Bullish Candlestick Reversal Patterns

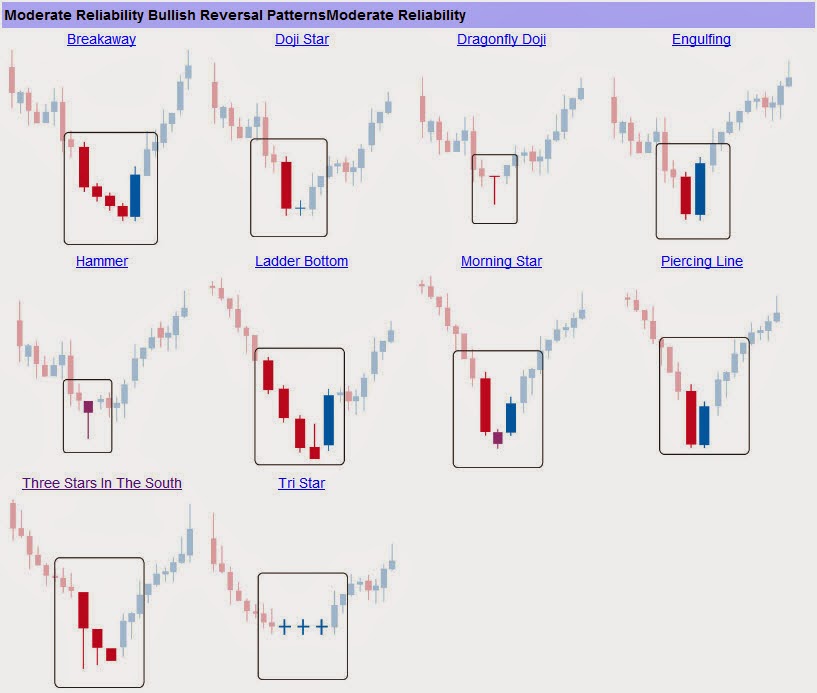

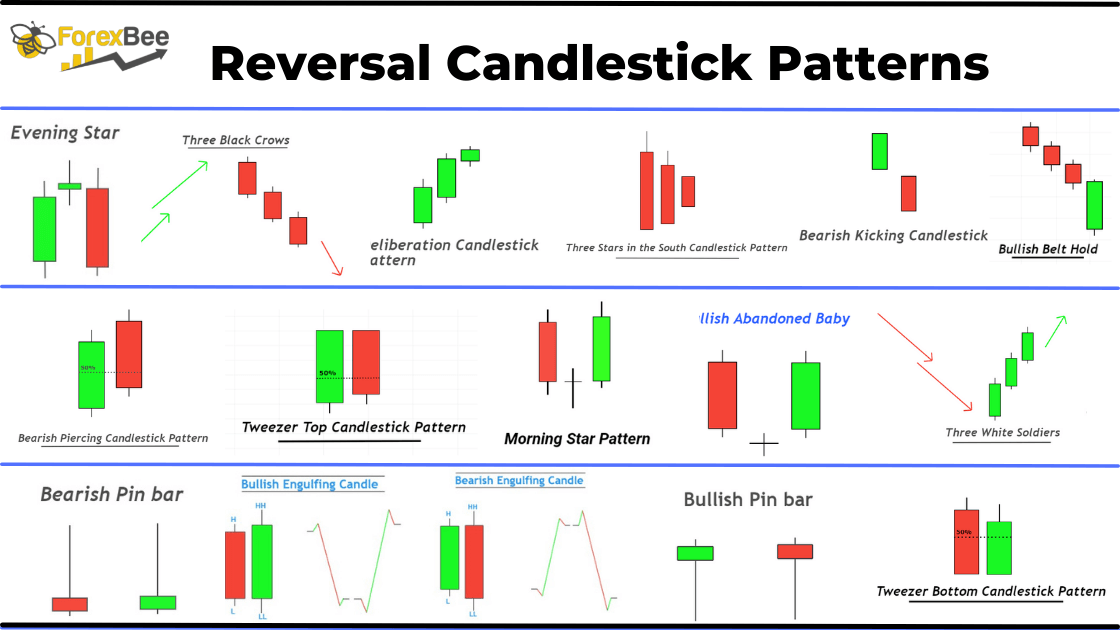

Bullish Candlestick Reversal Patterns - Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. Some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. Get a definition, signals of an uptrend, and downtrend on real charts. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. The shift can be either bullish or bearish. The hammer candlestick pattern is formed by one single candle. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. They are often used to go long, but can also be a warning signal to close short positions. Web 📍 bullish reversal candlestick patterns : Web there are a great many candlestick patterns that indicate an opportunity to buy. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. This is when momentum begins to shift. Web find out how bullish and bearish reversal candlestick patterns show that the market is. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. Here’s an extensive list of them: Web bullish reversal candlestick patterns. Witness real trading examples that highlight the practical power of understanding reversal patterns. Bullish reversal candlestick. They are often used to go long, but can also be a warning signal to close short positions. Web a candlestick reversal pattern is a series of one to three candlesticks in a specific order. This is when momentum begins to shift. Bullish reversal candlestick patterns show that buyers are in control, or regaining control of a movement. Web there. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Web bullish reversal candlestick patterns. This is when momentum begins to shift. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. They are often used to go long,. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Web find out how bullish and bearish reversal candlestick patterns show that the. This shows buying pressure stepped in and reversed the downtrend. They are often used to go long, but can also be a warning signal to close short positions. Web explore the intriguing stories that candlestick patterns have to tell, providing valuable insights into the battle between bull and bear! Web 📍 bullish reversal candlestick patterns : Get a definition, signals. Web for that reason, we suffice for a solid doji candle reversal pattern. Let's examine some of the most common bullish reversal candlestick patterns next. Web 📍 bullish reversal candlestick patterns : Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and. Web a candlestick reversal. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and. Web for that reason, we suffice for a solid doji candle reversal pattern. The shift can. Here’s an extensive list of them: Web 📍 bullish reversal candlestick patterns : Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and. Web bullish reversal candlestick patterns. Web for that reason, we suffice for a solid doji candle reversal pattern. And when you learn to spot them on charts, they can signal a potential change in trend direction. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. They are often used to go long, but can also be a warning signal to close short positions. Let's examine some of. The shift can be either bullish or bearish. Web when viewed together over a period of time, these candlesticks form patterns that traders analyze to gauge trend reversal points, momentum, and potential future price direction. Witness real trading examples that highlight the practical power of understanding reversal patterns. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Let's examine some of the most common bullish reversal candlestick patterns next. Web bullish reversal candlestick patterns are graphic representations of price movements in trading that suggest a potential reversal of a downward trend, indicating that the price of a security may begin to rise. This is when momentum begins to shift. This shows buying pressure stepped in and reversed the downtrend. Web for that reason, we suffice for a solid doji candle reversal pattern. Web there are a great many candlestick patterns that indicate an opportunity to buy. Web bullish candlestick reversal patterns contain the open price at the low of the period and close near the high. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers, dark cloud cover, hammer, morning star, and. And when you learn to spot them on charts, they can signal a potential change in trend direction. They are often used to go long, but can also be a warning signal to close short positions. Here’s an extensive list of them:

25 Bullish reversal candlestick pattern every trader must know and how

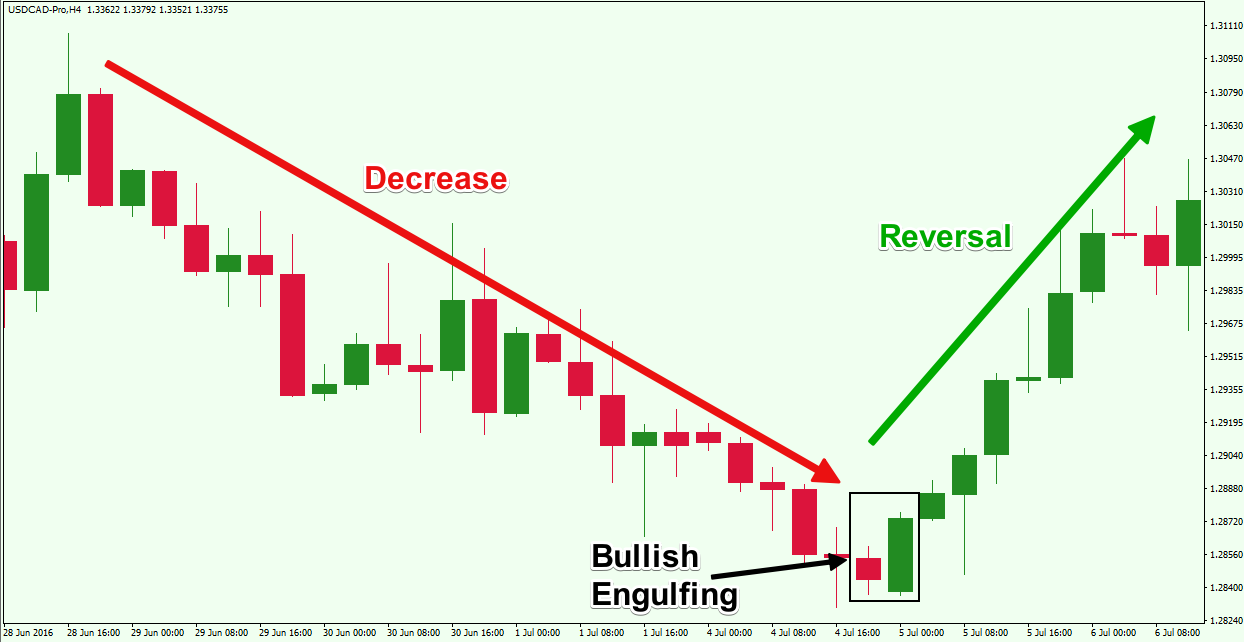

bullishengulfingreversalpattern Forex Training Group

Forex Master Class Candlestick Reversal Patterns

Bullish Reversal 13 Patterns To Identify a Bullish Move Value of Stocks

Bullish Reversal Candlestick Patterns The Forex Geek

Reversal Candlestick Patterns

Reversal Candlestick Patterns Complete Guide ForexBee

bullishreversalcandlestickpatternsforexsignals daytrading

All candlestick patterns for Trading Bullish reversal patterns for

Bullish Candlestick Reversal Patterns Cheat Sheet Trading charts

The Hammer Candlestick Pattern Is Formed By One Single Candle.

Some Examples Of Bullish Candles Are The Hammer, Inverted Hammer, And Bullish Engulfing Patterns.

Bullish Reversal Candlestick Patterns Show That Buyers Are In Control, Or Regaining Control Of A Movement.

Web Bullish Reversal Candlestick Patterns.

Related Post: