Bearish Reversal Patterns

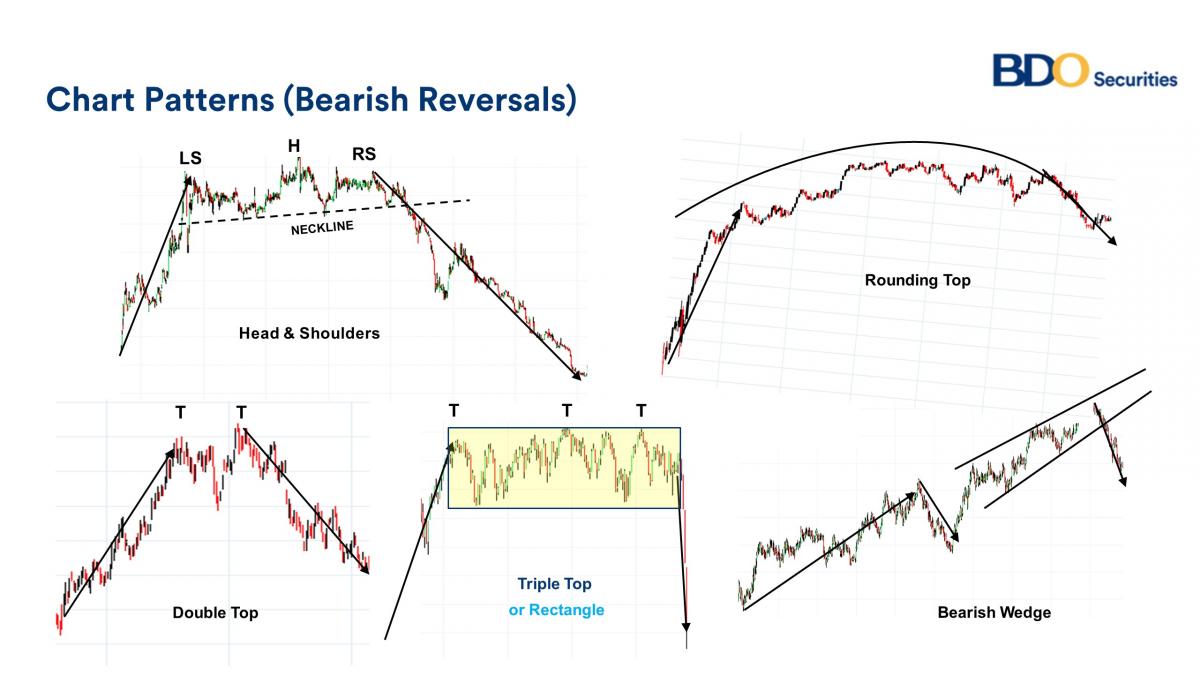

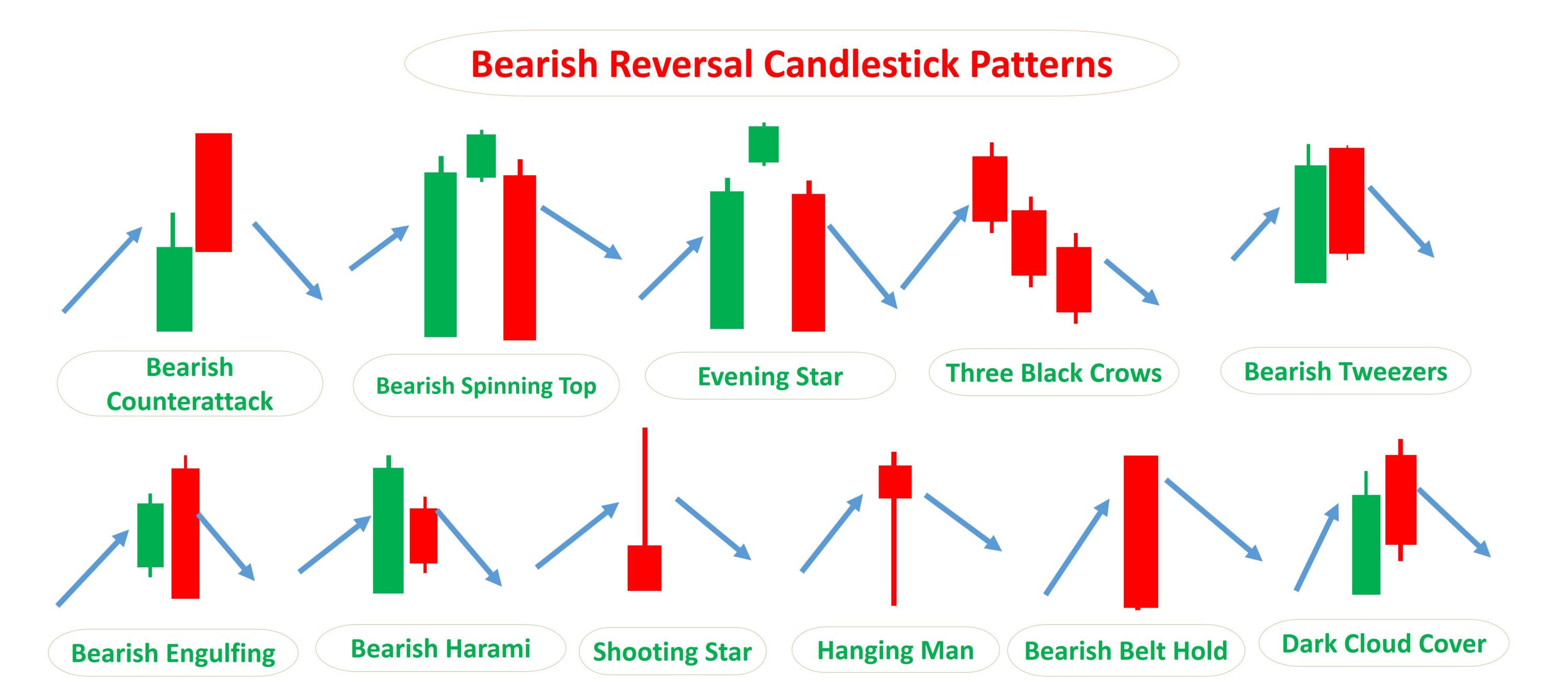

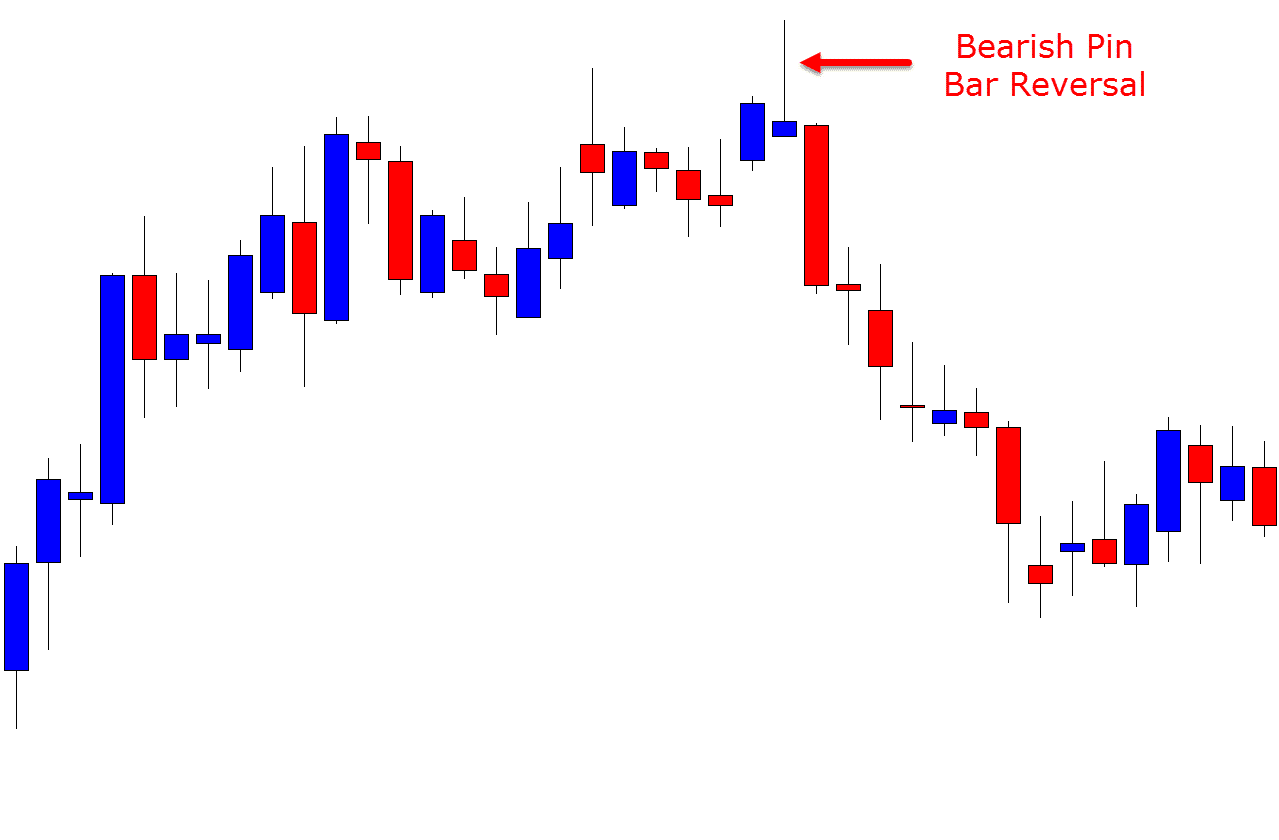

Bearish Reversal Patterns - Whether you trade stocks, forex, or crypto, understanding bullish and bearish reversal candlestick patterns can help you adeptly navigate price action. Web 📍 bearish reversal candlestick patterns : Examples of common bearish reversal patterns include head and shoulders, double tops, triangles, and wedges. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. It's a hint that the market sentiment may be shifting from buying to selling. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Many of these are reversal patterns. Bearish reversal candlestick patterns can form with one or more candlesticks; Traders use it alongside other technical indicators such as the relative strength. Web 📍 bearish reversal candlestick patterns : Examples of common bearish reversal patterns include head and shoulders, double tops, triangles, and wedges. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. Web a. Comprising two consecutive candles, the pattern features a smaller. Candlestick pattern strength is described as either strong, reliable, or weak. Examples of common bearish reversal patterns include head and shoulders, double tops, triangles, and wedges. Web a bearish reversal is a pattern that signals the end of an uptrend and the beginning of a downtrend. It's a hint that the. Web reversals are patterns that tend to resolve in the opposite direction to the prevailing trend, with bearish: Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Many of these are reversal patterns. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in. Bearish reversal candlestick patterns can form with one or more candlesticks; The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will. Candlestick pattern strength is described as either strong, reliable, or weak. Whether you trade stocks, forex, or crypto, understanding bullish. Comprising two consecutive candles, the pattern features a smaller. Web 📍 bearish reversal candlestick patterns : Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Traders use it alongside other technical indicators such as the relative strength. Web a bearish candlestick pattern is a visual representation of. Comprising two consecutive candles, the pattern features a smaller. Get a definition, signals of an uptrend, and downtrend on real charts. Whether you trade stocks, forex, or crypto, understanding bullish and bearish reversal candlestick patterns can help you adeptly navigate price action. Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. Many. Get a definition, signals of an uptrend, and downtrend on real charts. Examples of common bearish reversal patterns include head and shoulders, double tops, triangles, and wedges. It's a hint that the market sentiment may be shifting from buying to selling. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web. Traders use it alongside other technical indicators such as the relative strength. Web reversals are patterns that tend to resolve in the opposite direction to the prevailing trend, with bearish: They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. The actual reversal indicates that selling pressure overwhelmed buying pressure for one. Web a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Traders use it alongside other technical indicators such as the relative strength. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Get a definition, signals of an uptrend, and downtrend on real charts. Examples of common bearish reversal patterns include head and shoulders, double tops, triangles, and wedges. Many of these are reversal patterns. Web in this guide, we'll. Traders use it alongside other technical indicators such as the relative strength. Comprising two consecutive candles, the pattern features a smaller. Web 📍 bearish reversal candlestick patterns : Web reversals are patterns that tend to resolve in the opposite direction to the prevailing trend, with bearish: The actual reversal indicates that selling pressure overwhelmed buying pressure for one or more days, but it remains unclear whether or not sustained selling or lack of buyers will. Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Candlestick pattern strength is described as either strong, reliable, or weak. Web a bearish reversal is a pattern that signals the end of an uptrend and the beginning of a downtrend. Many of these are reversal patterns. Get a definition, signals of an uptrend, and downtrend on real charts. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Bearish reversal candlestick patterns can form with one or more candlesticks;

Reversal Patterns

Are Chart Patterns Reliable? Tackle Trading

Candlestick Patterns Types & How to Use Them

Bearish Candlestick Reversal Patterns in 2020 Technical analysis

Bearish Reversal Chart Patterns

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

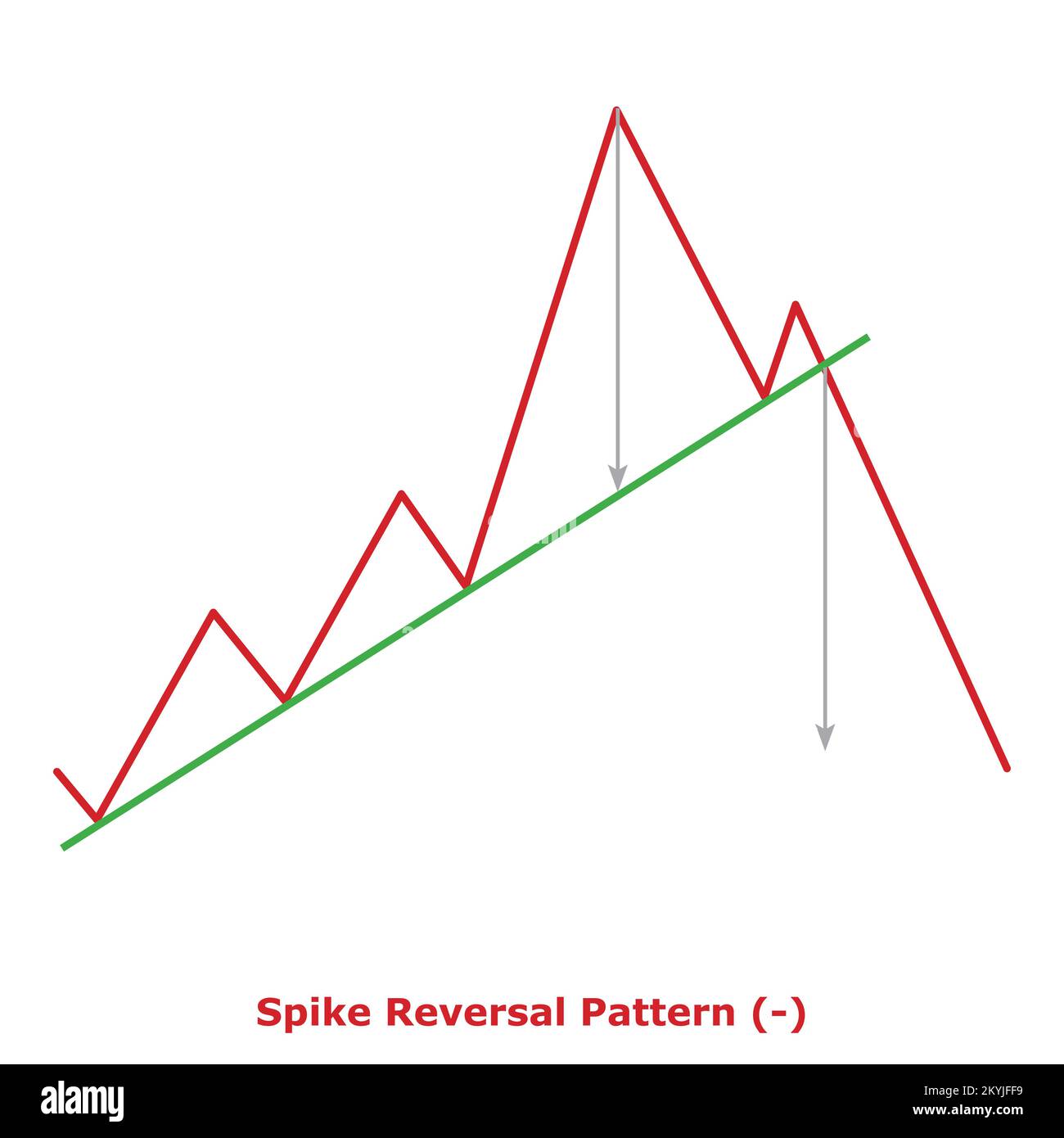

Spike Reversal Pattern Bearish () Small Illustration Green & Red

bearishreversalcandlestickpatternsforexsignals

What Is Bearish Reversal Candlestick Pattern BEST GAMES WALKTHROUGH

Bearish Reversal Candlestick Patterns The Forex Geek

Whether You Trade Stocks, Forex, Or Crypto, Understanding Bullish And Bearish Reversal Candlestick Patterns Can Help You Adeptly Navigate Price Action.

Web A Bearish Candlestick Pattern Is A Visual Representation Of Price Movement On A Trading Chart That Suggests A Potential Downward Trend Or Price Decline In An Asset.

Web Bearish Candlestick Patterns Are Either A Single Or Combination Of Candlesticks That Usually Point To Lower Price Movements In A Stock.

Examples Of Common Bearish Reversal Patterns Include Head And Shoulders, Double Tops, Triangles, And Wedges.

Related Post: