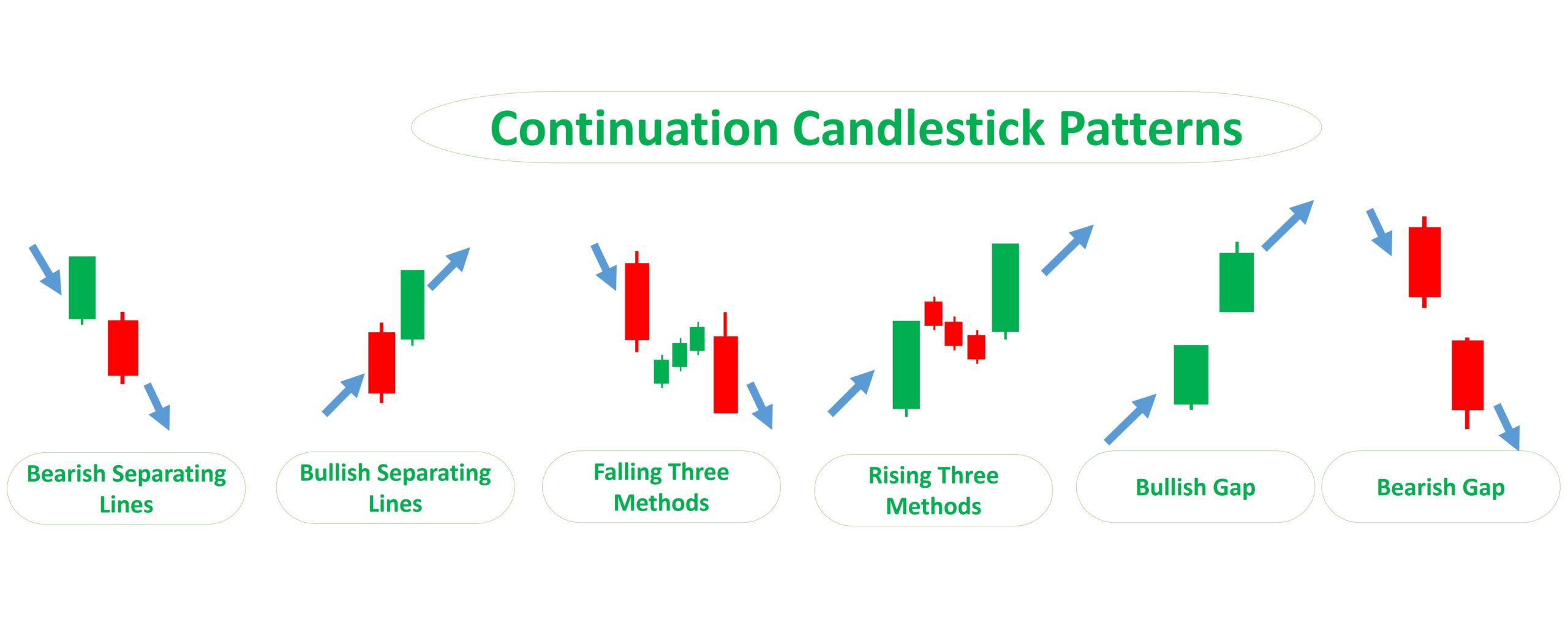

Continuation Candlestick Patterns

Continuation Candlestick Patterns - Find out the types of continuation patterns, such as triangles, flags, pennants and. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Web japanese candlestick bullish continuation patterns that tend to resolve in the same direction as the prevailing trend. This pattern occurs when a small bearish candlestick is. Web learn how to identify and use continuation candlestick patterns to forecast trend resumption in the market. A doji signifies indecision because it is has both an. Web learn all about continuation and reversal candlestick patterns, how to trade candlestick bars, and the best strategies to profit from them! Web continuation patterns occur over some time to indicate asset price movements, market pressures, and volatility. Bearish continuation candlestick patterns indicate that the price may continue trending lower even though it. A doji is another type of candlestick with a small real body. Let’s break down the basics: These can help traders to identify a period of rest in the. Web learn about all the trading candlestick patterns that exist: A doji is another type of candlestick with a small real body. Web if a candlestick pattern doesn’t indicate a change in market direction, it is what is known as a continuation pattern. A doji signifies indecision because it is has both an. Web continuation candlestick patterns, being that they are usually spotted during technical analysis on an asset’s candlestick pattern, can indicate stronger or weaker. Web learn how to identify and trade continuation patterns, which are chart formations that signal a temporary consolidation before a trend resumes. Bullish, bearish, reversal, continuation and. Web what are bearish continuation candlestick patterns? These can help traders to identify a period of rest in the. Web continuation candlestick patterns are important elements in price action strategies and for making accurate predictions about the movement of the market. Web a mat hold pattern is a candlestick formation indicating the continuation of a prior trend. Web learn all. These can help traders to. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. How to find high probability trend continuation setups. A doji signifies indecision because it is has both an. This pattern occurs when a small bearish candlestick is. Web a mat hold pattern is a candlestick formation indicating the continuation of a prior trend. How to find high probability trend continuation setups. How to understand any candlestick. Web article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by internationally known author and. Web #1 upside tasuki gap. Web four continuation candlestick patterns. Here’s a table of the characteristics and significance of the upside tasuki gap bullish continuation candlestick pattern. By delving deep into candlestick charts, the. Web continuation candlestick patterns are important elements in price action strategies and for making accurate predictions about the movement of the market. Find out the types of continuation patterns, such as triangles, flags, pennants and. By delving deep into candlestick charts, the. There can be either bearish or bullish mat hold patterns. Web article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by internationally known author and. Bullish, bearish, reversal, continuation and indecision with examples. Web trend continuation candlestick patterns. These can help traders to. Find out the types of continuation patterns, such as triangles, flags, pennants and. How to find high probability trend continuation setups. This pattern occurs when a small bearish candlestick is. Web article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by internationally known author and. Web continuation candlestick patterns are important elements in price action strategies and for making accurate predictions about the movement of the market. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a. Web continuation patterns occur over some time to indicate asset price movements, market pressures, and volatility. Web what are bearish continuation candlestick patterns? Find out the types of continuation patterns, such as triangles, flags, pennants and. See examples of doji, spinning top, tasuki. Web trend continuation candlestick patterns. Web what are bearish continuation candlestick patterns? Web learn how to identify and use continuation candlestick patterns to forecast trend resumption in the market. Web japanese candlestick bullish continuation patterns that tend to resolve in the same direction as the prevailing trend. Continuation of an uptrend upside tasuki gap. Web learn about all the trading candlestick patterns that exist: By displaying how an asset's price moves,. By delving deep into candlestick charts, the. Web continuation candlestick patterns, being that they are usually spotted during technical analysis on an asset’s candlestick pattern, can indicate stronger or weaker. Web continuation patterns occur over some time to indicate asset price movements, market pressures, and volatility. How to understand any candlestick. Web learn what continuation patterns are and how to spot them on price charts. Web learn how to identify and trade continuation patterns, which are chart formations that signal a temporary consolidation before a trend resumes. Web a mat hold pattern is a candlestick formation indicating the continuation of a prior trend. Web the difference between a hammer candlestick and a doji. Bearish continuation candlestick patterns indicate that the price may continue trending lower even though it. Web four continuation candlestick patterns.

Popular Candlestick Patterns and Categories TrendSpider Learning Center

FOUR CONTINUATION CANDLESTICK PATTERNS YouTube

Continuation Candlestick Patterns Cheat Sheet

Continuation Candlestick Patterns Cheat Sheet

Bearish Continuation Candlestick Patterns

Continuation Candlestick Patterns Cheat Sheet

Continuation Pattern Meaning, Types & Working Finschool

CANDLESTICK PATTERNS LEARNING = LIVING

Continuation Candlestick Patterns Cheat Sheet

Continuation Candlestick Patterns Cheat Sheet

Web If A Candlestick Pattern Doesn’t Indicate A Change In Market Direction, It Is What Is Known As A Continuation Pattern.

Web Article Shows The Top 10 Performing Continuation Candlesticks With Links To Descriptions And Performance Statistics, Written By Internationally Known Author And.

See Examples Of Doji, Spinning Top, Tasuki.

Web Candlestick Patterns Are Made Up Of Individual “Candles,” Each Showing The Price Movement For A Certain Time Period.

Related Post: