Bullish Harmonic Pattern

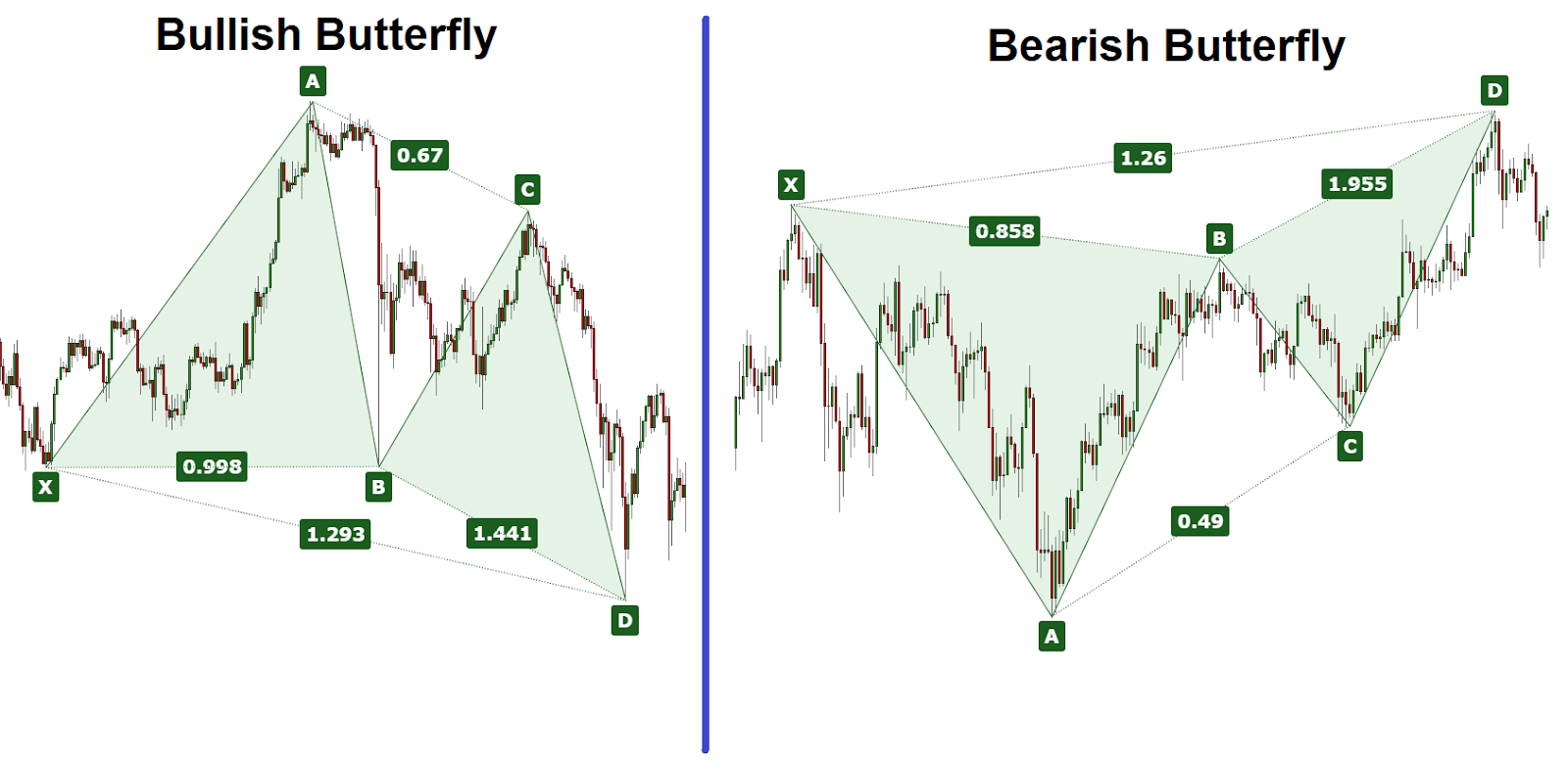

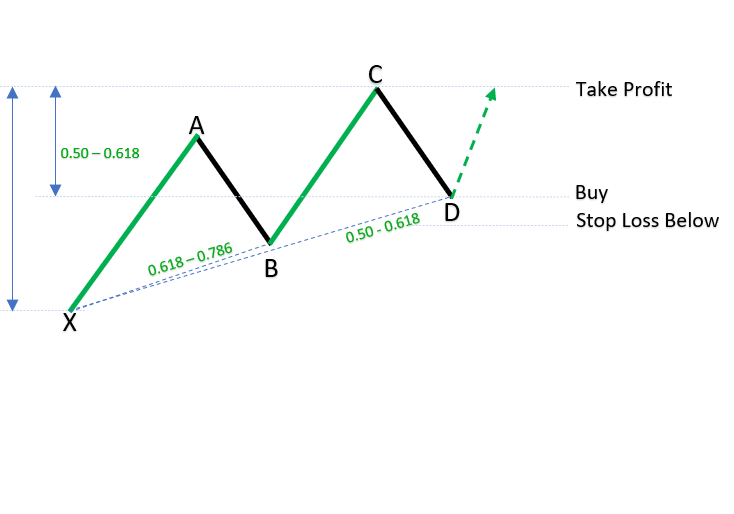

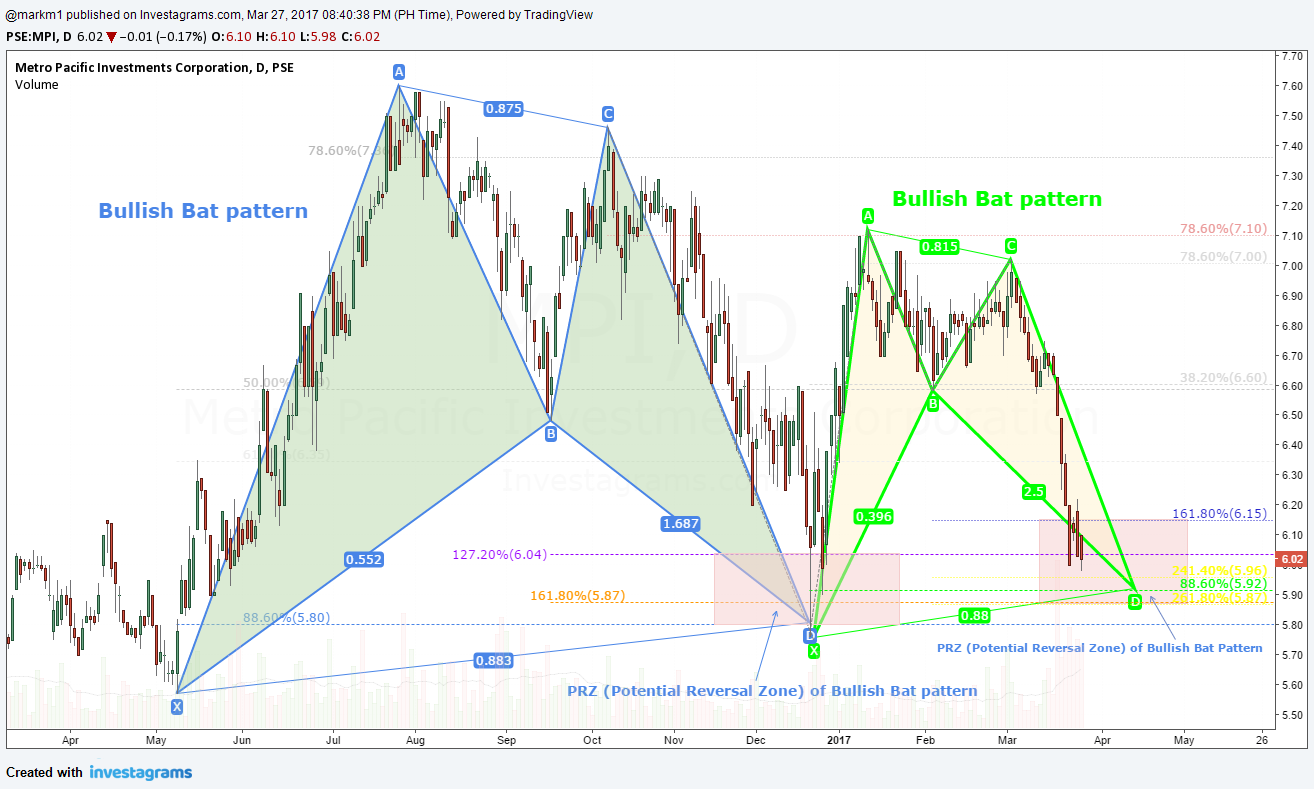

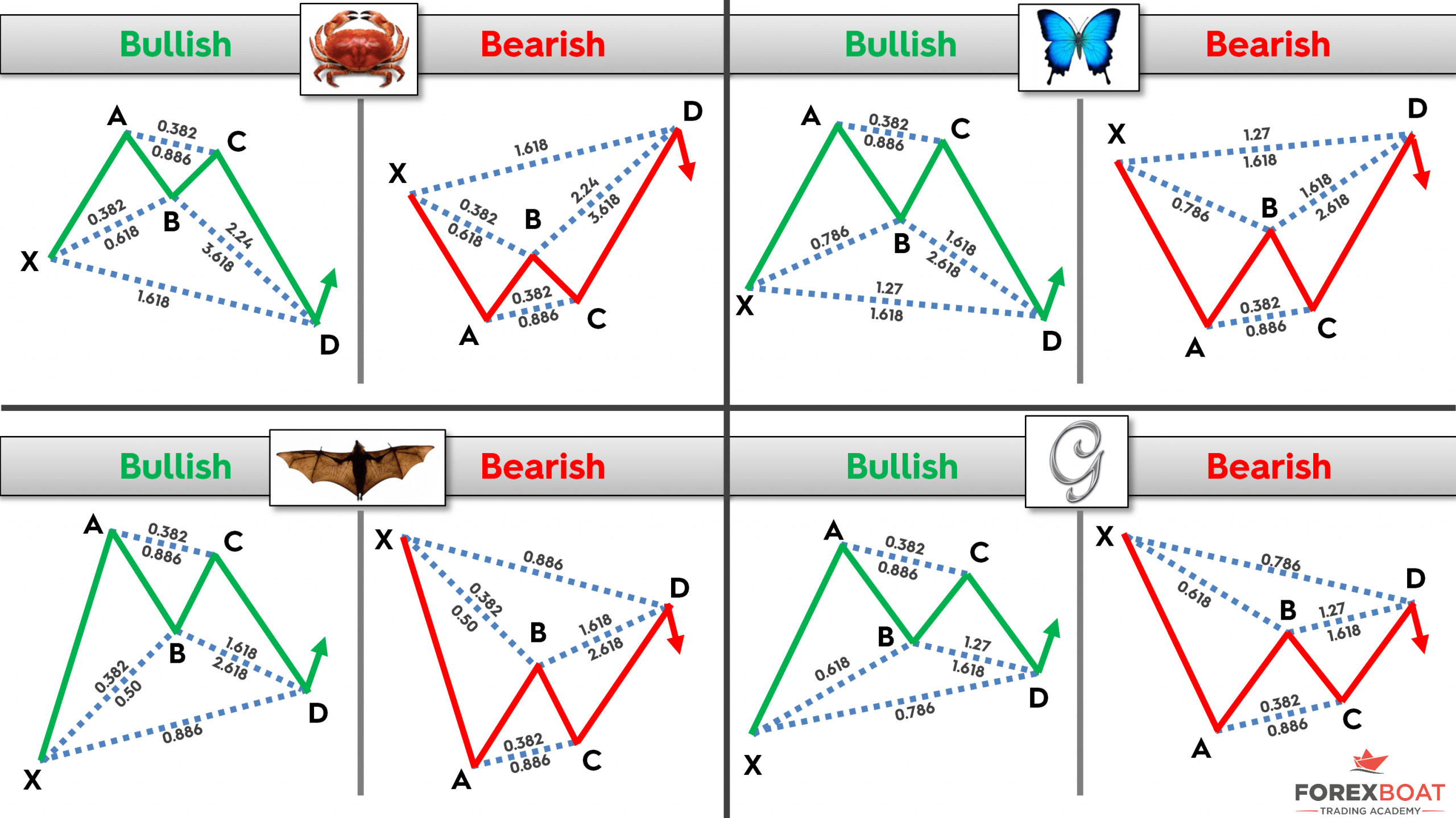

Bullish Harmonic Pattern - Harmonic chart patterns come in many shapes and sizes. Harmonic patterns are surprisingly successful as far as technical analysis goes. In this article, i will teach you how to recognize that pattern and trade it properly. These patterns are highly structured and rely upon the application of fibonacci ratios. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows. Web harmonic abcd pattern is a classic reversal pattern. Common stop levels lie behind a structure level beyond the d point or the next important level for the fibonacci sequence. Web we discuss four harmonic patterns used: The patterns are identified using fibonacci ratios, a series of numbers that can predict potential support and resistance levels in the market. As mentioned earlier, harmonic patterns can be either bullish or bearish in nature. Web the concept of harmonic patterns in trading was first introduced by h.m. They create geometric price patterns by using fibonacci numbers to identify potential price changes or trend reversals. When analysing harmonic patterns in price charts, a trader can make predictions about where and to what extent an asset’s price might move. And, they may act as both bullish. 1️⃣ ab leg 2️⃣ bc leg 3️⃣ cd leg the pattern is considered to be bullish if ab leg is bearish. It is generally indicated by a small increase in price (signified by a white candle) that can be. As mentioned earlier, harmonic patterns can be either bullish or bearish in nature. Like any other harmonic pattern, the theory behind. When trading harmonic patterns, it pays to remember the following relationships: How successful are harmonic patterns? They are more complex than other patterns and can assist technical analysts in interpreting even more market price action information. It is as effective as other harmonic patterns and a common variation on trading this pattern is to trade the last leg to completion.. This means that every pattern has both a bullish and bearish version. Web harmonic patterns in trading have emerged as a valuable means for traders to predict market movements and identify potential trend reversals. To make it easier to understand their fundamental differences, check out the table below. Harmonic patterns are specific formations used in technical analysis that can help. They create geometric price patterns by using fibonacci retracements to identify potential price changes or trend reversals. The bat harmonic pattern follows different fibonacci ratios. Web the cypher pattern, which can be either bullish or bearish, has five points (x, a, b, c, and d) and four legs (xa, ab, bc, and cd). In technical analysis, harmonic patterns are among. They create geometric price patterns by using fibonacci retracements to identify potential price changes or trend reversals. They are more complex than other patterns and can assist technical analysts in interpreting even more market price action information. This pattern is composed of 3 main elements (based on wicks of the candles): It is generally indicated by a small increase in. When analysing harmonic patterns in price charts, a trader can make predictions about where and to what extent an asset’s price might move. Web the cypher pattern, which can be either bullish or bearish, has five points (x, a, b, c, and d) and four legs (xa, ab, bc, and cd). Web bullish harmonic patterns are technical chart patterns that. Web a bullish harmonic pattern is a trading pattern that uses specific ratios to identify potential market reversals. Common stop levels lie behind a structure level beyond the d point or the next important level for the fibonacci sequence. This pattern is composed of 3 main elements (based on wicks of the candles): Like any other harmonic pattern, the theory. Web harmonic patterns are a form of technical analysis which can indicate that a price is going to reverse or continue on in the same pattern. Common stop levels lie behind a structure level beyond the d point or the next important level for the fibonacci sequence. Like any other harmonic pattern, the theory behind the cypher chart pattern is. Web harmonic patterns in trading have emerged as a valuable means for traders to predict market movements and identify potential trend reversals. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows. These patterns are highly structured and rely upon the application of fibonacci ratios. By identifying. As mentioned earlier, harmonic patterns can be either bullish or bearish in nature. Web harmonic price patterns are those that take geometric price patterns to the next level by utilizing fibonacci numbers to define precise turning points. While many indicators in forex predict a general change in price or trend, harmonic patterns are highly precise, and work with very specific movements in price. In this article, i will teach you how to recognize that pattern and trade it properly. Web harmonic patterns represent various price action points of an asset, like a stock. The abcd pattern, the gartley pattern, the butterfly pattern, and the bat pattern. The bat harmonic pattern follows different fibonacci ratios. Web the gartley pattern is a harmonic chart pattern, based on fibonacci numbers and ratios, that helps traders identify reaction highs and lows. How successful are harmonic patterns? Web harmonic patterns in trading have emerged as a valuable means for traders to predict market movements and identify potential trend reversals. It is as effective as other harmonic patterns and a common variation on trading this pattern is to trade the last leg to completion. Web harmonic patterns, as well as all chart patterns, can be conditionally divided into two types: A bearish harmonic pattern is present. Web the cypher pattern, which can be either bullish or bearish, has five points (x, a, b, c, and d) and four legs (xa, ab, bc, and cd). Web bullish harmonic patterns are technical chart patterns that traders use to identify potential bullish reversals in the market. Web harmonic patterns are a form of technical analysis which can indicate that a price is going to reverse or continue on in the same pattern.

Bullish Harmonic Patterns Don’t to SAVE in 2021 Stock

How to Identify & Trade Harmonic Butterfly Pattern for Profits Bybit

How To Draw Bullish Gartley Harmonic Pattern Forex Trading Strategy

121 Harmonic Pattern in Trading The Most Powerful Harmonics Scanner

Bullish shark trading harmonic patterns Vector Image

How To Trade The Harmonic Shark Pattern Forex Training Group

PSE Trends MPI bullish harmonic pattern update

9 Most Common Harmonic Chart Patterns and How to Use Them

Bullish Harmonic Pattern HindUniLvr for NSEHINDUNILVR by

Harmonic Patterns ForexBoat Trading Academy

1️⃣ Ab Leg 2️⃣ Bc Leg 3️⃣ Cd Leg The Pattern Is Considered To Be Bullish If Ab Leg Is Bearish.

Harmonic Patterns Are Surprisingly Successful As Far As Technical Analysis Goes.

Web We Discuss Four Harmonic Patterns Used:

️Initial Impulse (Bullish Or Bearish).

Related Post: