Candlestick Inverted Hammer Pattern

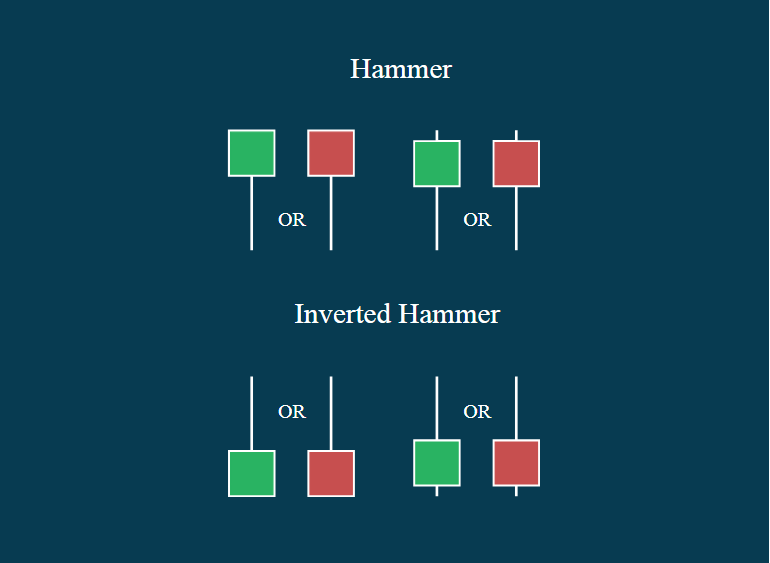

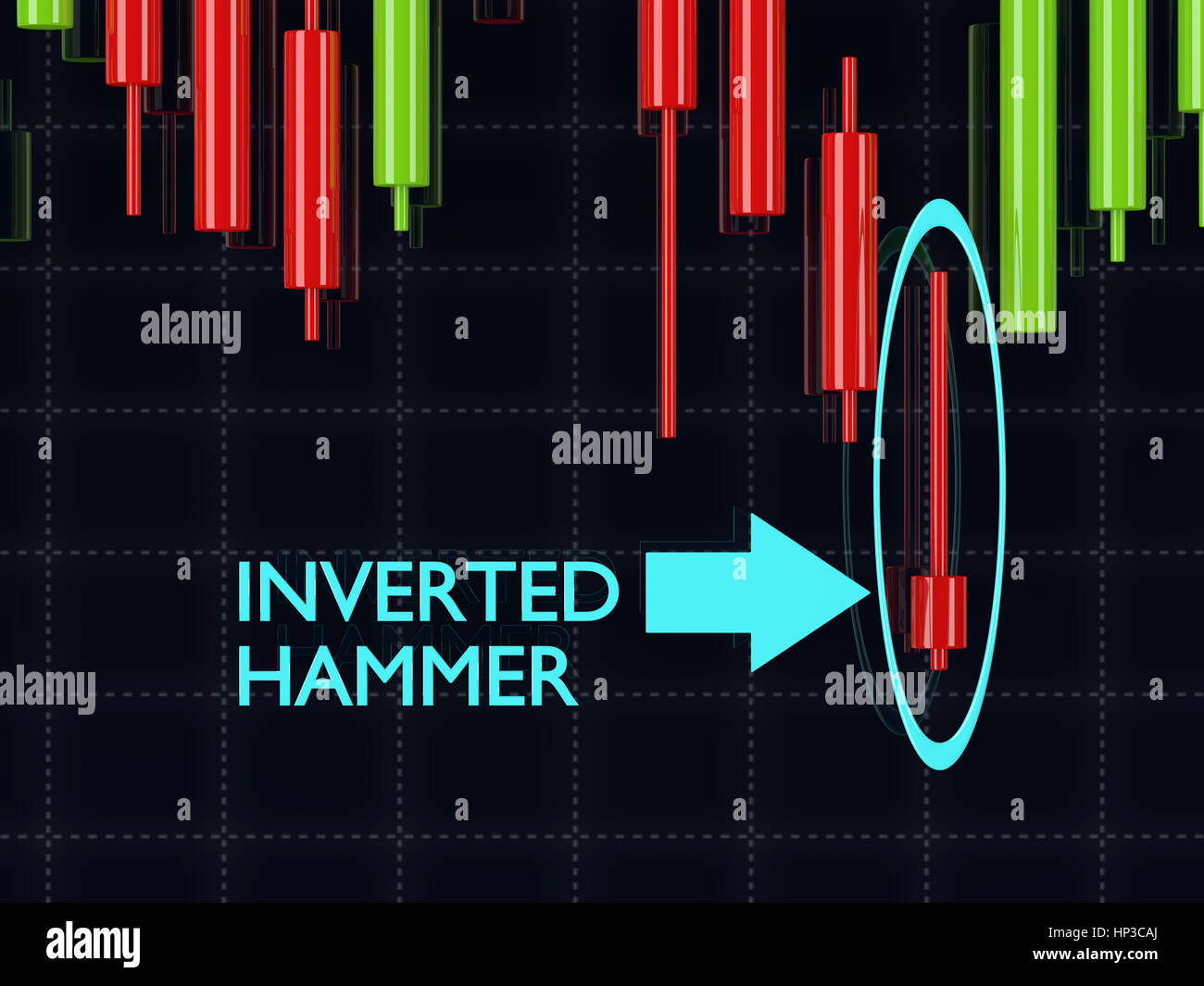

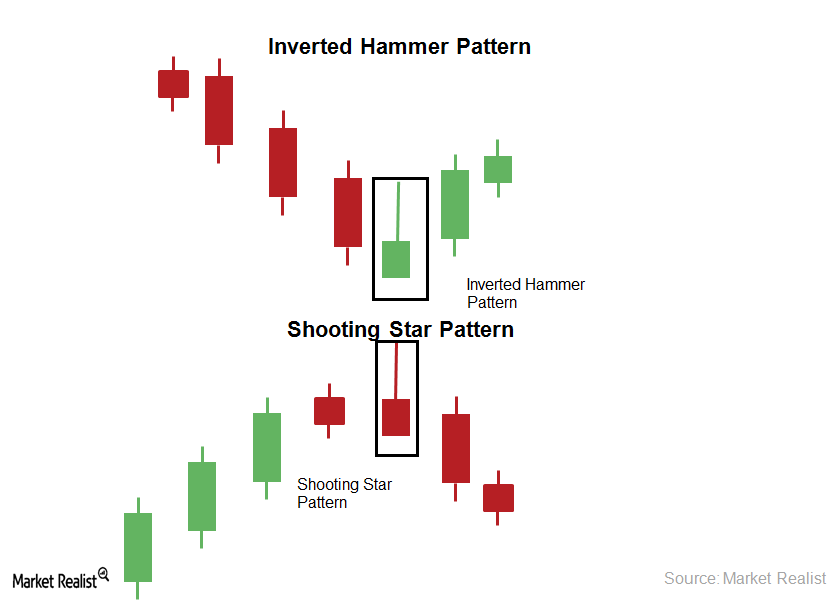

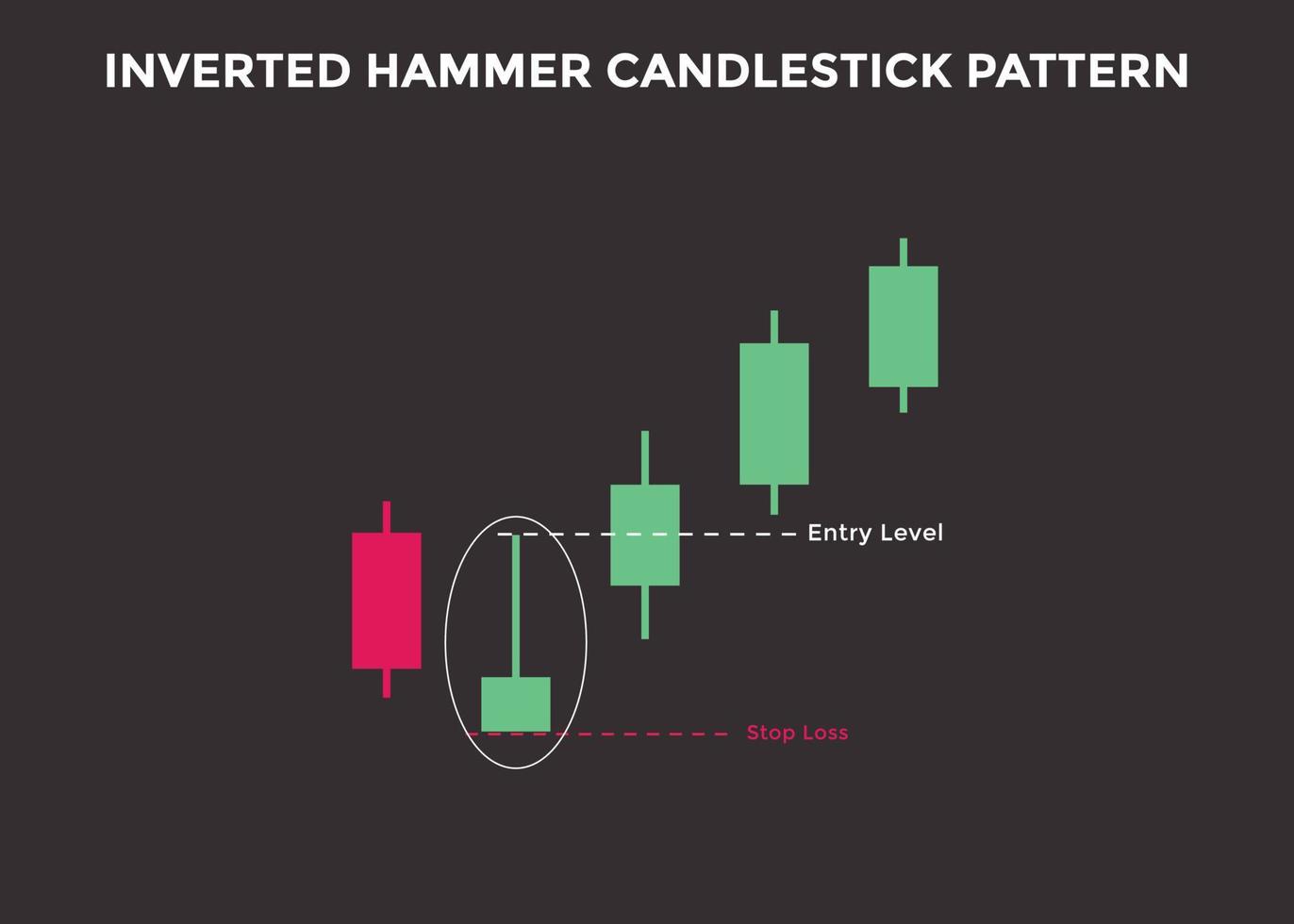

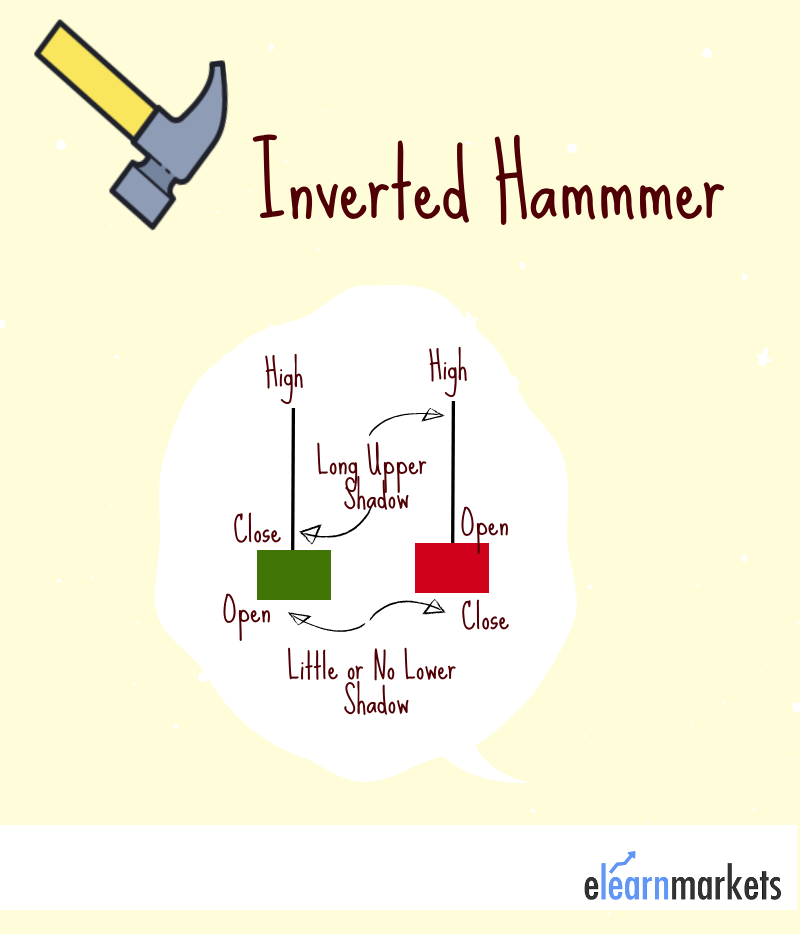

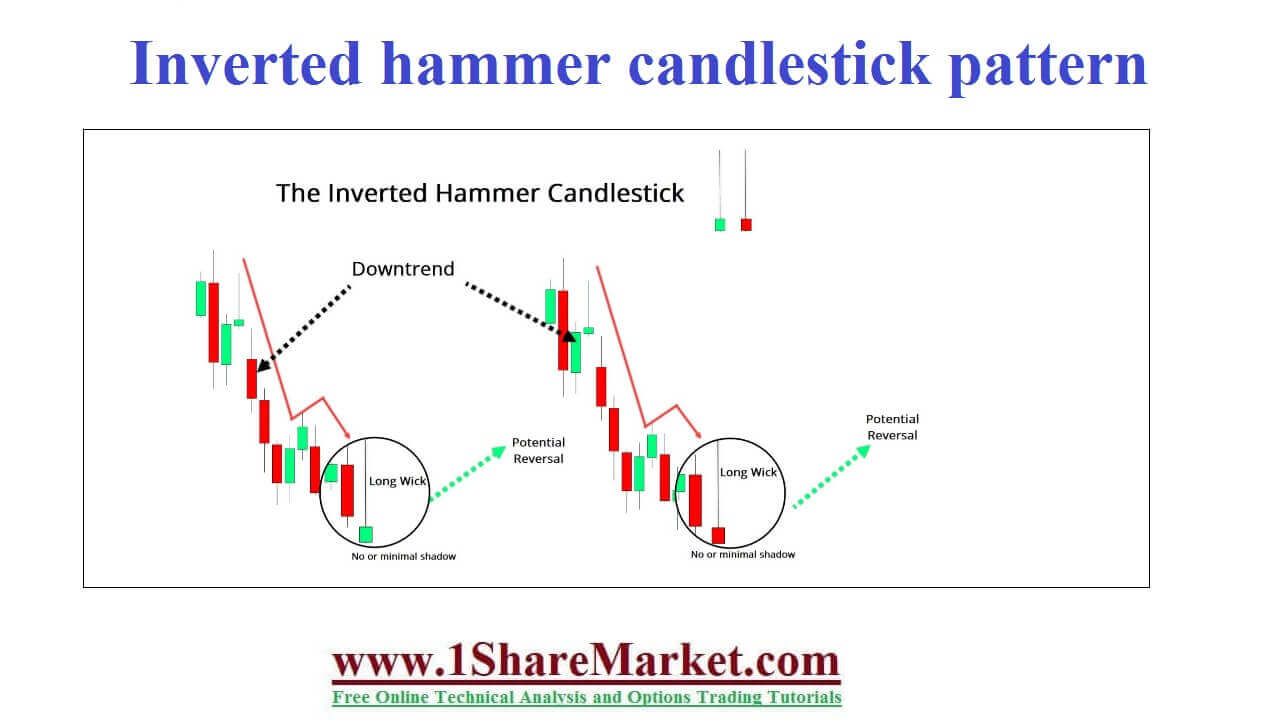

Candlestick Inverted Hammer Pattern - How to use the inverted hammer candlestick pattern in trading? Characterized by its distinctive shape, this. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Second, the upper shadow must. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate. Web the inverted hammer candlestick pattern, also known as the bullish inverted hammer, is identified by a small body located at the bottom, a little or no lower shadow,. Web what is a hammer candlestick pattern? Web the inverted hammer candlestick pattern, also known as the bullish inverted hammer, is identified by a small body located at the bottom, a little or no lower shadow,. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web how to spot an inverted hammer candlestick pattern: Web if you’re trying to identify. Here’s how to identify the inverted hammer candlestick pattern: Candle with a small real body, a long upper wick and little to no lower wick. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate. That means it can be one of the following candles:. Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate. Characterized by its distinctive shape, this. First, the candle must occur after a downtrend. Second, the upper shadow must. Characterized by its distinctive shape, this. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. Candle with a small real body, a long upper wick and little to no lower wick. Appears at the bottom of a. Here’s how to identify the inverted hammer candlestick pattern: Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web the inverted hammer candlestick pattern is formed by one single candle. Web the inverted hammer candlestick pattern is a unique stock chart pattern that showcases a trend reversal. That means it can be one of the following candles: Web the inverted hammer candlestick. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate. Web an inverted hammer candlestick pattern is one of the most common and is considered vital for. Web what is a hammer candlestick pattern? The first candle appears as a long line and has a black body. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a. Web a hammer is a price pattern in candlestick charting that occurs. It serves as a warning indicator for a trend reversal. Second, the upper shadow must. Web the inverted hammer candlestick pattern is formed by one single candle. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a. Web an inverted hammer candlestick. How to use the inverted hammer candlestick pattern in trading? Characterized by its distinctive shape, this. Web the inverted hammer pattern is built of two candles. Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: The candle has a small body. The inverted hammer candlestick pattern is formed on the chart. Second, the upper shadow must. Web the inverted hammer candlestick pattern is a unique stock chart pattern that showcases a trend reversal. Appears at the bottom of a. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that. Web how to spot an inverted hammer candlestick pattern: Web what is an inverted hammer pattern in candlestick analysis? The candle has a small body. Web the inverted hammer candlestick pattern, also known as the bullish inverted hammer, is identified by a small body located at the bottom, a little or no lower shadow,. Web the inverted hammer candlestick pattern is a crucial tool in technical analysis, heralding potential bullish reversals in bearish markets. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. Web the inverted hammer candlestick pattern is formed by one single candle. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate. Here’s how to identify the inverted hammer candlestick pattern: The inverted hammer candlestick pattern is formed on the chart. Characterized by its distinctive shape, this. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. Second, the upper shadow must. Stockbrokers and investors look for this trend to.

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Candlestick Pattern Forex Trading

Hammer Candlestick What Is It and How to Use It in Trend Reversal

3d rendering of forex candlestick inverted hammer pattern over dark

The Inverted Hammer And Shooting Star Candlestick Pattern

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Trade With Inverted Hammer Candlestick Pattern ELM

Inverted Hammer Candlestick Pattern (Bullish Reversal)

Inverted Hammer Candlestick Pattern Quick Trading Guide

inverted hammer candlestick pattern Use with Advantages and limitation

Web How To Identify An Inverted Hammer Candlestick Pattern?

Web The Inverted Hammer Candlestick Pattern Is A Unique Stock Chart Pattern That Showcases A Trend Reversal.

First, The Candle Must Occur After A Downtrend.

Web The Inverted Hammer Pattern Is Built Of Two Candles.

Related Post: