3 Candlestick Pattern

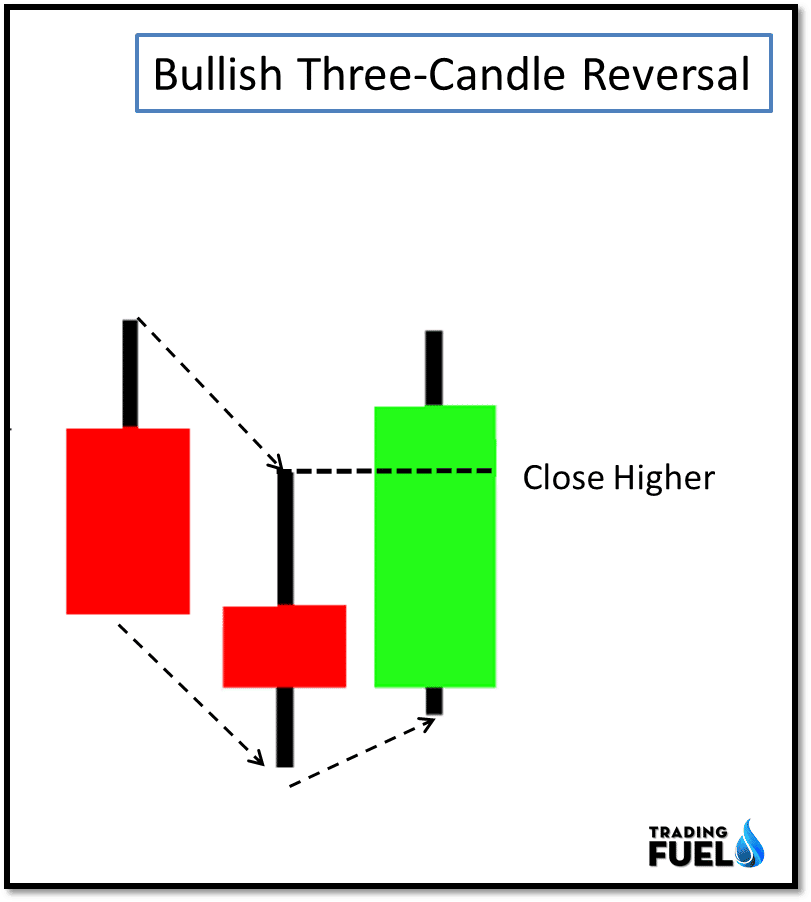

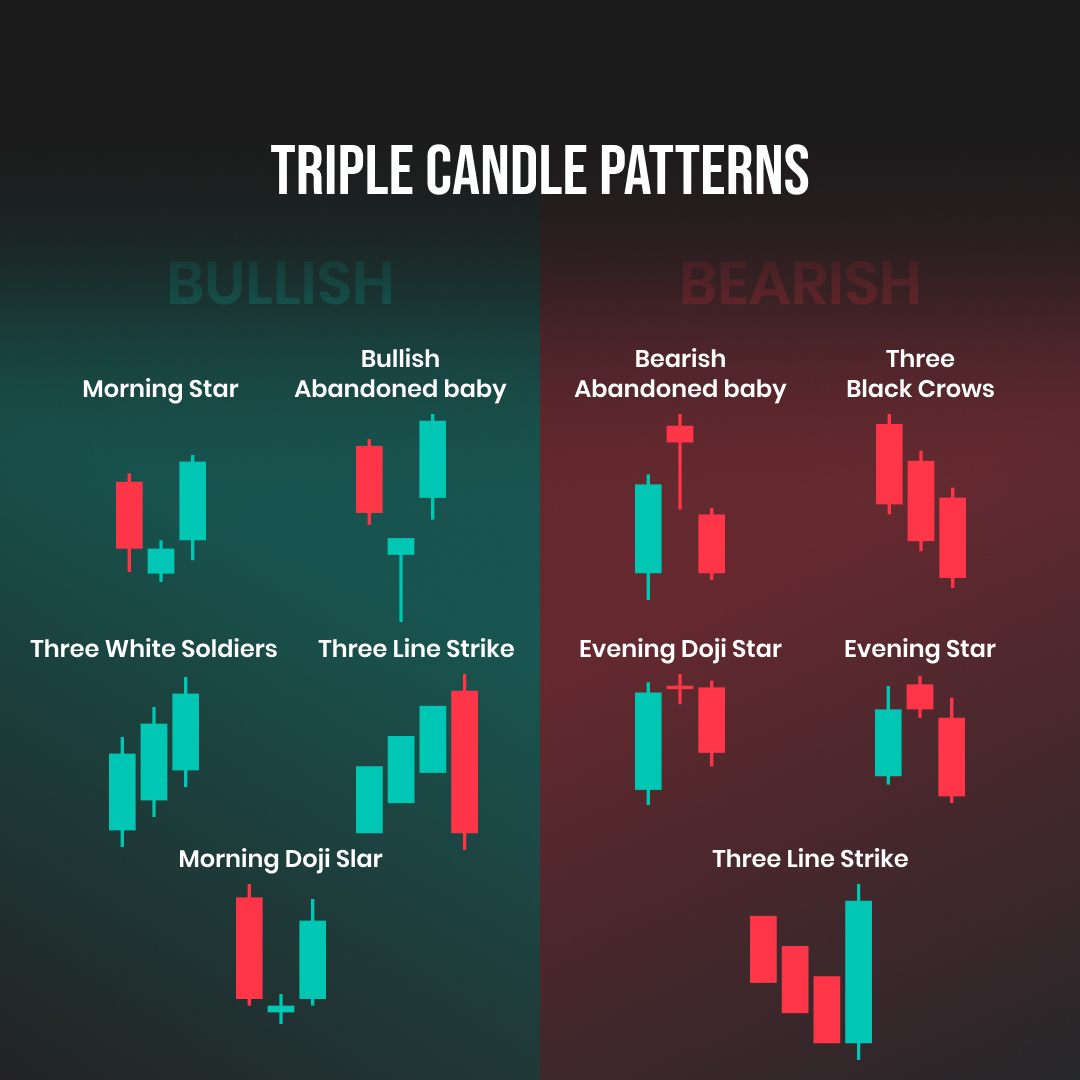

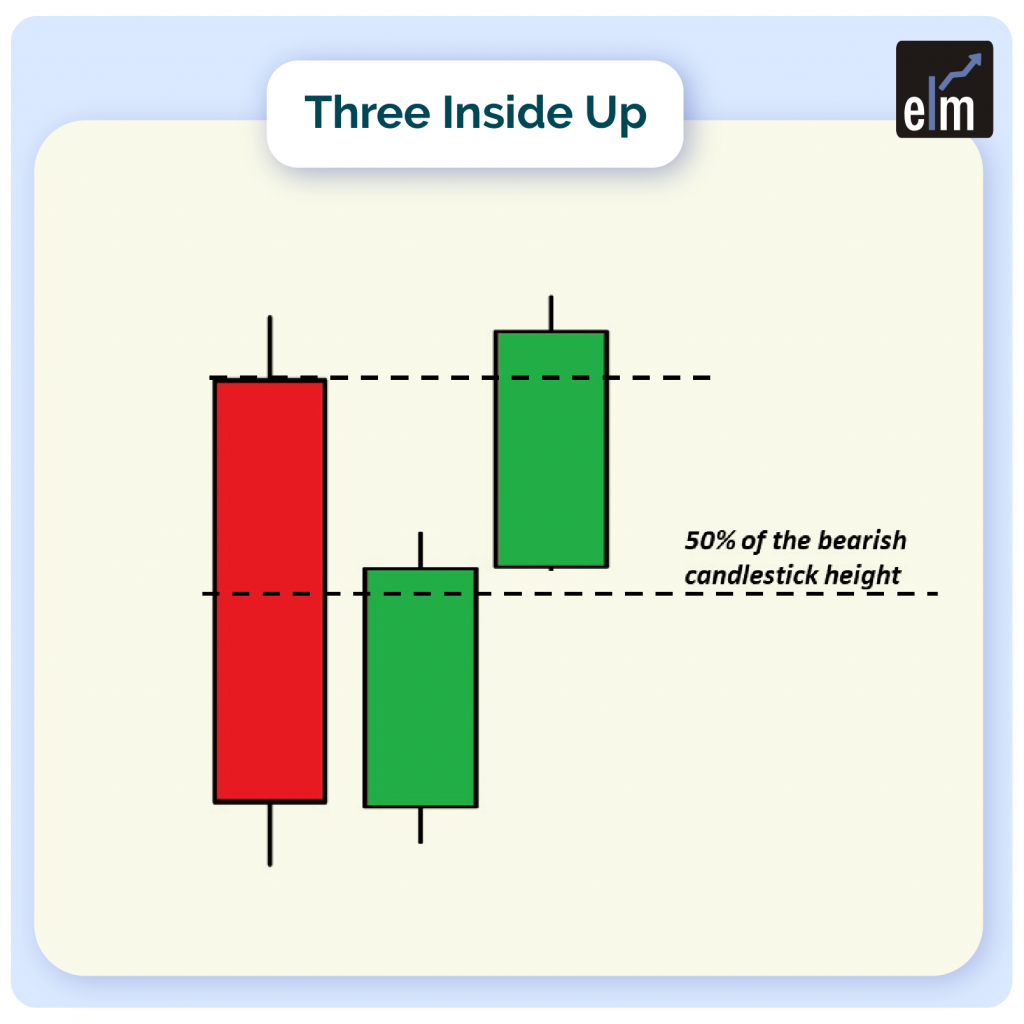

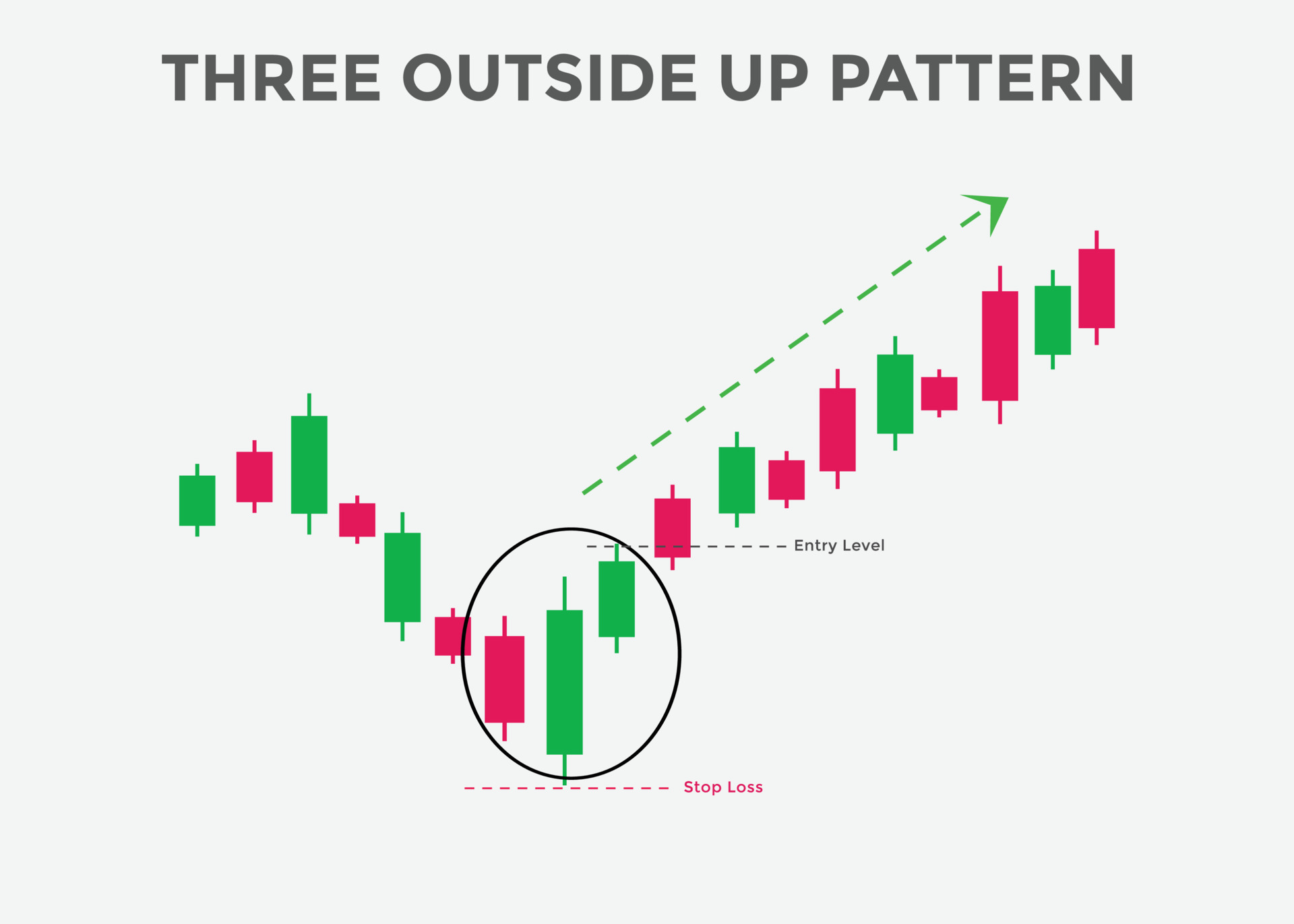

3 Candlestick Pattern - The first candlestick is long and bearish, indicating that the market is still in a downtrend. The evening star is similar to the. Web what are candlestick patterns? Let’s look at a single candle pattern. Web the 3 bar play pattern is a popular candlestick formation used by traders to identify strong momentum breakouts in either direction. Web the three candle pattern consists of three specific candlesticks: Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Web candlesticks are created with a body and wicks (or shadows). By examining the shape and color of the candlestick, traders can gauge market sentiment and potential future movements. They show current momentum is slowing and the price direction is changing. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Web some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of a new trend in the opposite direction. Web the 3 bar play pattern is a popular candlestick formation used by traders to identify. Web learn about all the trading candlestick patterns that exist: The evening star is similar to the. It typically represents a shift in momentum, with the price moving in the opposite direction after a sustained trend. Web triple candlestick patterns are crucial formations on price charts used to indicate potential trend reversals or continuations, with common examples including morning star,. The second candlestick is bullish and should ideally close at the halfway mark of the first candlestick. Candlestick patterns are a technical trading tool used for centuries to help predict price moments. The body represents the range between the open and close prices…. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current. Web triple candlestick patterns are crucial formations on price charts used to indicate potential trend reversals or continuations, with common examples including morning star, evening star, three white soldiers, and three black crows. Traders use these different patterns in studying participation in the market on the side of the demand or supply. The first candlestick is long and bearish, indicating. The wicks show the highest and lowest prices reached during the trading session…. Web rising three methods is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend. Some patterns are referred to as. It typically represents a shift in momentum, with the price moving in the opposite direction after a. The bullish formation is composed of a big green candle, 3 up candles, and one down candle erasing the advance made by the prior 3 candles. Web the following chart shows an example of a three inside up pattern: Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. The. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Candlestick trading is a form of technical analysis that uses chart patterns, as opposed to fundamental analysis, which focuses on the financial health of assets. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares. Web rising three methods is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend. Web learn about all the trading candlestick patterns that exist: Web candlesticks are created with a body and wicks (or shadows). Candlestick trading is a form of technical analysis that uses chart patterns, as opposed to. Web candlesticks are created with a body and wicks (or shadows). Candlestick trading is a form of technical analysis that uses chart patterns, as opposed to fundamental analysis, which focuses on the financial health of assets. The setup candle, confirmation candle, and trigger candle. Web candlesticks patterns are used by traders to gauge the psychology of the market and as. Web what are candlestick patterns? Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. The third candlestick closes above the high of candlestick 1. Some patterns are referred to as. The morning star is a buy indicator. Traders use it alongside other technical indicators such as the relative strength index. The decisive (fifth) strongly bullish candle is. This pattern consists of two smaller bars followed by a large third bar, indicating a sharp increase in buying or selling pressure. Web learn about all the trading candlestick patterns that exist: Candlestick trading is a form of technical analysis that uses chart patterns, as opposed to fundamental analysis, which focuses on the financial health of assets. The following candlestick closes below the opening of the first candlestick. Web the third candlestick is a bullish candlestick that should at least pass the halfway point of the first bearish candle. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. The evening star is similar to the. The setup candle is the first candle in the pattern and sets the stage for a potential reversal. The bullish formation is composed of a big green candle, 3 up candles, and one down candle erasing the advance made by the prior 3 candles. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. Web three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. This chart pattern suggests a strong change in. There are dozens of different candlestick patterns with intuitive, descriptive. They show current momentum is slowing and the price direction is changing.

How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

10 Price Action Candlestick Patterns Trading Fuel Research Lab

An Overview of Triple Candlestick Patterns Forex Training Group

How to trade candlestick patterns? FTMO

Understand Three Inside Up And Three Inside Down

Candlestick Patterns The Definitive Guide (2021)

Candlestick Trading Chart Patterns For Traders. three candle pattern

Candlestick Pattern Book Candlestick Pattern Tekno

Three outside up candlestick pattern. Candlestick chart Pattern For

Candlestick patterns cheat sheet Artofit

The Wicks Show The Highest And Lowest Prices Reached During The Trading Session….

Web Candlestick Patterns Are Technical Trading Tools That Have Been Used For Centuries To Predict Price Direction.

Web Candlesticks Patterns Are Used By Traders To Gauge The Psychology Of The Market And As Potential Indicators Of Whether Price Will Rise, Fall Or Move Sideways.

The Morning Star Is A Buy Indicator.

Related Post: