Bsby Rate History Chart

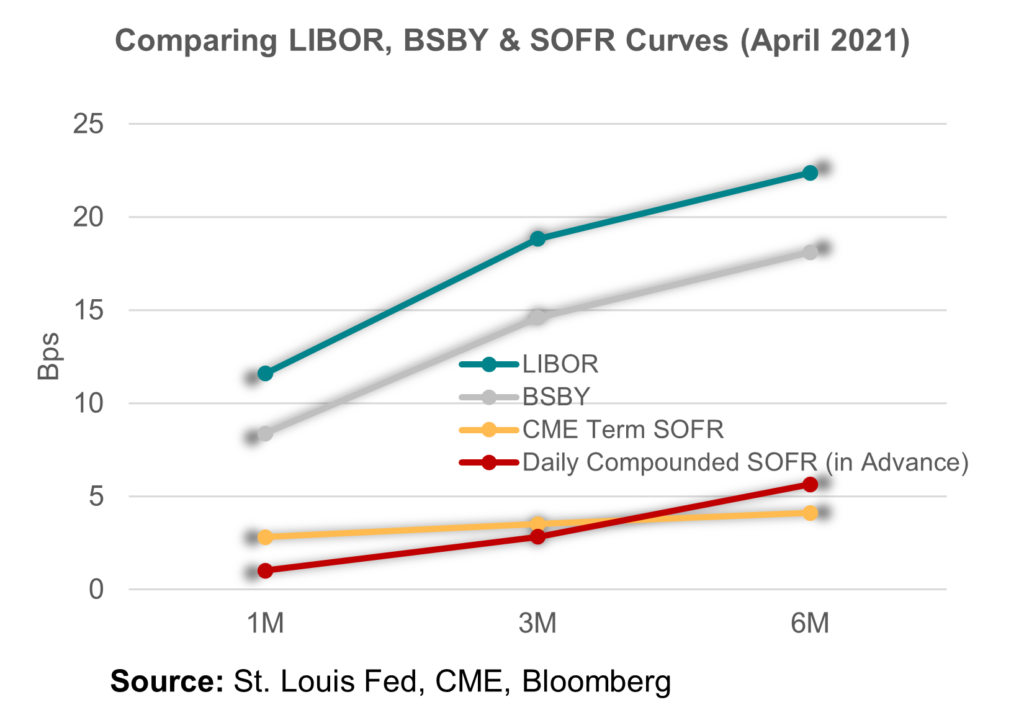

Bsby Rate History Chart - Each tenor demonstrates strong historical correlation with the corresponding usd libor rate, supporting the role of bsby as an appropriate representation of the u.s. The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. Shows the daily level of the federal funds rate back to 1954. Bsby is highly correlated to libor. Web index performance for bloomberg 1month short term bank yield index (usd) (bsby1m) including value, chart, profile & other market data. You'll find the closing yield, open, high, low, change and %change for the selected range of dates. Bsby also seeks to measure the average yields at which. Web bloomberg short term bank yield index (bsby) alternative reference rate for lending solutions. However, as shown in figure 2, aggregate daily underlying volumes used to construct bsby increased in 2022, averaging more than $400 billion driven by an increase in volumes across all underlying instruments, primarily cp/cd and bank deposit markets. You can also learn more about usd libor. Web search for american dollar libor (usd libor) historical data and make dynamic chart in the easiest way! Interest rate benchmark published by the bloomberg l.p. Shows the daily level of the federal funds rate back to 1954. Each tenor demonstrates strong historical correlation with the corresponding usd libor rate, supporting the role of bsby as an appropriate representation of. Each tenor demonstrates strong historical correlation with the corresponding usd libor rate, supporting the role of bsby as an appropriate representation of the u.s. The federal open market committee (fomc. The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. Web bsby. Web bsby has proven robust to a range of historical backtests. Web search for american dollar libor (usd libor) historical data and make dynamic chart in the easiest way! In addition, each tenor has shown strong historical correlation with the corresponding us libor rate, supporting the role of bsby as an appropriate representation of the us The arrc has endorsed. The bsby index is based on. This is a draft of the bsby updated methodology (subject to final approvals). Web bloomberg short term bank yield index (bsby) alternative reference rate for lending solutions. Web search for american dollar libor (usd libor) historical data and make dynamic chart in the easiest way! The arrc has endorsed ( here) cme’s term sofr. Web index performance for bloomberg 1month short term bank yield index (usd) (bsby1m) including value, chart, profile & other market data. The federal open market committee (fomc. Web this update highlights the formal endorsement of term sofr by the arrc, expands the discussion to include ameribor and dives more deeply into the issues associated with term sofr swaps resulting in. Web what’s the economic difference between libor, csrs and sofrs? You can also learn more about usd libor. Web search for american dollar libor (usd libor) historical data and make dynamic chart in the easiest way! Web bsby provides a series of credit sensitive reference rates that incorporate bank credit spreads and defines a forward term structure. Trade ideas, forecasts. Web bsby has proven robust to a range of historical backtests. However, as shown in figure 2, aggregate daily underlying volumes used to construct bsby increased in 2022, averaging more than $400 billion driven by an increase in volumes across all underlying instruments, primarily cp/cd and bank deposit markets. Trade ideas, forecasts and market news are at your disposal as. Bsby also seeks to measure the average yields at which. Web based on the activity of a transparent list of 34 eligible banks and capturing typically over $200bn of trades and executable quotes daily across the maturity spectrum, bsby provided the market. Web search for american dollar libor (usd libor) historical data and make dynamic chart in the easiest way!. Web what’s the economic difference between libor, csrs and sofrs? In addition, each tenor has shown strong historical correlation with the corresponding us libor rate, supporting the role of bsby as an appropriate representation of the us Web bloomberg short term bank yield index (bsby) alternative reference rate for lending solutions. Each tenor demonstrates strong historical correlation with the corresponding. Web based on the activity of a transparent list of 34 eligible banks and capturing typically over $200bn of trades and executable quotes daily across the maturity spectrum, bsby provided the market. Historical data and forecasted values on. Web what’s the economic difference between libor, csrs and sofrs? Web bloomberg short term bank yield index (bsby) alternative reference rate for. Historical data and forecasted values on. Web index performance for bloomberg 1month short term bank yield index (usd) (bsby1m) including value, chart, profile & other market data. However, as shown in figure 2, aggregate daily underlying volumes used to construct bsby increased in 2022, averaging more than $400 billion driven by an increase in volumes across all underlying instruments, primarily cp/cd and bank deposit markets. Web bsby has proven robust to a range of historical backtests. In addition, each tenor has shown strong historical correlation with the corresponding us libor rate, supporting the role of bsby as an appropriate representation of the us The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. You'll find the closing yield, open, high, low, change and %change for the selected range of dates. The federal open market committee (fomc. Each tenor demonstrates strong historical correlation with the corresponding usd libor rate, supporting the role of bsby as an appropriate representation of the u.s. The bsby index is based on. Bsby also seeks to measure the average yields at which. Web this update highlights the formal endorsement of term sofr by the arrc, expands the discussion to include ameribor and dives more deeply into the issues associated with term sofr swaps resulting in a mismatch with any related hedge by the lender. Web based on the activity of a transparent list of 34 eligible banks and capturing typically over $200bn of trades and executable quotes daily across the maturity spectrum, bsby provided the market. Web bloomberg short term bank yield index (bsby) alternative reference rate for lending solutions. The arrc has endorsed ( here) cme’s term sofr. Interest rate benchmark published by the bloomberg l.p.

Current 30 Day Bsby Rate

Housing affordability What happens when lower home prices take on

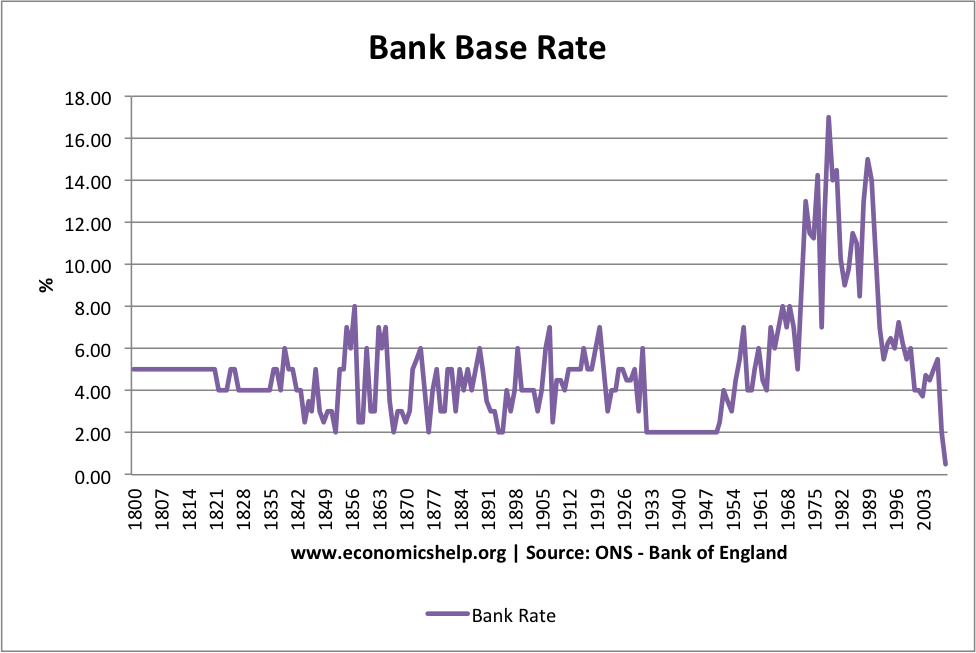

Bank Of England Base Rate 2022 Dates

The Latest Stimulus Bill Will Make the US Covid Response More Expensive

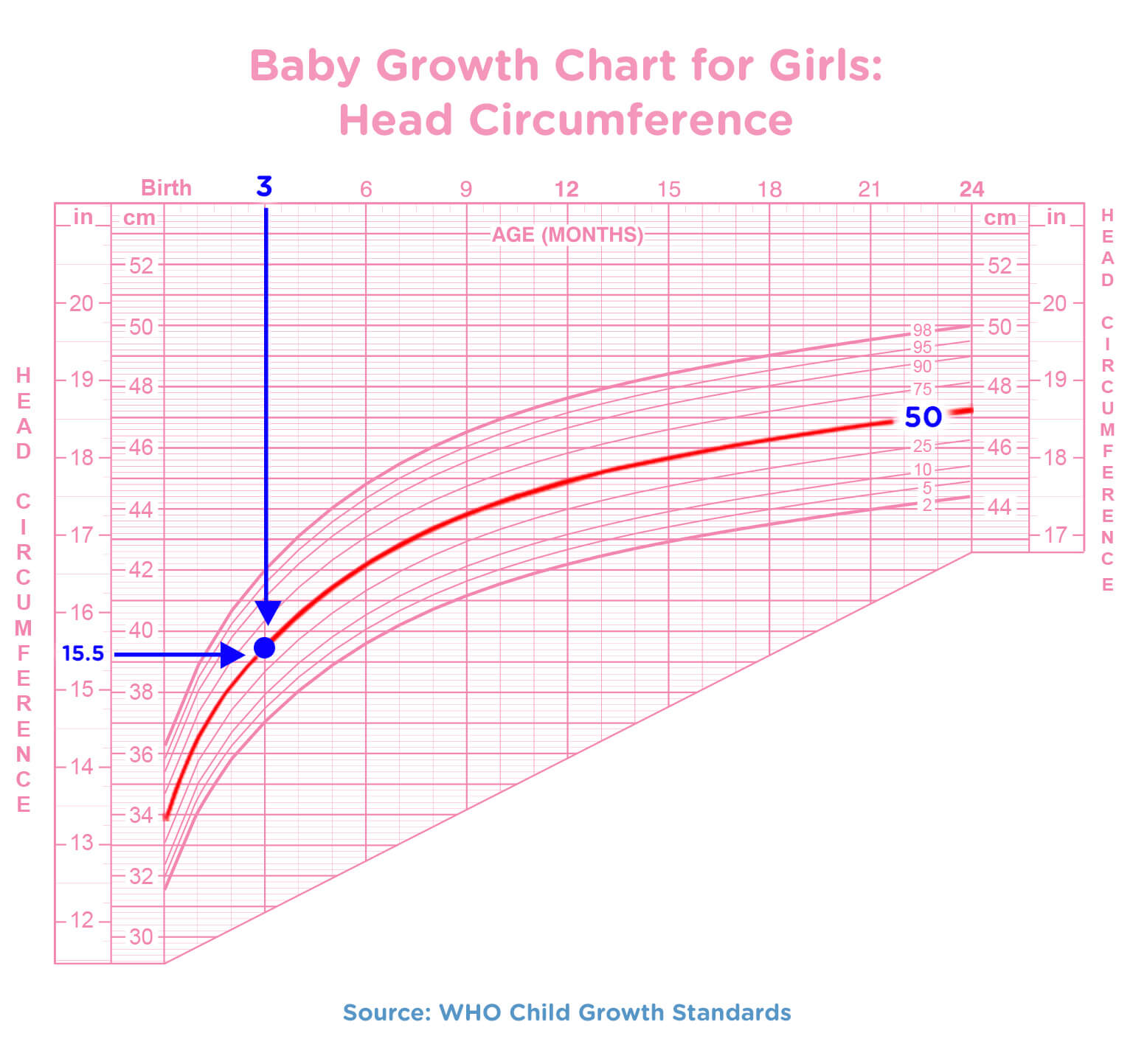

How to Read a Baby Growth Chart Pampers

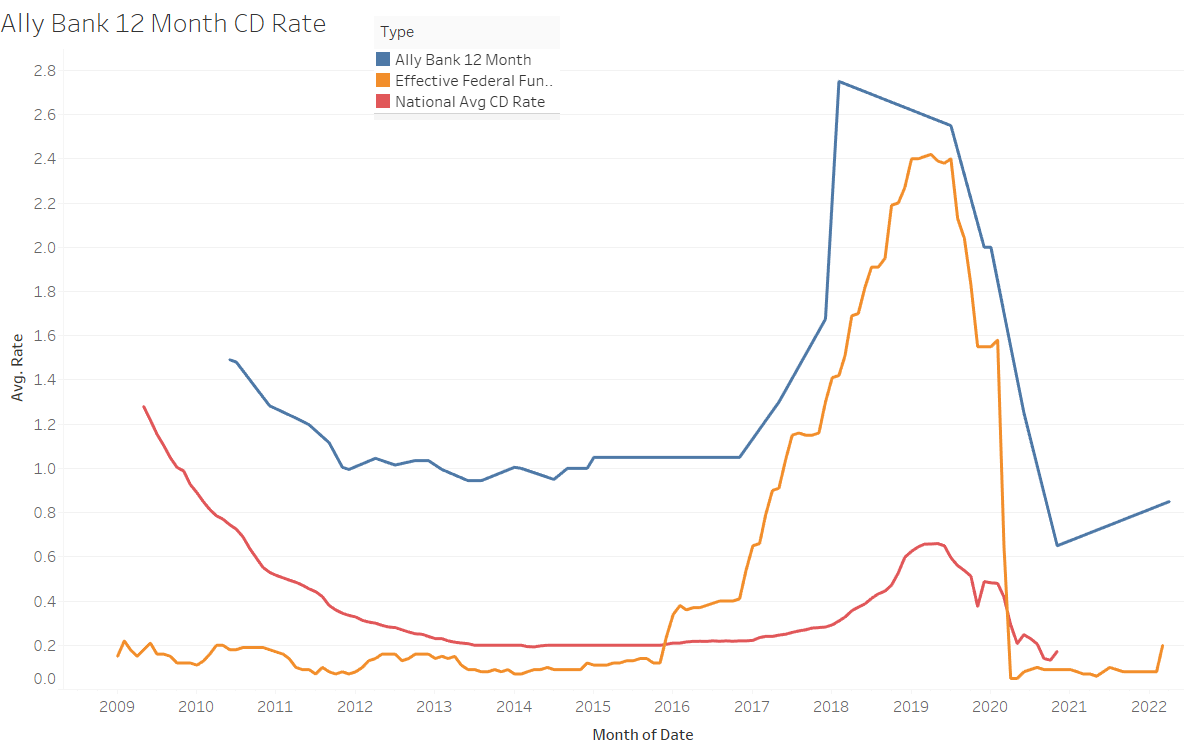

Historical Cd Rate Chart

IRS Mileage Reimbursement Rates 2023 Alternative Solutions

What Is The Bsby Rate Today

The Bloomberg Shortterm Bank Yield Index (BSBY) A year in the life

Mortgage Rates Canada Predictions 2024 Bliss Tiffani

Web Search For American Dollar Libor (Usd Libor) Historical Data And Make Dynamic Chart In The Easiest Way!

As A Result, Libor And Csr Curves Will Be Higher And Steeper Than Sofr Curves.

Web What’s The Economic Difference Between Libor, Csrs And Sofrs?

Shows The Daily Level Of The Federal Funds Rate Back To 1954.

Related Post: