Cogs Template

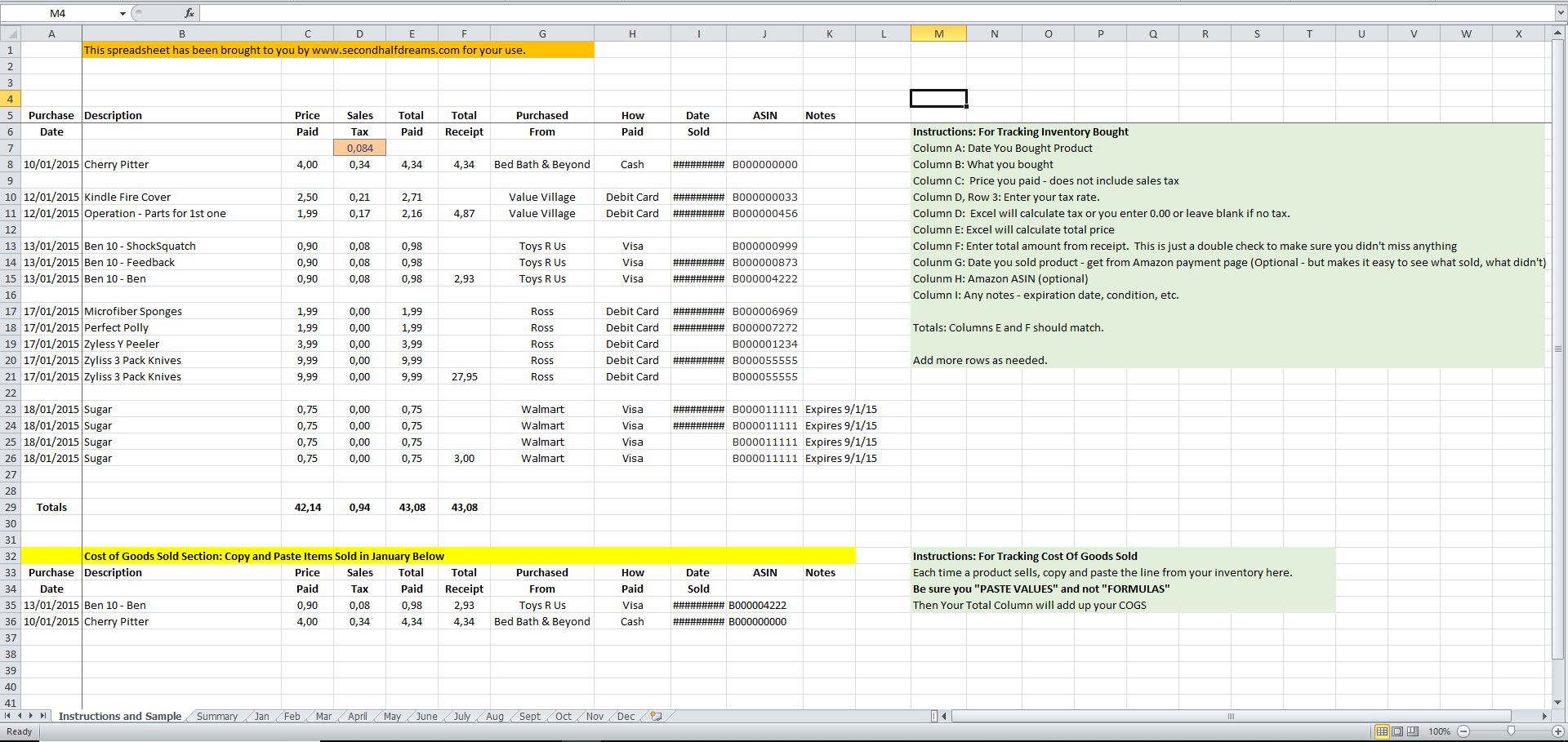

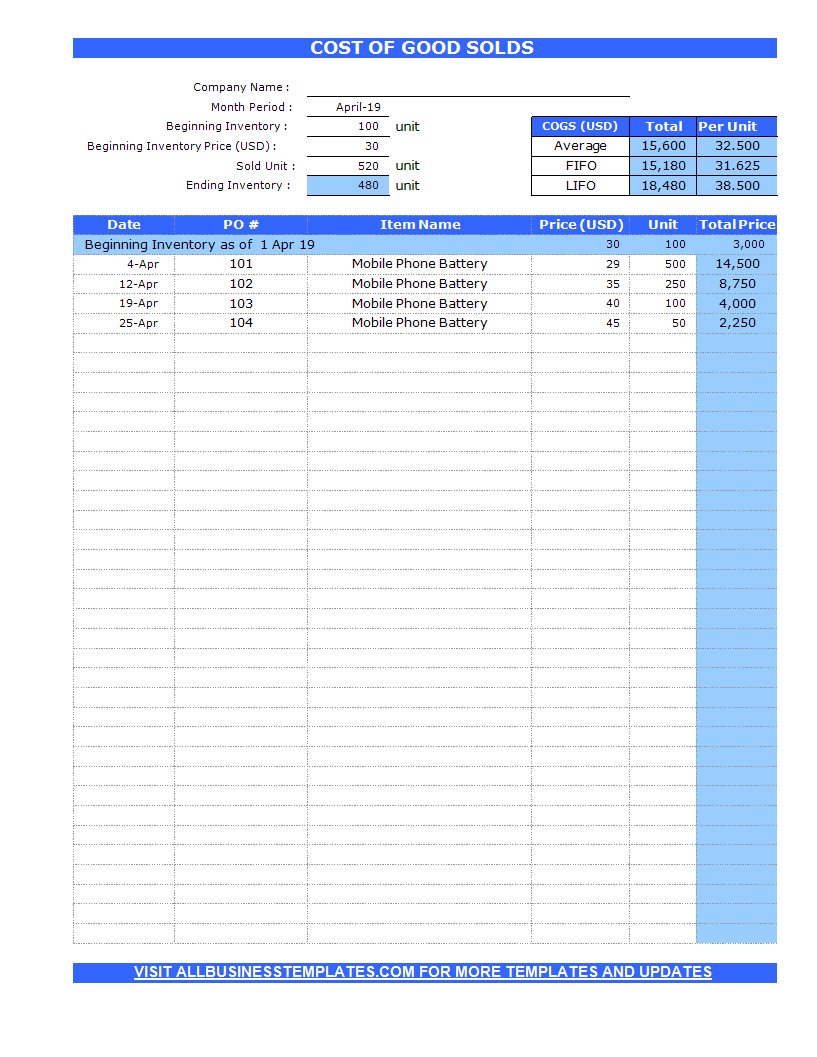

Cogs Template - To compute the total cost of goods sold, we use the cost of goods sold formula: Sales revenue minus cost of goods sold is a business’s gross profit. Web this template can be an effective tool for general managers, higher management of production units for defining the product prize, and keep the monitor the cost. It includes material cost, direct labor cost, and direct factory overheads and is directly proportional to revenue. Web calculate and manage the cost of goods sold (cogs), a crucial metric that directly impacts the profitability of your saas business. This amount includes the cost of the materials and labor directly used to create the good. Find & easily calculate your cogs for free, here. How to calculate cost of goods sold (cogs) Web what is cost of goods sold (cogs)? Web calculate the cost of goods sold (cogs). Web cogs, sometimes called “cost of sales,” is reported on a company’s income statement, right beneath the revenue line. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or services. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production. Web this cost of goods sold excel template helps you easily track and calculate your costs of goods sold (cogs) and overhead expenses. This includes direct labor cost, direct material cost, and direct factory overheads. Accommodate up up to 50 different items; Find & easily calculate your cogs for free, here. The cost of goods sold (cogs) represents the total. It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. Type purchase and sales transaction date and let the formulas calculate cogs based on fifo, average and lifo method in monthly basis automatically It includes material cost, direct labor cost, and direct factory overheads and is directly proportional to revenue. Web cost of. Our template takes the cost of goods sold equation and automatically calculates your cogs for you. Understanding and managing cogs helps leaders run their companies more efficiently and more profitably. It does not include indirect expenses, such as sales force costs and distribution costs. The cost of goods sold is considered an expense in accounting. Download our free template today. It includes material cost, direct labor cost, and direct factory overheads and is directly proportional to revenue. Cost of goods sold is the direct cost incurred in the production of any goods or services. Accommodate up up to 50 different items; To compute the total cost of goods sold, we use the cost of goods sold formula: Web the cost. Web calculate and manage the cost of goods sold (cogs), a crucial metric that directly impacts the profitability of your saas business. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. It includes all the direct costs associated with producing the goods or services you sell, such as the cost. Cogs includes all direct costs needed to produce a product for sale. Accommodate up up to 50 different items; Learn how this metric is used on income statements to determine gross profit. It includes material cost, direct labor cost, and direct factory overheads and is directly proportional to revenue. It includes all the direct costs associated with producing the goods. The cost of goods sold (cogs) represents the total expense a company incurs to produce the goods it sells in a specific period. Web this easy to use inventory and cost of goods sold spreadsheet template is designed to help you with the very basics of tracking your materials, products and orders to get you started on your inventory journey.. It includes all the direct costs associated with producing the goods or services you sell, such as the cost of materials, labor, and other costs such as commissions. Type purchase and sales transaction date and let the formulas calculate cogs based on fifo, average and lifo method in monthly basis automatically Cogs covers all the direct costs involved in making. Accommodate up up to 50 different items; Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web calculate and manage the cost of goods sold (cogs), a crucial metric that directly impacts the profitability of your saas business. Our template takes the cost of goods sold equation and automatically calculates. Web you can read more information in particular worksheet in this cogs calculator template. Web the cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with slots for the cost of goods for each product or service and the number of products and services sold. Accommodate up up to 50 different items; Type purchase and sales transaction date and let the formulas calculate cogs based on fifo, average and lifo method in monthly basis automatically Web cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Web the cost of goods sold (cogs) is how much it costs a business to produce its goods. Web cost of goods sold (cogs) measures the “direct cost” incurred in the production of any goods or services. Web what is cost of goods sold (cogs)? It does not include indirect expenses, such as sales force costs and distribution costs. The cost of goods sold is considered an expense in accounting. Additionally, this template can be useful for new startups, production units, or any other small business for cost management purposes. Cost of goods sold is the direct cost incurred in the production of any goods or services. Cogs covers all the direct costs involved in making a product, such as raw materials, labor, and specific overhead costs. Web use our cost of goods sold calculator to save time and quickly work out what the cost of goods sold (cogs) is for your business. Understanding and managing cogs helps leaders run their companies more efficiently and more profitably. Sales revenue minus cost of goods sold is a business’s gross profit.

Cogs Excel Template Get Support For This Template.Printable Template

CoGS Calculator »

Cogs coloring, Download Cogs coloring for free 2019

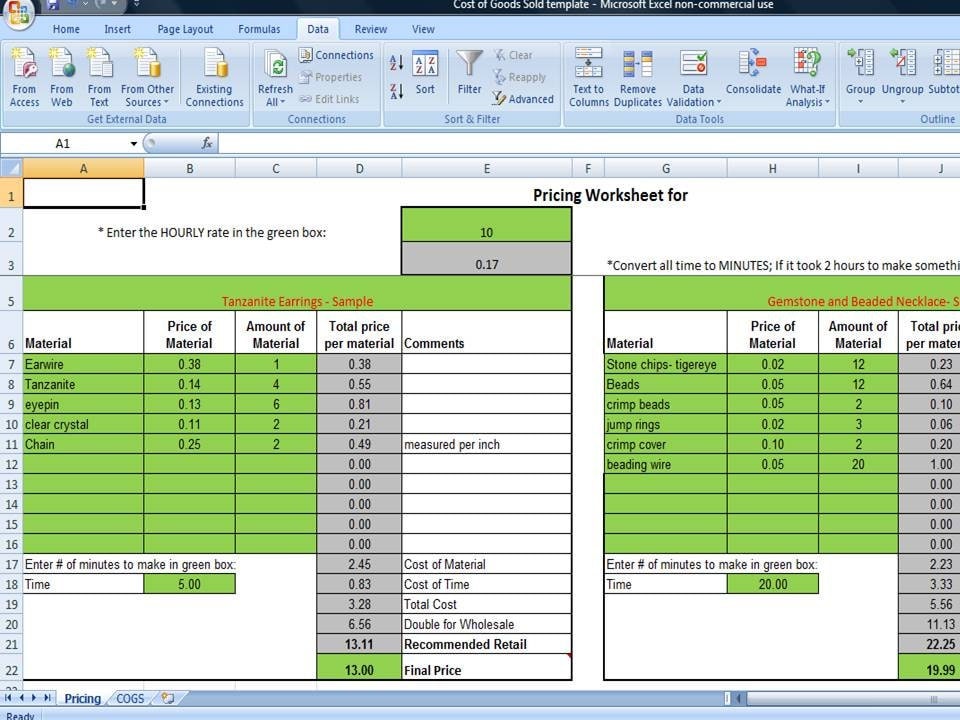

Cost of Goods Sold Spreadsheet Calculate COGS for Handmade

Cost of Goods Sold Calculator » The Spreadsheet Page

Cogs Spreadsheet With Solved The Following Spreadsheet Is Posted. I

Cogs Excel Template prntbl.concejomunicipaldechinu.gov.co

CoGS Calculator Templates at

Cogs Illustration Free Stock Photo Public Domain Pictures

Cogs And Gears Icon Vector Illustration Isolated Gears icon, Vector

Cogs Includes All Direct Costs Needed To Produce A Product For Sale.

Learn How This Metric Is Used On Income Statements To Determine Gross Profit.

Our Template Takes The Cost Of Goods Sold Equation And Automatically Calculates Your Cogs For You.

Cost Of Goods Sold (Cogs), Otherwise Known As The “Cost Of Sales”, Refers To The Direct Costs Incurred By A Company While Selling Its Goods Or Services.

Related Post: