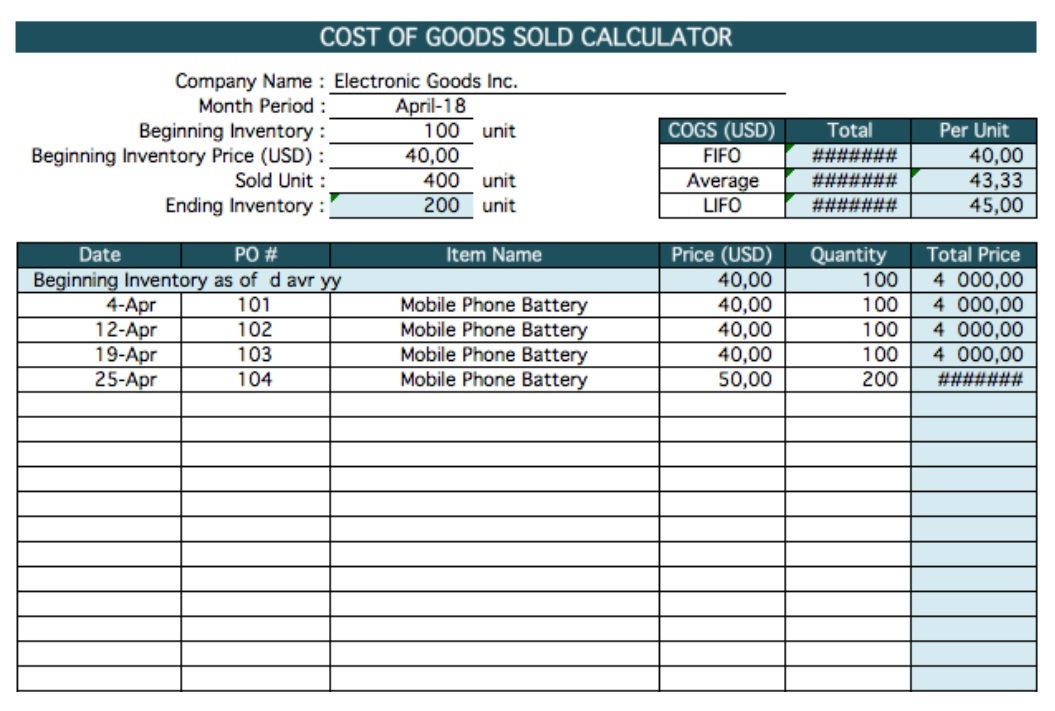

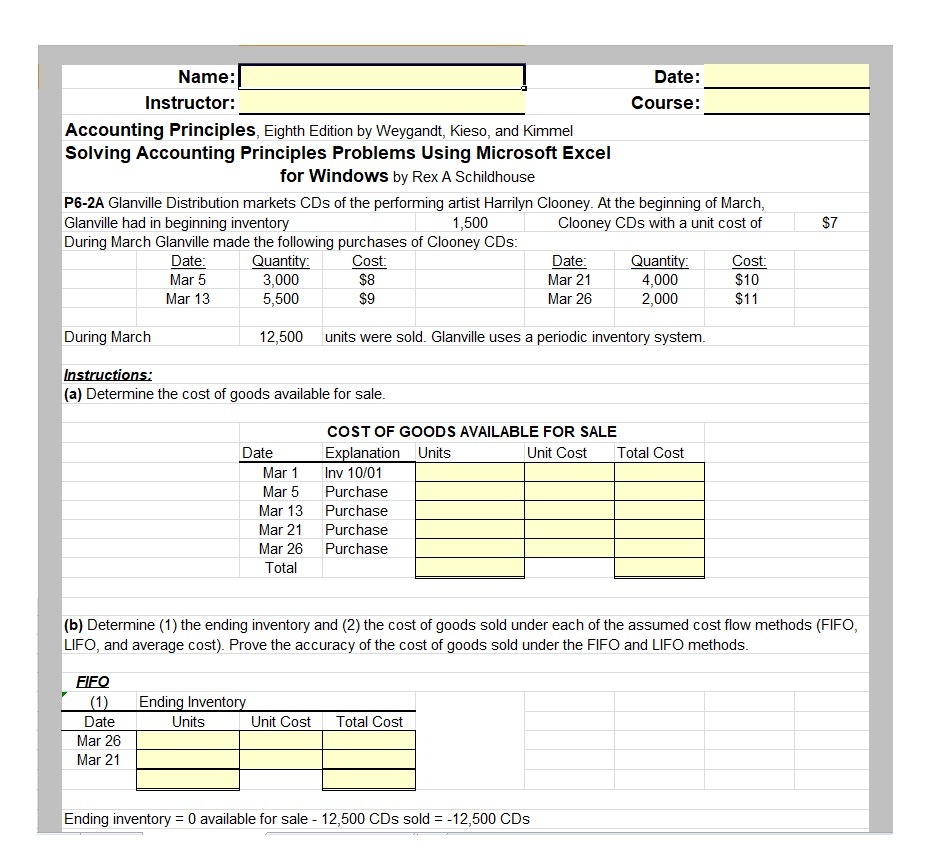

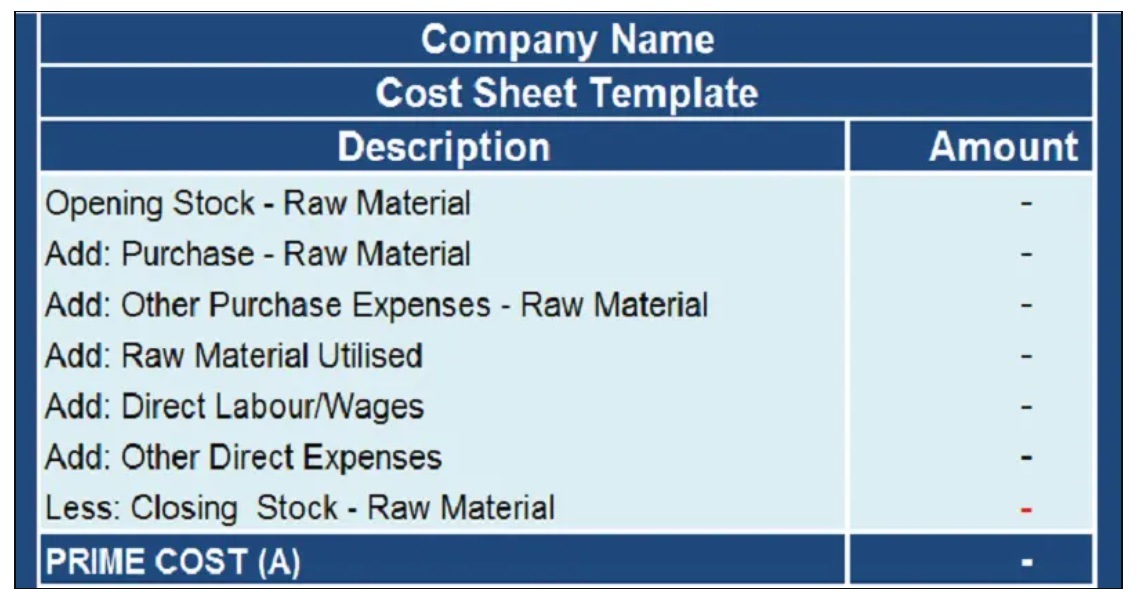

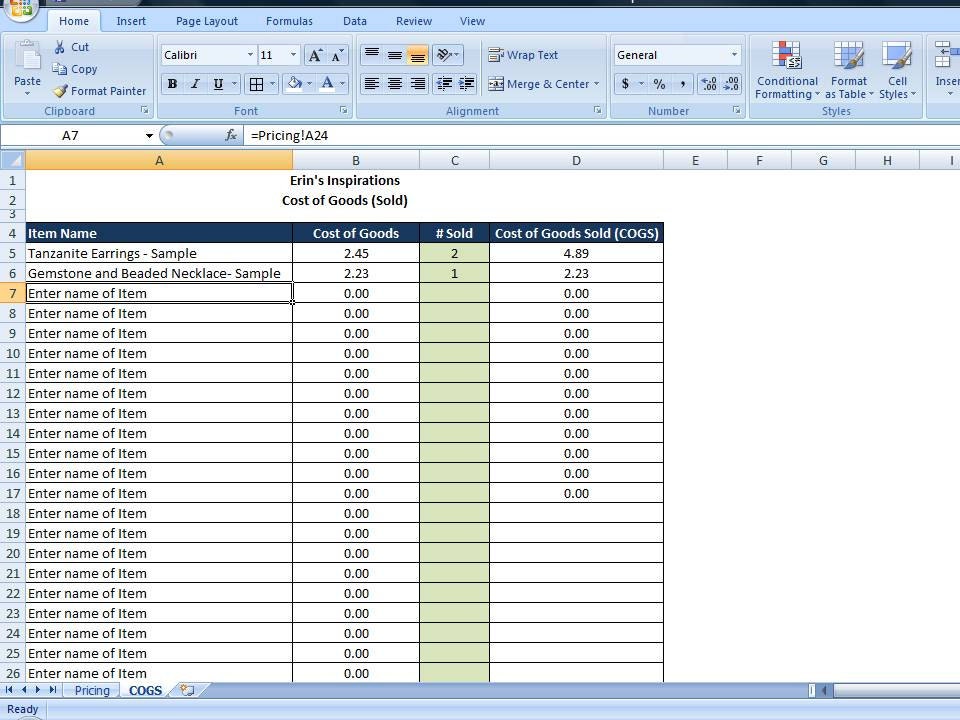

Cost Of Goods Template - Cogs directly impacts a company's profits as cogs is. This way, you can get rid of manual calculation and formatting. Let us say that you are selling bath soaps. Get complete visibility and control over the cost of goods you manufacture and. This particular template is free, downloadable and ready to use right away. A cost of goods sold statement shows the cost of goods sold over a specific accounting period, typically offering more insights than are found on a normal income statement. Fifo, lifo and weighted average. The formula looks at all costs directly related to your inventory, including raw materials, transportation, storage, and direct labor for manufacturers. Perfect for auditors, accountants, and business owners. It includes all the direct costs associated with producing the goods or services you sell, such as the cost of materials, labor, and other costs such as commissions. Web this cost of goods sold template demonstrates three methods of cogs accounting: Web calculate cost of goods sold in minutes. Web you can get this cost of goods sold template and worksheet to calculate important factors that can maximize profits and lead to better business practices. Get your numbers right with this excel cost of goods sold template. Last. Web what is cost of goods sold (cogs)? Fifo, lifo and weighted average. Web this cost of goods sold excel template helps you easily track and calculate your costs of goods sold (cogs) and overhead expenses. Apply the cost of goods sold formula: Has the following details for recording the inventory for the calendar year ending on december 31st, 2018. Web what is a cost of goods sold statement? The formula looks at all costs directly related to your inventory, including raw materials, transportation, storage, and direct labor for manufacturers. Web download our cogs (cost of goods sold) template and learn how to effectively track and analyze your company’s direct costs associated with the production of goods sold. Web this. Web calculate cost of goods sold in minutes. Cost of goods sold is the direct cost incurred in the production of any goods or services. Cost per batch, unit cost and cogm. Web cost of goods sold template has basic formulas and formats that make the calculation easier and automatic. Get your numbers right with this excel cost of goods. Web the formula for calculating cost of goods sold (cogs) is the sum of the beginning inventory balance and purchases in the current period, subtracted by the ending inventory balance. Web what is cost of goods sold? Web cost of goods manufactured (cogm) excel template | download. Cogs measures the “direct cost” incurred Sales revenue minus cost of goods sold. Web download our cogs (cost of goods sold) template and learn how to effectively track and analyze your company’s direct costs associated with the production of goods sold. Web what is a cost of goods sold statement? Web cost of goods manufactured (cogm) excel template | download. Cogs directly impacts a company's profits as cogs is. It does not include. Our template takes the cost of goods sold equation and automatically calculates your cogs for you. Web cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good. Cogs directly impacts a company's profits as cogs is. Web cost of goods manufactured (cogm) excel template. Web cost of goods manufactured (cogm) excel template | download. Cogs is a business and sales metric that determines the value of inventory sold (and created, if you’re the manufacturer) in a specific time. The formula looks at all costs directly related to your inventory, including raw materials, transportation, storage, and direct labor for manufacturers. Web cogs template you can. The cost of goods sold (cogs) is a key financial measure that indicates the total cost of producing your goods and services. Web this cost of goods sold template demonstrates three methods of cogs accounting: The formula looks at all costs directly related to your inventory, including raw materials, transportation, storage, and direct labor for manufacturers. This way, you can. The cost of goods manufactured (cogm) is a managerial accounting term that is used to show the total production costs for a specific time period. Our template takes the cost of goods sold equation and automatically calculates your cogs for you. Web use our template to automatically generate the numbers you need: Cogs is a business and sales metric that. The cost of goods sold is considered an expense in accounting. Last in, first out (lifo), items purchased last are sold first. Cost of goods sold is the direct cost incurred in the production of any goods or services. Web what is cost of goods sold (cogs)? The cost of goods manufactured (cogm) is a managerial accounting term that is used to show the total production costs for a specific time period. Cost per batch, unit cost and cogm. It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. Sales revenue minus cost of goods sold is a business’s gross profit. Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web cost of goods manufactured (cogm) excel template | download. Web cost of goods sold is the direct cost of producing a good, which includes the cost of the materials and labor used to create the good. Cogs is a business and sales metric that determines the value of inventory sold (and created, if you’re the manufacturer) in a specific time. Web calculate cost of goods sold in minutes. Web use our template to automatically generate the numbers you need: Perfect for auditors, accountants, and business owners. Get your numbers right with this excel cost of goods sold template.

Cost Of Goods Sold Excel Template

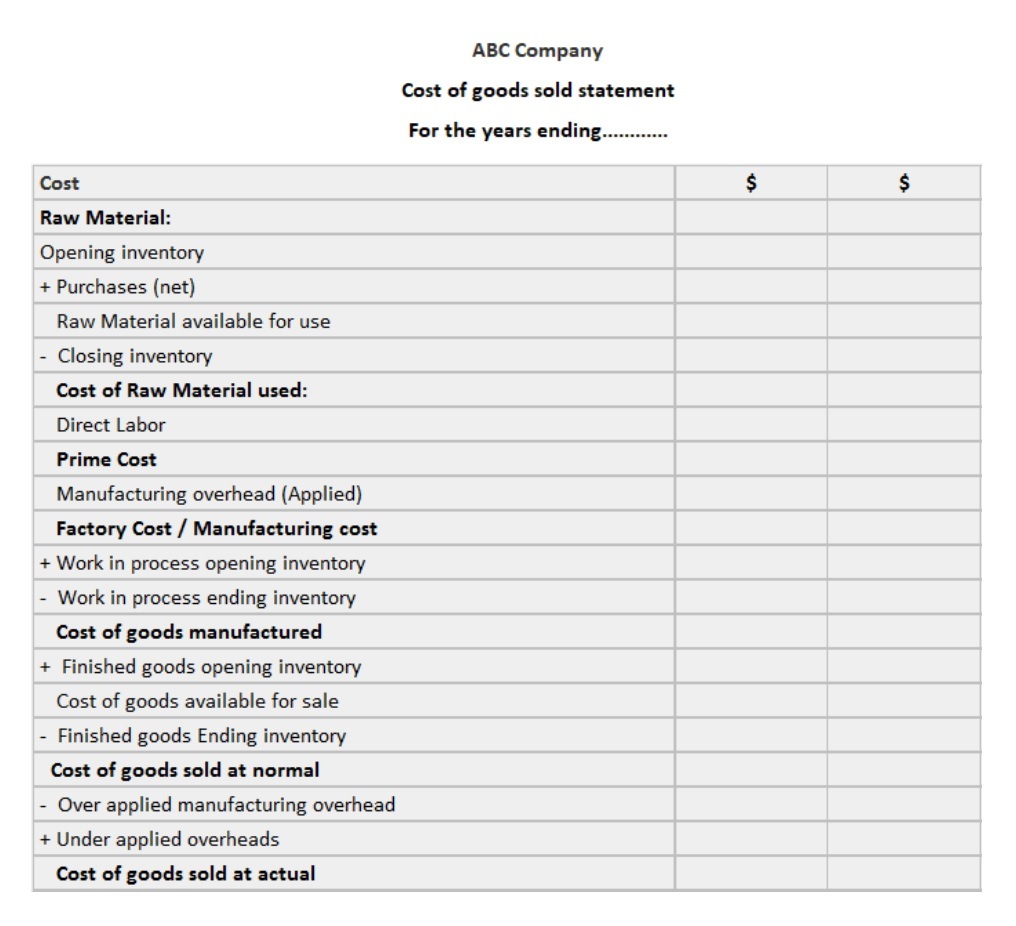

Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Cost of Goods Sold Statement Example Free Excel Templates

Cost Of Goods Sold Excel Template

Cost of Goods Sold Spreadsheet Calculate by TimeSavingTemplates

Cost of Sales Templates 8+ Free MS Docs, Xlsx & PDF Formats, Samples

EXCEL of Cost Accounting of Purchased Goods.xlsx WPS Free Templates

Cost of Goods Sold Statement Template Free Excel Templates

Cost Of Goods Template Excel Free

Schedule of Cost of Goods Manufactured Excel Templates

Cogs = Beginning Inventory + Purchases + Ending Inventory.

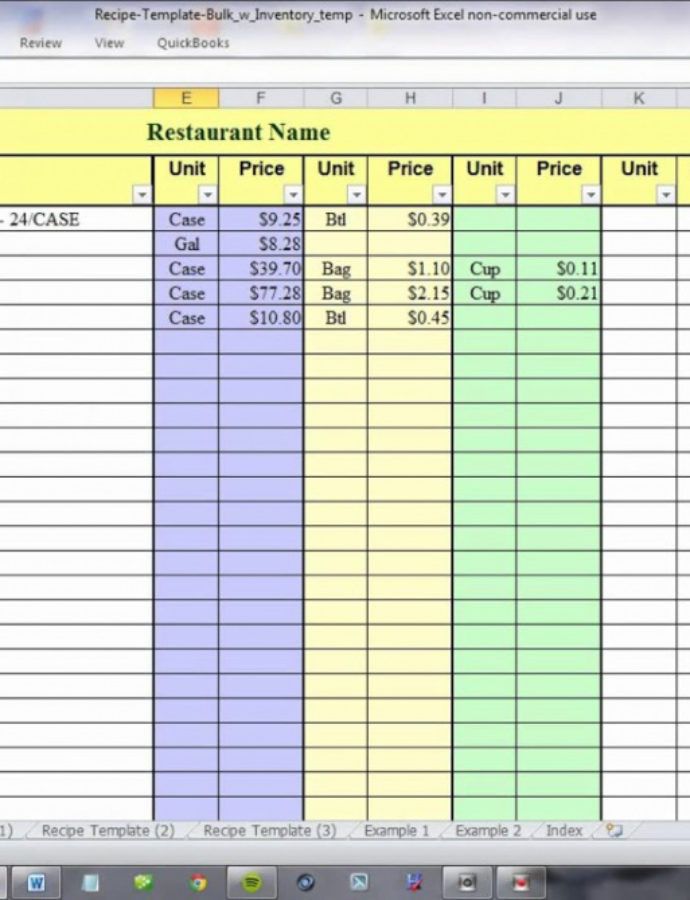

How To Use The Inventory And Cost Of Goods Sold Spreadsheet.

It Does Not Include Indirect Expenses, Such As Sales Force Costs And Distribution Costs.

Web You Can Calculate The Cost Of Goods Sold In Four Steps:

Related Post: