Business Debt Schedule Template

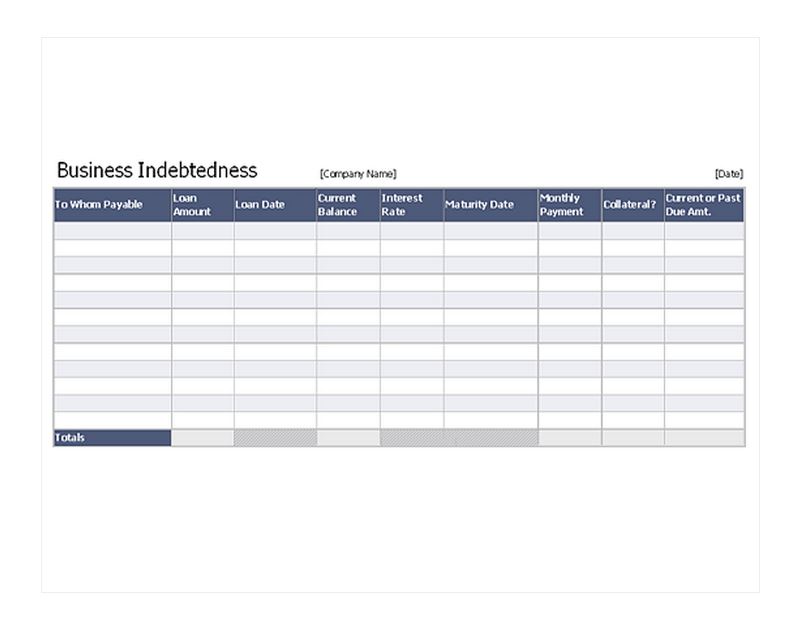

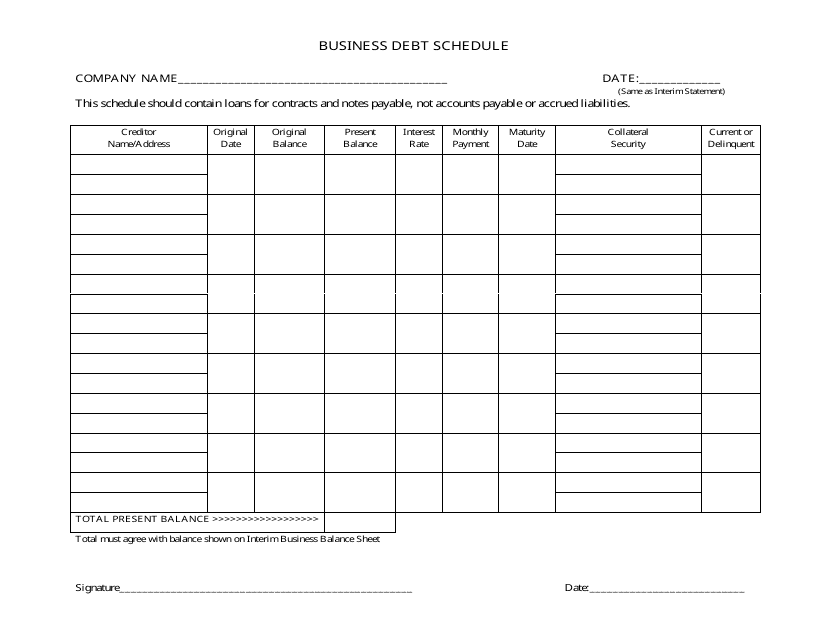

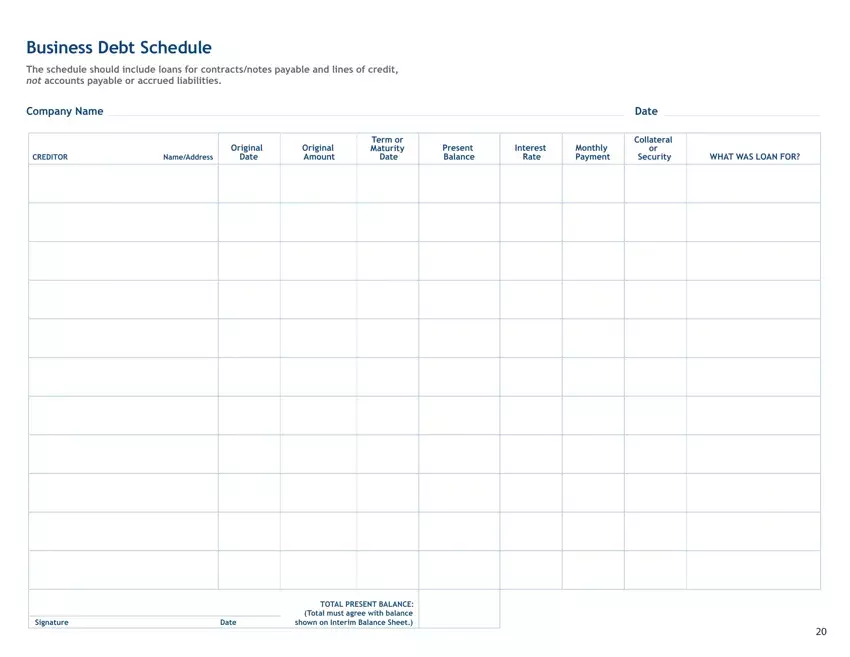

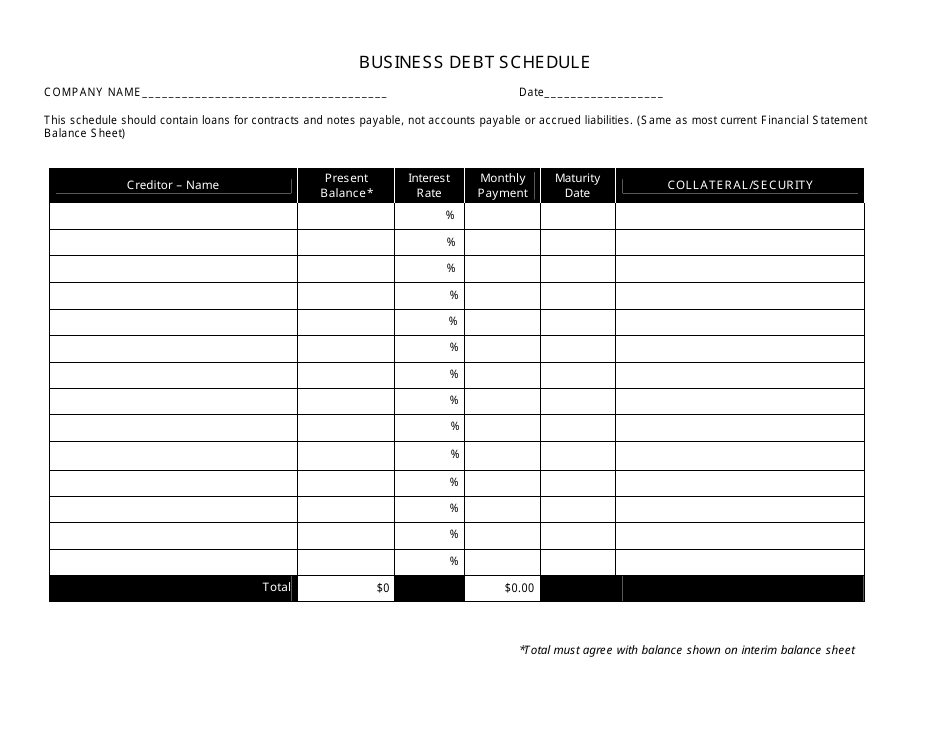

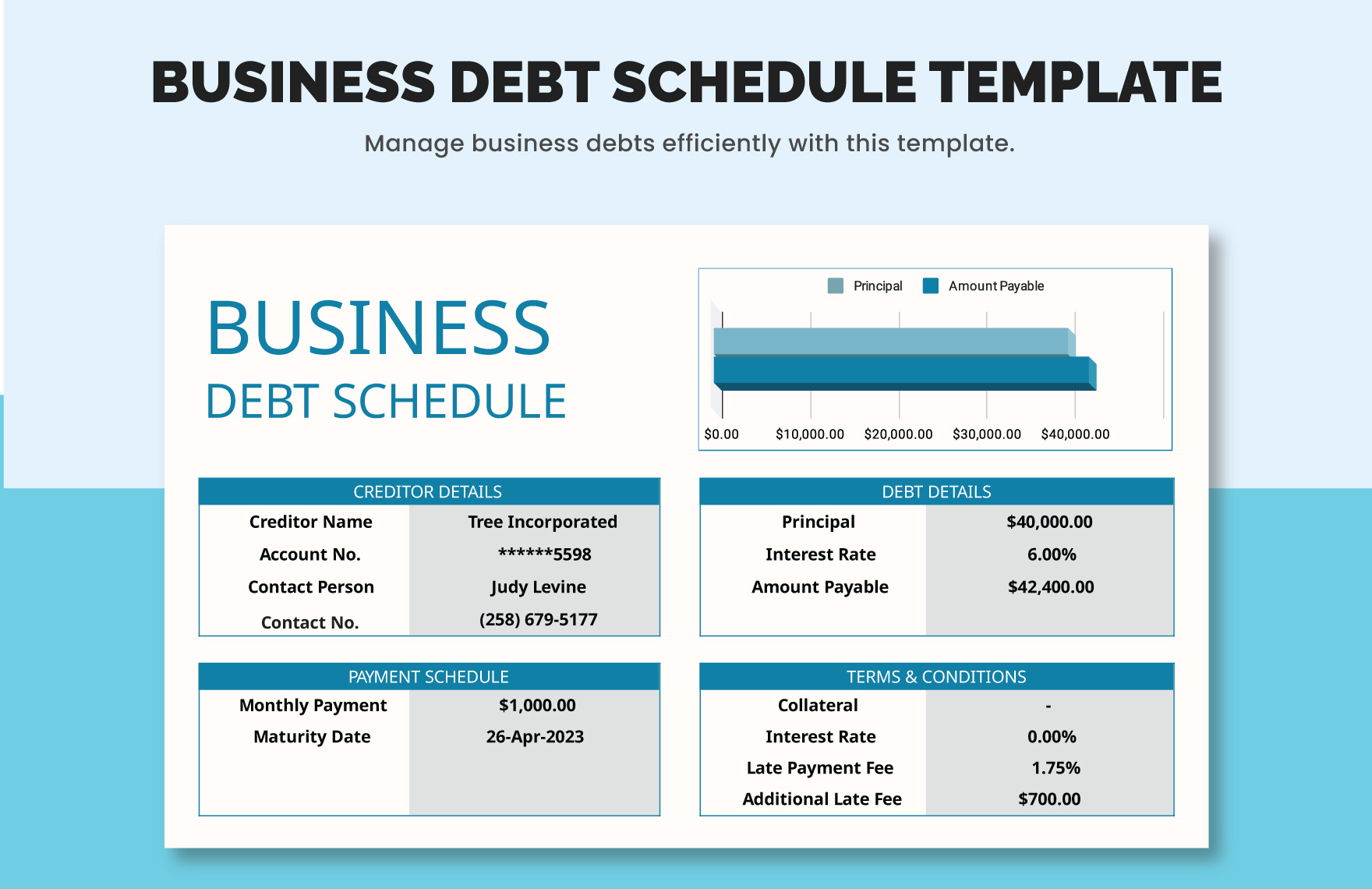

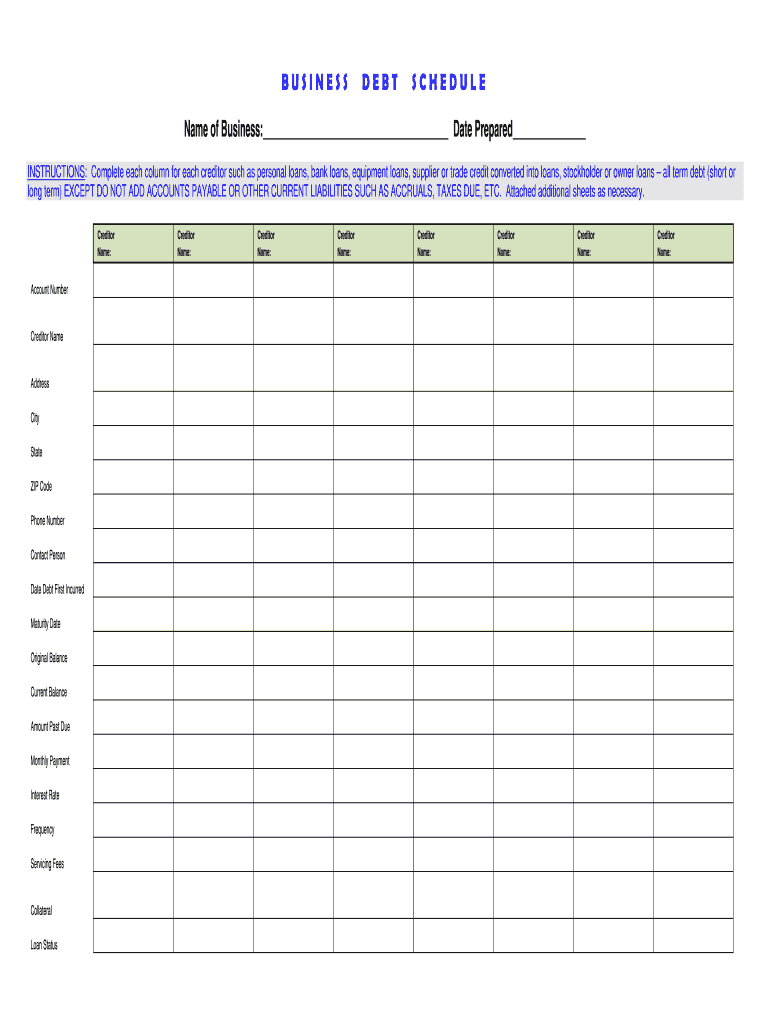

Business Debt Schedule Template - Web benefits of a debt schedule. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help you analyze your cash flow by connecting your income statement, balance sheet, and cash flow. Web if your business carries debt, it’s important to be able to quickly monitor your obligations. These may include small business loans, business lines. Get it for free right here! Web business debt schedule template a business debt schedule keeps up with who your company owes money. If you’re applying for a loan, lenders may ask you to prepare one. It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and conditions, and the repayment schedule.this template helps businesses monitor and manage their debt obligations effectively. Business schedules of debt demonstrate how easy it can be to keep tabs on what your company owes and to whom. Web what is a business debt schedule? Web maintaining a business debt schedule allows you to make more informed decisions about planning for and executing business growth, implementing payment strategies and handling unexpected costs. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help. Examples of what categories to list when creating a business debt schedule include: It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and conditions, and the repayment schedule.this template helps businesses monitor and manage their debt obligations effectively. Creditor name, original loan principal, term, secured or unsecured debt, maturity. Organization is the. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help you analyze your cash flow by connecting your income statement, balance sheet, and cash flow. Web maximize your financial organization and streamline your debt management with our. It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and conditions, and the repayment schedule.this template helps businesses monitor and manage their debt obligations effectively. A business debt schedule allows businesses to track and visualize their debts in order to make informed decisions about business growth, cash flow analysis and payment strategies.. Web benefits of a debt schedule. Web what is a business debt schedule? Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template. A business debt schedule allows businesses to track and visualize their debts in order to make informed decisions about business growth, cash flow analysis and payment strategies. Get it for. Web a business debt schedule is a list of all your business’s outstanding debts. If you’re applying for a loan, lenders may ask you to prepare one. Web business debt schedule template a business debt schedule keeps up with who your company owes money. A business debt schedule allows businesses to track and visualize their debts in order to make. Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template. Web a business debt schedule is a list of all your business’s outstanding debts. Web maintaining a business debt schedule allows you to make more informed decisions about planning for and executing business growth, implementing payment strategies and handling unexpected costs. Web the. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help you analyze your cash flow by connecting your income statement, balance sheet, and cash flow. If you’re applying for a loan, lenders may ask you to prepare. A business debt schedule allows businesses to track and visualize their debts in order to make informed decisions about business growth, cash flow analysis and payment strategies. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help. Creditor name, original loan principal, term, secured or unsecured debt, maturity. Web maintaining a business debt schedule allows you to make more informed decisions about planning for and executing business growth, implementing payment strategies and handling unexpected costs. Examples of what categories to list when creating a business debt schedule include: Web what is a business debt schedule? These may. These may include small business loans, business lines. Creditor name, original loan principal, term, secured or unsecured debt, maturity. Web business debt schedule template a business debt schedule keeps up with who your company owes money. Web benefits of a debt schedule. Web if your business carries debt, it’s important to be able to quickly monitor your obligations. If you’re applying for a loan, lenders may ask you to prepare one. Web a business debt schedule is a list of all your business’s outstanding debts. Web a business debt schedule template is used to organize and track all the debts that a business owes. A business debt schedule allows businesses to track and visualize their debts in order to make informed decisions about business growth, cash flow analysis and payment strategies. Organization is the leading benefit of having a debt schedule, and saving valuable time throughout the day is a benefit of using a business debt schedule form.additionally, having a debt schedule will help you analyze your cash flow by connecting your income statement, balance sheet, and cash flow. Web maximize your financial organization and streamline your debt management with our flexible business debt schedule template. Business schedules of debt demonstrate how easy it can be to keep tabs on what your company owes and to whom. It provides a clear overview of the outstanding debts, including the creditor, the amount owed, the terms and conditions, and the repayment schedule.this template helps businesses monitor and manage their debt obligations effectively. Examples of what categories to list when creating a business debt schedule include:

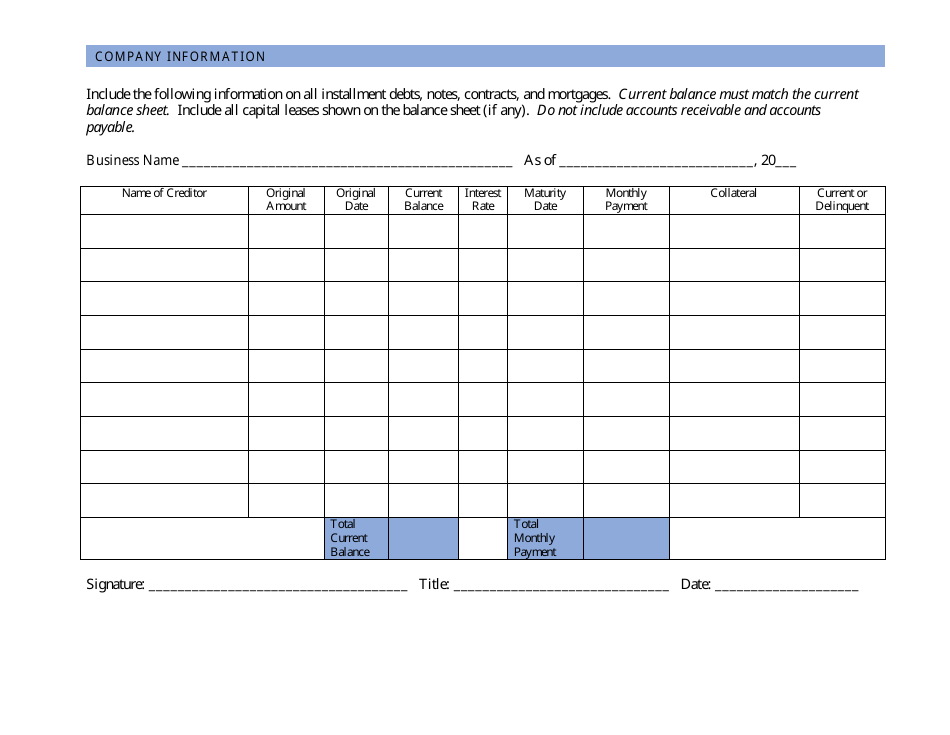

Business Debt Schedule Template Business Debt Schedule

Business Debt Schedule Template Fill Out, Sign Online and Download

Business Debt Schedule Form ≡ Fill Out Printable PDF Forms Online

Business Debt Schedule Template Black and White Fill Out, Sign

Free Debt Schedule Template Printable Templates

Free Business Debt Schedule Template

Business Debt Schedule Template Varicolored Fill Out, Sign Online

Company Debt Schedule Template Download Printable PDF Templateroller

Business Debt Schedule Template Excel prntbl.concejomunicipaldechinu

Debt Schedule Template Complete with ease airSlate SignNow

Web What Is A Business Debt Schedule?

Web The Business Debt Schedule Template Is Designed For Small Businesses To Maintain Accurate Tracking Of Those Debts.

Web Maintaining A Business Debt Schedule Allows You To Make More Informed Decisions About Planning For And Executing Business Growth, Implementing Payment Strategies And Handling Unexpected Costs.

Get It For Free Right Here!

Related Post: