Bearish Head And Shoulders Pattern

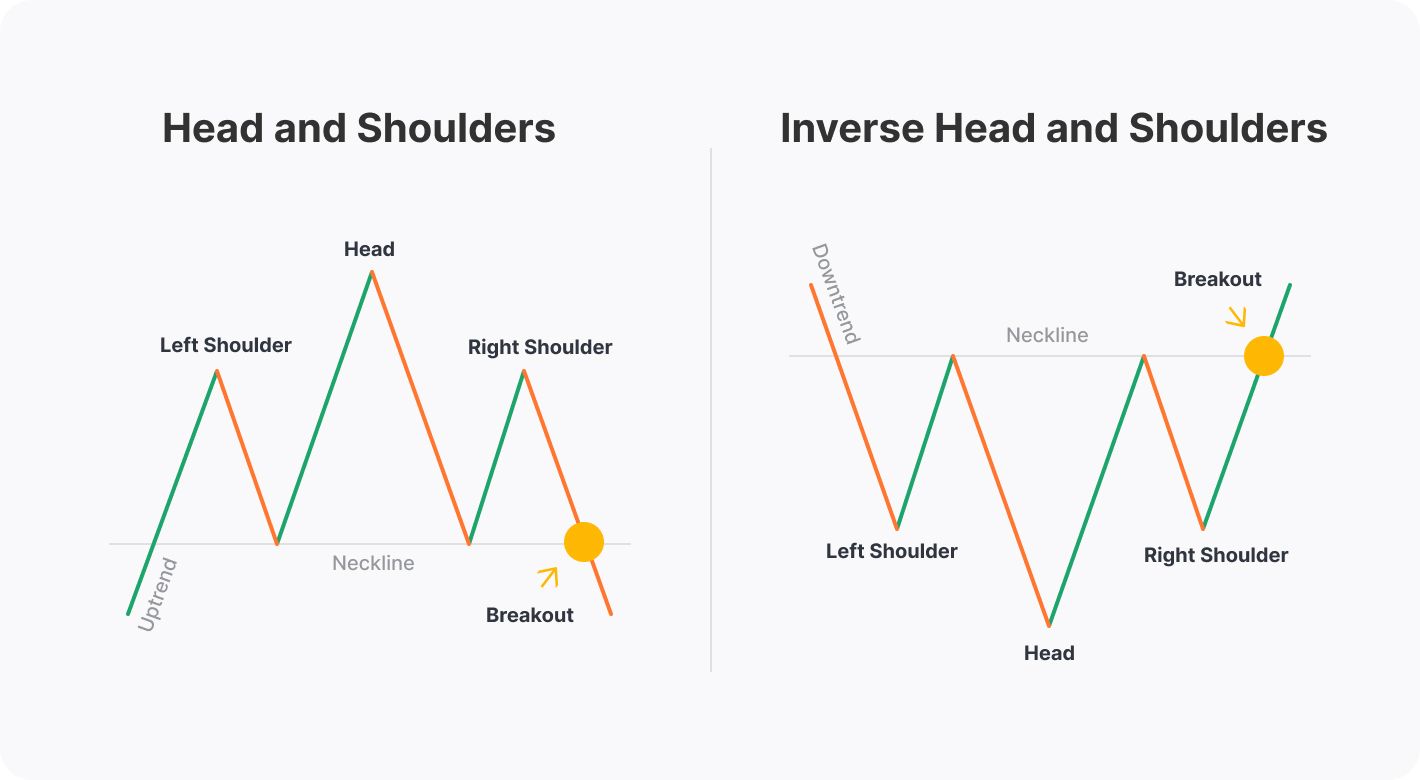

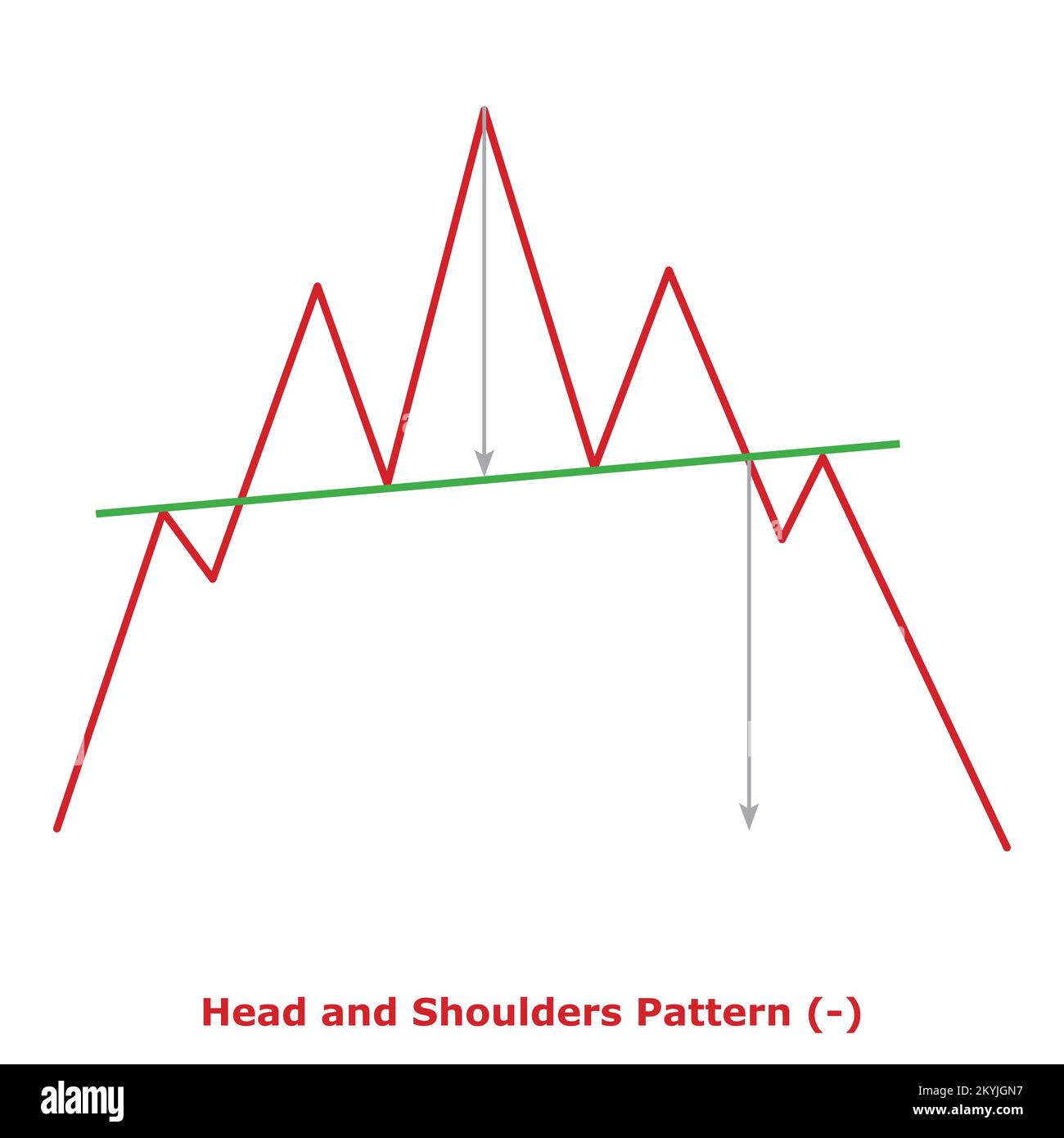

Bearish Head And Shoulders Pattern - Web bearish head and shoulders. Web the reasoning behind a head & shoulders pattern is as follows: Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that. Web overview this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. The patterns included are as follows: Web the head and shoulders pattern is a specific chart formation that predicts a bullish to bearish trend reversal. It consists of 3 tops. Web sustained selling pressure could spur a breakdown and a downtrend that’s the same height as the chart pattern, potentially taking the stock index down to the next. Web a head and shoulders pattern is used in technical analysis which occurs when a massive reversal in the ongoing trend in the market happens occurs. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Web bearish head and shoulders. Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that. Web sustained selling. Web head and shoulders pattern, as the name suggests the shape of a head along with two shoulders. Web a head and shoulders pattern is used in technical analysis which occurs when a massive reversal in the ongoing trend in the market happens occurs. The middle dip resembles a head, while the right and left dips on the. Web the. It consists of 3 tops. This is a reversal pattern and can act both as a bullish and. The head and shoulders pattern is considered as one of the. Web the head and shoulders chart pattern indicates a potential trend reversal of the current uptrend. Web the second is a bearish case involving a breakdown of the support at $63,000,. The middle dip resembles a head, while the right and left dips on the. Web bearish head and shoulders. Web the reasoning behind a head & shoulders pattern is as follows: Web on the technical analysis chart, the head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish or bearish trend;. Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. Web the head and shoulders pattern is a specific chart formation that predicts a bullish to bearish trend reversal. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position. Web a head and shoulders pattern is used in technical analysis which occurs when a massive reversal in the ongoing trend in the market happens occurs. The middle dip resembles a head, while the right and left dips on the. Is head and shoulders bullish or bearish? Web the head and shoulders pattern is a technical analysis chart pattern we. Web on the technical analysis chart, the head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish or bearish trend; Bears push prices downwards making new lows; The middle dip resembles a head, while the right and left dips on the. Web the inverse head and shoulders bottom is a reversal. Specifically, there are two head and shoulder chart. Web learn how to identify and trade head & shoulders patterns, which are reversal patterns that form at the top or bottom of a trend. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. What does a. Web learn how to identify and trade head & shoulders patterns, which are reversal patterns that form at the top or bottom of a trend. Web sustained selling pressure could spur a breakdown and a downtrend that’s the same height as the chart pattern, potentially taking the stock index down to the next. Web what is a head and shoulders. Web overview this indicator automatically draws and sends alerts for all of the chart patterns in my public library as they occur. Web bearish head and shoulders. Web the head and shoulders chart pattern indicates a potential trend reversal of the current uptrend. So you should be looking for a head and shoulders pattern in an. Web sustained selling pressure. Web bearish head and shoulders. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web the second is a bearish case involving a breakdown of the support at $63,000, swiftly moving the price down to $61,000. Web the head and shoulders pattern is not a continuation pattern but a bearish reversal chart pattern. Web the reasoning behind a head & shoulders pattern is as follows: The head and shoulders stock pattern is a common tool to help identify the fall of a previously rising stock. Web the inverse head and shoulders bottom is a reversal pattern within a declining trend, signaling a shift from bearish to bullish market conditions. Web the head and shoulders pattern is a specific chart formation that predicts a bullish to bearish trend reversal. The patterns included are as follows: This is a reversal pattern and can act both as a bullish and. Specifically, head and shoulders charting signal an impending. Web a head and shoulders pattern is used in technical analysis which occurs when a massive reversal in the ongoing trend in the market happens occurs. Web the head and shoulders pattern is a technical analysis chart pattern we use to predict price moments. What does a head and shoulders pattern tell you? The neckline represents the point at which bearish traders start selling. Web what is a head and shoulders pattern?

Head And Shoulders Chart Pattern Entry

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

Head and Shoulders Pattern Trading Strategy Synapse Trading

Trading Chart Patterns with Technical Analysis

Candlestick Patterns Complete Guide to Bearish and Bullish

How to Use the Forex Head and Shoulders Pattern Benzinga

Top 10 Chart Patterns You Can Use When Trading Stocks Market Pulse

INVERTED HEAD AND SHOULDERS (Bullish) Head & shoulders, Trading

Head and Shoulders Pattern Bearish () Small Illustration Green

Bullish Inverted Head and Shoulder YouTube

5 Reasons Why Forex Traders Should Use The.

The Pattern Also Indicates That The.

Web Head And Shoulders Pattern, As The Name Suggests The Shape Of A Head Along With Two Shoulders.

The Head And Shoulders Pattern Is Considered As One Of The.

Related Post: