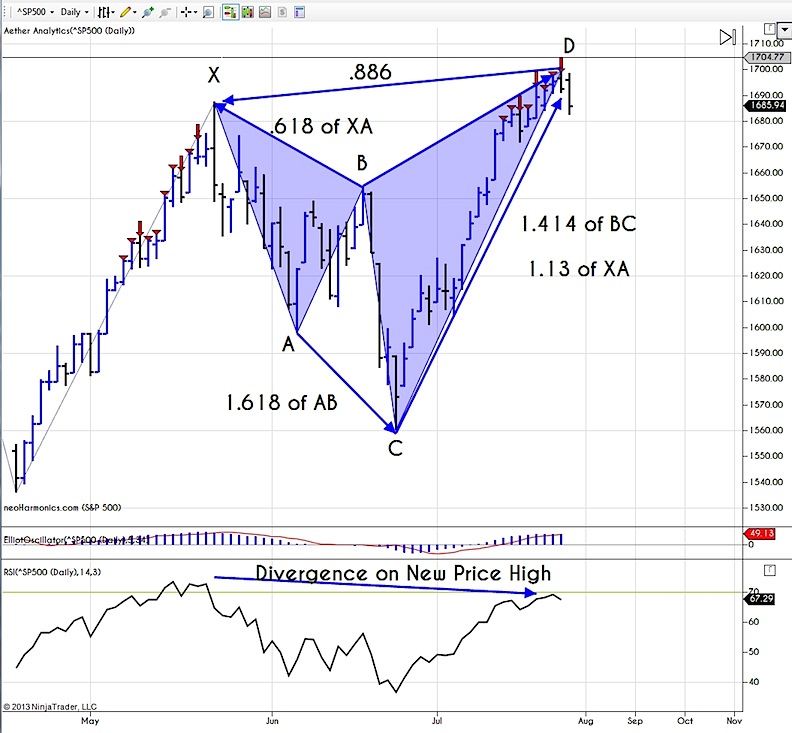

Bearish Bat Pattern

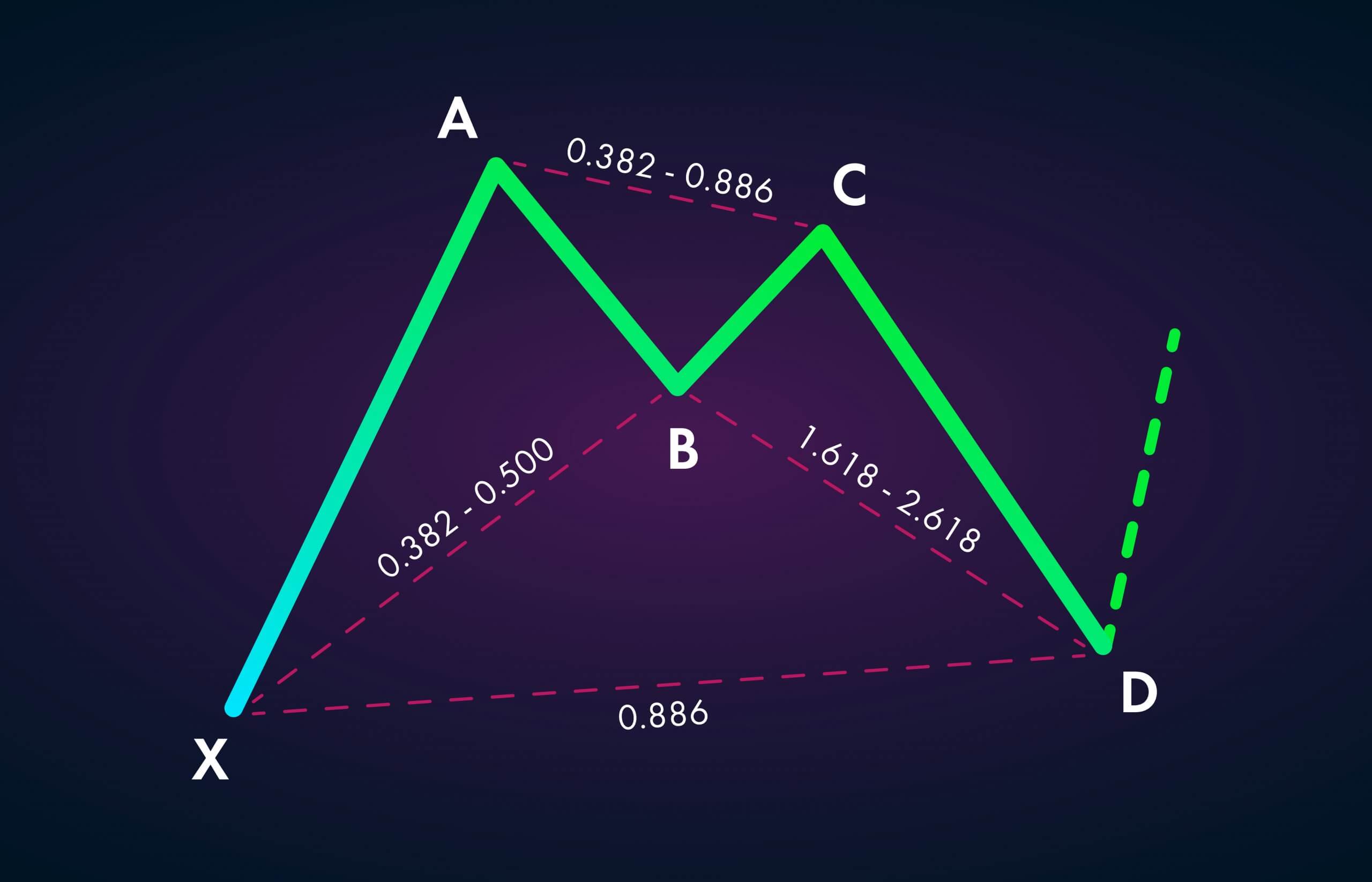

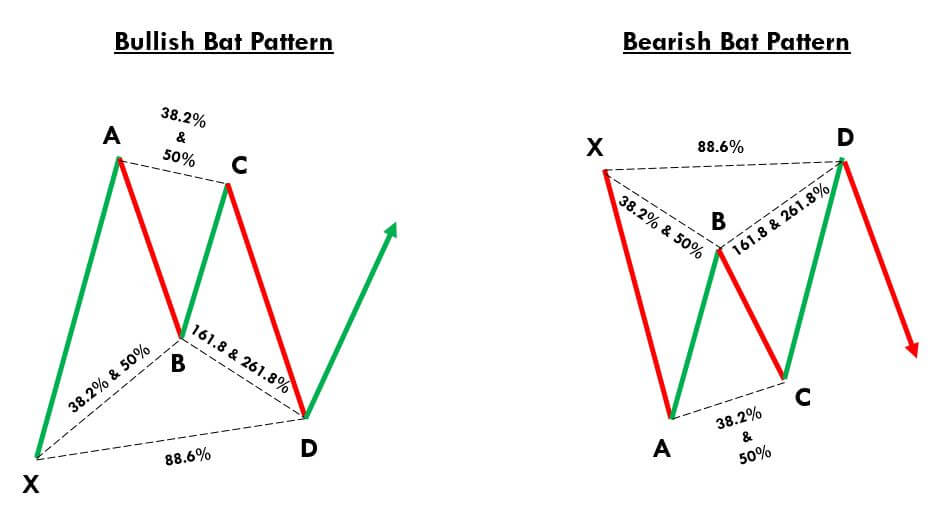

Bearish Bat Pattern - Web bearish bat pattern. The pattern incorporates the 1.13xa retracement, as the defining element in the potential reversal zone (prz). Web the bat pattern is a popular harmonic trading pattern that helps traders identify potential trend reversals in the financial markets. Web two powerful tools that professional traders often rely on are the bearish and bullish bat harmonic patterns. It usually dances its way in after a notable upward crescendo, indicating that the market might just be preparing for a brief intermission. In an uptrend, the appearance of a bearish bat pattern indicates a. Web identified by scott carney in 2001, the bat pattern is made up of precise elements that identify przs. I tested the pattern using only the below identification guidelines. If the entire pattern is significant enough within the chart, the trend is less important. The first thing to look for when looking for this pattern is the impulsive leg or the xa leg. Web for a bearish bat pattern, simply do the opposite for your orders. If the entire pattern is significant enough within the chart, the trend is less important. Web the alternate bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2003. The first thing to look for when looking for this pattern is the impulsive leg or. Web bearish bat pattern. The pattern incorporates the 1.13xa retracement, as the defining element in the potential reversal zone (prz). For going long, traders take their positions at the point d. Web gbpusd showcases a bearish bat pattern on the daily chart, signaling a potential shorting opportunity with a likely retest around 1.2691. Web bat patterns can be bearish and. Web identified by scott carney in 2001, the bat pattern is made up of precise elements that identify przs. The bat harmonic pattern is an advanced formation in price charts that are quite sophisticated for a beginner trader. Web look for a bearish bat pattern in bullish trends as a sign of a potential bearish reversal. Web bat patterns can. Web the harmonic pattern bat is made up of 5 swing points, x,a, b, c and d and come in bullish and bearish bat variations. The bearish bat appears in an uptrend and identifies a downward movement. In the bullish pattern, the x leg is at a low level. Web as with many patterns, there is a bullish and a. We’re looking for a strong move up or down depending if we have a bullish bat structure or a bearish bat structure. Web the bearish bat pattern is one of four major harmonic trading patterns. The pattern possesses many distinct elements that define an excellent potential reversal zone (prz). The bearish bat appears in an uptrend and identifies a downward. These patterns, grounded in fibonacci ratios,. The bearish bat appears in an uptrend and identifies a downward movement. The pattern incorporates the 1.13xa retracement, as the defining element in the potential reversal zone (prz). It usually dances its way in after a notable upward crescendo, indicating that the market might just be preparing for a brief intermission. The bat harmonic. The bat pattern is a retracement and continuation pattern that lets you enter a trend at a good price just as it is resuming. Web for a bearish bat pattern, simply do the opposite for your orders. The harmonic bat pattern has the following characteristics which can be used to identify the bat pattern. I tested the pattern using only. Web the bat pattern is a popular harmonic trading pattern that helps traders identify potential trend reversals in the financial markets. Gartley observed that markets have a tendency to move in repetitive patterns, and he identified several specific patterns that he believed could be used to predict future price movements. Web the alternate bat pattern™, is a precise harmonic pattern™. Gartley in his book profits in the stock market, published in 1935. The bat pattern is a retracement and continuation pattern that lets you enter a trend at a good price just as it is resuming. For going long, traders take their positions at the point d. Additional rules may or may not improve performance. Web bat pattern formations are. Web gbpusd showcases a bearish bat pattern on the daily chart, signaling a potential shorting opportunity with a likely retest around 1.2691. The first thing to look for when identifying the bat pattern (see figure below) is the impulsive leg or the xa leg. Web the bat pattern is probably the most accurate pattern in the entire harmonic trading arsenal.. The retracements in price between each reversal point x, a, b, c and d are significant and are used to predict sentiment of the market. The other three include the gartley pattern, butterfly pattern, and crab pattern. The bat pattern offers the best reward to risk profile of all these other harmonic structures. Web the bat pattern is a popular harmonic trading pattern that helps traders identify potential trend reversals in the financial markets. The bat harmonic pattern is an advanced formation in price charts that are quite sophisticated for a beginner trader. I tested the pattern using only the below identification guidelines. Web bearish bat pattern. Web hinting at potential price dips, the bearish bat pattern may emerge like a cliffhanger. The pattern possesses many distinct elements that define an excellent potential reversal zone (prz). Web as with many patterns, there is a bullish and a bearish version of the bat. Web the bat pattern comes in both bullish and bearish variations and is made up of five swing points x, a, b, c, and d. Web the harmonic pattern bat is made up of 5 swing points, x,a, b, c and d and come in bullish and bearish bat variations. Web the alternate bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2003. Web the concept of harmonic patterns in trading was first introduced by h.m. If the entire pattern is significant enough within the chart, the trend is less important. Web the bat harmonic pattern is a technical analysis tool used by traders to predict potential price reversals in financial markets.

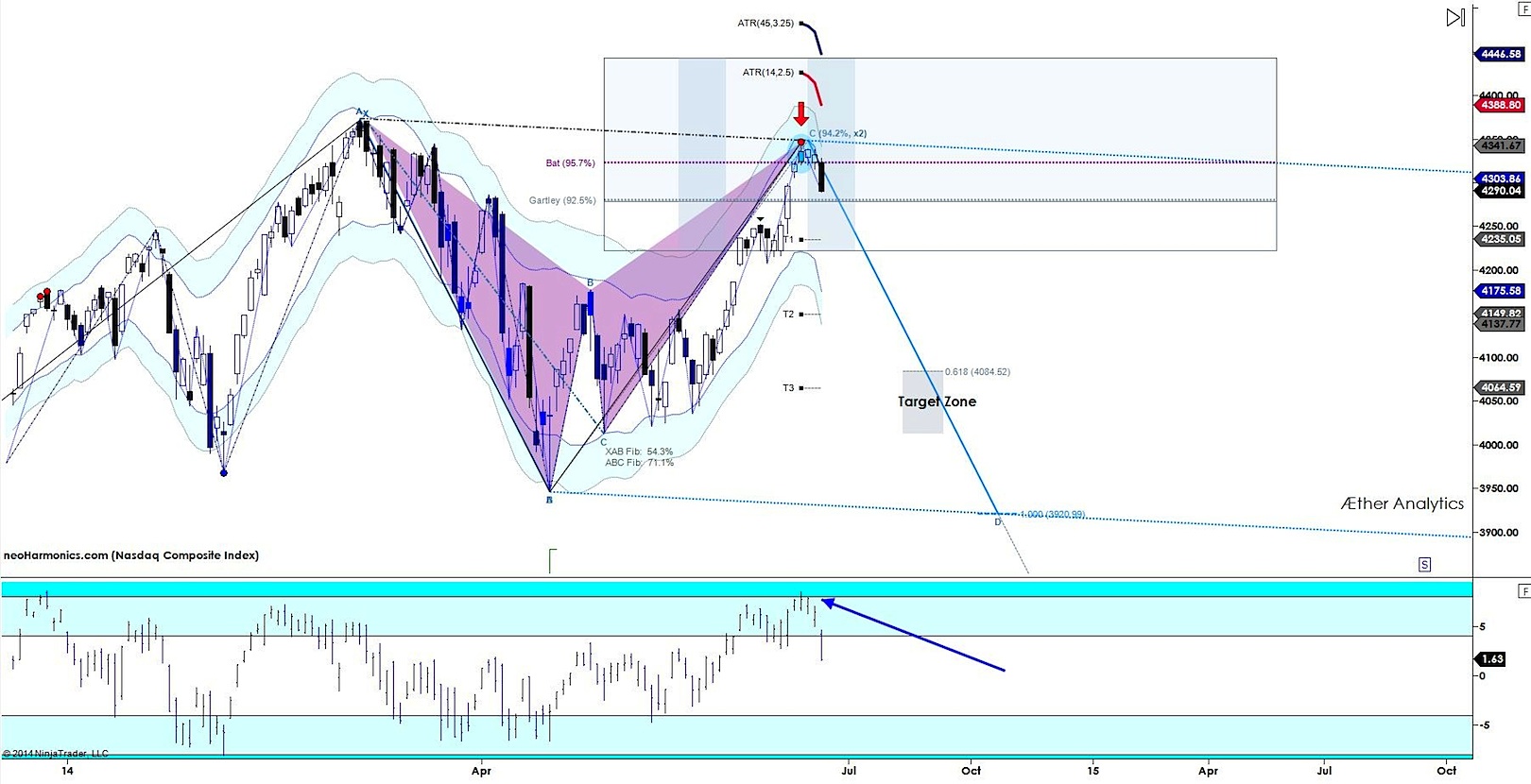

The Anatomy Of A Bearish Bat Pattern The Nasdaq Composite See It Market

Bearishbatpattern — TradingView — India

Harmonic patterns cheat sheet for stock market Part 1

Bearish bat harmonic patterns Royalty Free Vector Image

Tips For Trading The Harmonic Bat Pattern Forex Training Group

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

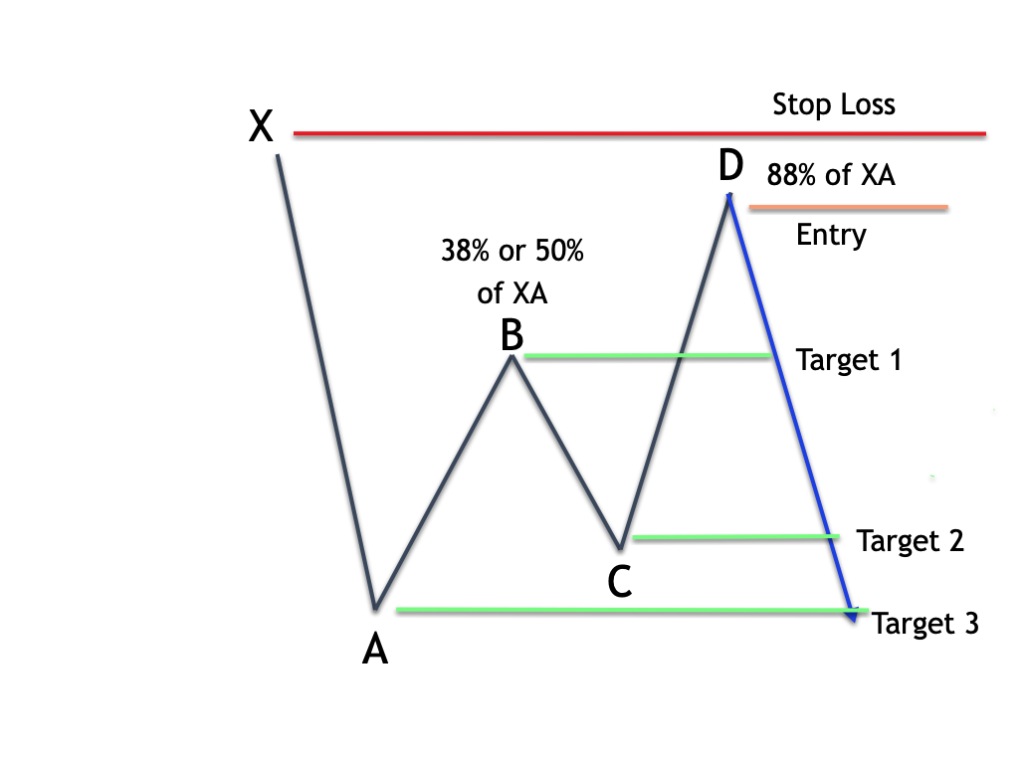

123. Trading The Bullish & Bearish Bat Pattern Forex Academy

Trading The Bullish & Bearish Bat Pattern Like A Pro Forex Academy

Trading The Bullish & Bearish Bat Pattern Like A Pro Forex Academy

A Bearish Bat Pattern and a Look at the Dow Divergence

The Harmonic Bat Pattern Has The Following Characteristics Which Can Be Used To Identify The Bat Pattern.

In The Bullish Pattern, The X Leg Is At A Low Level.

The Bearish Bat Appears In An Uptrend And Identifies A Downward Movement.

Additional Rules May Or May Not Improve Performance.

Related Post: