Apr Fees Chart

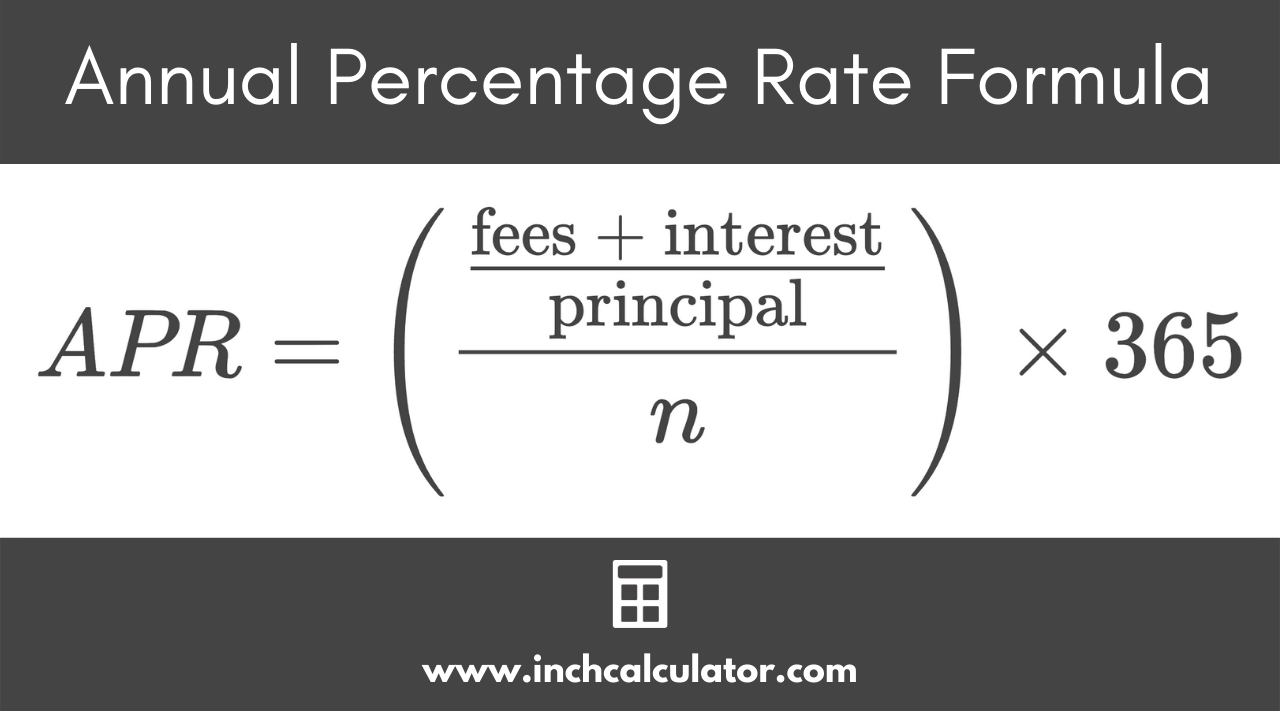

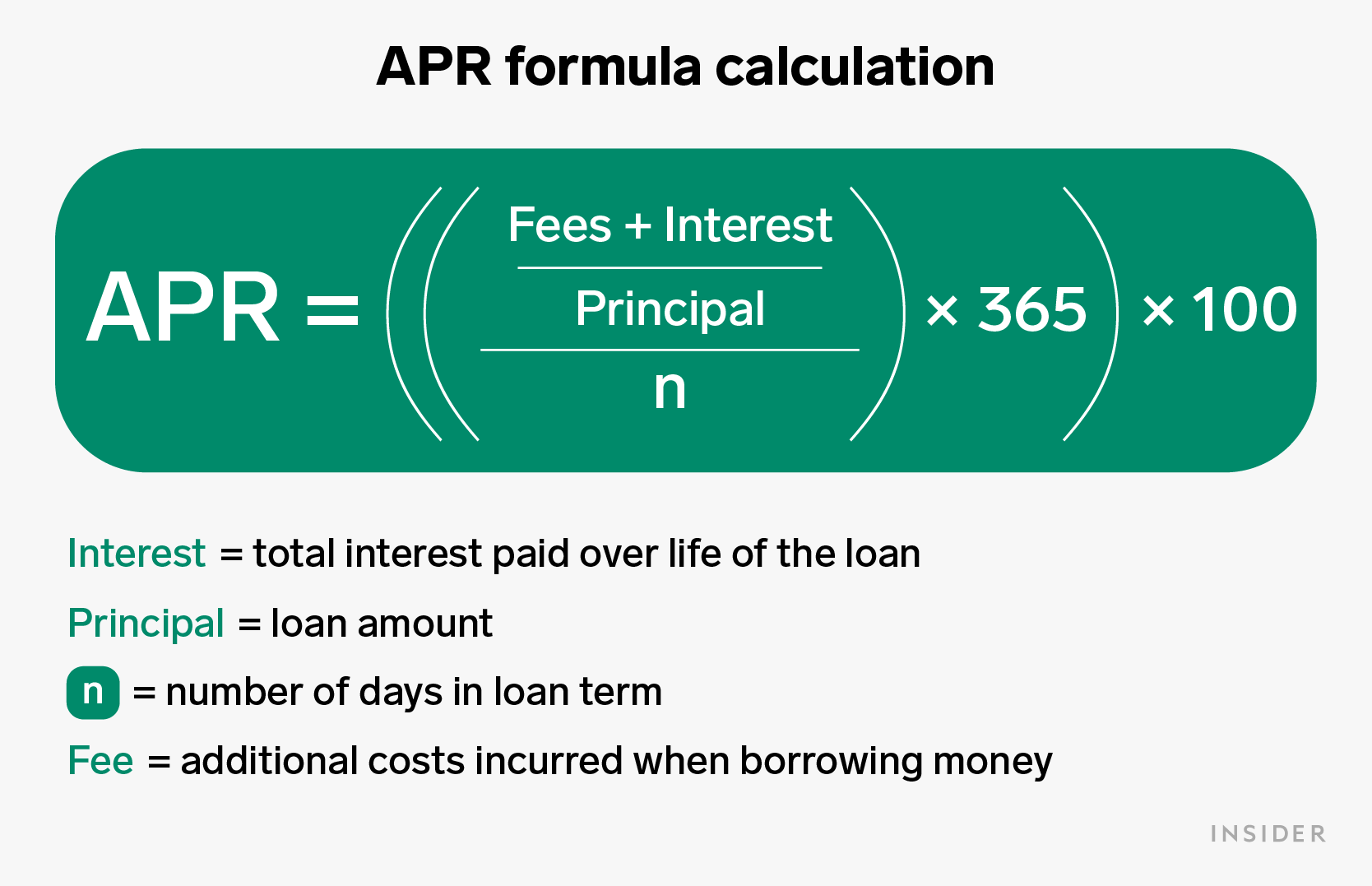

Apr Fees Chart - Your credit card's apr is the interest rate you are charged on any unpaid credit card balances you have every month. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit. Apr is a tool that you can use to compare loan offers. O n/a g n/a n/arefer to qm /. Apr is higher than the interest rate because it encompasses all these loan costs. Web how does apr work on a credit card? Web calculate mortgage apr by entering interest rate, discount points and fees. Web apr represents the yearly cost of borrowing money and interest rate plus additional fees. The apr is the stated interest rate of the loan averaged over 12 months. Use our calculator to see the annual percentage rate (apr) you’ll pay on your mortgage. As of june 2024, a good apr rate would be anywhere from 16% to 20%. Web mortgage apr measures costs including the interest rate, points and fees charged by the lender. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension. Knowing about apr can help you compare credit offers and find the one that’s best for you. It’s an even more effective tool than the interest rate of measuring your loan’s annual cost. If your apr for the same loan was 3%, you’d pay monthly payments of £. Web annual percentage rate (apr) 4.81% apr or annual percentage rate —. The annual percentage rate on a loan is its total annual cost expressed as a percentage. Web july 8, 2024 | 7 min read. People borrow money for various reasons. Web aprs for personal loans can range from around 8 percent to 36 percent. Web how to use bankrate's apr loan calculator. The true cost of bank loans. People borrow money for various reasons. Key benefits and helpful tips. The true cost of bank loans. If your apr for the same loan was 3%, you’d pay monthly payments of £. Web apr represents the yearly cost of borrowing money and interest rate plus additional fees. The annual percentage rate on a loan is its total annual cost expressed as a percentage. As of june 2024, a good apr rate would be anywhere from 16% to 20%. There is also a version specially designed for mortgage loans. Web the apr calculator. In addition to the loan’s interest rate, the apr also includes other. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit. Web annual percentage rate (apr) 4.81% apr or annual percentage rate — is a key element in. Apr represents the annual cost to borrow money. As of june 2024, a good apr rate would be anywhere from 16% to 20%. If you’re shopping for a loan or credit card, you may notice something called the annual percentage rate (apr). Required fees from the lender, such as an origination fee or mortgage broker fee. Use our mortgage apr. People borrow money for various reasons. Web fees can drive up the cost of your student loan, personal loan or small business loan. F the premium is refundable on a prorated basis. The apr is the stated interest rate of the loan averaged over 12 months. Web what are annual percentage rates? Our calculator tool will help you to estimate your monthly payments on a personal loan, as well as the total interest accrual over the life of the loan. Web what are annual percentage rates? Use our calculator to see the annual percentage rate (apr) you’ll pay on your mortgage. According to a bankrate study, the average apr for a personal. 15 application fee yes yes yes yes 16 appraisal desk review yes yes yes. Required fees from the lender, such as an origination fee or mortgage broker fee. Web mortgage apr measures costs including the interest rate, points and fees charged by the lender. Use our mortgage apr calculator with monthly payments to see exactly how much you will be. Key benefits and helpful tips. According to a bankrate study, the average apr for a personal loan is 12.38 percent as of july 31, 2024. Required fees from the lender, such as an origination fee or mortgage broker fee. Understanding the general apr formula. You can use it as you compare offers by entering the following details: 15 application fee yes yes yes yes 16 appraisal desk review yes yes yes. It’s an even more effective tool than the interest rate of measuring your loan’s annual cost. Your monthly statement may break down your credit card apr yearly, but you can break it. The true cost of bank loans. Apr is a tool that you can use to compare loan offers. Web july 8, 2024 | 7 min read. Input your loan amount, interest rate, loan term, and financing fees to find the apr for the loan. Web mortgage apr measures costs including the interest rate, points and fees charged by the lender. 14 annual fee no no no no not a finance charge unless based on usage. However, the best apr you can receive is 0%. Web free calculator to find out the real apr of a loan, considering all the fees and extra charges.

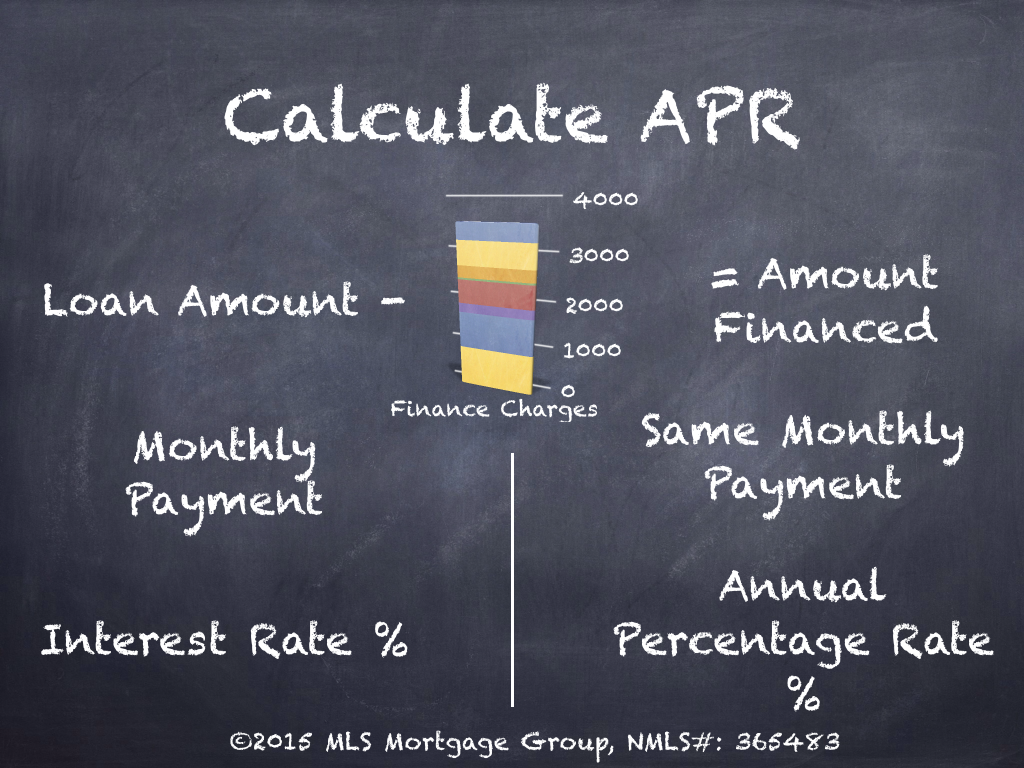

What is APR? Mortgage APR? MLS Mortgage

PPT Truth In Lending Regulation Z PowerPoint Presentation ID262500

Use the APR table in the Business Math Handbook to estimate the APR for

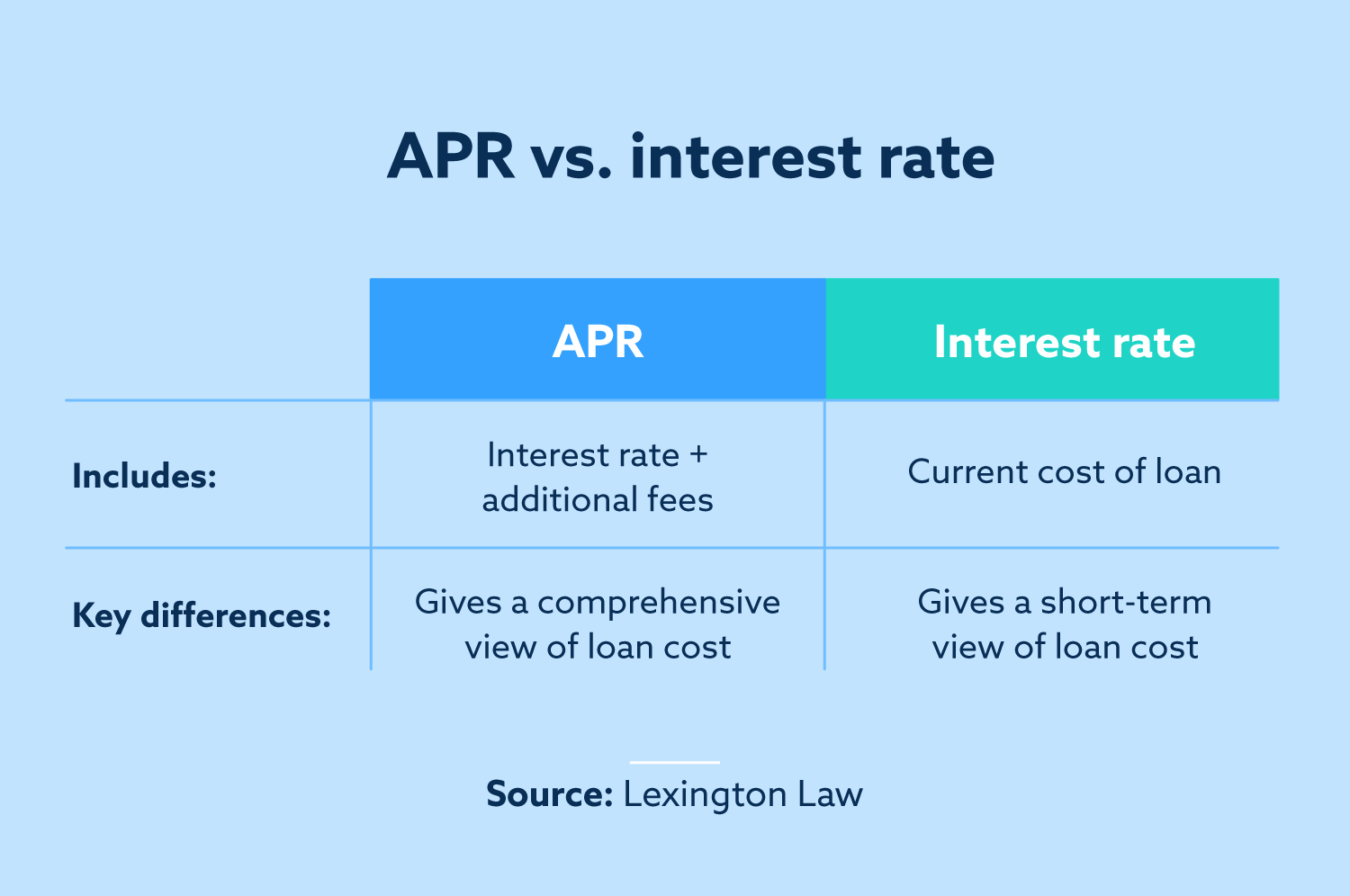

What Is APR and How Is It Calculated? Lexington Law

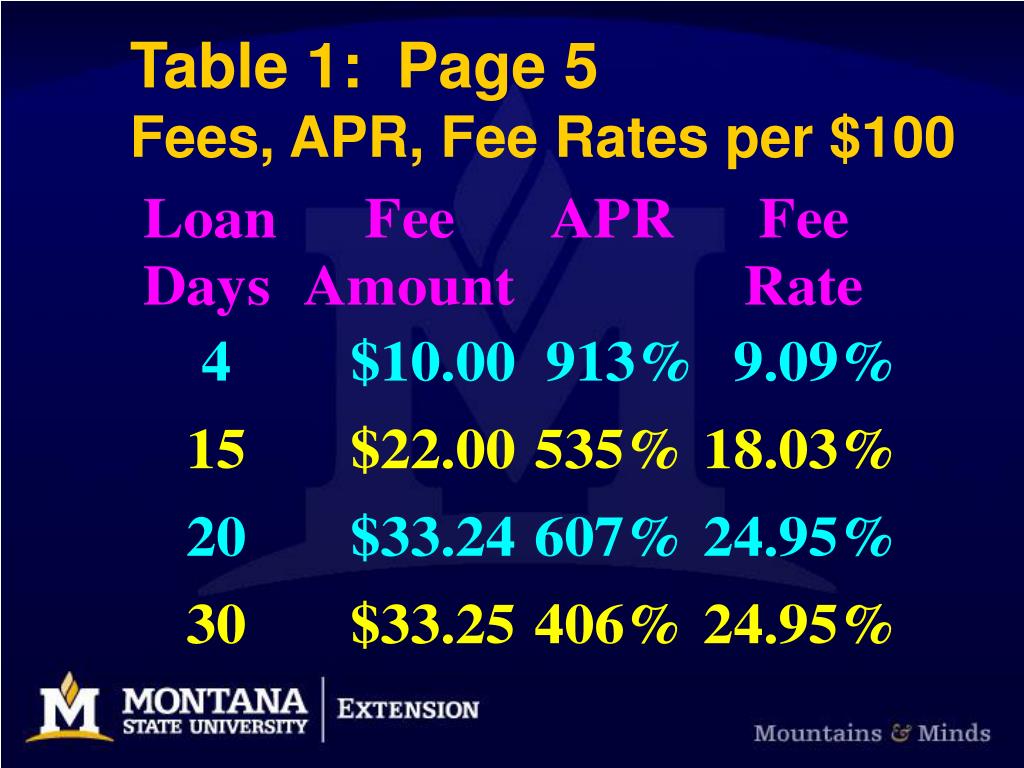

PPT Payday Loans PowerPoint Presentation, free download ID1460493

Financial Math APR Table and finding h, the interest per 100 financed

APR Calculator Inch Calculator

What is APR and How Does it Work? Guide for 2023

What is APR? Mortgage APR? MLS Mortgage

What is APR?

Web Apr To Apy.

Web 10 Agency Fee (Fha) Yes Yes Yes Yes 11 Alta X.x No No No No Title Fee.

Exclude Monthly Or Annual Pmi Premiums.

How Much You Plan To Borrow.

Related Post: