1099 Int Template

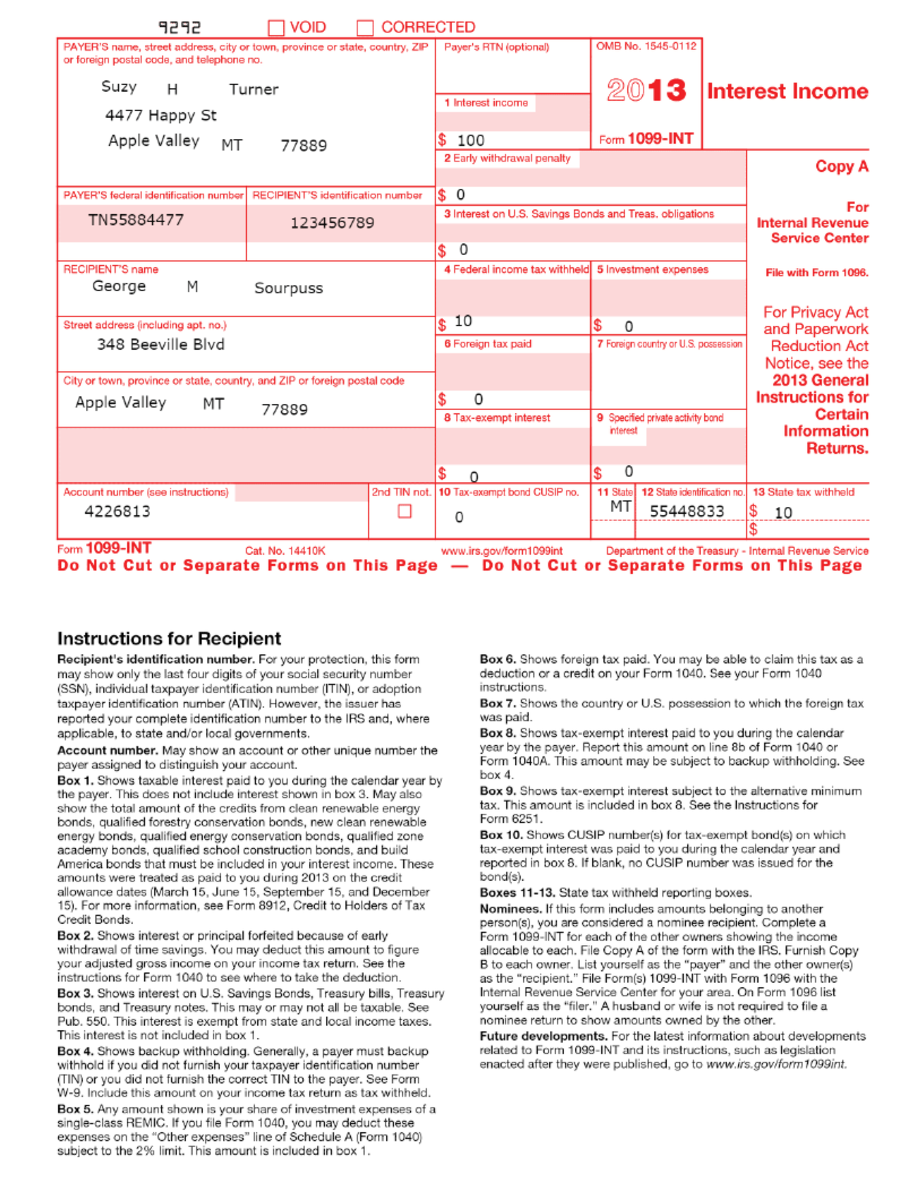

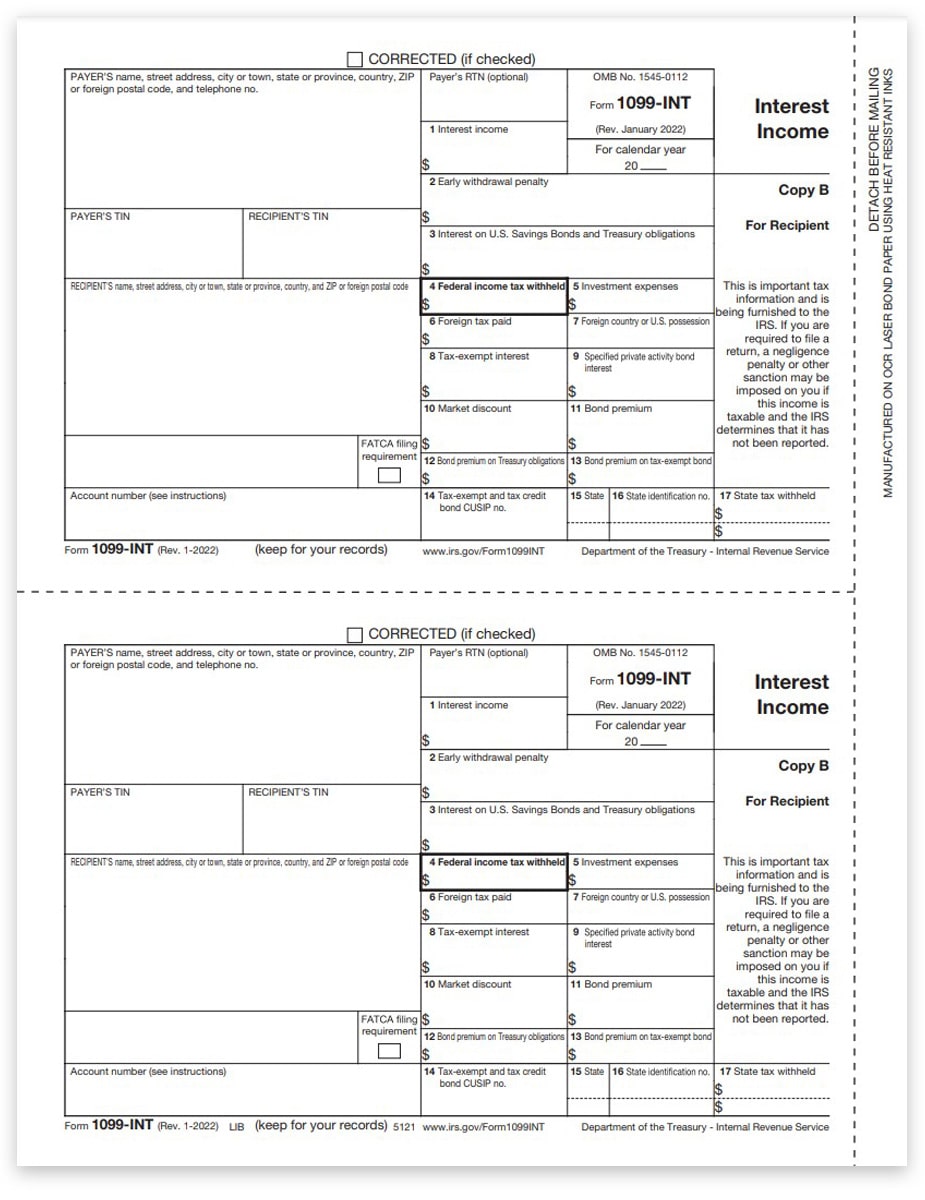

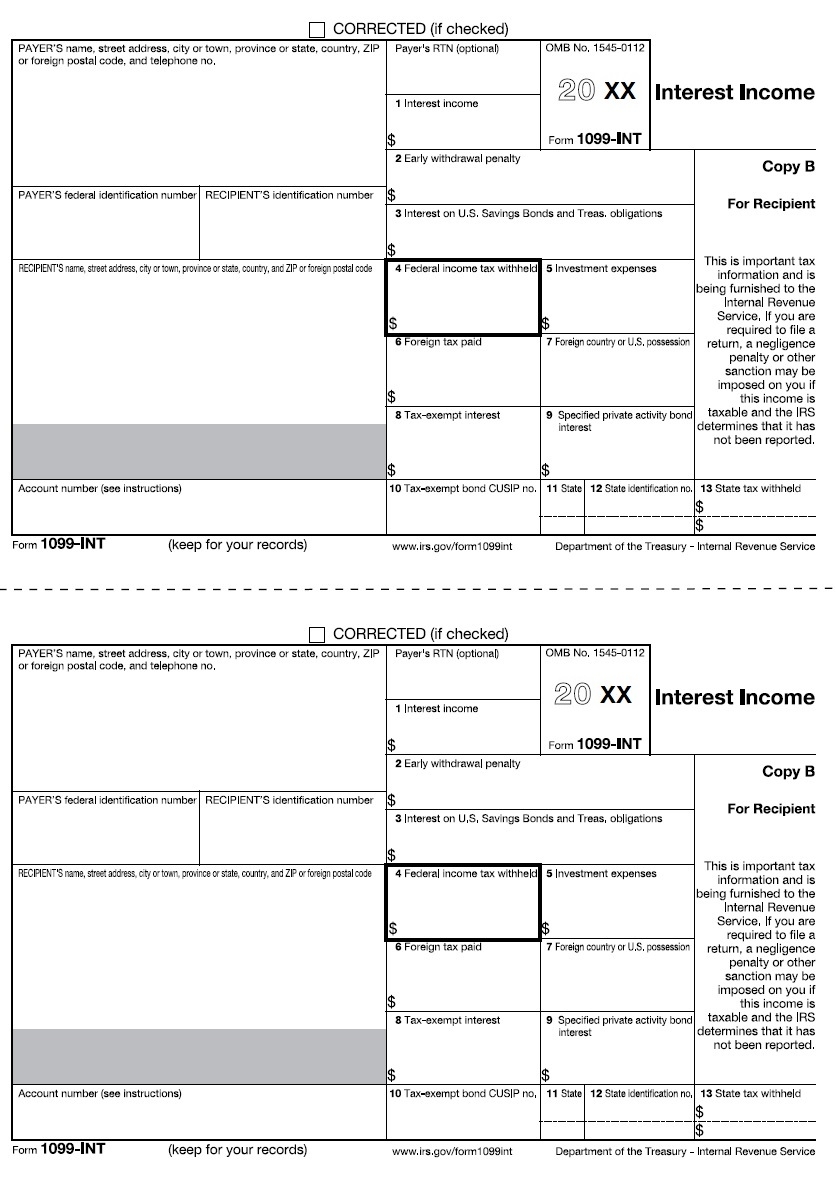

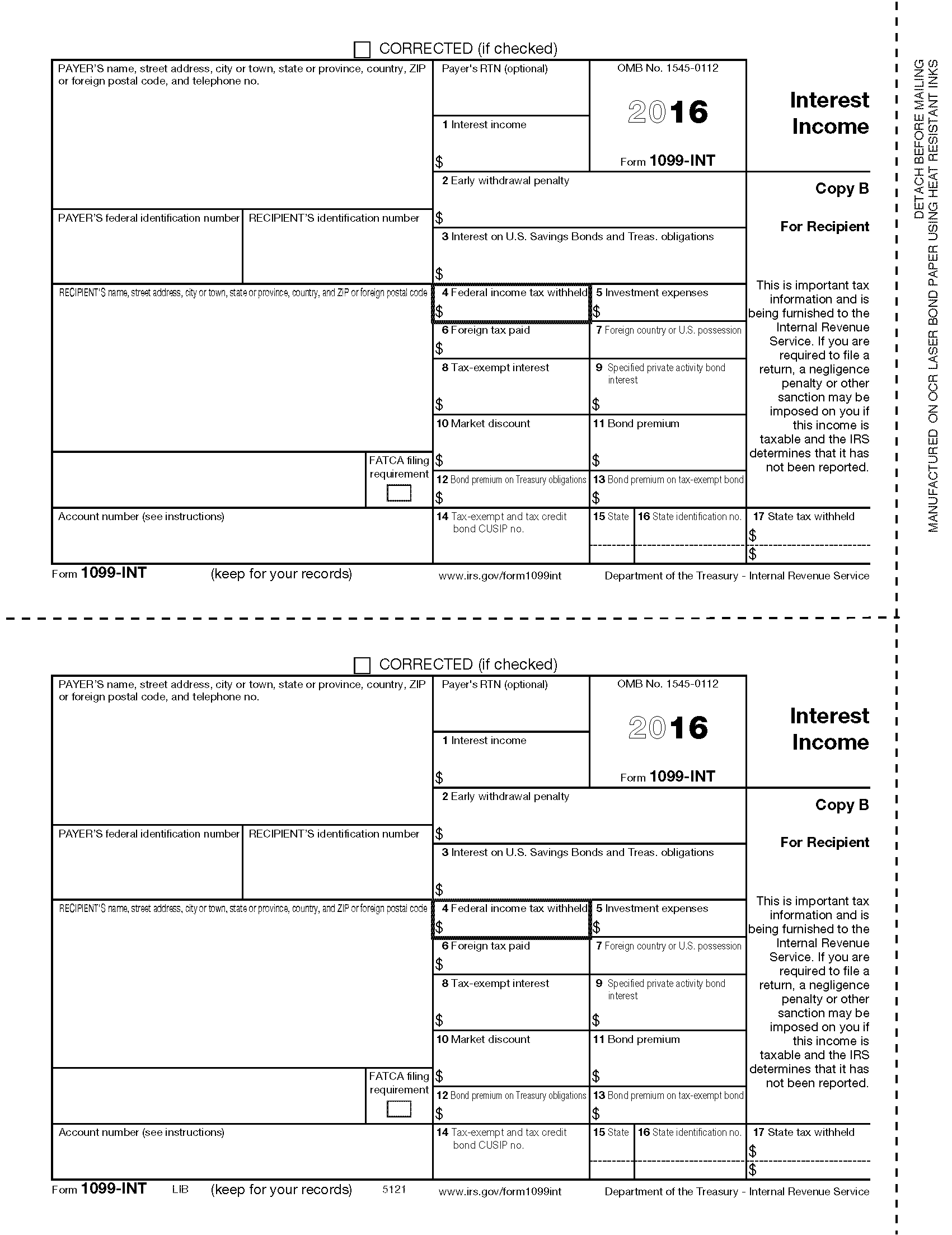

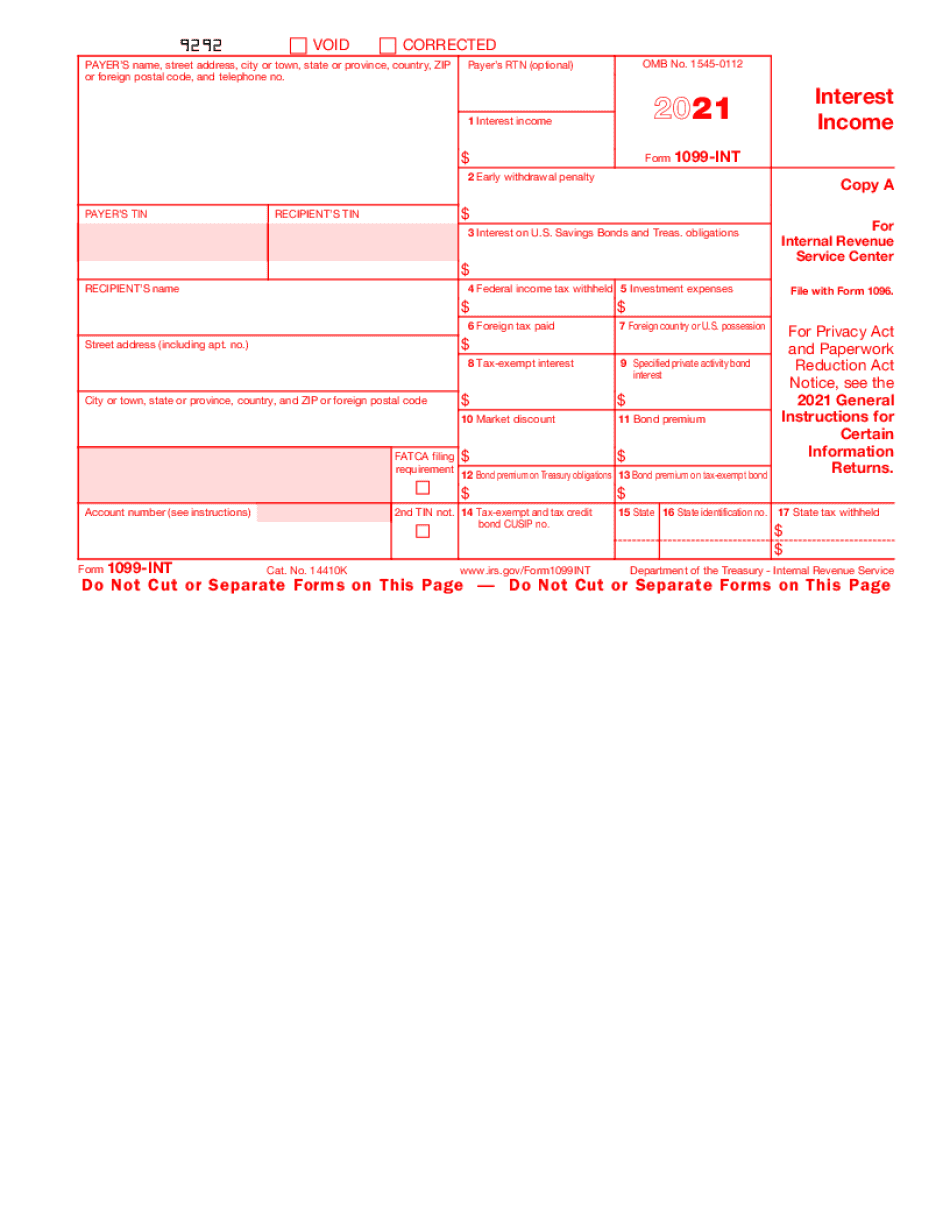

1099 Int Template - If you got it, it means. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that. Sign & make it legally binding. Web the banks and the investment firms will send this form for reporting interest over $10 to the recipients by 31st january every year. To calculate and print to irs 1099 forms with their unconventional spacing. Web for the most recent version, go to irs.gov/form1099int. You’ll receive this form if you earn at least $10 in interest during the tax year. Download this 2023 excel template. The form is filed with the irs and gets used to. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that. Web the banks and the investment firms will send this form for reporting interest over $10 to the recipients by 31st january every year. You’ll receive this form if you earn. The form must be filed for any customer who. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. If you got it, it means. Web for the most recent version, go to irs.gov/form1099int. Save, download, print, and share. Web for the most recent version, go to irs.gov/form1099int. January 2022) interest income and original issue discount. This form is sent to the irs during the tax year,. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. Most interest is taxable and should be. You’ll receive this form if you earn at least $10 in interest during the tax year. Download this 2023 excel template. Save, download, print, and share. If you still don’t know the definition and purpose of this form, you might have never received the interest. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. You’ll receive this form if you earn at least $10 in interest during the tax year. The form must be filed for any customer who. This form is sent to the irs during the tax year,. To calculate and print to irs 1099 forms with their unconventional spacing. If you got it, it means. If you still don’t know the definition and purpose of this form, you might have never received the interest. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer. Web the banks and the investment firms will send this form for reporting interest over $10 to the recipients by. To whom you paid amounts reportable in boxes 1, 3, or 8 of at. You’ll receive this form if you earn at least $10 in interest during the tax year. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer. The form must be filed for any customer who.. January 2022) interest income and original issue discount. If you still don’t know the definition and purpose of this form, you might have never received the interest. Most interest is taxable and should be. This form is sent to the irs during the tax year,. You’ll receive this form if you earn at least $10 in interest during the tax. Web recipient’s taxpayer identification number (tin). Most interest is taxable and should be. Sign & make it legally binding. January 2022) interest income and original issue discount. This form is sent to the irs during the tax year,. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer. If you still don’t know the definition and purpose of this form, you might have never received the interest. You’ll receive this form if you earn at least $10 in interest during the tax year. Web for the most. You’ll receive this form if you earn at least $10 in interest during the tax year. This form is sent to the irs during the tax year,. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer. Web recipient’s taxpayer identification number (tin). Web the banks and the investment firms will send this form for reporting interest over $10 to the recipients by 31st january every year. The form must be filed for any customer who. Save, download, print, and share. The form is filed with the irs and gets used to. January 2022) interest income and original issue discount. To calculate and print to irs 1099 forms with their unconventional spacing. Most interest is taxable and should be. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that. Download this 2023 excel template. If you got it, it means.

1099 Int Template

1099Int Template. Create A Free 1099Int Form.

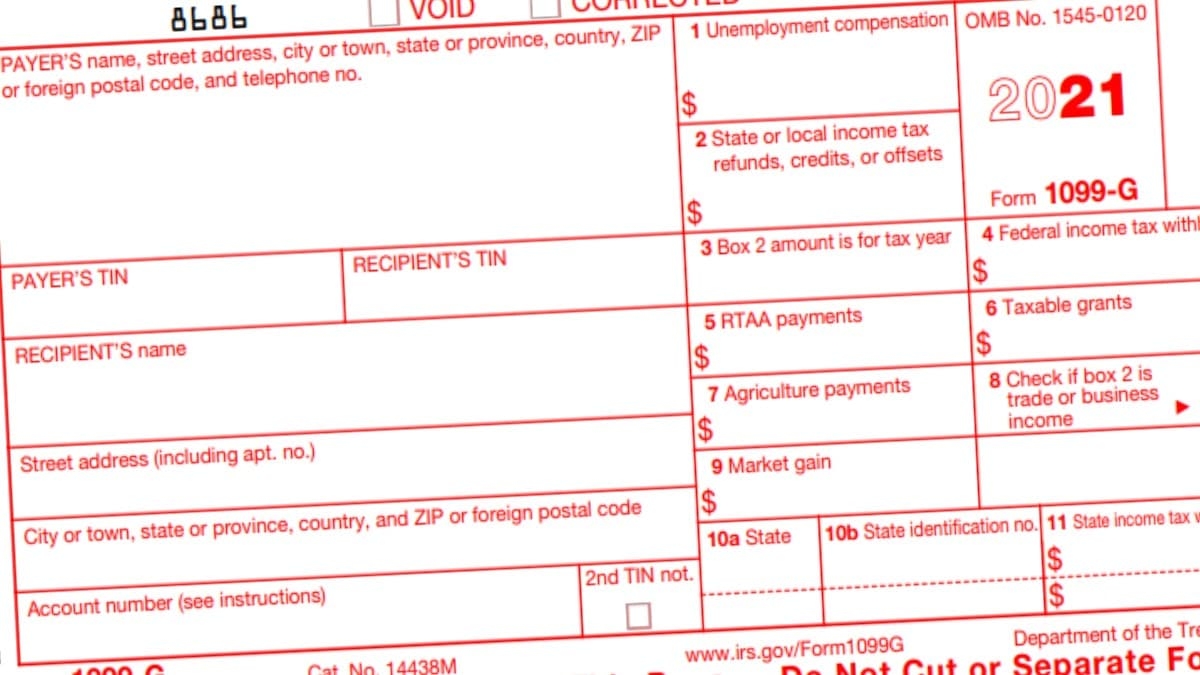

Fillable Online irs form 1099 int Fax Email Print pdfFiller

1099INT Form Fillable, Printable, Downloadable. 2023 Instructions

1099INT Tax Forms 2022, Recipient Copy B DiscountTaxForms

1099INT A Quick Guide to This Key Tax Form The Motley Fool

1099INT Recipient Copy B

Fillable 1099 Int Forms 2022 Fillable Form 2024

1099 Int Template

The Fastest Way To Create Fillable 1099 Int Form

If You Still Don’t Know The Definition And Purpose Of This Form, You Might Have Never Received The Interest.

Sign & Make It Legally Binding.

Web For The Most Recent Version, Go To Irs.gov/Form1099Int.

To Whom You Paid Amounts Reportable In Boxes 1, 3, Or 8 Of At.

Related Post: