1099Q Recipient Is Not The Designated Beneficiary

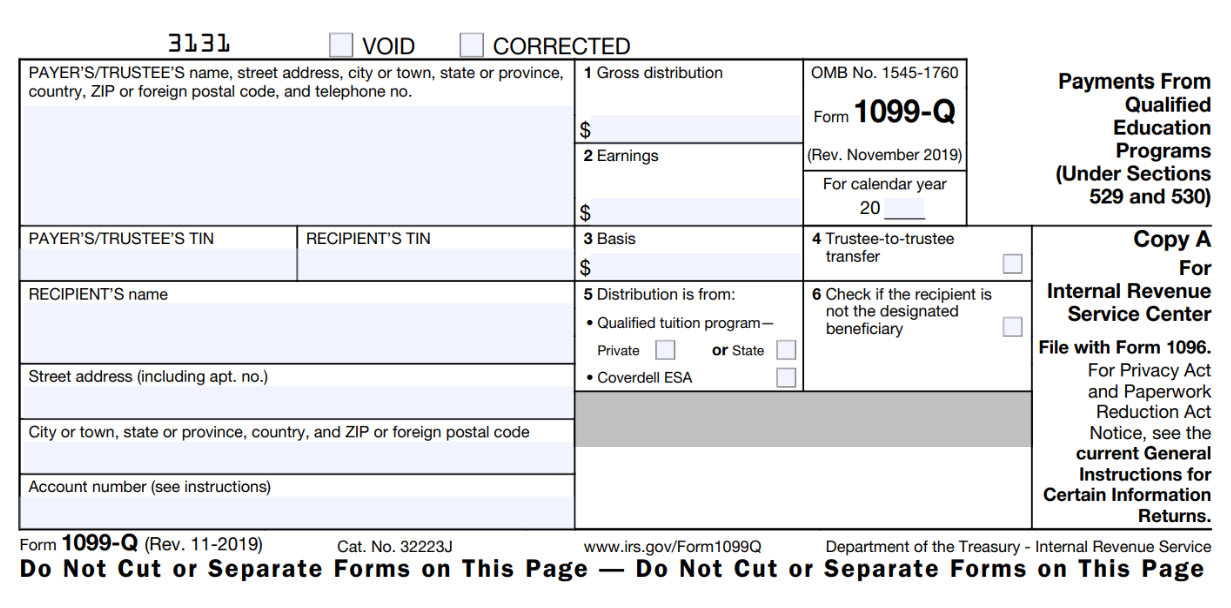

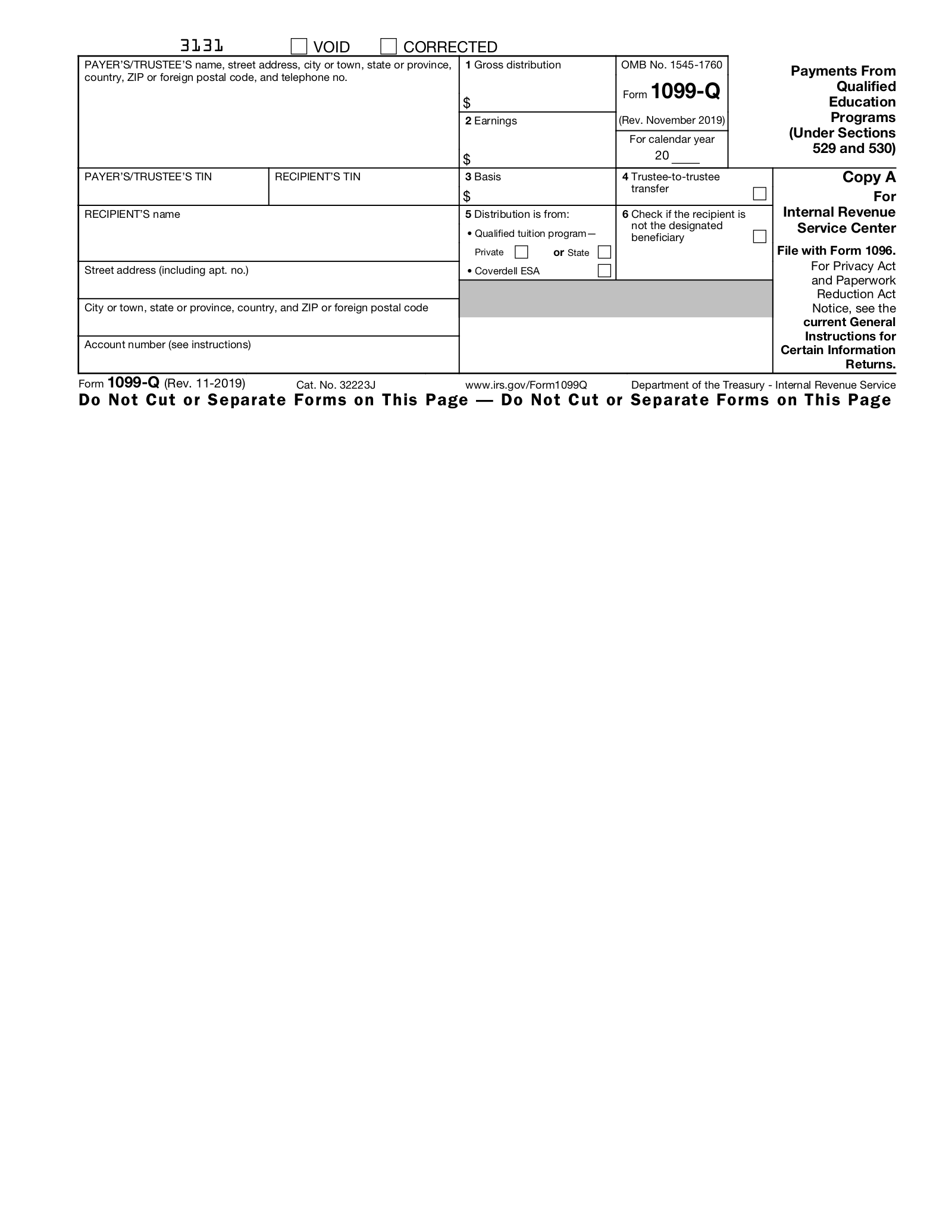

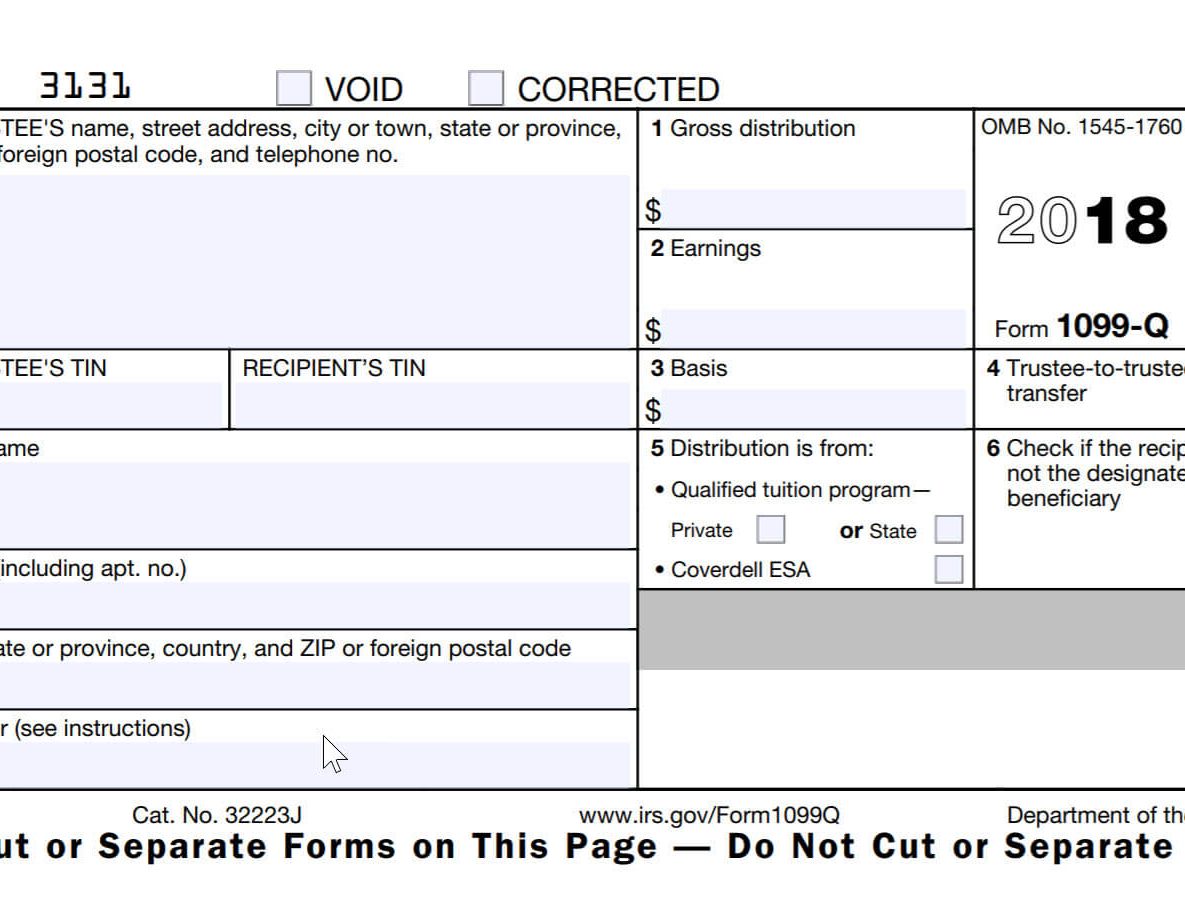

1099Q Recipient Is Not The Designated Beneficiary - In other words, the person whose ssn is on. The gross distribution in block 1 is. In general, activities that affh should promote non. Yes, you should keep records to show that the. If it goes on any return, it goes on the recipient's return. Web it depends whose social security number is on the form. When the money goes directly from the. Web if you were the beneficiary, and you were not a student in 2016, then the distribution is taxable. Web list the designated beneficiary as the recipient only if the distribution is made (a) directly to the designated beneficiary, or (b) to an eligible educational institution for the benefit of. If the funds did go directly to the educational. Yes, you should keep records to show that the. On account of the designated beneficiary's dying or. But it does not have to be entered on either. If the funds did go directly to the educational. If your wife's ssn is on the form, then she is the recipient. The gross distribution in block 1 is. 970, tax benefits for education, for how to figure earnings. Web if you are not the designated beneficiary, see irs pub. When the money goes directly from the. Under the social security act amendments, states had the option to either grant medicaid to all persons. In other words, the person whose ssn is on. Web list the designated beneficiary as the recipient only if the distribution is made (a) directly to the designated beneficiary, or (b) to an eligible educational institution for the benefit of. On account of the designated beneficiary's dying or. Web the recipient's ssn on the 1099q is the parent's & block. Because the funds were used for another. Web list the designated beneficiary as the recipient only if the distribution is made (a) directly to the designated beneficiary, or (b) to an eligible educational institution for the benefit of. Web new york state will monitor the efforts of local government grantees to satisfy and certify their own duty to affh. Web. In general, activities that affh should promote non. 970, tax benefits for education, for how to figure earnings. Only the education expenses of the beneficiary count as non. If your wife's ssn is on the form, then she is the recipient. If it goes on any return, it goes on the recipient's return. In general, activities that affh should promote non. Web if you are not the designated beneficiary, see irs pub. Web the recipient's ssn on the 1099q is the parent's & block 6 is checked, as the recipient (parent) is not the designated beneficiary. 970 and the instructions for form 1040. Web the recipient of the distribution can be either the. But it does not have to be entered on either. Web new york state will monitor the efforts of local government grantees to satisfy and certify their own duty to affh. Under the social security act amendments, states had the option to either grant medicaid to all persons. Web if you are not the designated beneficiary, see irs pub. Web. Yes, you should keep records to show that the. When the box 1 amount on. Web if you were the beneficiary, and you were not a student in 2016, then the distribution is taxable. Web the recipient of the distribution can be either the owner or the beneficiary depending on who the money was sent to. Web it depends whose. 970 and the instructions for form 1040. Web recipient is not the designated beneficiary if the fair market value (fmv) is shown below, see pub. If you are not the. Web if you were the beneficiary, and you were not a student in 2016, then the distribution is taxable. But it does not have to be entered on either. The gross distribution in block 1 is. Web it depends whose social security number is on the form. On account of the designated beneficiary's dying or. If it goes on any return, it goes on the recipient's return. Only the education expenses of the beneficiary count as non. Only the education expenses of the beneficiary count as non. Web the recipient's ssn on the 1099q is the parent's & block 6 is checked, as the recipient (parent) is not the designated beneficiary. The gross distribution in block 1 is. Web certain nonqualified distributions are not subject to the penalty. On account of the designated beneficiary's dying or. When the box 1 amount on. Web if you are not the designated beneficiary, see irs pub. When the money goes directly from the. Web list the designated beneficiary as the recipient only if the distribution is made (a) directly to the designated beneficiary, or (b) to an eligible educational institution for the benefit of. But it does not have to be entered on either. In general, activities that affh should promote non. Because the funds were used for another. Web the recipient of the distribution can be either the owner or the beneficiary depending on who the money was sent to. Web the designated beneficiary is the individual named in the document creating the trust or custodial account to receive the benefit of the funds in the account. Web new york state will monitor the efforts of local government grantees to satisfy and certify their own duty to affh. Under the social security act amendments, states had the option to either grant medicaid to all persons.

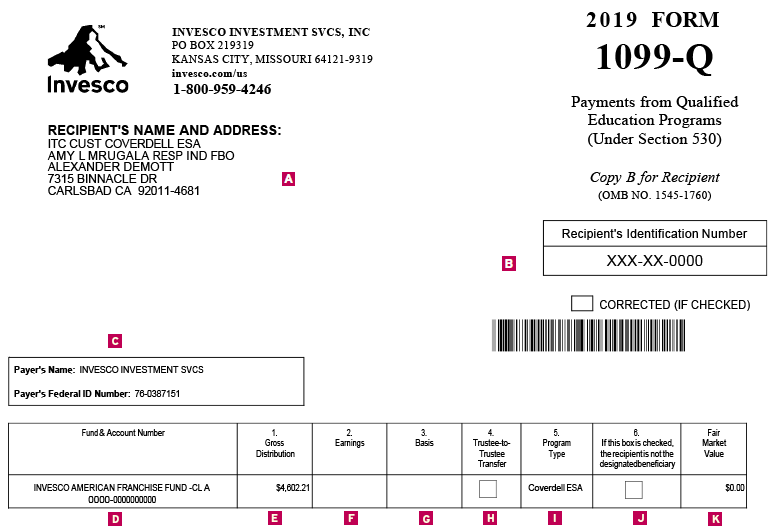

Free IRS Form 1099Q PDF eForms

How To File Form 1099Q for 2022 (Efile Form 1099 Q) YouTube

:max_bytes(150000):strip_icc()/tradition-ira-roth-ira-contribution-limits-5a01592613f1290037067ebc.jpg)

Not Designated Beneficiary What It Is and Requirements

1099Q 2023 Public Documents 1099 Pro Wiki

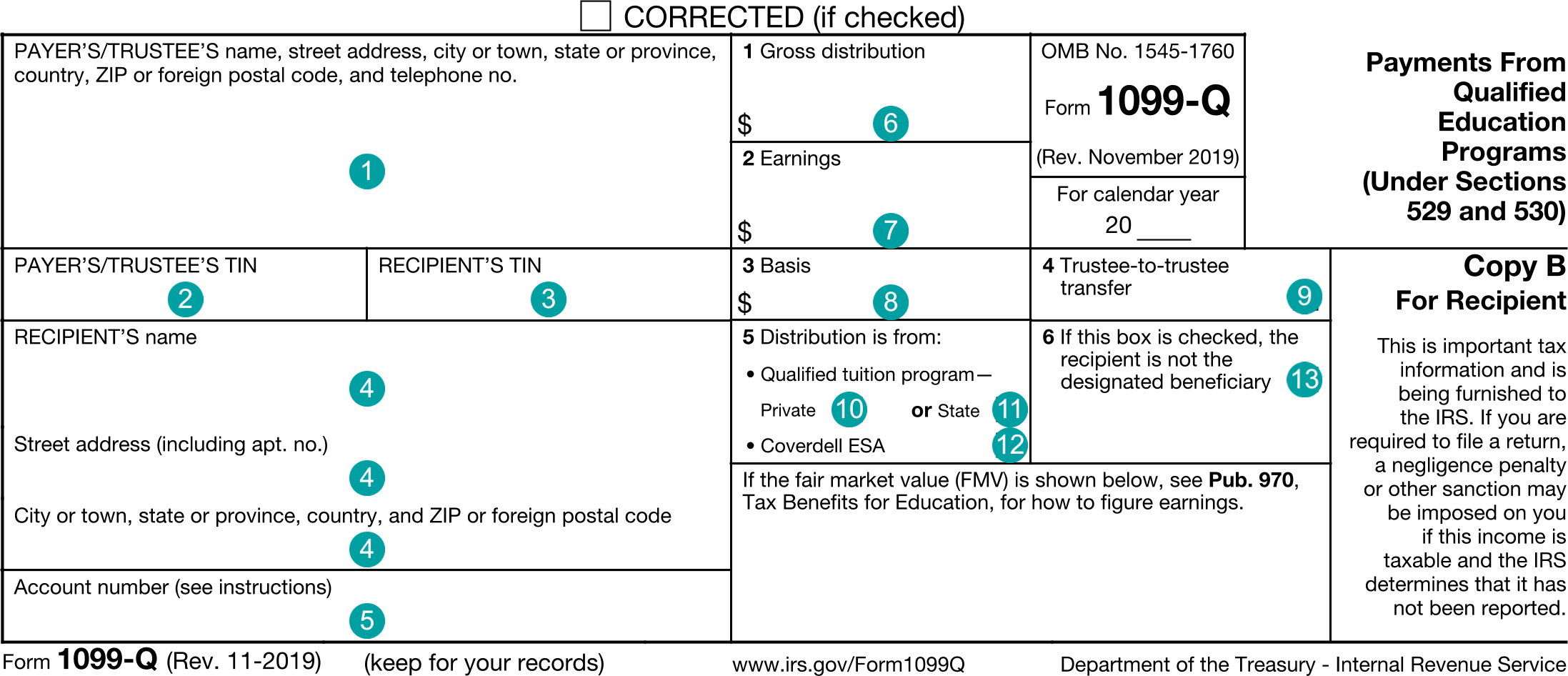

Free IRS Form 1099Q PDF eForms

form1099Q_ Kelly CPA

Invesco OpenEnd Tax Guide Accounts & Services

1099 q Fill out & sign online DocHub

Excerpts from Publication 1220

Form 1099QPayments From Qualified Education Programs (Under Section…

If It Goes On Any Return, It Goes On The Recipient's Return.

Web Recipient Is Not The Designated Beneficiary If The Fair Market Value (Fmv) Is Shown Below, See Pub.

If The Funds Did Go Directly To The Educational.

In Other Words, The Person Whose Ssn Is On.

Related Post: