Accounting Chart Of Accounts For Restaurant

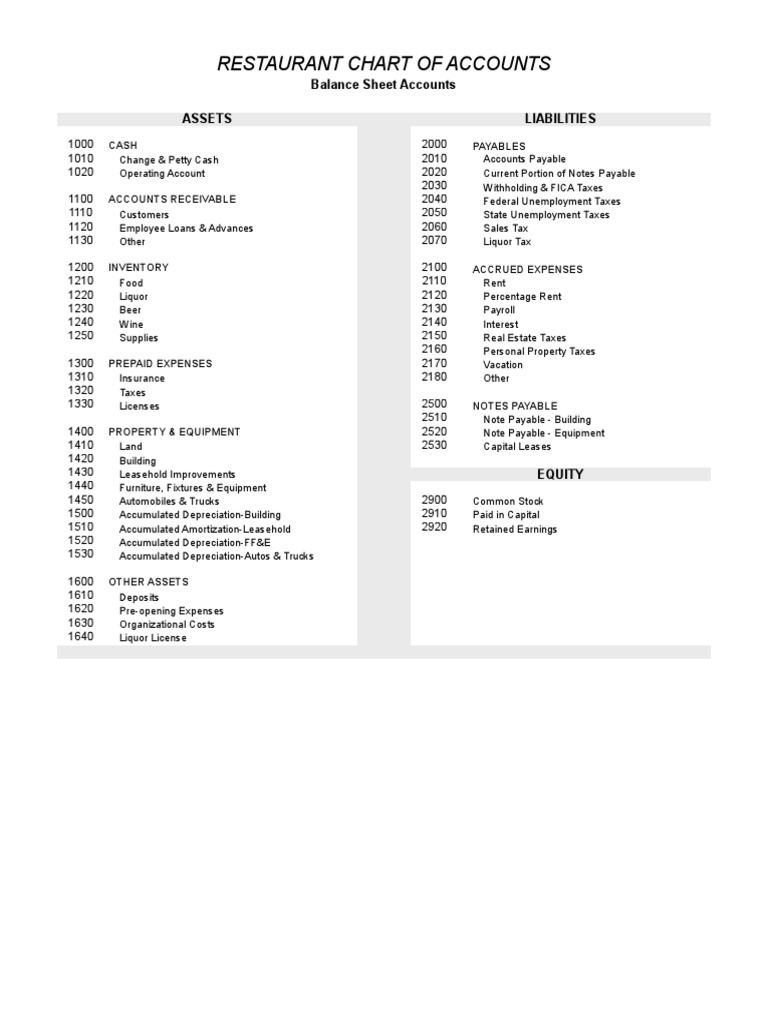

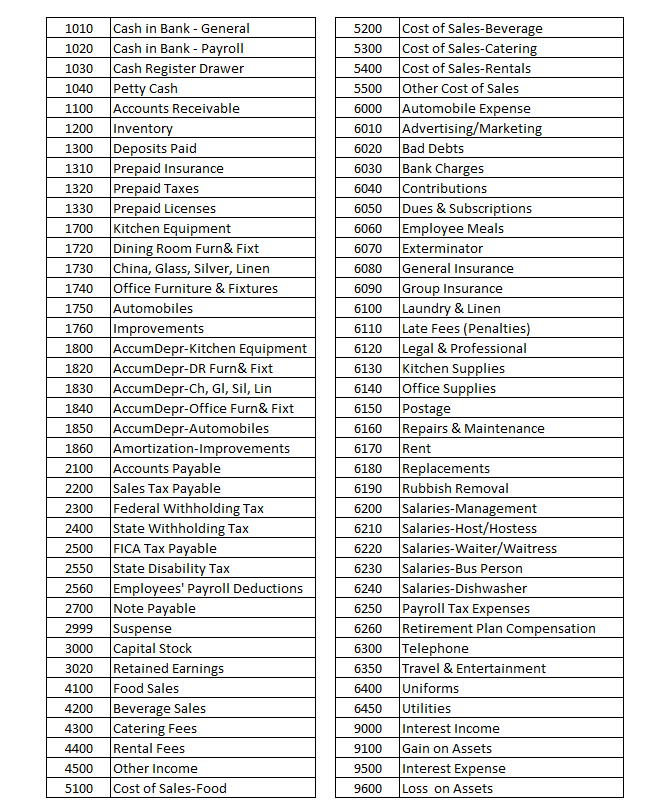

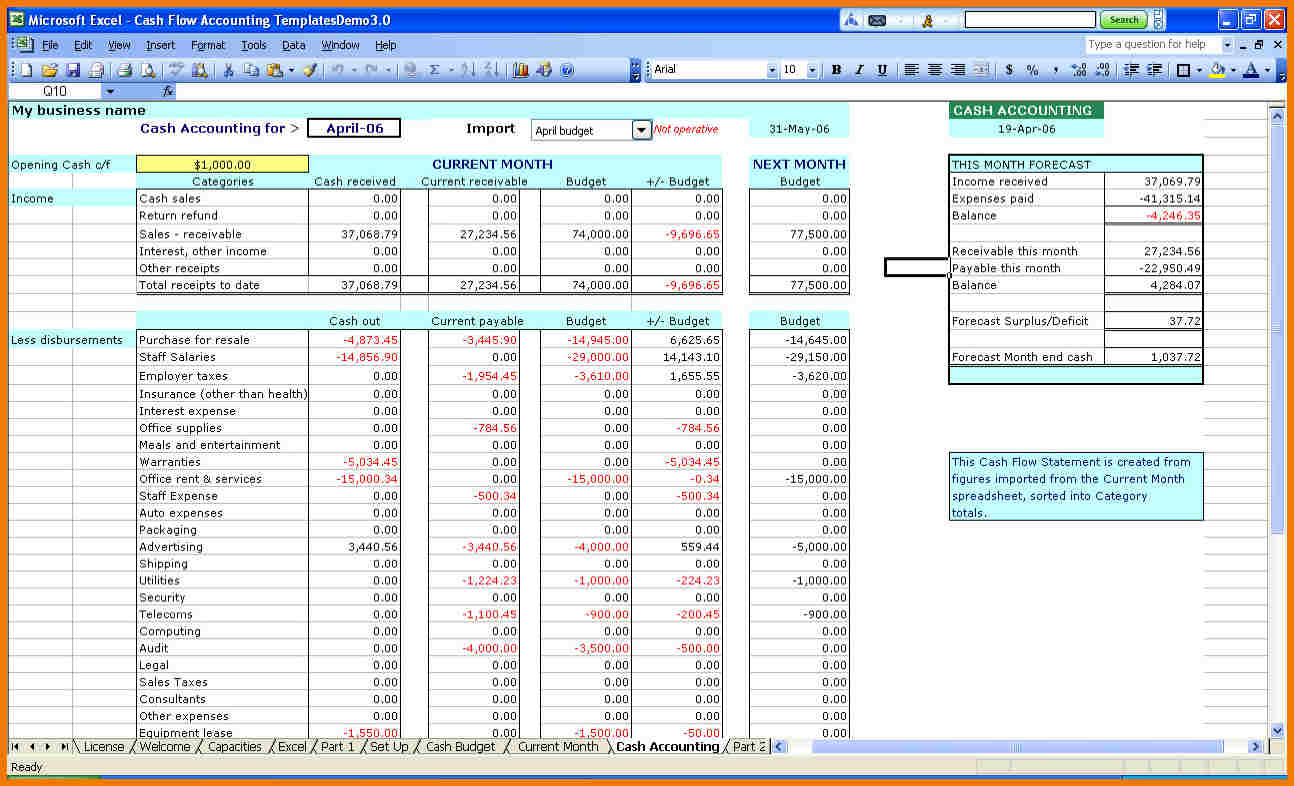

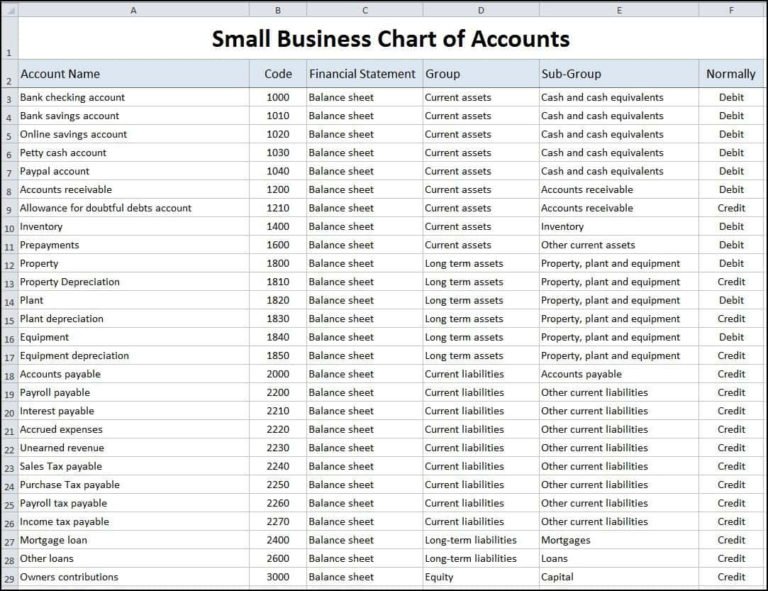

Accounting Chart Of Accounts For Restaurant - Web learn how to properly set up your chart of accounts for a restaurant, bar or cafe. It includes all the accounts we believe the average restaurant will need, and combines some common accounts that are rarely used by smaller businesses. Restaurant chart of accounts & cost coding guide. Use the cost code guide to consistently code your operating expenses and other costs to the correct or most appropriate account. Web developed the uniform accounting system chart of accounts to be used as the standard for recording and reporting financial information to the state of florida. Web this is the default chart of accounts we use for simple restaurant accounting. Web you’ll have at least 7 categories in your restaurant chart of accounts. The chart of accounts is the source of your restaurant’s financial statements, so it’s essential for getting insights into your revenue and expenses. Simpler coas provide a system for documenting all credits and debits. Web the restaurant chart of accounts documents all financial transactions in your restaurant, including revenue, assets, and liabilities. Usually, the chart will associate a bank account. We highlight all the restaurant income, cost of goods and expense accounts. Use the cost code guide to consistently code your operating expenses and other costs to the correct or most appropriate account. Web subtract from the amount in (1): Web you’ll have at least 7 categories in your restaurant chart of. Web 2022 uniform accounting system manual. This helps you have a breakdown of your financial information. Web generally, a restaurant chart of accounts would show the business’ raw material costs, labor wages, venue rent, amenities, marketing, and advertising expenses, and of course, the business’s revenue and profit. Web a chart of accounts allows you to look at a clear picture. Web a tailored chart of accounts helps organize costs into appropriate general ledger accounts, which makes analyses and reporting more meaningful. Usually, the chart will associate a bank account. We have added account codes for bank fees, bank fee refunds, and repayments from small business loans. Restaurant chart of accounts & cost coding guide. This helps you have a breakdown. Restaurant chart of accounts & cost coding guide. Web you add the total amount due ($100) to your accounts payable. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business. Web a chart of accounts allows you to look at a clear picture of where all your money. The chart of accounts format is coded numerically by section. It includes all the accounts we believe the average restaurant will need, and combines some common accounts that are rarely used by smaller businesses. A restaurant’s inventory is food and beverages, both of which have expiration dates. Divide the result in (2) by $15,000 ($10,000 if filing a joint return,. Web the bureau of labor statistics (bls) states that the average hourly rate for accountants is $37, but accountants’ fees vary, depending on factors, such as the accountant’s experience and your. This system can be used for both small and large businesses, and it can help you keep track of your expenses, income, and other important financial information. Web a. Web developed the uniform accounting system chart of accounts to be used as the standard for recording and reporting financial information to the state of florida. Web your chart of accounts includes your assets, liabilities, revenue, expenses, and equity. Web a tailored chart of accounts helps organize costs into appropriate general ledger accounts, which makes analyses and reporting more meaningful.. We have added account codes for bank fees, bank fee refunds, and repayments from small business loans. Web the bureau of labor statistics (bls) states that the average hourly rate for accountants is $37, but accountants’ fees vary, depending on factors, such as the accountant’s experience and your. Web by analyzing the relationship between revenue and expense accounts in a. The cost for restaurant accounting is typically driven by volume. This system can be used for both small and large businesses, and it can help you keep track of your expenses, income, and other important financial information. For efficient restaurant accounting, you need to understand the ins and outs of the food and beverage industry. The large transaction volume involved. Web developed the uniform accounting system chart of accounts to be used as the standard for recording and reporting financial information to the state of florida. The large transaction volume involved in manufacturing accounting can be managed more smoothly, accurately and efficiently when integrated with automated accounting and inventory management. Web you add the total amount due ($100) to your. The large transaction volume involved in manufacturing accounting can be managed more smoothly, accurately and efficiently when integrated with automated accounting and inventory management. Web by convention, a chart of accounts for restaurants is broken up into sections for (at a minimum) operating revenue, assets, liabilities, operating expenses, and equity, with additional categories that vary by a business’s unique needs. $146,000 for all other individuals. Usually, the chart will associate a bank account. Simpler coas provide a system for documenting all credits and debits. Web your chart of accounts includes your assets, liabilities, revenue, expenses, and equity. Web generally, a restaurant chart of accounts would show the business’ raw material costs, labor wages, venue rent, amenities, marketing, and advertising expenses, and of course, the business’s revenue and profit. An organisational chart that summarises where your accounting transactions are recorded. Web this is the default chart of accounts we use for simple restaurant accounting. It includes all the accounts we believe the average restaurant will need, and combines some common accounts that are rarely used by smaller businesses. Web your chart of accounts (coa) is the foundation for all financial record keeping at your restaurant. Web 2022 uniform accounting system manual. Divide the result in (2) by $15,000 ($10,000 if filing a joint return, qualifying widow (er), or married filing. Web a chart of accounts allows you to look at a clear picture of where all your money is going and coming from. Web you add the total amount due ($100) to your accounts payable. This system can be used for both small and large businesses, and it can help you keep track of your expenses, income, and other important financial information.:max_bytes(150000):strip_icc()/ChartofAccounts-af770ef73df043c284b6499018a1a2bf.jpg)

Restaurant Accounting Chart Of Accounts

Sample Chart Of Accounts For Restaurant

Chart Of Accounts For Restaurant Pdf

Chart Of Accounts For Restaurant Sample

Restaurant Chart of Accounts CheckMark Knowledge Base

Accounting For Restaurants Chart Of Accounts

Chart of Accounts Restaurant Tableware Taxes

Restaurant Accounts Spreadsheet for Restaurant Accounting Chart Of

Restaurant Chart of Accounts

Restaurant Bookkeeping Excel Template

These Categories Will Further Be Divided Into Subcategories Depending On The Size, Location, Operational Capacity, And Other Such.

A Restaurant’s Inventory Is Food And Beverages, Both Of Which Have Expiration Dates.

We’ve Followed Best Accounting Practices For Numbering The Categories Below.

This Is Where A Chart Of Accounts Comes Into Play — An Organized System That Will Help You Better Understand How Your Restaurant Makes Money And Where That Money Is Spent.

Related Post: