Basing Pattern

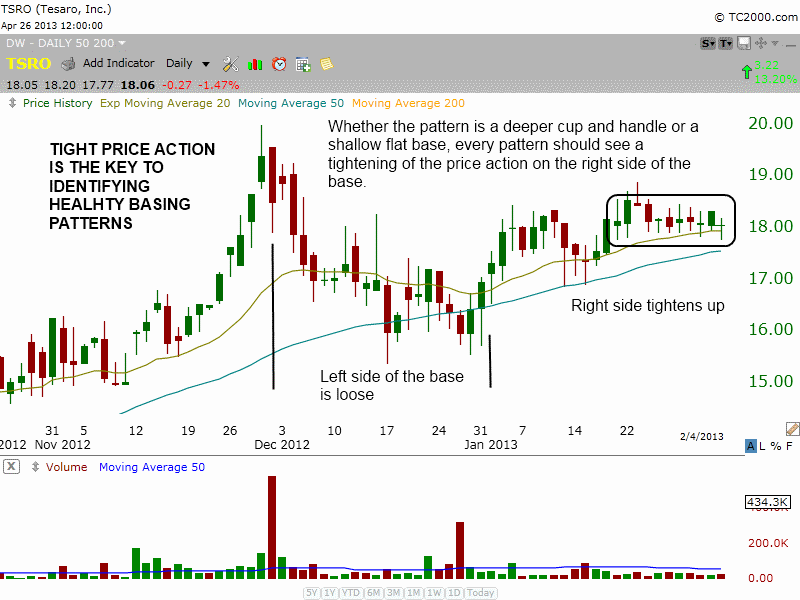

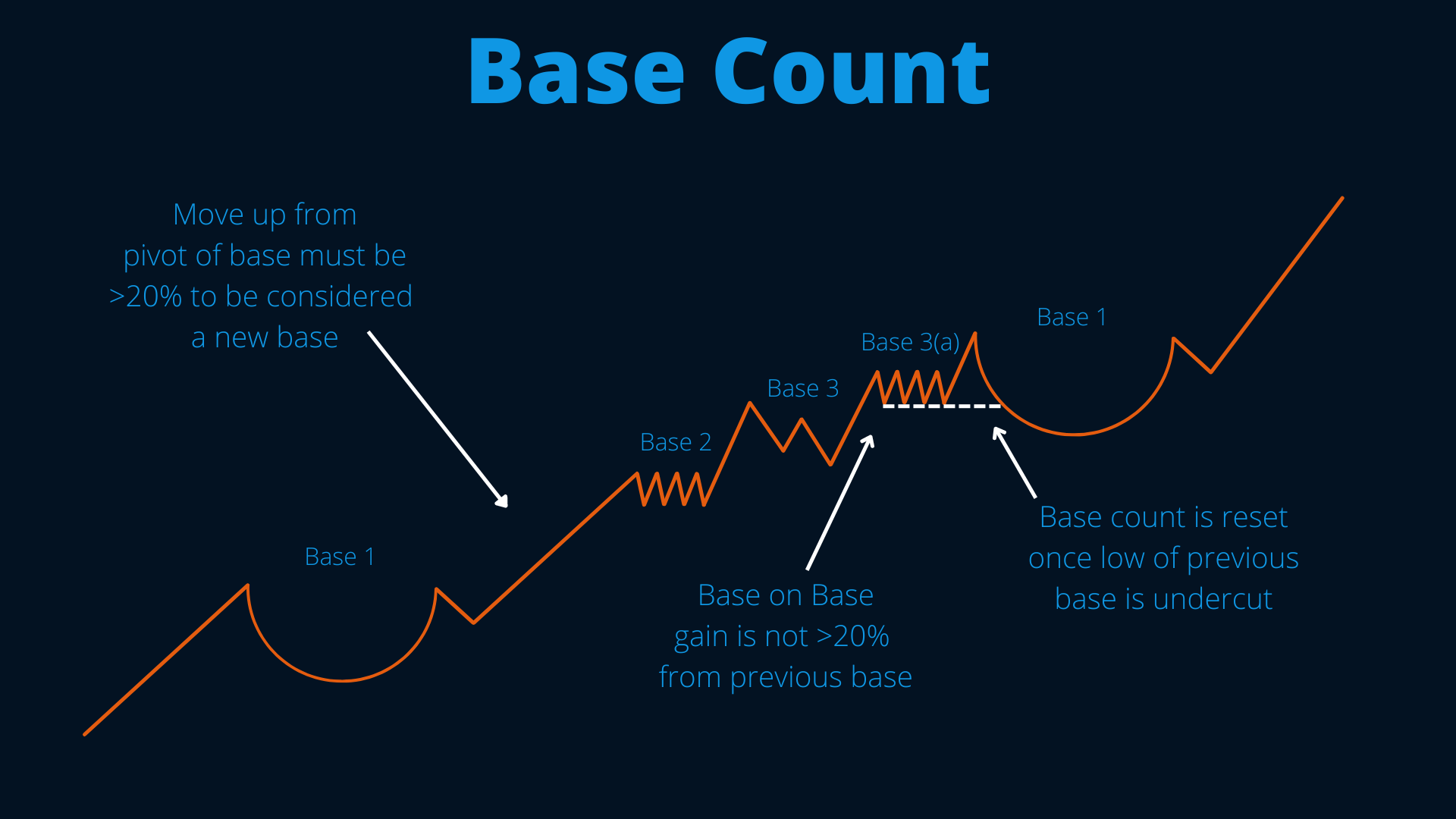

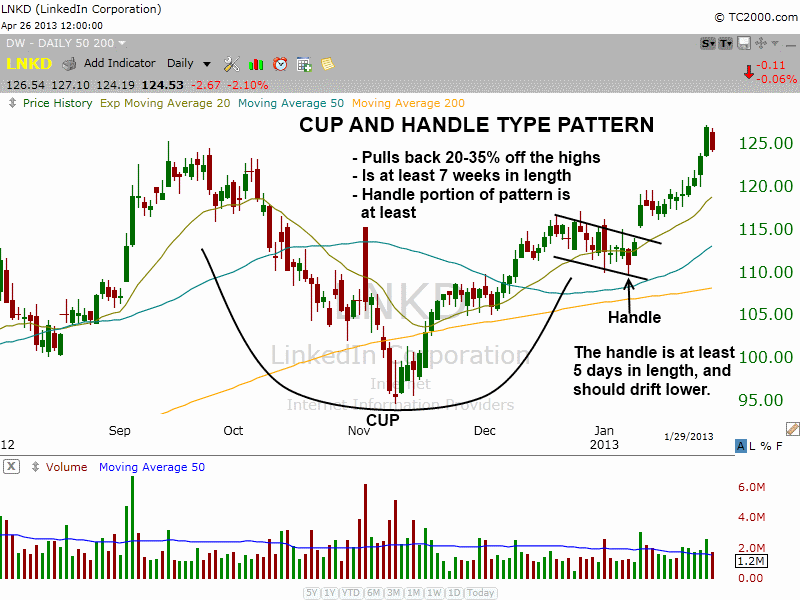

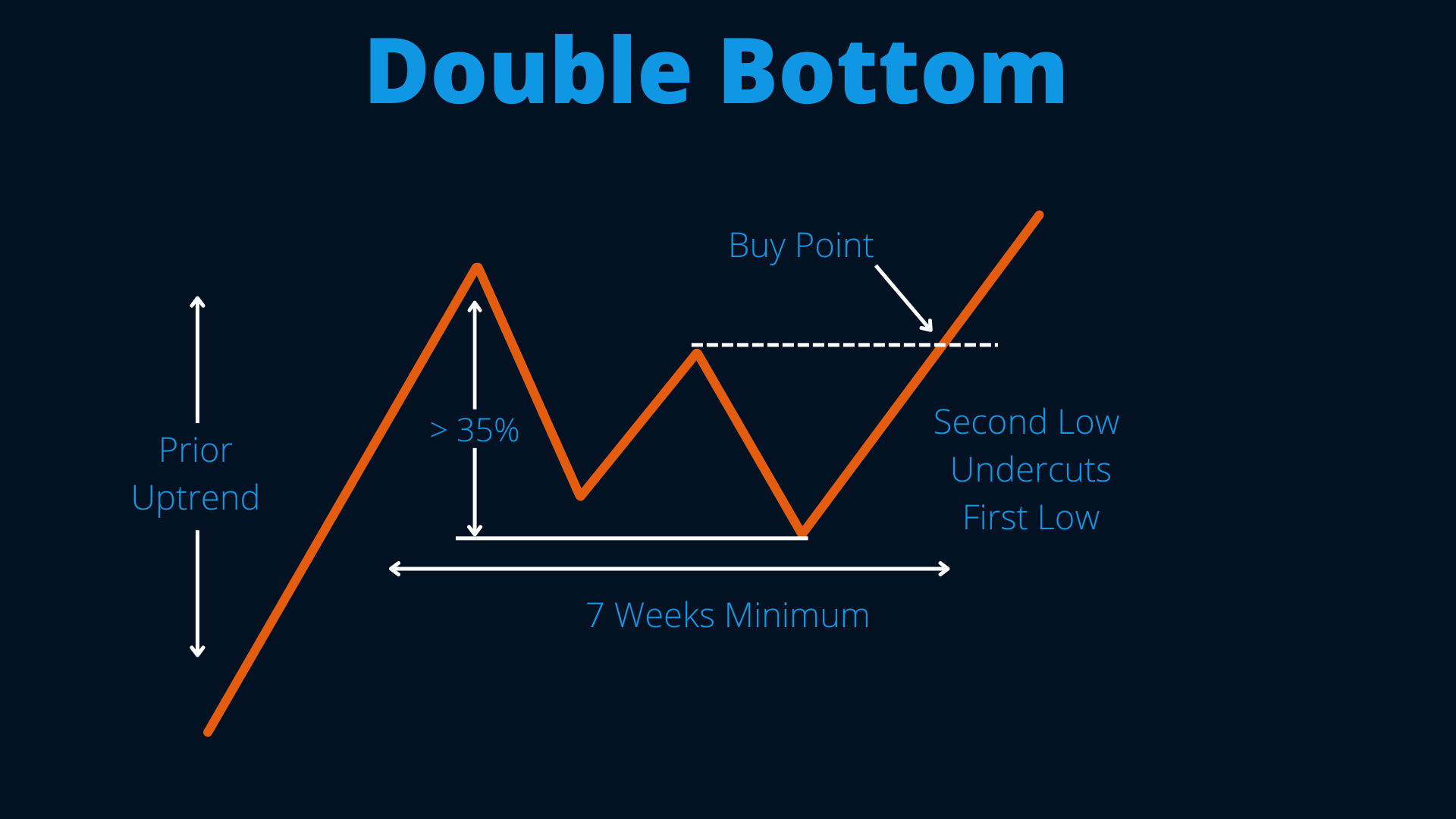

Basing Pattern - The end of july marked the 80th anniversary of the invasion of tinian, completing the campaign to capture the marianas islands during operation forager. Web the flat base pattern is a bullish continuation chart pattern that signals a potential breakout and continuation of an existing uptrend. Web in this article, we will show you how to spot the two top “basing” chart patterns that precede the best breakout buy setups: Second, don't count a base if it forms well below 10 a. A stock can boast strong fundamentals and belong to a leading industry group or. The resulting price pattern looks flat or slightly. The term basing refers to the consolidation in the price of a security. Web basing patterns in financial markets are a goldmine of strategic insights for astute traders. Web december 16, 2019 by mark dow. Selling short in a topping. Web in this educational article, we clearly show you how to spot the two best basing patterns on a stock chart: Web basing patterns in financial markets are a goldmine of strategic insights for astute traders. Web first, use weekly ibd charts. A stock can boast strong fundamentals and belong to a leading industry group or. When the stock market. It consists of a period of consolidation, where the stock's price moves sideways with minimal fluctuations, forming a flat or nearly flat horizontal base. Web basing refers to a period when a stock’s price moves sideways after a significant rise or fall. Overall, based on the six reasons provided by the nominator, along with the fact that these codes were. Web first, use weekly ibd charts. Web basing refers to a period when a stock’s price moves sideways after a significant rise or fall. Web in this educational article, we clearly show you how to spot the two best basing patterns on a stock chart: Web base finder is a powerful free tool for @tradingview used to identify basing patterns,. Selling short in a topping. Web a pocket pivot is a price/volume pattern that reveals an interest of large players and is available in our charts and stock screener. Web december 16, 2019 by mark dow. Web basing refers to a period when a stock’s price moves sideways after a significant rise or fall. This phase is crucial as it. A stock can boast strong fundamentals and belong to a leading industry group or. Mike krivdo july 31, 2024. The end of july marked the 80th anniversary of the invasion of tinian, completing the campaign to capture the marianas islands during operation forager. Web a “base breakout” strategy in trading is a technique used to identify and capitalize on a. My usual response is “buy after you see some kind of basing pattern.” below i give three current examples of what i mean. These patterns act as a crucial indicator, hinting at whether a stock is preparing for a trend continuation or gearing up for a reversal. Second, don't count a base if it forms well below 10 a. Cup. The resulting price pattern looks flat or slightly. They provide about two years of price data, making it easier to find each base in the stock's major advance. Overall, based on the six reasons provided by the nominator, along with the fact that these codes were last valued almost 30 years ago, and given the identified billing. This movement in. My usual response is “buy after you see some kind of basing pattern.” below i give three current examples of what i mean. Web in this article, we will show you how to spot the two top “basing” chart patterns that precede the best breakout buy setups: Web a “base breakout” strategy in trading is a technique used to identify. Have a minimum average daily volume of at least 500,000 shares Web in this educational article, we clearly show you how to spot the two best basing patterns on a stock chart: Web a “base breakout” strategy in trading is a technique used to identify and capitalize on a stock that is breaking out from a prior trading range or. The term basing refers to the consolidation in the price of a security. This phase is crucial as it signals a consolidation period where the stock is preparing for its next big move. Volatility has fallen to low levels and the bollinger bands bandwidth has narrowed to near 6. When is a basing pattern buyable? Web the flat base pattern. The end of july marked the 80th anniversary of the invasion of tinian, completing the campaign to capture the marianas islands during operation forager. Web a pocket pivot is a price/volume pattern that reveals an interest of large players and is available in our charts and stock screener. Web a “base breakout” strategy in trading is a technique used to identify and capitalize on a stock that is breaking out from a prior trading range or a “base” of consolidation. These patterns act as a crucial indicator, hinting at whether a stock is preparing for a trend continuation or gearing up for a reversal. Overall, based on the six reasons provided by the nominator, along with the fact that these codes were last valued almost 30 years ago, and given the identified billing. Second, don't count a base if it forms well below 10 a. Have a minimum share price of $20; Web five ways to spot the base on base, a bullish pattern in growth stocks. Web december 16, 2019 by mark dow. Web the flat base pattern is a bullish continuation chart pattern that signals a potential breakout and continuation of an existing uptrend. I get asked often about how and when to buy assets that have taken a beating. Web basing patterns in financial markets are a goldmine of strategic insights for astute traders. Web basing, a fundamental concept in technical analysis, provides traders with valuable insights into market movements. Web in this article, we will show you how to spot the two top “basing” chart patterns that precede the best breakout buy setups: It consists of a period of consolidation, where the stock's price moves sideways with minimal fluctuations, forming a flat or nearly flat horizontal base. Mike krivdo july 31, 2024.

Chart Basing Patterns How to Find Top Stocks to Buy BEFORE They Break Out

Basing Patterns by Brandon Amphibian Trading

Chart Basing Patterns How to Find Top Stocks to Buy BEFORE They Break

How To Invest The Power Of The Rare Ascending Base Pattern

Master The Flat Base Pattern For Maximum Profits TraderLion

How to Find Basing Stocks Pocket Sense

Chart Basing Patterns How to Find Top Stocks to Buy BEFORE They Break Out

Basing Patterns by Brandon Amphibian Trading

Basing Patterns by Brandon Amphibian Trading

Long term basing pattern preparing for a BIG move !! for BITFINEX

Web Base Finder Is A Powerful Free Tool For @Tradingview Used To Identify Basing Patterns, Sell Signals, Signs Of Accumulation Or Distribution And Much More.

My Usual Response Is “Buy After You See Some Kind Of Basing Pattern.” Below I Give Three Current Examples Of What I Mean.

When The Stock Market Climbs And Consolidates Often, Many Stocks Form The Base On Base, A Bullish Chart Pattern.

This Movement In Price Is Commonly Used By Technical Analysts And Usually Comes After A Downtrend Before It Begins A Bullish Phase.

Related Post: