Candlestick Patterns Hammer

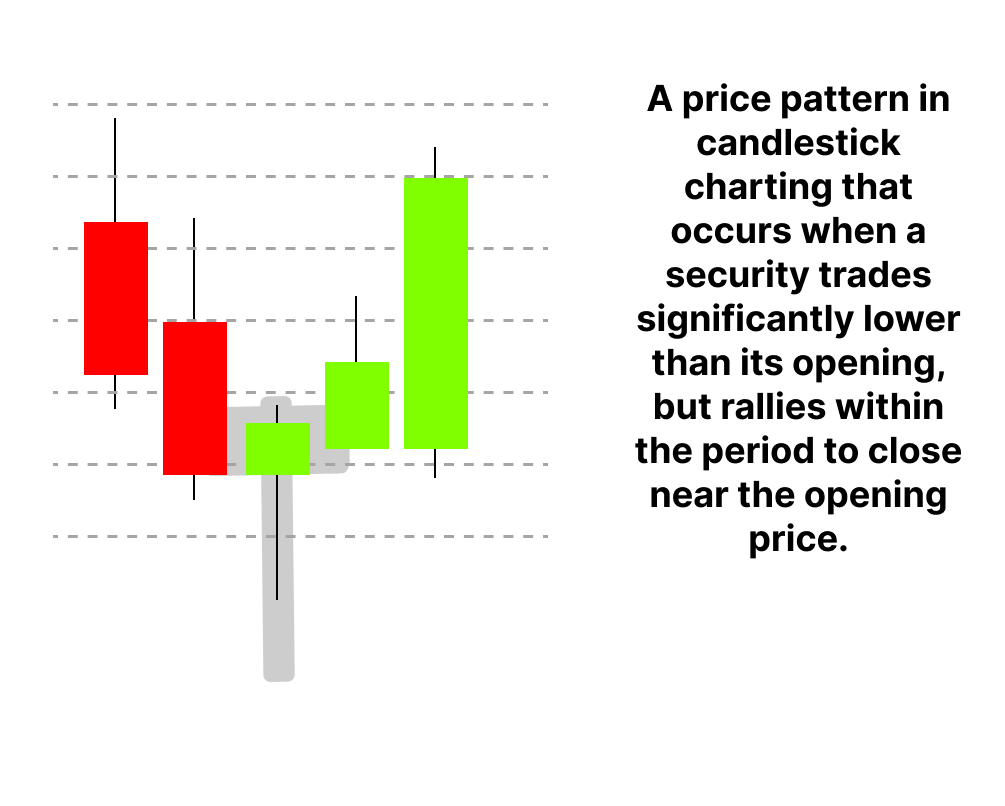

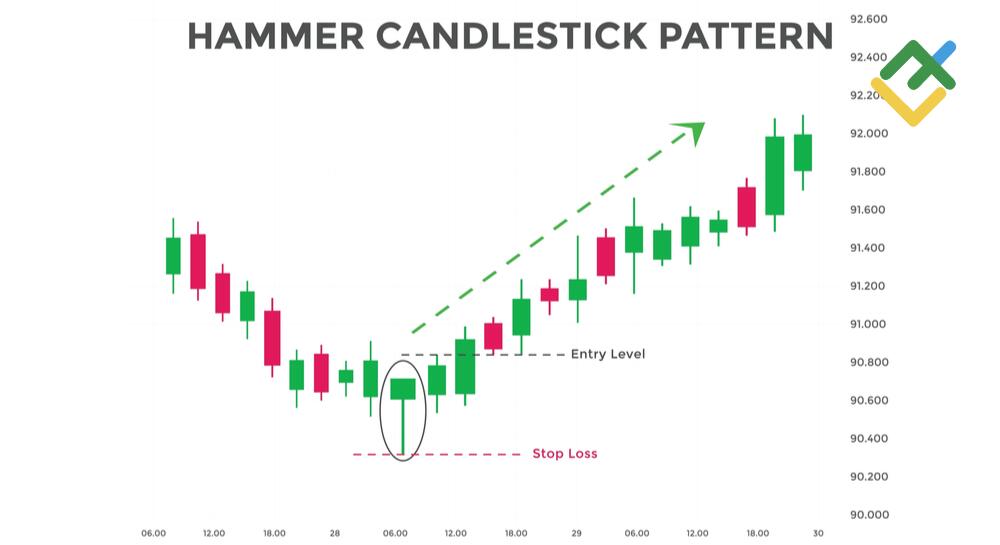

Candlestick Patterns Hammer - This coupled with an upward trend in earnings. They consist of small to medium size lower shadows, a real body, and little to no upper wick. The hammer helps traders visualize where support and demand are located. It looks like this on your charts: This pattern is typically seen as a bullish reversal signal, indicating that a downward price swing has likely reached its bottom and is poised to move higher. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. The hammer is an unreliable and risky pattern with a low accuracy rate of 52.1%, which is hardly better than flipping a coin. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Hammer candlestick has a unique shape. Deborah rippel o, w, n, e rippel deborah address 824 e eau gallie blvd, indian harbour be, fl, 32937 last annual reports. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web hammer heads gift & smoke shop, llc principals. The color of the body doesn’t matter; Here’s how to. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. At the top, it should have no wick, or be very small; At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. The hammer candlestick pattern is. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Deborah rippel o, w, n, e rippel deborah address 824 e eau gallie blvd, indian harbour be, fl, 32937 last annual reports. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. Deborah rippel o, w, n, e rippel deborah address 824 e eau gallie blvd, indian harbour be, fl, 32937 last annual reports. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading.. At the top, it should have no wick, or be very small; Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and abandoned baby, to name. The hammer. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. The hammer helps traders visualize where support and demand are located. Agent name rippel deborah (p) Lower shadow more than twice the. Here’s how to identify the hammer candlestick pattern: Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. The hammer candlestick pattern is viewed as a potential reversal signal when it appears after a trend or during a downtrend. You will improve your candlestick analysis skills and be. The wick at the bottom must be big compared to the body; It appears during the downtrend and signals that the bottom is near. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. Web hammer candlestick pattern. Lower shadow more than twice the length of the body. This coupled with an upward trend in earnings. Web the hammer is a classic bottom reversal pattern that warns traders that prices have reached the bottom and are going to move up. Occurrence after bearish price movement. Small candle body with longer lower shadow, resembling a hammer, with minimal (to. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web a hammer candlestick is a term used in technical analysis. It looks like this on your charts: Learn what it is, how to identify it, and how to use it for intraday trading. Candlestick patterns are a. At the top, it should have no wick, or be very small; Our guide includes expert trading tips and examples. The hammer candlestick pattern is formed by one single candle. Lower shadow more than twice the length of the body. It signals that the market is about to change trend direction and advance to new heights. Web the hammer candlestick pattern is a bullish reversal pattern that indicates a potential price reversal to the upside. The hammer is an unreliable and risky pattern with a low accuracy rate of 52.1%, which is hardly better than flipping a coin. Published on december 9, 2023. It appears during the downtrend and signals that the bottom is near. Web a hammer candlestick pattern is a bullish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. It looks like this on your charts: Web constellation energy corporation (ceg) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. The wick at the bottom must be big compared to the body; The hammer helps traders visualize where support and demand are located. In the hammer pattern, the color of the body can either be red or green.

Hammer Candlestick Pattern Trading Guide

How To Trade Blog What Is Hammer Candlestick? 2 Ways To Trade

The Hammer Candlestick Pattern A Trader’s Guide TrendSpider Learning

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Patterns A Trader’s Guide

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Importance of Hammer Candlestick Pattern Premium Store

All 30 Powerful Candlestick Chart Patterns in Stock Market Explained

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Patterns

This Pattern Is Typically Seen As A Bullish Reversal Signal, Indicating That A Downward Price Swing Has Likely Reached Its Bottom And Is Poised To Move Higher.

Web In This Blog Post, We Are Going To Explore The Hammer Candlestick Pattern, A Bullish Reversal Candlestick.

After A Downtrend, The Hammer Can Signal To Traders That The Downtrend Could Be Over And That Short Positions Could.

Imagine Each Pattern As A Hint About What Might Happen Next In The Stock Market.

Related Post: