Bullish Megaphone Pattern

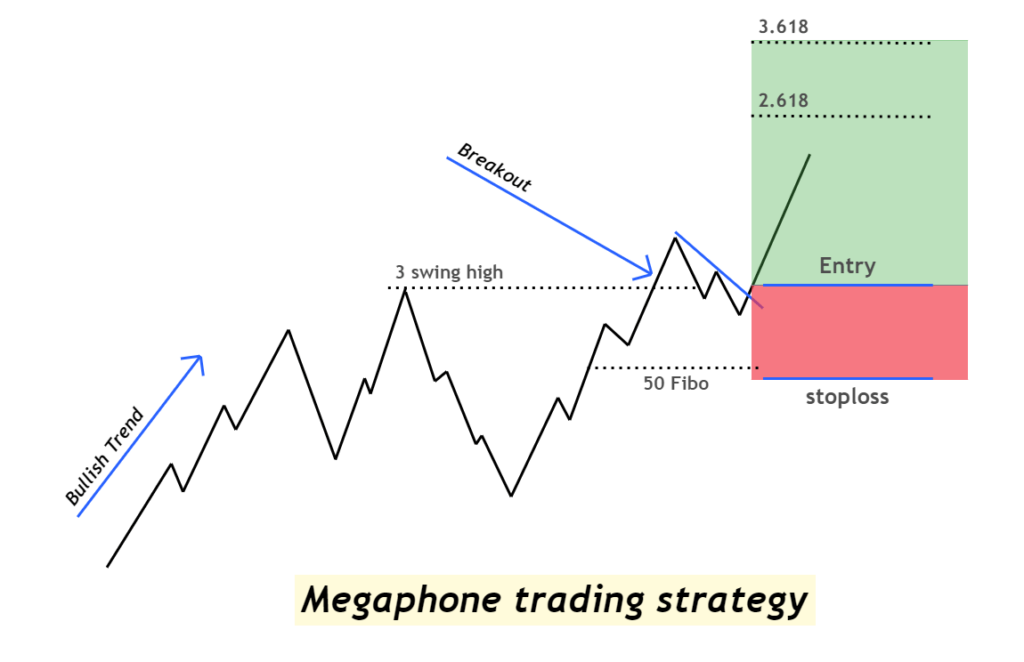

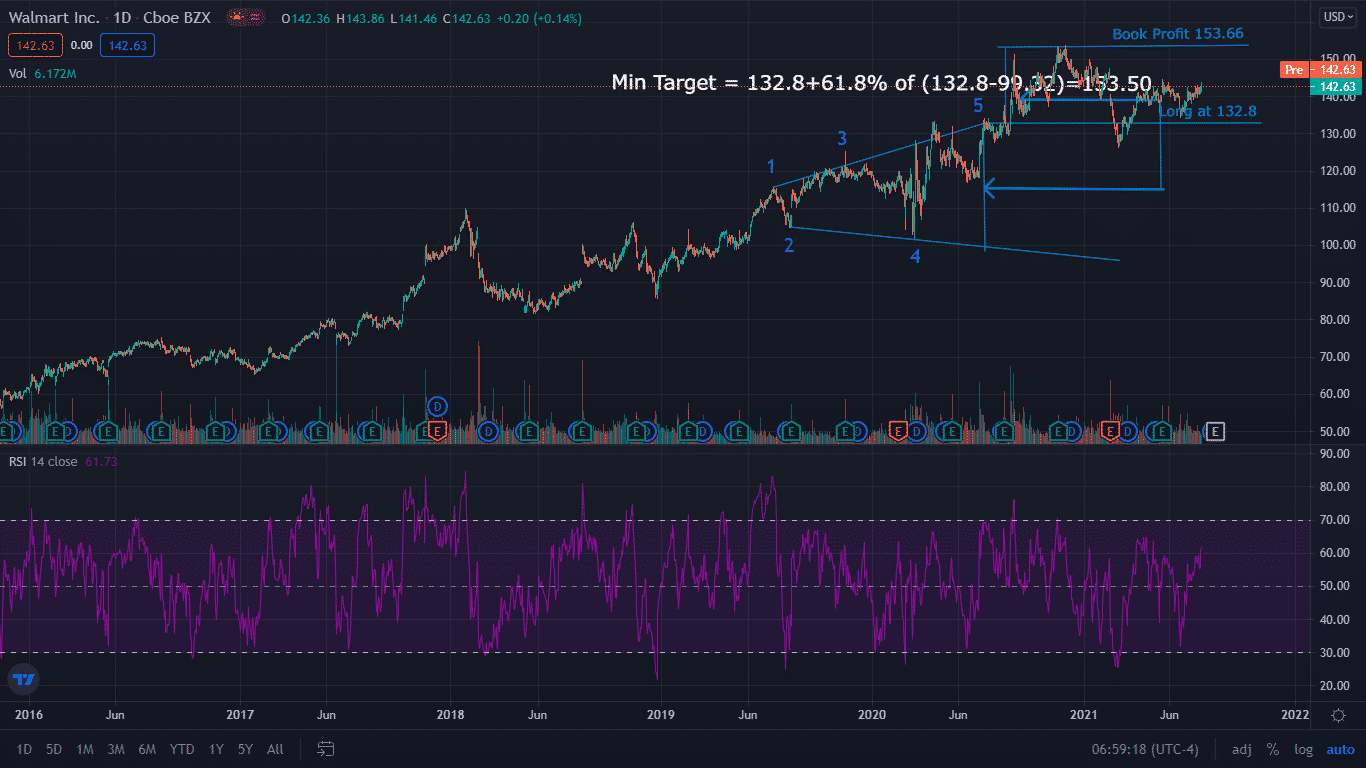

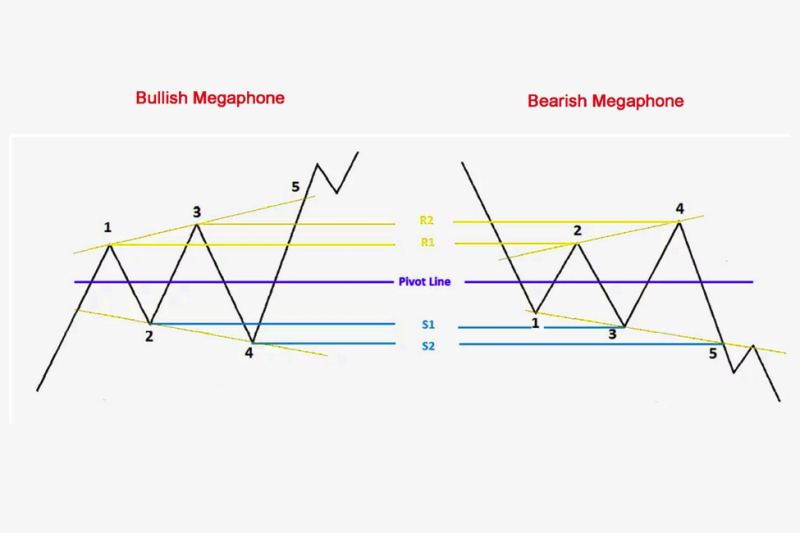

Bullish Megaphone Pattern - This can be a bullish or bearish pattern, depending on whether it slows upwards or downwards. Web if the stock or security experiences a bullish trend (upward movement) when the megaphone chart pattern begins, it is called a bullish megaphone pattern or megaphone bottom. The megaphone pattern at a market top usually signifies the exhaustion of a bullish trend and hints at an upcoming bearish reversal. Thus forming a megaphone like trend line shape. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. Is a megaphone pattern bullish or bearish? Trading the breakout as a megaphone continuous pattern and trading the reversal as a megaphone reversal pattern. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. The megaphone pattern can be. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Traders see this as a red flag signaling that the bulls are exhausting their strength, opening up the possibility of a bearish takeover. The megaphone pattern can be. This pattern is identified by the presence of at least two higher highs and two lower lows, indicating the market’s uncertainty and continuous fight between bulls and bears. The pattern is generally. Trades are placed after price reverses from the 5th swing pivot level. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web a megaphone pattern is a pattern that consists of a minimum of two higher highs and two lower lows. This pattern usually results in a.. The megaphone pattern can be. Web if the stock or security experiences a bullish trend (upward movement) when the megaphone chart pattern begins, it is called a bullish megaphone pattern or megaphone bottom. Web megaphone patterns present two trading opportunities: Thus forming a megaphone like trend line shape. The megaphone pattern at a market top usually signifies the exhaustion of. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. The megaphone pattern can be. Web a megaphone pattern is a pattern that consists of a minimum of two higher highs and two lower lows. This can be a bullish or bearish pattern, depending on whether it slows. Web the megaphone pattern, also known as the broadening formation, is a technical chart pattern that signifies increased volatility and uncertainty in the market. This pattern usually results in a. This can be a bullish or bearish pattern, depending on whether it slows upwards or downwards. This pattern is identified by the presence of at least two higher highs and. This pattern usually results in a. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. Web the megaphone pattern, also known as the broadening formation, is a technical chart pattern that signifies increased volatility and uncertainty in the market. The megaphone pattern at a market top usually. This can be a bullish or bearish pattern, depending on whether it slows upwards or downwards. Traders see this as a red flag signaling that the bulls are exhausting their strength, opening up the possibility of a bearish takeover. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. The megaphone pattern can. Web the megaphone pattern, also known as the broadening formation, is a technical chart pattern that signifies increased volatility and uncertainty in the market. Web the megaphone pattern is significant in stock trading as it can exhibit both bullish and bearish patterns. Thus forming a megaphone like trend line shape. This pattern is characterized by a series of higher highs. Web a megaphone pattern is when price action makes a series of higher highs and lower lows over a period of time. This pattern is characterized by a series of higher highs and lower lows, creating a shape that resembles a megaphone or a broadening wedge. The pattern is generally formed when the market is highly volatile in nature and. Web if the stock or security experiences a bullish trend (upward movement) when the megaphone chart pattern begins, it is called a bullish megaphone pattern or megaphone bottom. The megaphone pattern at a market top usually signifies the exhaustion of a bullish trend and hints at an upcoming bearish reversal. Web a megaphone bottom pattern can show you that the. The megaphone pattern can be. Trading the breakout as a megaphone continuous pattern and trading the reversal as a megaphone reversal pattern. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Trades are placed after price reverses from the 5th swing pivot level. This pattern usually results in a. The megaphone pattern at a market top usually signifies the exhaustion of a bullish trend and hints at an upcoming bearish reversal. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web a megaphone bottom pattern can show you that the stock is headed in an bullish direction. Web if the stock or security experiences a bullish trend (upward movement) when the megaphone chart pattern begins, it is called a bullish megaphone pattern or megaphone bottom. This pattern is identified by the presence of at least two higher highs and two lower lows, indicating the market’s uncertainty and continuous fight between bulls and bears. Web the megaphone pattern is significant in stock trading as it can exhibit both bullish and bearish patterns. Web megaphone patterns present two trading opportunities: Web a megaphone pattern is a pattern that consists of a minimum of two higher highs and two lower lows. Thus forming a megaphone like trend line shape. Is a megaphone pattern bullish or bearish?

Bullish Megaphone Pattern for NSEBRIGADE by PrasantaP — TradingView India

MICK bullish megaphone pattern? for NYSEMCK by Peet_Serfontein

ALPHA/BTC Bullish Megaphone Pattern for BINANCEALPHABTC by

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

What is the Megaphone Pattern? How To Trade It.

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Learn To Spot The Megaphone Pattern • Asia Forex Mentor

S&P500 Bullish Megaphone Pattern Buy on Dips for OANDASPX500USD by

🔥 SHIB Bullish Megaphone Pattern for BINANCESHIBUSDT by FieryTrading

Bullish Megaphone & Bearish Megaphone Chart Pattern Stock Market

Web The Megaphone Pattern, Also Known As The Broadening Formation, Is A Technical Chart Pattern That Signifies Increased Volatility And Uncertainty In The Market.

A Megaphone Top Pattern Can Show You That The Stock Is Headed In A Bearish Direction.

This Pattern Is Characterized By A Series Of Higher Highs And Lower Lows, Creating A Shape That Resembles A Megaphone Or A Broadening Wedge.

Web A Megaphone Pattern Is When Price Action Makes A Series Of Higher Highs And Lower Lows Over A Period Of Time.

Related Post: