Black Scholes Excel Template

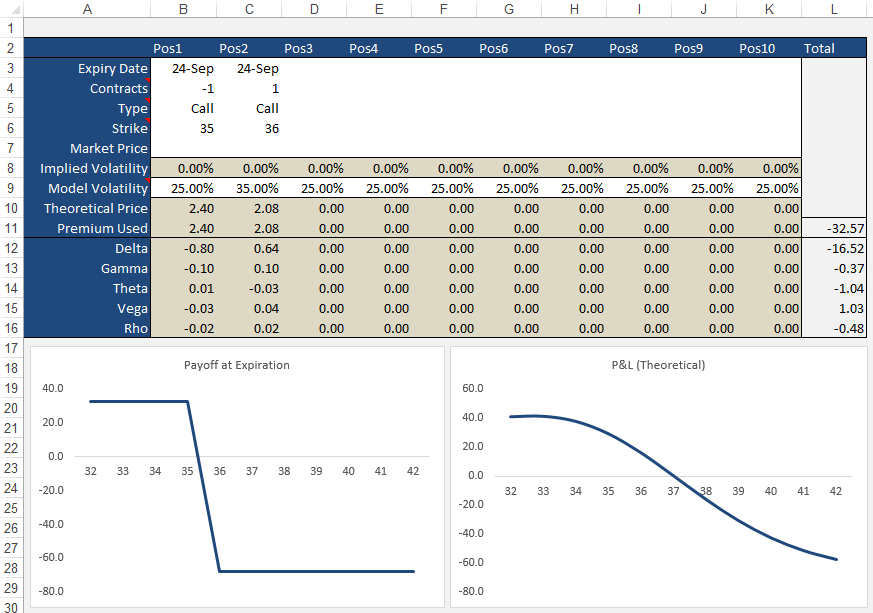

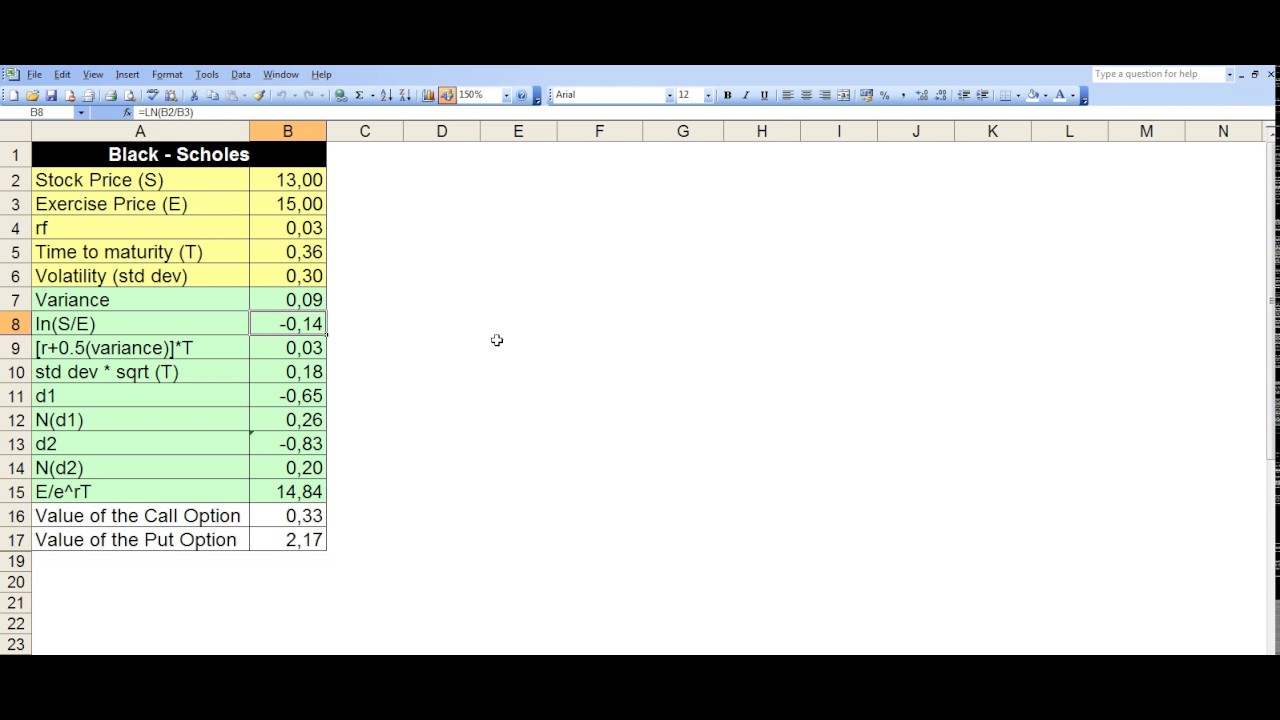

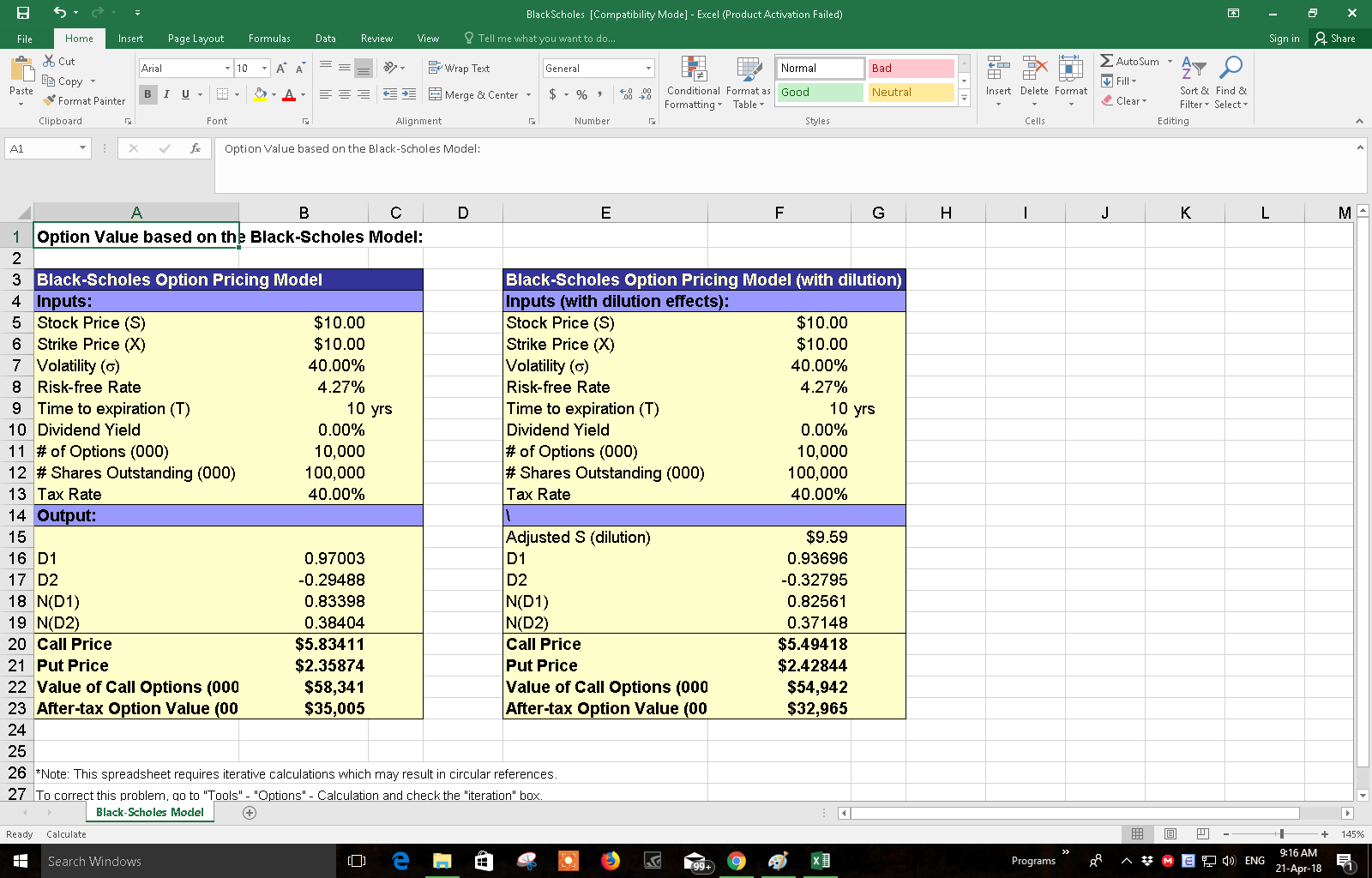

Black Scholes Excel Template - The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and the annual volatility of the underlying stock is 20%. Web need to calculate some puts and calls? The spreadsheet allows for dividends and also gives you the greeks. Web how do you determine the fair market value of a european call or put option? If you’re just playing around it doesn’t matter how you structure the calculation. These are sample parameters and results. The spreadsheet shoppe has got you covered! Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. Web need to calculate some puts and calls? Web how do you determine the fair market value of a european call or put option? If you’re just playing around it doesn’t matter how you structure the calculation. The spreadsheet allows for dividends and also gives you the greeks. The spreadsheet shoppe has got you covered! Web need to calculate some puts and calls? The spreadsheet shoppe has got you covered! These are sample parameters and results. If you’re just playing around it doesn’t matter how you structure the calculation. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. Web need to calculate some puts and calls? These are sample parameters and results. The spreadsheet shoppe has got you covered! The spreadsheet allows for dividends and also gives you the greeks. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. These are sample parameters and results. If you’re just playing around it doesn’t matter how you structure the calculation. Web need to calculate some puts and calls? The spreadsheet allows for dividends and also gives you the greeks. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in. Web how do you determine the fair market value of a european call or put option? The spreadsheet shoppe has got you covered! Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. The stock price at time 0, six months before expiration date of the option. Web need to calculate some puts and calls? Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. If you’re just playing around it doesn’t matter how you structure the calculation. The spreadsheet allows for dividends and also gives you the greeks. The spreadsheet shoppe has got. If you’re just playing around it doesn’t matter how you structure the calculation. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. These are sample parameters and results. Web how do you determine the fair market value of a european call or put option? The spreadsheet. If you’re just playing around it doesn’t matter how you structure the calculation. The spreadsheet allows for dividends and also gives you the greeks. The spreadsheet shoppe has got you covered! These are sample parameters and results. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and. If you’re just playing around it doesn’t matter how you structure the calculation. Web sometimes an online option calculator isn’t enough and you’d like to implement the black & scholes (b&s) option pricing equations in excel. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of. These are sample parameters and results. The spreadsheet shoppe has got you covered! The spreadsheet allows for dividends and also gives you the greeks. The stock price at time 0, six months before expiration date of the option is $42.00, option exercise price is $40.00, the rate of interest on a government bond with 6 months to expiration is 5%, and the annual volatility of the underlying stock is 20%. Web how do you determine the fair market value of a european call or put option? Web need to calculate some puts and calls?

Option Value Excel Model with BlackScholes formula Eloquens

hướng dẫn giải mô hình BlackScholes trên excel YouTube

10 Black Scholes Excel Template Excel Templates

Black Scholes Excel Template SampleTemplatess SampleTemplatess

Black Scholes Option Calculator

Black & Scholes for Puts/Calls in a Single Excel Cell Six Figure

10 Black Scholes Excel Template Excel Templates

Black Scholes Calculator Download Free Excel Template BlackScholes

BlackScholes Model on Excel for Option Pricing YouTube

BlackScholes Excel Pricing Model Eloquens

Web Sometimes An Online Option Calculator Isn’t Enough And You’d Like To Implement The Black & Scholes (B&S) Option Pricing Equations In Excel.

If You’re Just Playing Around It Doesn’t Matter How You Structure The Calculation.

Related Post: