Bearish Reversal Candle Patterns

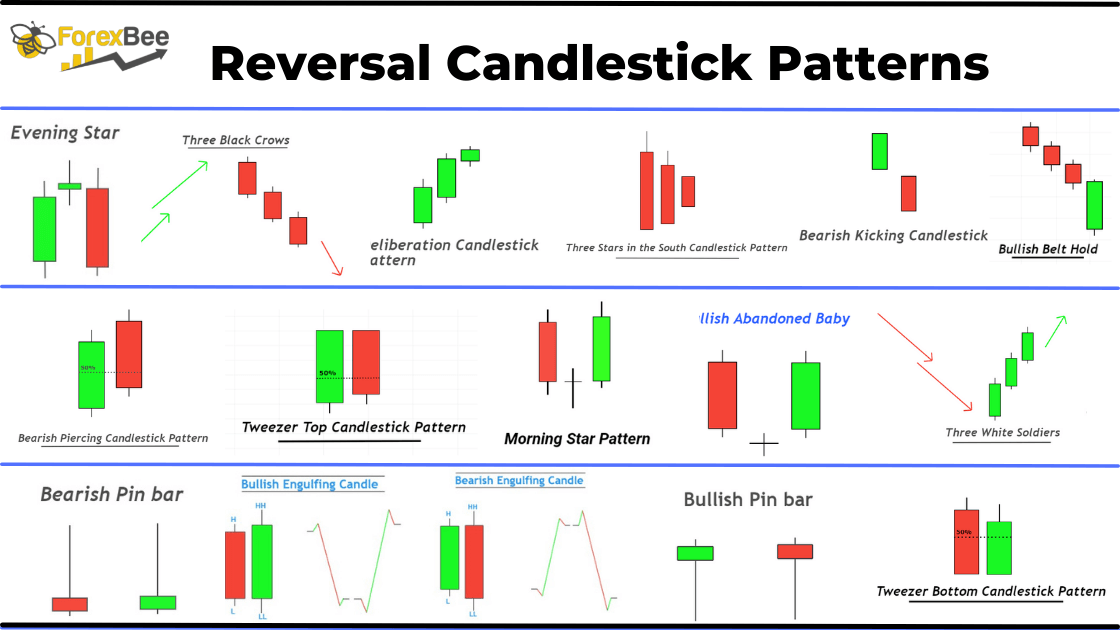

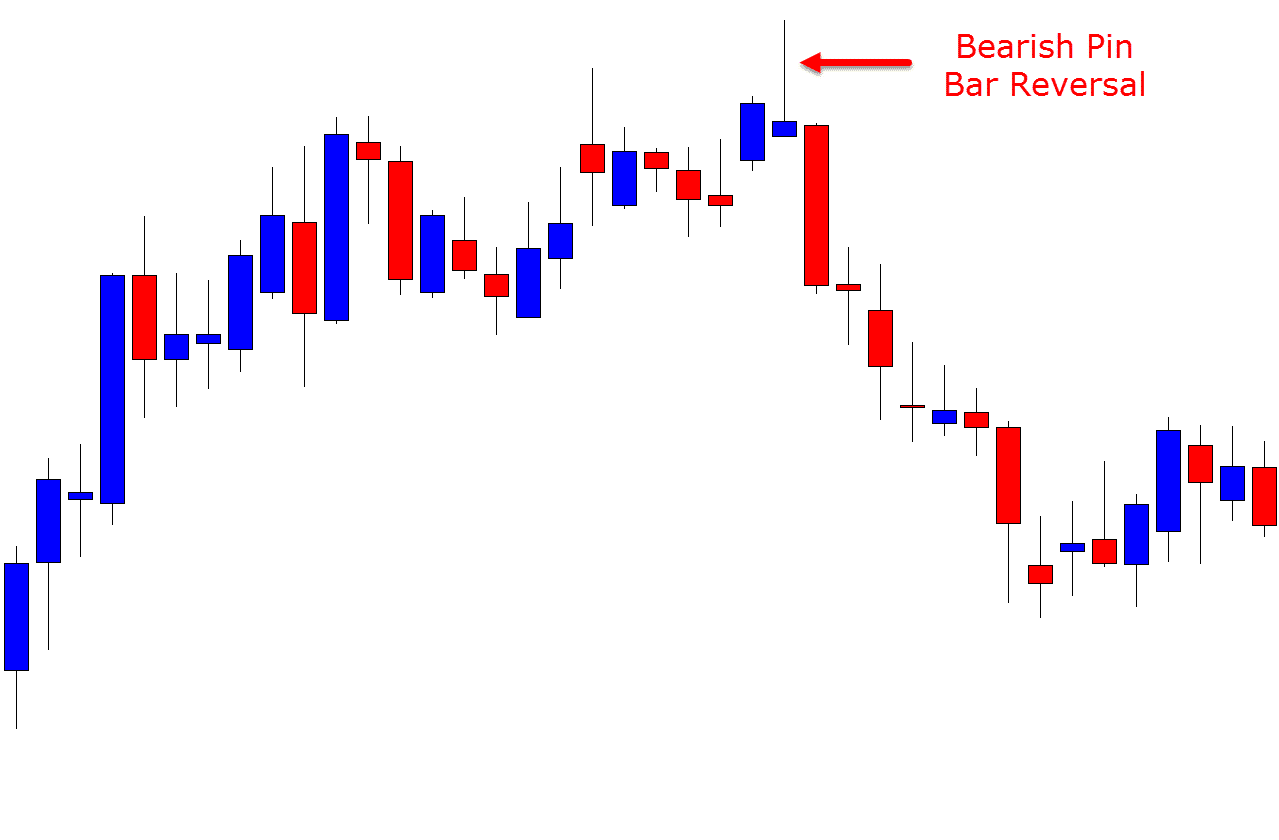

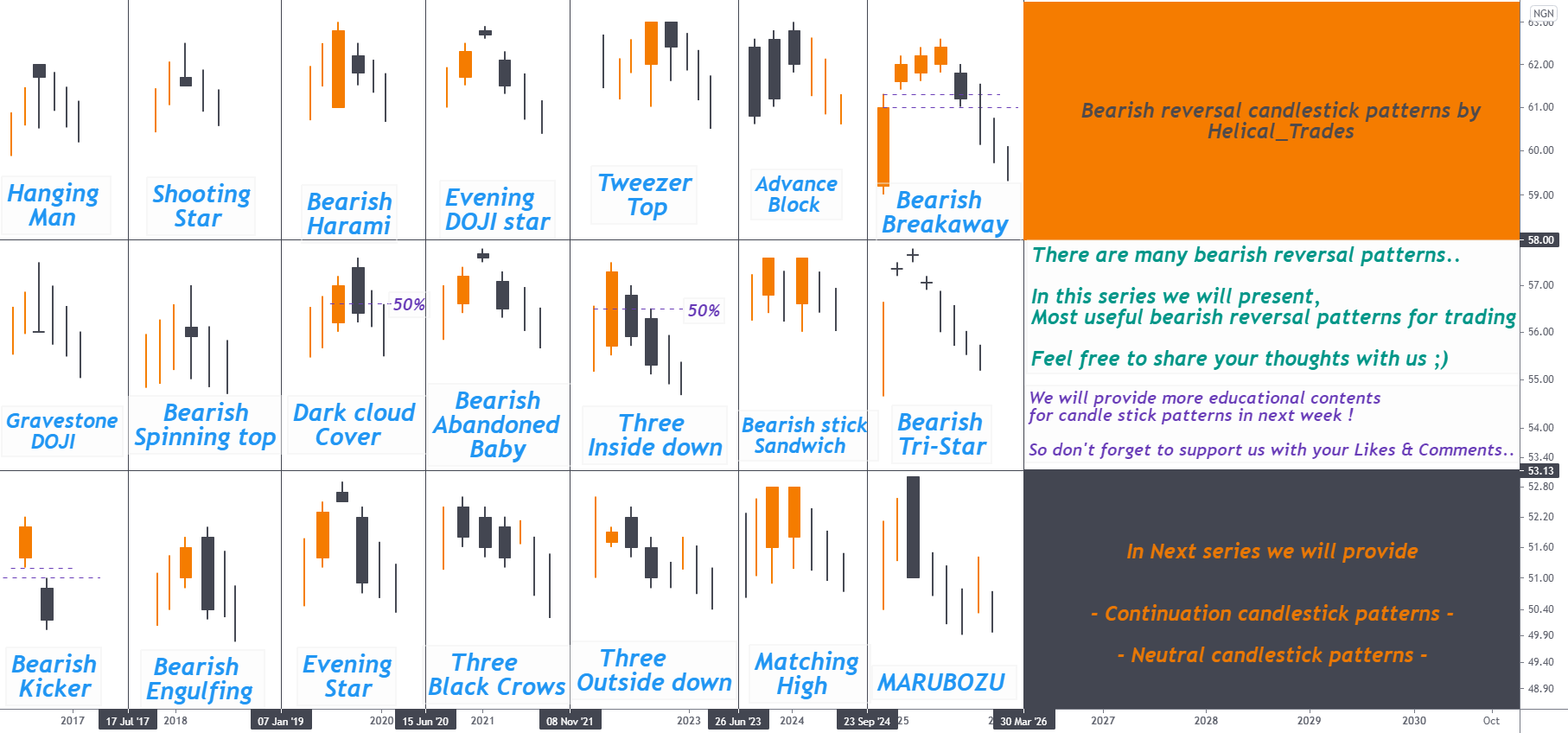

Bearish Reversal Candle Patterns - Hanging man is a bearish reversal candlestick pattern having a long lower shadow with a small real body. Get a definition, signals of an uptrend, and downtrend on real charts. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. Price reversals are a common occurrence while trading stocks, commodities, currencies, and other. Traders use it alongside other technical indicators such as the relative strength. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web what is a bearish candlestick pattern? Bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Signs of a bearish reversal may be a hammer or doji. Good trading requires the best charting tool! Web what is a bearish candlestick pattern? Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. Without further ado, let’s dive into the 8 bearish candlestick patterns. It's a hint that the market. Let’s break down the basics: Hopefully at this point in your trading. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward. Web the 15 best bullish & bearish reversal candlestick patterns explained. Signs of a bearish reversal may be a hammer or doji. Many of these are reversal patterns. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Traders use it alongside other technical indicators such as the relative strength. Web bearish japanese candlestick reversal patterns are displayed below from strongest to weakest. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period.. A bearish reversal single candlestick pattern: Signs of a bearish reversal may be a hammer or doji. This formation consists of three distinct peaks, with. Let’s break down the basics: Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. A bearish reversal single candlestick pattern: Web the 15 best bullish & bearish reversal candlestick patterns explained. This formation consists of three distinct peaks, with. Price reversals are a common occurrence while trading stocks, commodities, currencies, and other. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Without further ado, let’s dive into the 8 bearish candlestick patterns. Traders use it alongside other technical indicators such as the relative strength. Let’s break down the basics: Web bullish and bearish reversal candlestick pattern price action roadmap dive into the. Price reversals are a common occurrence while trading stocks, commodities, currencies, and other. Web a bearish reversal means a stock may show signs of going into an uptrend and reversing from a current downtrend. Web find out how bullish and bearish reversal candlestick patterns show that the market is reversing. Hopefully at this point in your trading. Traders use it. Web what is a bearish candlestick pattern? Hopefully at this point in your trading. Get a definition, signals of an uptrend, and downtrend on real charts. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web a bearish reversal candlestick pattern is a sequence of price actions or a pattern,. Web the 15 best bullish & bearish reversal candlestick patterns explained. Appearing at the end of the uptrend, this bearish. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward. A bearish reversal single candlestick pattern: Signs of a bearish reversal may be a hammer or doji. Appearing at the end of the uptrend, this bearish. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web a bearish reversal means a stock may show signs of going into an uptrend and reversing from a current downtrend. A bearish reversal single candlestick pattern: Many of these are reversal. Let’s break down the basics: Web many of these are reversal patterns. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. Web candlestick patterns are made up of individual “candles,” each showing the price movement for a certain time period. Try tradingview and chart all. Good trading requires the best charting tool! Many of these are reversal patterns. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Check out or cheat sheet below and feel free to use it for your training! Traders use it alongside other technical indicators such as the relative strength. Price reversals are a common occurrence while trading stocks, commodities, currencies, and other. Hopefully at this point in your trading. Bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web in this guide, we'll explore the most powerful candlestick reversal patterns that signal potential trend reversions. A bearish reversal single candlestick pattern: This formation consists of three distinct peaks, with.

bearishreversalcandlestickpatternsforexsignals Candle Stick

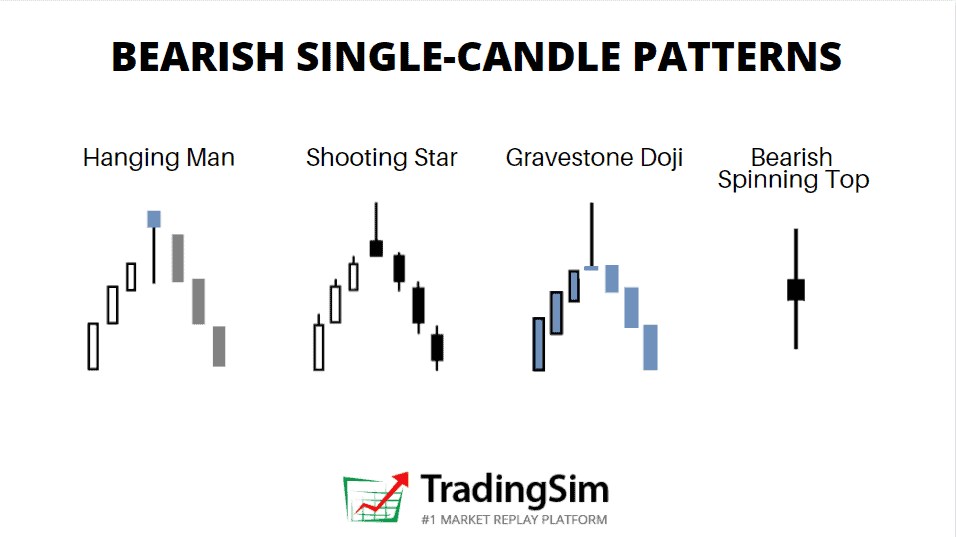

8 Best Bearish Candlestick Patterns for Day Trading TradingSim

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

Reversal Candlestick Patterns Complete Guide ForexBee

What are Bearish Candlestick Patterns

The Bearish Harami candlestick pattern show a strong reversal

Bearish Reversal Candlestick Patterns The Forex Geek

All candlestick patterns for Trading Bearish reversal patterns for

Bearish Candlestick Reversal Patterns in 2020 Technical analysis

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns4-fa047e5b2078456998bfc730dd6d7619.png)

Advanced Candlestick Patterns

Web A Bearish Reversal Candlestick Pattern Is A Sequence Of Price Actions Or A Pattern, That Signals A Potential Change From Uptrend To Downtrend.

Web Find Out How Bullish And Bearish Reversal Candlestick Patterns Show That The Market Is Reversing.

Hanging Man Is A Bearish Reversal Candlestick Pattern Having A Long Lower Shadow With A Small Real Body.

A Bearish Candlestick Pattern Is A Visual Representation Of Price Movement On A Trading Chart That Suggests A Potential Downward.

Related Post: