Bearish Candlestick Pattern

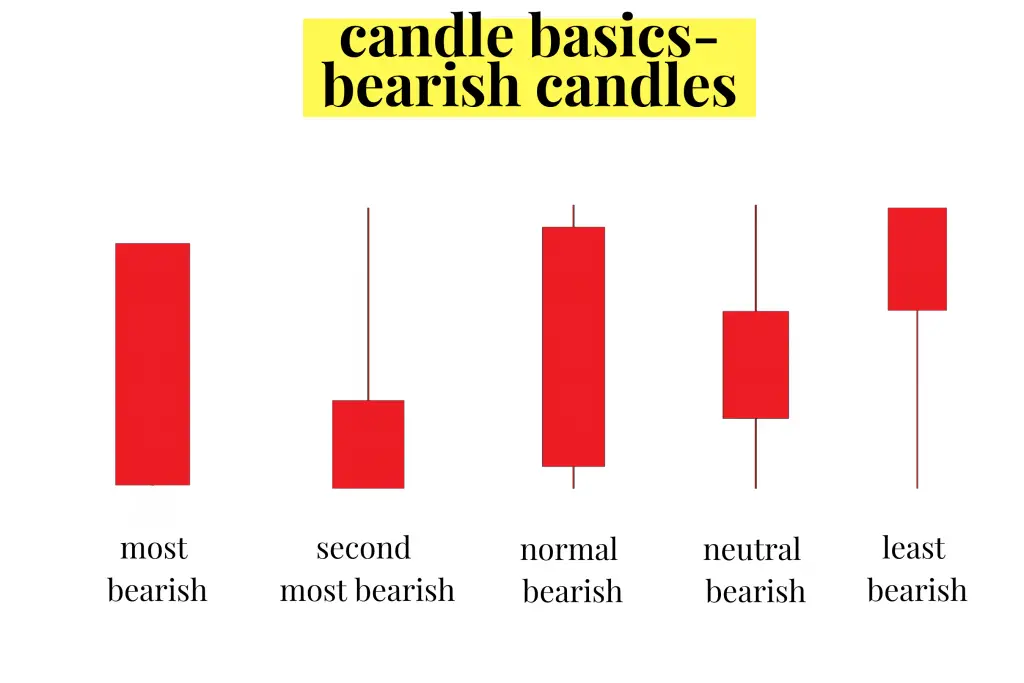

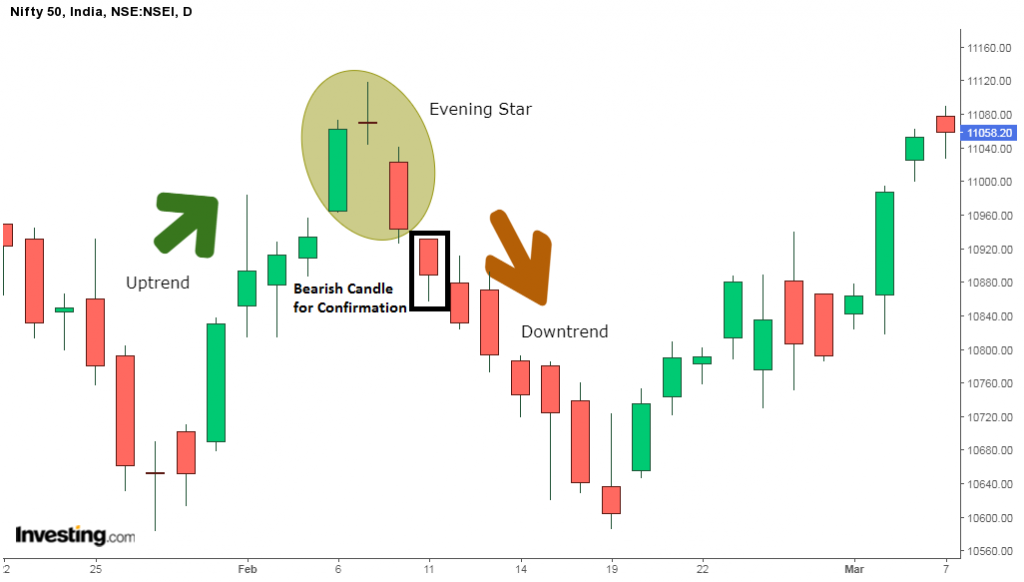

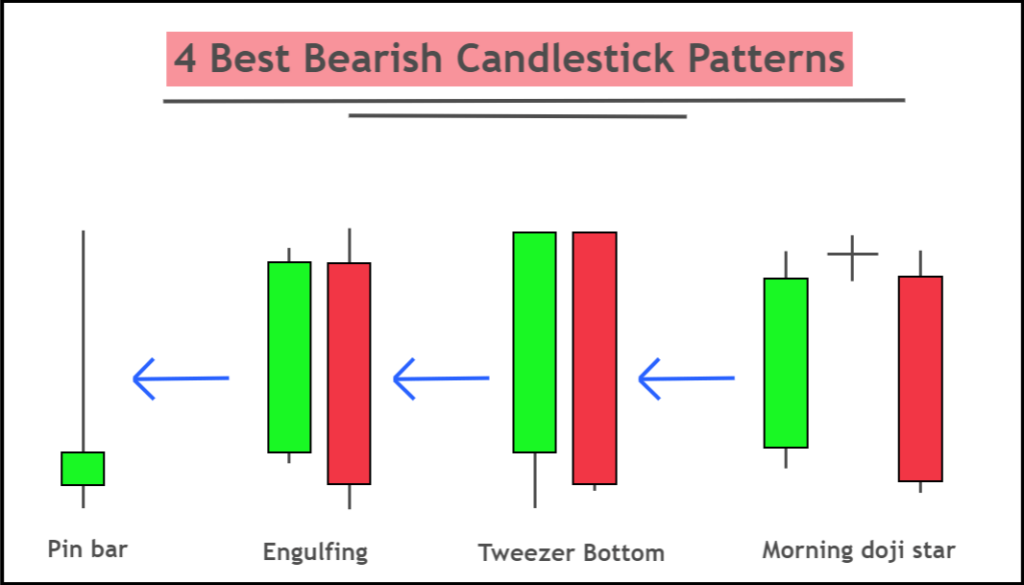

Bearish Candlestick Pattern - Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Comprising two consecutive candles, the pattern features a smaller. In this article, we are introducing some examples of bearish candlestick patterns. Frequently asked questions (faqs) what are bearish candlestick patterns? In this course, we shall delve into one of the most popular trend continuation price action patterns, the fair value gap pattern. Web bull call spread bear call spread bear put spread. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. Web the critical question now is whether nvidia can find its feet or whether this bearish momentum will continue heading into the close. Web there are eight typical bearish candlestick patterns, which are examined below. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Comprising two consecutive candles, the pattern features a smaller. Bullish candles show that the price of a stock is going up. They are relatively easy to remember which makes them ideal for trade planning and system development. Which candlestick patterns are bearish? Ai stocks biotechnology stocks blockchain stocks bullish moving averages candlestick patterns cannabis stocks cathie wood stocks clean energy stocks cybersecurity stocks dividend stocks emacd buy signals ev stocks gold stocks hot penny stocks oil stocks power infrastructure reit. A bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or. Web what are bearish candlestick patterns. Web learn about all the trading candlestick patterns that exist: Bullish candles show that the price of a stock is going up. The sell condition is met when. Just like sociology, there is no laboratory for finding out the best approach that will guarantee desired results in the stock market. What is the 3 candle rule in trading? Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web bearish candles show that the price of a stock is going down. The bearish abandoned baby is a powerful reversal pattern characterized by a gap down after an uptrend. Web there are eight typical bearish candlestick patterns, which are examined below. Ai stocks biotechnology stocks blockchain stocks bullish moving averages candlestick patterns cannabis stocks cathie wood stocks clean energy stocks cybersecurity stocks dividend stocks emacd buy signals ev stocks gold stocks hot penny stocks oil stocks power infrastructure reit. Web bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock.. Just like sociology, there is no laboratory for finding out the best approach that will guarantee desired results in the stock market. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. What is the 3 candle rule in trading? These patterns are recognized. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. A. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Just like sociology, there is no laboratory for finding out the best approach that will guarantee desired results in the stock market. Web what is a bearish candlestick pattern? Web top bearish candlestick patterns. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. They are typically red or black on stock charts. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Ai stocks biotechnology stocks blockchain stocks bullish. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web what is a bearish candlestick pattern? Web there are eight typical bearish candlestick patterns, which are examined below. Web 5 powerful bearish candlestick patterns. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a. In this course, we shall delve into one of the most popular trend continuation price action patterns, the fair value gap pattern. Web bearish candles show that the price of a stock is going down. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Web in technical analysis, the bearish engulfing pattern is a chart pattern that can signal a reversal in an upward price trend. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web bull call spread bear call spread bear put spread. They are typically red or black on stock charts. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web there are eight typical bearish candlestick patterns, which are examined below. The bearish abandoned baby is a powerful reversal pattern characterized by a gap down after an uptrend. Ai stocks biotechnology stocks blockchain stocks bullish moving averages candlestick patterns cannabis stocks cathie wood stocks clean energy stocks cybersecurity stocks dividend stocks emacd buy signals ev stocks gold stocks hot penny stocks oil stocks power infrastructure reit. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Web 5 powerful bearish candlestick patterns. Web 📚 a gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. Web price and candlestick patterns are the building blocks of quality technical analysis and price action. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price.

What are Bearish Candlestick Patterns

Bearish Candlestick Patterns PDF Guide Free Download

Candlestick Patterns The Definitive Guide (2021)

Candlestick Patterns Explained New Trader U

Bearish Candlestick Reversal Patterns in 2020 Technical analysis

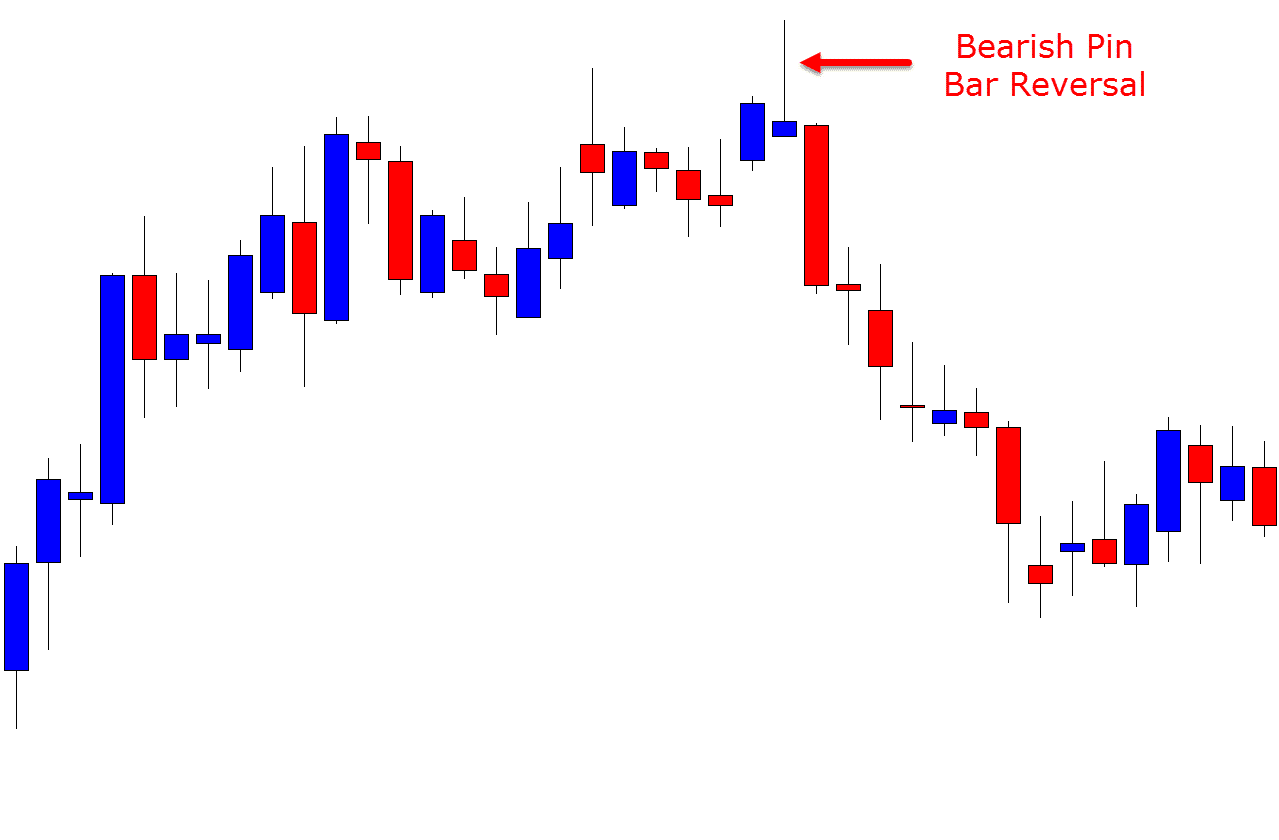

Bearish Reversal Candlestick Patterns The Forex Geek

5 Powerful Bearish Candlestick Patterns

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

Bearish Reversal Candlesticks Patterns for BINANCEBTCUSDT by EXCAVO

4 Best Bearish Candlestick Patterns ForexBee

We Have To Compare It.

Web A Bearish Candlestick Pattern Is A Visual Representation Of Price Movement On A Trading Chart That Suggests A Potential Downward Trend Or Price Decline In An Asset.

A Shooting Star Is A Bearish Reversal Pattern.

Web Bearish Candlestick Patterns Usually Form After An Uptrend, And Signal A Point Of Resistance.

Related Post: