Car Repo Rates Chart 2024

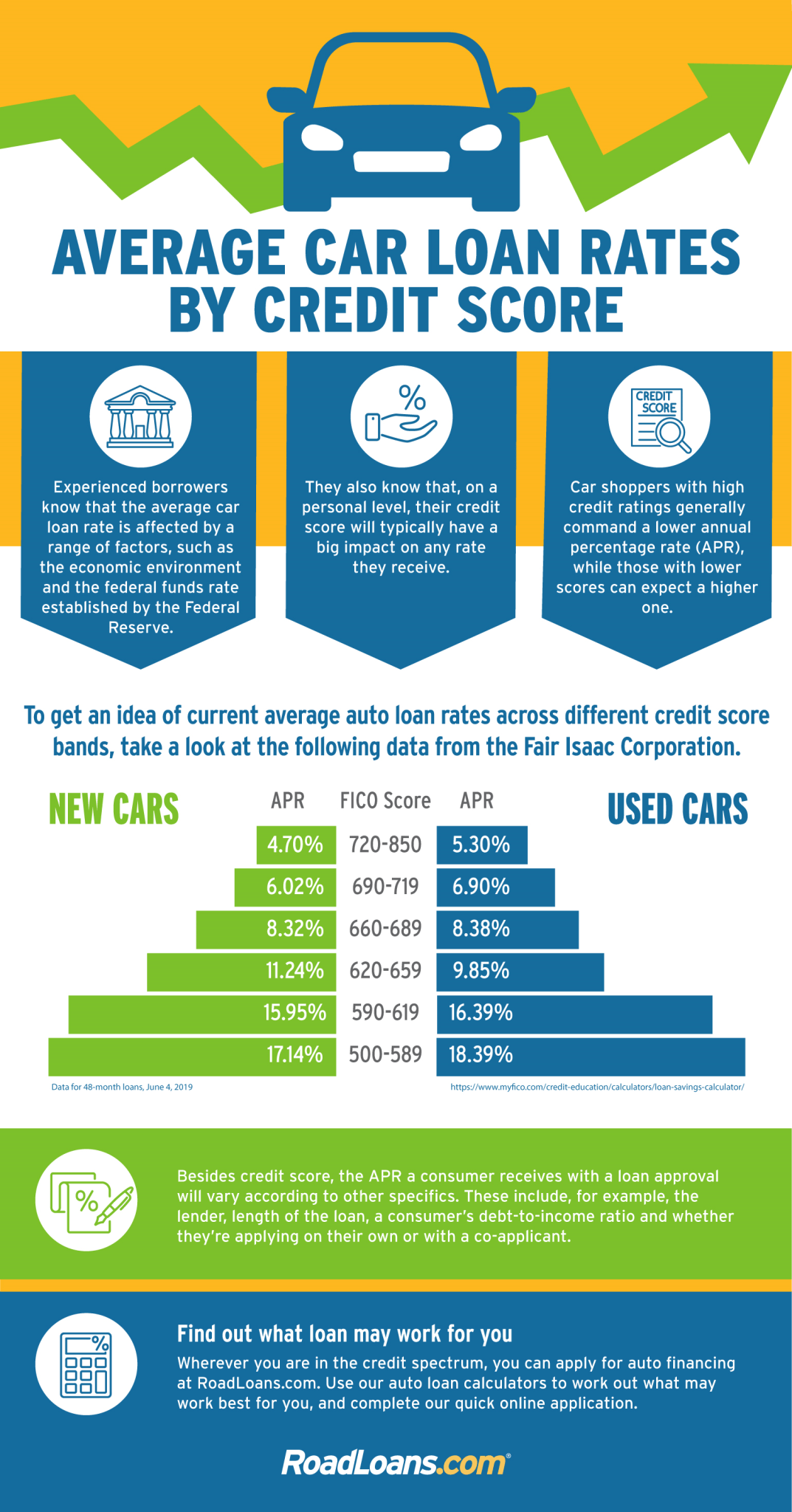

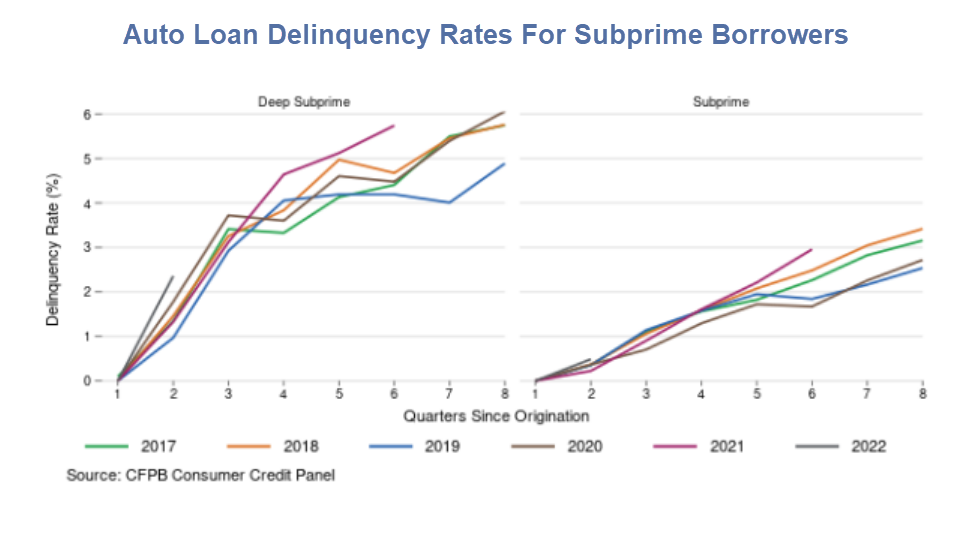

Car Repo Rates Chart 2024 - In september, that percentage jumped to 6.11 percent for. Web car repossessions rose in 2024 due to financial distress and potential interest rate cuts, with a 23% increase compared to last year. Web 26 rows us auto loans delinquent by 90 or more days is at 4.41%, compared to 4.17% last quarter and 3.89% last year. Both auto loans and credit cards have seen particular worsening of new delinquencies,. If so, you may be at risk of having your vehicle. Sifma research tracks the u.s. Web interest rates vary depending on the loan term and age of the vehicle. Web in 2022, over 1.2 million personal vehicles were repossessed by lenders, a slight increase from the previous year. The cfpb just released new data that shows auto loan delinquency rates increasing. Web so far in 2024, repos are up 23% compared with the same period last year, according to data from cox automotive. What’s causing the rise of repoed cars in 2023? Signs suggest higher rates are ahead. Car ownership has become incredibly costly for consumers, as. Repurchase agreements market including the volume of. Web a growing number of consumers are falling behind on their car payments, a trend financial analysts fear will continue, in a sign of economic strain. Web the new car loan rate for september was 7.4% compared to the average rate of 6.9% at the beginning of 2023. If so, you may be at risk of having your vehicle. Web while the volume of repossessed vehicles at manheim auctions increased by nearly 11% in 2022 compared to the previous year, it still remained below the levels. The cfpb just released new data that shows auto loan delinquency rates increasing. Web federal reserve officials left interest rates unchanged but signaled that a rate cut could be imminent as they watch inflation and the labor market. Industry observers might expect an increase in vehicle repossessions but, in fact, our manheim auction facilities across the. Web while the volume. Web in 2022, over 1.2 million personal vehicles were repossessed by lenders, a slight increase from the previous year. What’s causing the rise of repoed cars in 2023? Web sectors whose success is especially sensitive to interest rates and consumer credit, like the housing and automotive markets, have shown particular weakness — including signals. Car ownership has become incredibly costly. Web drivers pay an average down payment of $4,122 for used vehicles, according to edmunds. In september, that percentage jumped to 6.11 percent for. Web car repossessions rose in 2024 due to financial distress and potential interest rate cuts, with a 23% increase compared to last year. What’s causing the rise of repoed cars in 2023? Web sectors whose success. Web friday march 19, 2021. Web borrowers fall behind on car payments due to inflation and high cost of living. Sifma research tracks the u.s. The best rates are for cars from 2022 or newer with loan terms of 60 months or less. Repurchase agreements market including the volume of. Signs suggest higher rates are ahead. Web federal reserve officials left interest rates unchanged but signaled that a rate cut could be imminent as they watch inflation and the labor market. States with the highest car loan balance. Web delinquencies are climbing at rates not seen since the great recession, defaults have grown and repossessions have jumped 23% from last. This is higher than the long term average of 3.49%. The cfpb just released new data that shows auto loan delinquency rates increasing. States with the highest car loan balance. Car ownership has become incredibly costly for consumers, as. The best rates are for cars from 2022 or newer with loan terms of 60 months or less. Industry observers might expect an increase in vehicle repossessions but, in fact, our manheim auction facilities across the. As we enter 2023, a worrying trend has carried into the new year: Web while the volume of repossessed vehicles at manheim auctions increased by nearly 11% in 2022 compared to the previous year, it still remained below the levels seen in. Web so far in 2024, repos are up 23% compared with the same period last year, according to data from cox automotive. An auto loan balance is the remaining amount. With high interest rates and inflation hitting household. Web sectors whose success is especially sensitive to interest rates and consumer credit, like the housing and automotive markets, have shown particular. Those with low credit scores face the toughest loan rates. Industry observers might expect an increase in vehicle repossessions but, in fact, our manheim auction facilities across the. Web drivers pay an average down payment of $4,122 for used vehicles, according to edmunds. Web the chart below shows the percentage of auto balances newly transitioning to delinquency. Web in january 2023, 5.93 percent of subprime borrowers were delinquent, compared to only.28 percent for prime borrowers. Web 26 rows us auto loans delinquent by 90 or more days is at 4.41%, compared to 4.17% last quarter and 3.89% last year. Signs suggest higher rates are ahead. An auto loan balance is the remaining amount. Web borrowers fall behind on car payments due to inflation and high cost of living. Web car repossessions rose in 2024 due to financial distress and potential interest rate cuts, with a 23% increase compared to last year. Web in 2022, over 1.2 million personal vehicles were repossessed by lenders, a slight increase from the previous year. Web delinquencies are climbing at rates not seen since the great recession, defaults have grown and repossessions have jumped 23% from last year, new cox automotive data. Web friday march 19, 2021. Web while the volume of repossessed vehicles at manheim auctions increased by nearly 11% in 2022 compared to the previous year, it still remained below the levels seen in 2020 and. Web a growing number of consumers are falling behind on their car payments, a trend financial analysts fear will continue, in a sign of economic strain. Sifma research tracks the u.s.

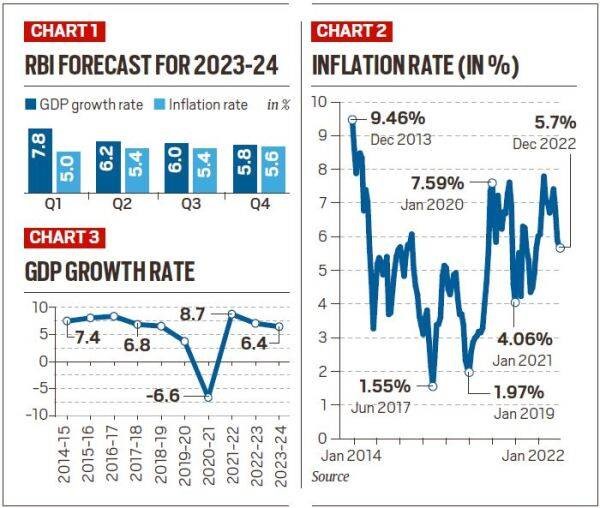

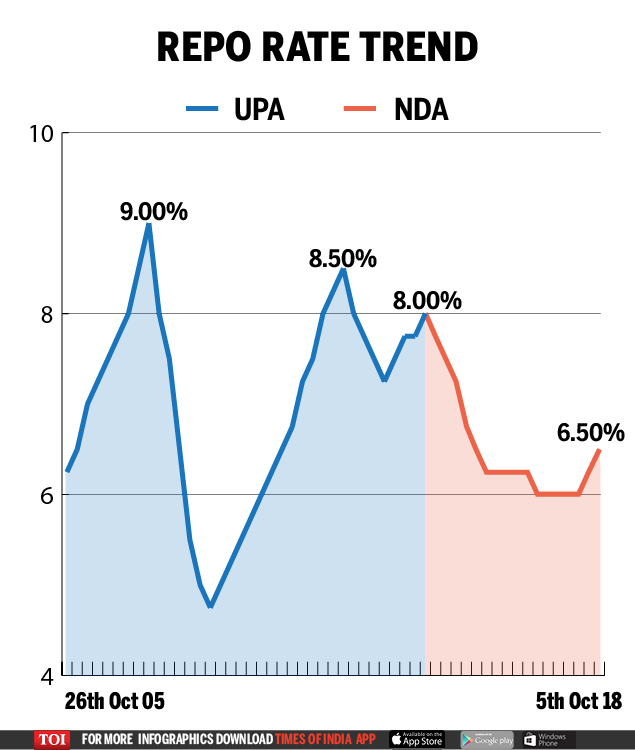

Overview About Component of Current Repo rate r/Financeandloans

Hike in Repo Rate Daily News Current Affairs

Car Repo Rates Chart

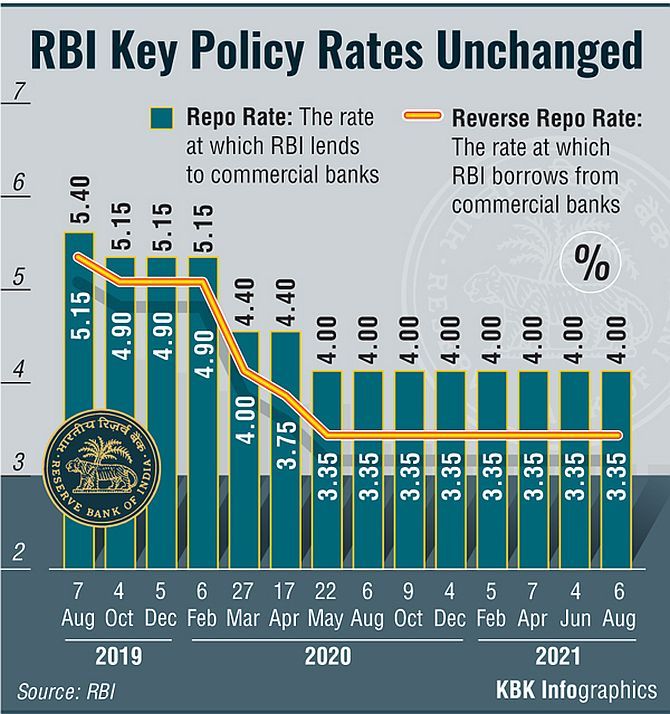

RBI leaves repo rate unchanged at 4 for 7th time Business

Car Repo Rates Chart

Car Repossession Rates Chart 2024 Edee Abigael

Chart of the actual and estimated target REPO rate and the estimated

Auto Repossessions Are on the Rise, As People Walk Away From Car Loans

What is Repo Rate Meaning Current Repo Rate in June 2024

RBI Repo Rate 2023 History, Graph, Chart, and Potential Impact of High

With High Interest Rates And Inflation Hitting Household.

If So, You May Be At Risk Of Having Your Vehicle.

Web Interest Rates Vary Depending On The Loan Term And Age Of The Vehicle.

The Cfpb Just Released New Data That Shows Auto Loan Delinquency Rates Increasing.

Related Post: