Contractionary Monetary Policy Is Designed To

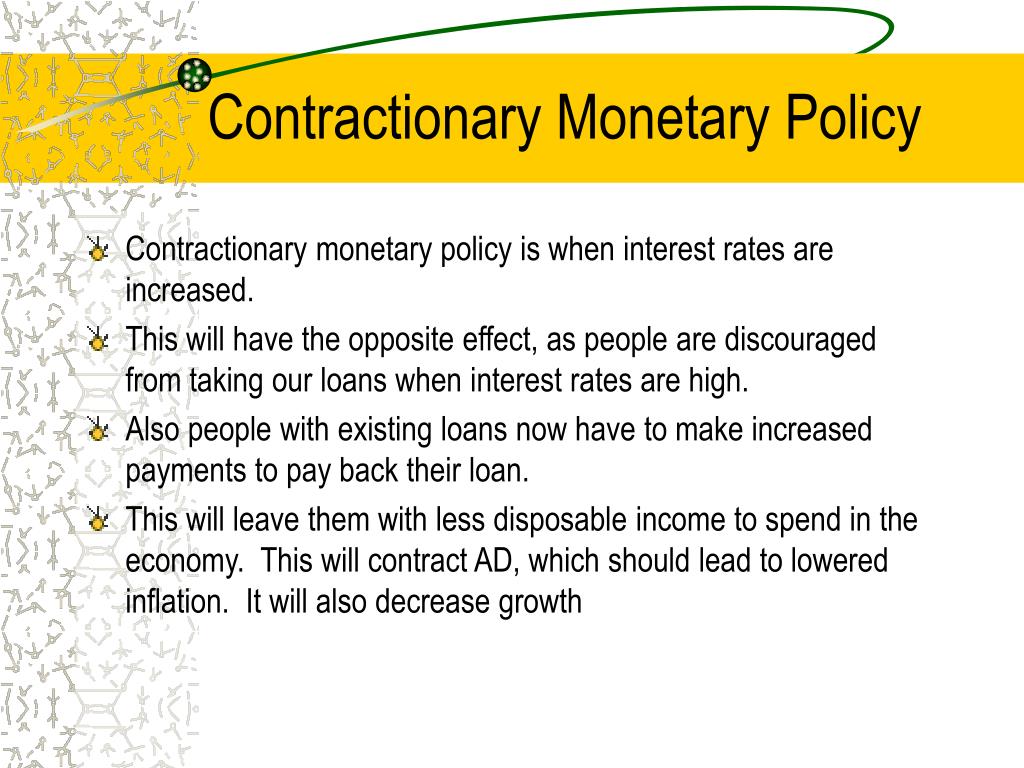

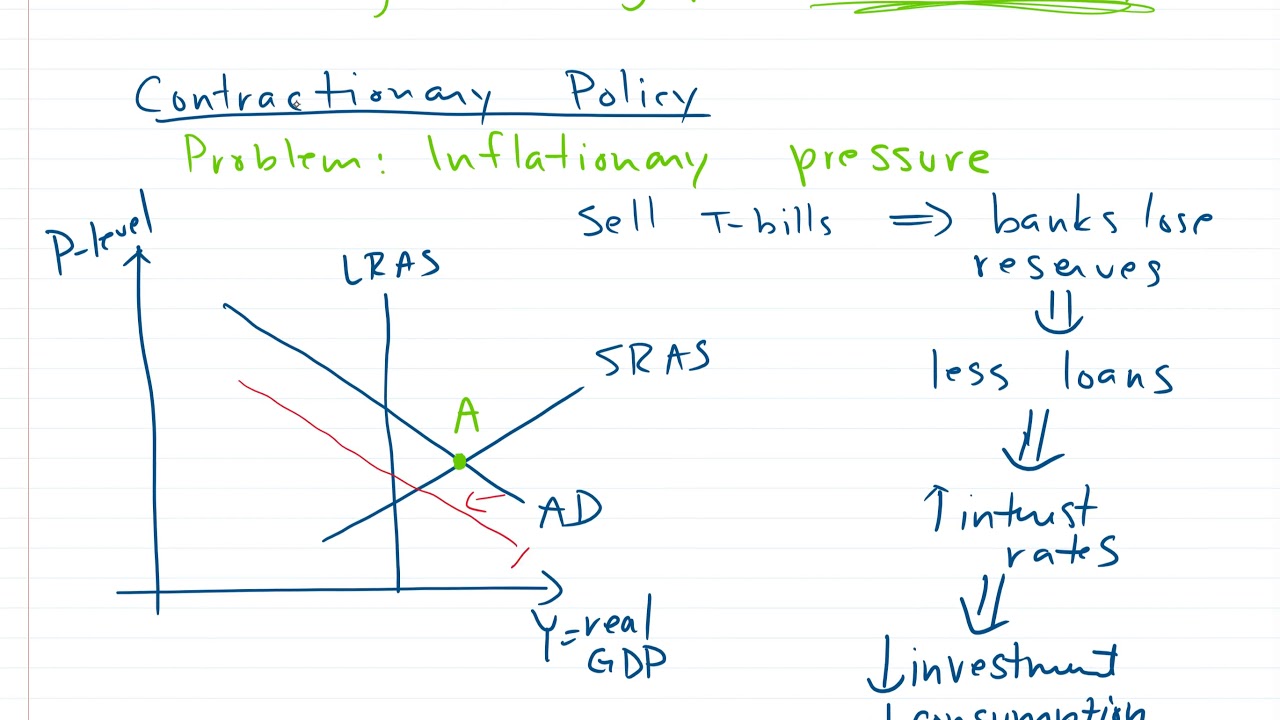

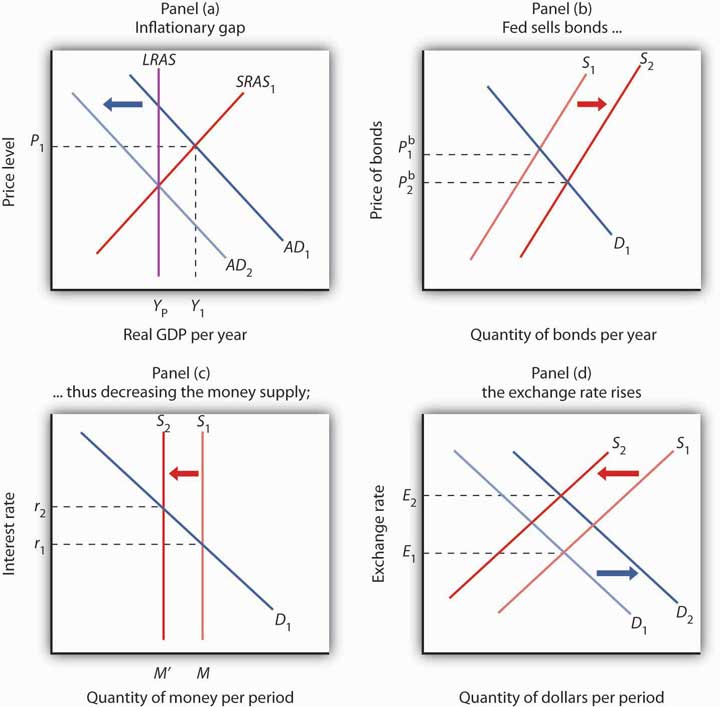

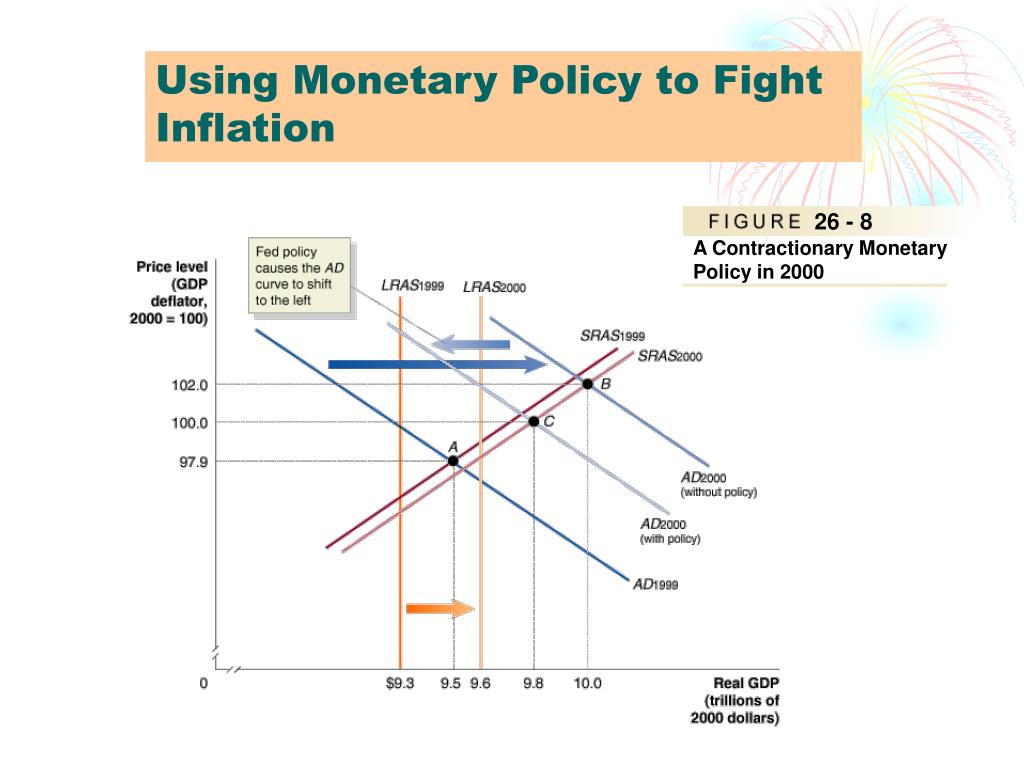

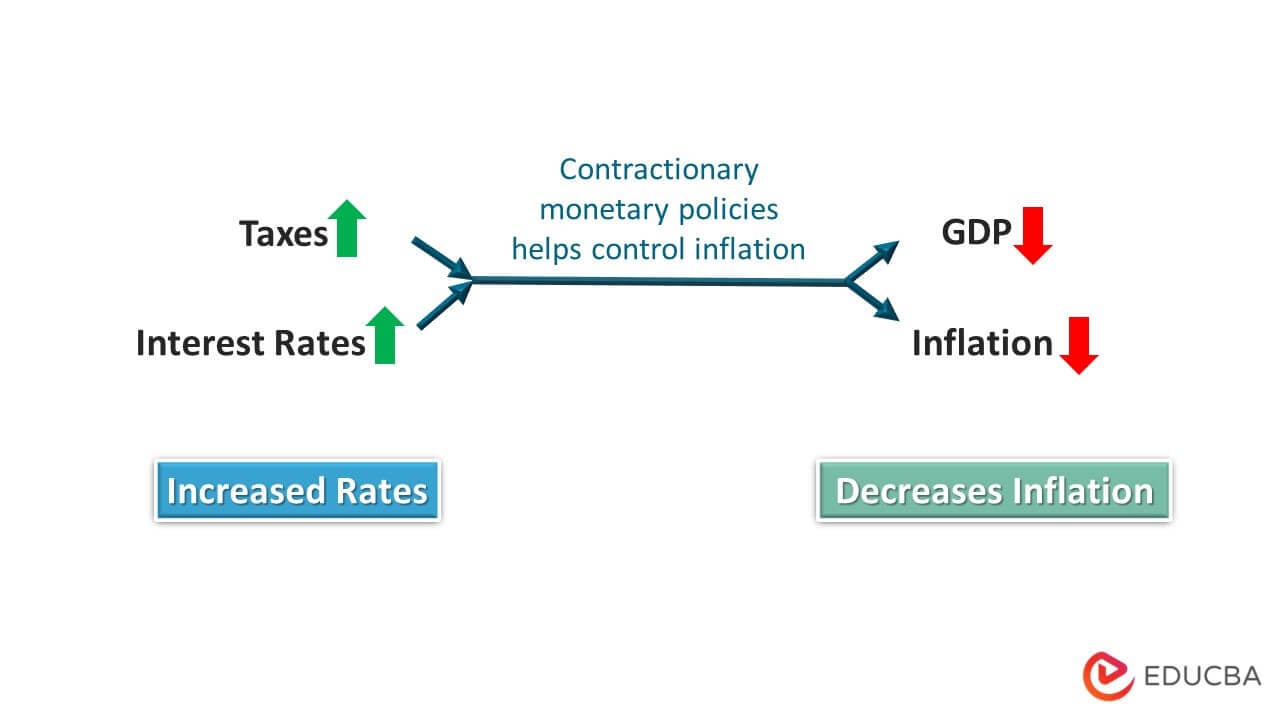

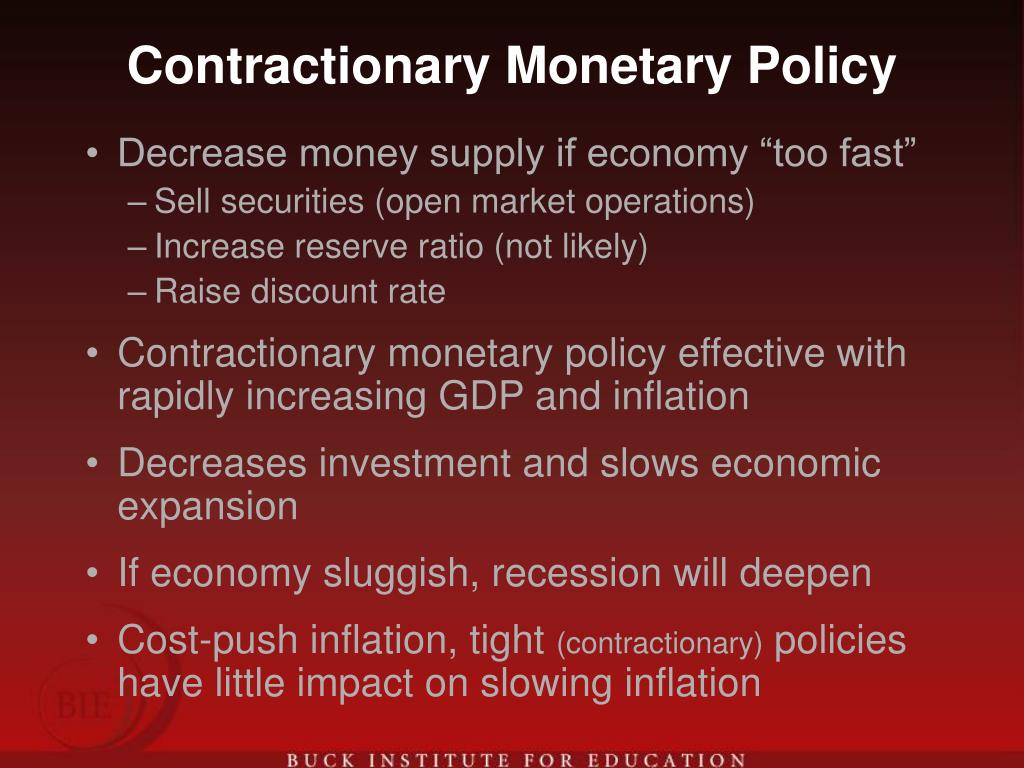

Contractionary Monetary Policy Is Designed To - It is a macroeconomic tool used to combat rising inflation. Web contractionary monetary policy consists of actions taken by the federal reserve to curtail inflation by dampening economic growth. A rise in inflation is considered the. Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. Web what type of monetary policy (expansionary or contractionary) would be appropriate for closing the gap? Web if inflation heats up, raising interest rates or restricting the money supply are both contractionary monetary policies designed to lower inflation. A contractionary policy is a monetary measure to reduce government spending or the rate of monetary expansion by a central bank. Find out how the fed uses expansionary and contractionary monetary policy to close gaps. It involves reducing the money supply to ensure the cost of borrowing is high. The main contractionary policies employed by the united states government include raising interest rates, increasing bank. It is a macroeconomic tool used to combat rising inflation. A contractionary policy is a monetary measure to reduce government spending or the rate of monetary expansion by a central bank. Web a contractionary monetary policy is a type of monetary policy that is intended to reduce the rate of monetary expansion to fight inflation. Web contractionary monetary policy is. It involves reducing the money supply to ensure the cost of borrowing is high. A rise in inflation is considered the. Web the goal of a contractionary policy is to reduce the money supply within an economy by increasing interest rates. Web a contractionary monetary policy is a type of monetary policy that is intended to reduce the rate of. Web contractionary monetary policy is an economic policy used to deal with inflation. Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. This helps slow economic growth by making. Web with monetary policy, a central bank increases or decreases the amount of currency and credit in circulation, in a. Web the goal of a contractionary policy is to reduce the money supply within an economy by increasing interest rates. Web a contractionary policy is a crucial tool used by governments and central banks to reduce government spending or slow the rate of monetary expansion. Conversely, a monetary policy that raises. Web contractionary monetary policy is an economic policy used. Web contractionary monetary policy would be appropriate in this situation. Web tight or contractionary monetary policy that leads to higher interest rates and a reduced quantity of loanable funds will reduce two components of aggregate demand. Expansionary fiscal policy causes inflation by increasing aggregate demand which puts upward pressure on. The use of the money supply to influence macroeconomic aggregates,. Web a contractionary policy is a crucial tool used by governments and central banks to reduce government spending or slow the rate of monetary expansion. Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. This helps slow economic growth by making. Web contractionary monetary policy is an economic policy. Web how monetary policy works. Web a contractionary monetary policy is a type of monetary policy that is intended to reduce the rate of monetary expansion to fight inflation. Find out how the fed uses expansionary and contractionary monetary policy to close gaps. Web contractionary monetary policy would be appropriate in this situation. Web the goal of a contractionary policy. The use of the money supply to influence macroeconomic aggregates, such as output, inflation, and unemployment. Web learn about the goals, tools, and challenges of monetary policy in the u.s. Web what type of monetary policy (expansionary or contractionary) would be appropriate for closing the gap? Web a contractionary policy is a crucial tool used by governments and central banks. Find out how the fed uses expansionary and contractionary monetary policy to close gaps. Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. The main contractionary policies employed by the united states government include raising interest rates, increasing bank. Web contractionary monetary policy is one of the two types. Web what type of monetary policy (expansionary or contractionary) would be appropriate for closing the gap? Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. Web contractionary monetary policy would be appropriate in this situation. Web learn about the goals, tools, and challenges of monetary policy in the u.s.. Web contractionary monetary policy is an economic policy used to deal with inflation. Web a monetary policy that lowers interest rates and stimulates borrowing is an expansionary monetary policy or loose monetary policy. Expansionary fiscal policy causes inflation by increasing aggregate demand which puts upward pressure on. The main contractionary policies employed by the united states government include raising interest rates, increasing bank. Web contractionary monetary policy consists of actions taken by the federal reserve to curtail inflation by dampening economic growth. The use of the money supply to influence macroeconomic aggregates, such as output, inflation, and unemployment. Web learn about the goals, tools, and challenges of monetary policy in the u.s. Web a contractionary policy is a crucial tool used by governments and central banks to reduce government spending or slow the rate of monetary expansion. A rise in inflation is considered the. Conversely, a monetary policy that raises. Web what type of monetary policy (expansionary or contractionary) would be appropriate for closing the gap? Find out how the fed uses expansionary and contractionary monetary policy to close gaps. Web expansionary monetary policy is simply a policy which expands (increases) the supply of money, whereas contractionary monetary policy contracts. Web a contractionary monetary policy is a type of monetary policy that is intended to reduce the rate of monetary expansion to fight inflation. Web tight or contractionary monetary policy that leads to higher interest rates and a reduced quantity of loanable funds will reduce two components of aggregate demand. Web contractionary monetary policy is one of the two types of monetary policy and can be defined as actions taken by the central bank in order to close an inflationary.

PPT Policy PowerPoint Presentation, free download ID5390615

:max_bytes(150000):strip_icc()/Contractionary-policy_final-e4519c7207b94ce6aaa8f3e97f2f23a1.png)

What Is Contractionary Policy? Definition, Purpose, and Example

PPT Money, the Interest Rate, and Output Analysis and Policy

Contractionary Policy YouTube

Policy in the United States

Module Policy and the Interest Rate ppt video online download

PPT Policy PowerPoint Presentation, free download ID3445602

PPT Policy (chapter 26) PowerPoint Presentation, free

How does Contractionary Policy work? Meaning & Examples

PPT Policy Tools PowerPoint Presentation, free download ID

Web The Goal Of A Contractionary Policy Is To Reduce The Money Supply Within An Economy By Increasing Interest Rates.

A Contractionary Policy Is A Monetary Measure To Reduce Government Spending Or The Rate Of Monetary Expansion By A Central Bank.

Web If Inflation Heats Up, Raising Interest Rates Or Restricting The Money Supply Are Both Contractionary Monetary Policies Designed To Lower Inflation.

Web With Monetary Policy, A Central Bank Increases Or Decreases The Amount Of Currency And Credit In Circulation, In A Continuing Effort To Keep Inflation, Growth And.

Related Post: