Based On The Attached Chart And Not Considering Dividends

Based On The Attached Chart And Not Considering Dividends - Web this section explains the two types of dividends—cash dividends and share dividends—showing the journal entries involved and the reason why companies declare. Based on the attached chart and not consideringdividends, if you invested $10,000 in the spx at thebeginning of 2022, approximately how much would your. Solution for based on the attached chart and not considering dividends, if you invested $10,000 in the spx at the 2022 october low, how much would your value…. Web in this article, i’ll tell you why building a portfolio of dividend stocks, a form of income investing, may not be the best retirement investment strategy. Dividends are typically paid on a quarterly basis, though some pay. It is for a single taxpayer, but numbers can. But for common stock, or ordinary shares in. Web take a quick dive into the basics of dividends including how they work, when they're paid, and why companies share profits with stockholders. Or is there real merit to. Web the power of dividends: Based on the attached chart and not consideringdividends, if you invested $10,000 in the spx at thebeginning of 2022, approximately how much would your. Or is there real merit to. You must own a stock before the ex. Web the question asks how much the value of a $10,000 investment in the spx (s&p 500 index) would have decreased by. You must own a stock before the ex. Free retirement guidewealth managementpersonalized strategyretirement investment Or is there real merit to. Yield channels can be seen. The s&p 500) over any. Web take a quick dive into the basics of dividends including how they work, when they're paid, and why companies share profits with stockholders. Web dividend growth rates are useful for measuring a company’s financial health and predicting future dividend payments. Web this section explains the two types of dividends—cash dividends and share dividends—showing the journal entries involved and the. 19 to shareholders of record. They are not considered expenses, and they are not reported on the income statement. Free retirement guidewealth managementpersonalized strategyretirement investment Web based on the attached chart and not considering dividends, if you invested $ 1 0, 0 0 0 in the spx at the beginning of 2 0 2 2, approximately how much would your.. Web operations management questions and answers. Dividends are typically paid on a quarterly basis, though some pay. Yield channels can be seen. Or is there real merit to. Based on the attached chart and not consideringdividends, if you invested $10,000 in the spx at thebeginning of 2022, approximately how much would your. Web preferred stock sets the actual dollar amount to be paid out each period based on the par value of the security. Free retirement guidewealth managementpersonalized strategyretirement investment They are a distribution of the net income of a company and are not a cost of business operations. Web this flowchart is designed to quickly determine the tax on capital gains. 2024 | equity market perspectives volatility. Web this section explains the two types of dividends—cash dividends and share dividends—showing the journal entries involved and the reason why companies declare. Web dividend yield, calculated by dividing the annual dividend by the current stock price, is one key metric that helps investors understand the return they might. Solution for based on the. Web take a quick dive into the basics of dividends including how they work, when they're paid, and why companies share profits with stockholders. Web operations management questions and answers. Based on the attached chart and not consideringdividends, if you invested $10,000 in the spx at thebeginning of 2022, approximately how much would your. Web a dividend is usually a. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Yield channels can be seen. 19 to shareholders of record. Web take a quick dive into the basics of dividends including how they work, when they're paid, and why companies share profits with stockholders. They are not considered expenses,. It is for a single taxpayer, but numbers can. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Or is there real merit to. Free retirement guidewealth managementpersonalized strategyretirement investment You must own a stock before the ex. It is for a single taxpayer, but numbers can. Web this flowchart is designed to quickly determine the tax on capital gains and dividends, based on the taxpayer's taxable income. Web based on the attached chart and not considering dividends, if you invested $10,000 in the spx at the beginning of 2022, approximately how much would your investment value. Web the question asks how much the value of a $10,000 investment in the spx (s&p 500 index) would have decreased by the october 2022 low, not considering. Web based on the attached chart and not considering dividends, if you invested $ 1 0, 0 0 0 in the spx at the beginning of 2 0 2 2, approximately how much would your. Web take a quick dive into the basics of dividends including how they work, when they're paid, and why companies share profits with stockholders. Based on the attached chart and not consideringdividends, if you invested $10,000 in the spx at thebeginning of 2022, approximately how much would your. Solution for based on the attached chart and not considering dividends, if you invested $10,000 in the spx at the 2022 october low, how much would your value…. Free retirement guidewealth managementpersonalized strategyretirement investment Web the power of dividends: They are not considered expenses, and they are not reported on the income statement. Web a dividend is usually a cash payment from earnings that companies pay to their investors. Web based on the attached chart and not considering dividends, if you invested $ 1 0, 0 0 0 in the spx at the 2 0 2 2 october low, how much would your value have increased. 19 to shareholders of record. But for common stock, or ordinary shares in. Based on the attached chart and not considering dividends, if you invested $10,000 in the spx at the beginning of 2022,.[Solved] 4. If two years' preferred dividends are in arrears at the

Solved Based on the attached chart and not considering

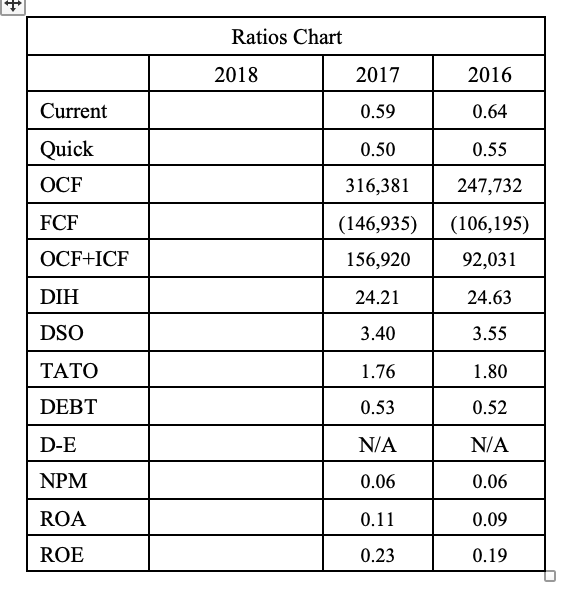

[Solved] need answers to these questions please A recent annual report

[Solved] Consider an option on a nondividendpaying stock when the

Solved Use the attached financial statements to complete the

[Solved] LSUS Corporation is expected to pay annual dividends of 1.70

Solved Based on the attached chart below and not considering

Solved Based on the attached chart and not considering

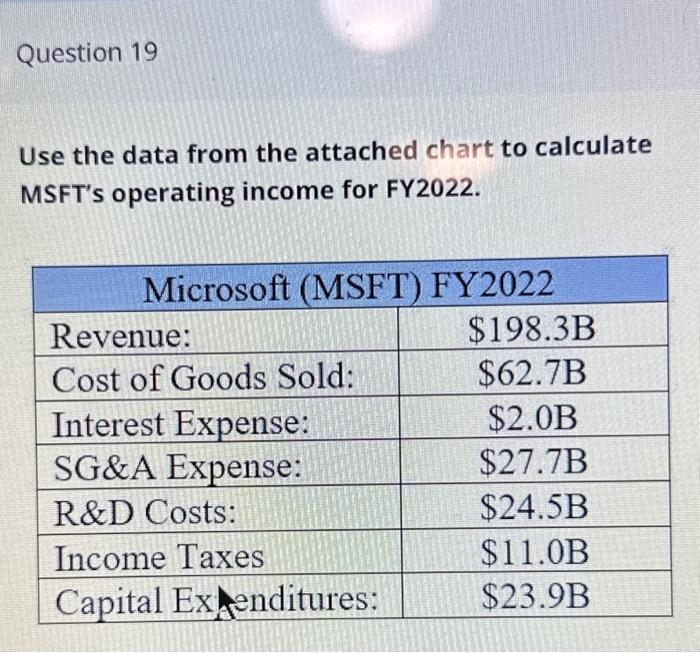

Solved Use the data from the attached chart to calculate

SOLVED Based on the attached chart and not considering dividends, if

Dividends Are Typically Paid On A Quarterly Basis, Though Some Pay.

Web Dividends Are A Distribution Of A Corporation’s Earnings.

8, Invitation Homes Announced A 7.7% Increase In Its Quarterly Dividend, From $0.26 To $0.28 Per Share, Payable On Jan.

Web Dividend Yield, Calculated By Dividing The Annual Dividend By The Current Stock Price, Is One Key Metric That Helps Investors Understand The Return They Might.

Related Post: