Bullish Wedge Pattern

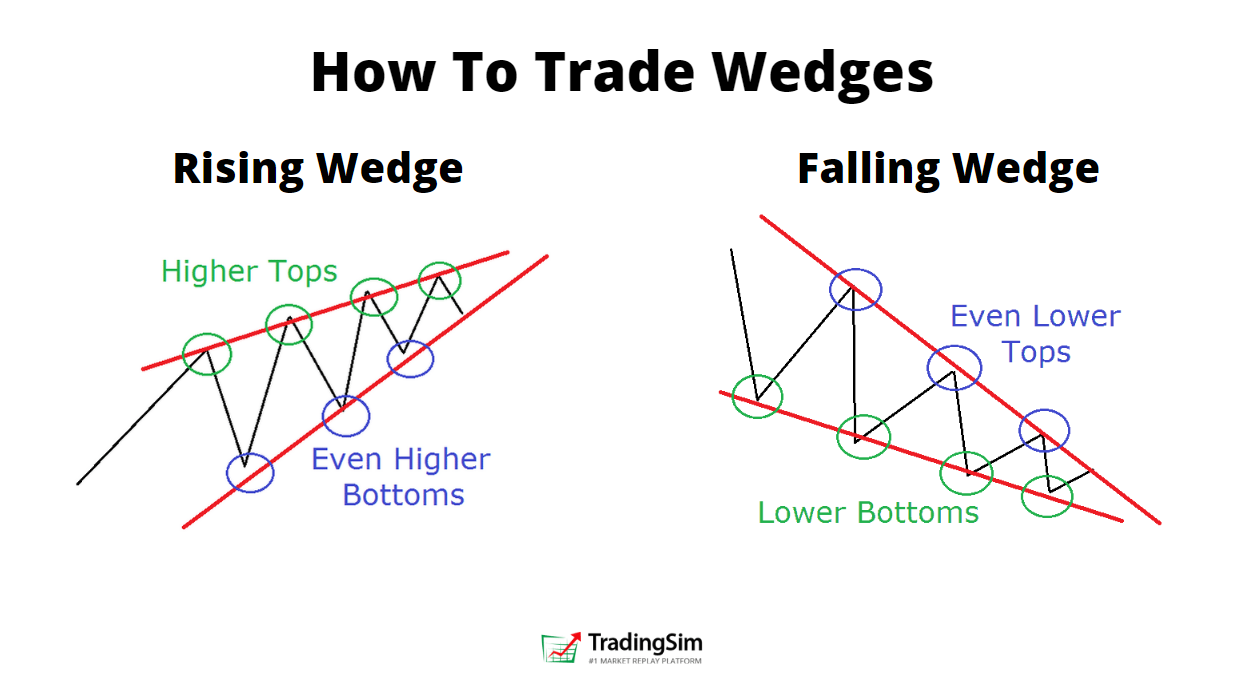

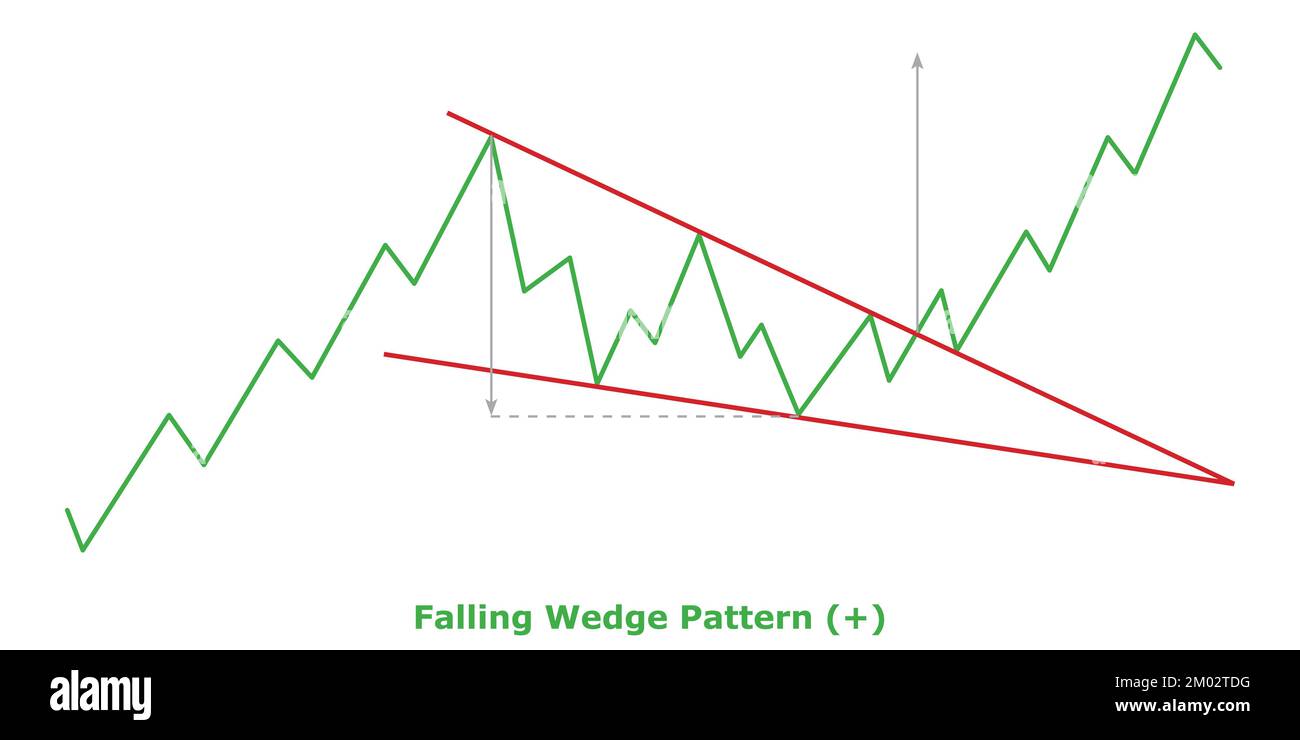

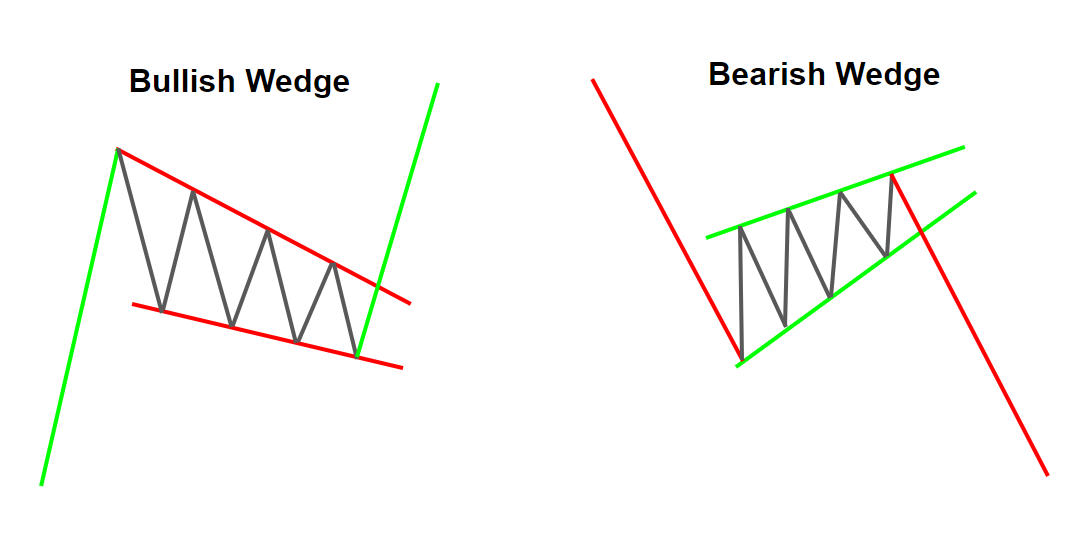

Bullish Wedge Pattern - Web bullish patterns can have bearish implications and bearish patterns can have bullish implications. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Web a wedge pattern can signal either bullish or bearish price reversals. Web captain faibik’s analysis reveals dot consolidating within a falling wedge pattern. They are composed of the support and resistance trend lines that move in the same direction as the channel gets narrower, until one of the trend lines get broken and. The falling wedge is characterized by two sloping lines, connecting local. The bearish candlestick pattern turns bullish when the price breaks out of wedge. This formation often precedes bullish reversals in technical analysis. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. It suggests a potential reversal in the trend. It is characterized by downward sloping support and resistance lines, with lower highs forming faster than lower lows. There is no denying that chart patterns exist, but their implications will vary from market to market and timeframe to timeframe. In either case, this pattern holds three common characteristics: A sign of weakening trends and reversals. Web bullish patterns can have. Wedge patterns, as a classic chart formation, reveal potential reversal signals in the market with their unique converging trendline structure. Web a falling wedge pattern consists of multiple candlesticks that form a big sloping wedge. The rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. The pattern often appears in a. Web captain faibik’s analysis reveals dot consolidating within a falling wedge pattern. It often appears in uptrends and signals a potential upside breakout. In either case, this pattern holds three common characteristics: Web a falling wedge, also known as the descending wedge, is usually considered a bullish pattern. The breakout direction from the wedge determines whether the price resumes the. There is no denying that chart patterns exist, but their implications will vary from market to market and timeframe to timeframe. The rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. These patterns form by connecting at least two to three lower highs and two to three lower lows, becoming trend. Web bullish patterns can have bearish implications and bearish patterns can have bullish implications. Wedge patterns, as a classic chart formation, reveal potential reversal signals in the market with their unique converging trendline structure. Web bullish wedge pattern as a bullish descending wedge pattern, you should notice that volume is increasing as the stock puts in new lows. There is. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. Web ☑️what is the rising wedge pattern? Web a falling wedge, also known as the descending wedge, is usually considered a bullish pattern. Web in trading, the falling wedge pattern is a bullish. Web captain faibik identified a breakout from a falling wedge pattern, followed by a successful retest of the breakout level. Web link is trending downward within a falling wedge pattern. Web a falling wedge, also known as the descending wedge, is usually considered a bullish pattern. There is no denying that chart patterns exist, but their implications will vary from. The bearish candlestick pattern turns bullish when the price breaks out of wedge. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. Web in trading, the falling wedge pattern is. It’s the opposite of the falling (descending) wedge pattern (bullish). This formation often precedes bullish reversals in technical analysis. These patterns form by connecting at least two to three lower highs and two to three lower lows, becoming trend lines. Web falling wedge in the beginning of an uptrend (bullish) here's a falling wedge in the very beginning of an. This pattern suggests that the sellers are becoming weaker and that the price is likely to break out to the upside. It is characterized by downward sloping support and resistance lines, with lower highs forming faster than lower lows. Web captain faibik’s analysis reveals dot consolidating within a falling wedge pattern. The falling wedge, is a bullish reversal pattern that. Web ☑️what is the rising wedge pattern? Web the falling wedge pattern occurs when the asset’s price is moving in an overall bullish trend before the price action corrects lower. It is characterized by downward sloping support and resistance lines, with lower highs forming faster than lower lows. They are composed of the support and resistance trend lines that move in the same direction as the channel gets narrower, until one of the trend lines get broken and. Web falling wedge in the beginning of an uptrend (bullish) here's a falling wedge in the very beginning of an uptrend. Web bullish wedge pattern as a bullish descending wedge pattern, you should notice that volume is increasing as the stock puts in new lows. Web is a falling wedge pattern bullish? The two wedges are usually seen as bullish and bearish, respectively. Web the wedge trading strategy is a price action trading method that focuses on the wedge chart pattern. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. As this “effort” to push the stock downward increases along the lows, you’ll notice that the result of the price action is. The bearish candlestick pattern turns bullish when the price breaks out of wedge. The breakout and retest occurred around the $22.00 mark, reinforcing a. Web a falling wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down. Web bullish patterns can have bearish implications and bearish patterns can have bullish implications. The breakout direction from the wedge determines whether the price resumes the previous trend or moves in the same direction.

Topstep Trading 101 The Wedge Formation

Wedge Patterns How Stock Traders Can Find and Trade These Setups

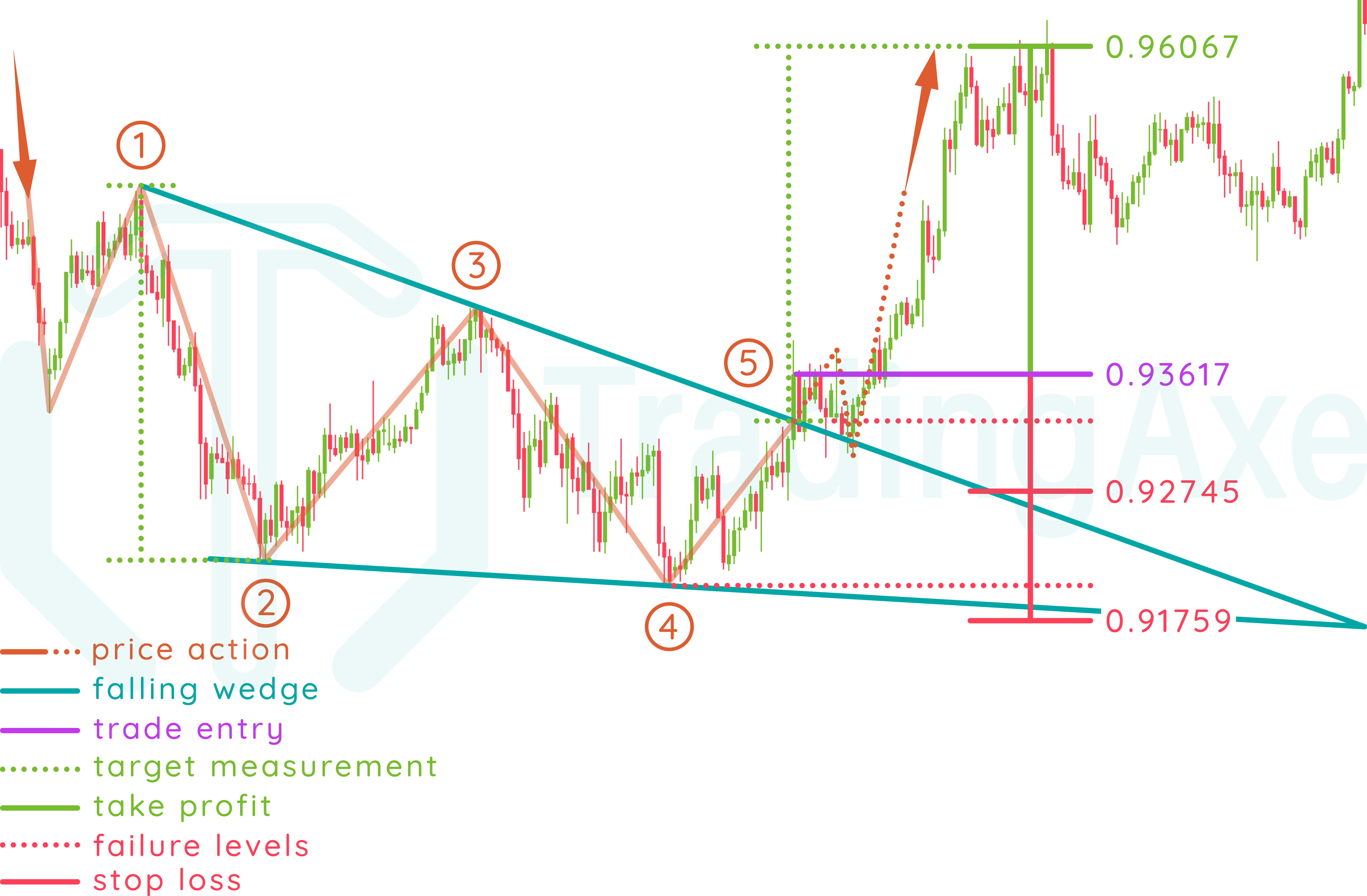

How To Trade Falling Wedge Chart Pattern TradingAxe

Bullish falling wedge pattern thenewvery

Wedge Chart Pattern Cheat Sheet Sexiz Pix Sexiz Pix

Bullish rising wedge pattern Strategy Rising wedge pattern breakout

Falling Wedge Pattern Bullish (+) Green & Red Bullish

Wedge Patterns How Stock Traders Can Find and Trade These Setups

What is Falling Wedge Bullish Patterns ThinkMarkets EN

Topstep Trading 101 The Wedge Formation Topstep

These Patterns Can Be Extremely Difficult To Recognize And Interpret On A Chart Since They Bear Much Resemblance To Triangle Patterns And Do Not Always Form Cleanly.

The Falling Wedge Is Characterized By Two Sloping Lines, Connecting Local.

Web The Daily Chart For Doge/Usd Reveals A Falling Wedge Pattern, Typically Considered A Bullish Reversal Signal.

It Is A Bullish Candlestick Pattern That Turns Bearish When The Price Breaks Out Of A Wedge.

Related Post: